Handling PDF forms online can be simple with our PDF tool. You can fill out spousal impoverishment income allocation illinois here with no trouble. To retain our editor on the forefront of convenience, we strive to implement user-oriented features and enhancements on a regular basis. We are always thankful for any suggestions - assist us with remolding PDF editing. To begin your journey, consider these easy steps:

Step 1: Click the "Get Form" button above. It will open up our pdf editor so that you could begin completing your form.

Step 2: This editor enables you to customize your PDF form in many different ways. Modify it with personalized text, adjust existing content, and include a signature - all close at hand!

Pay close attention when filling in this document. Ensure every single field is filled out accurately.

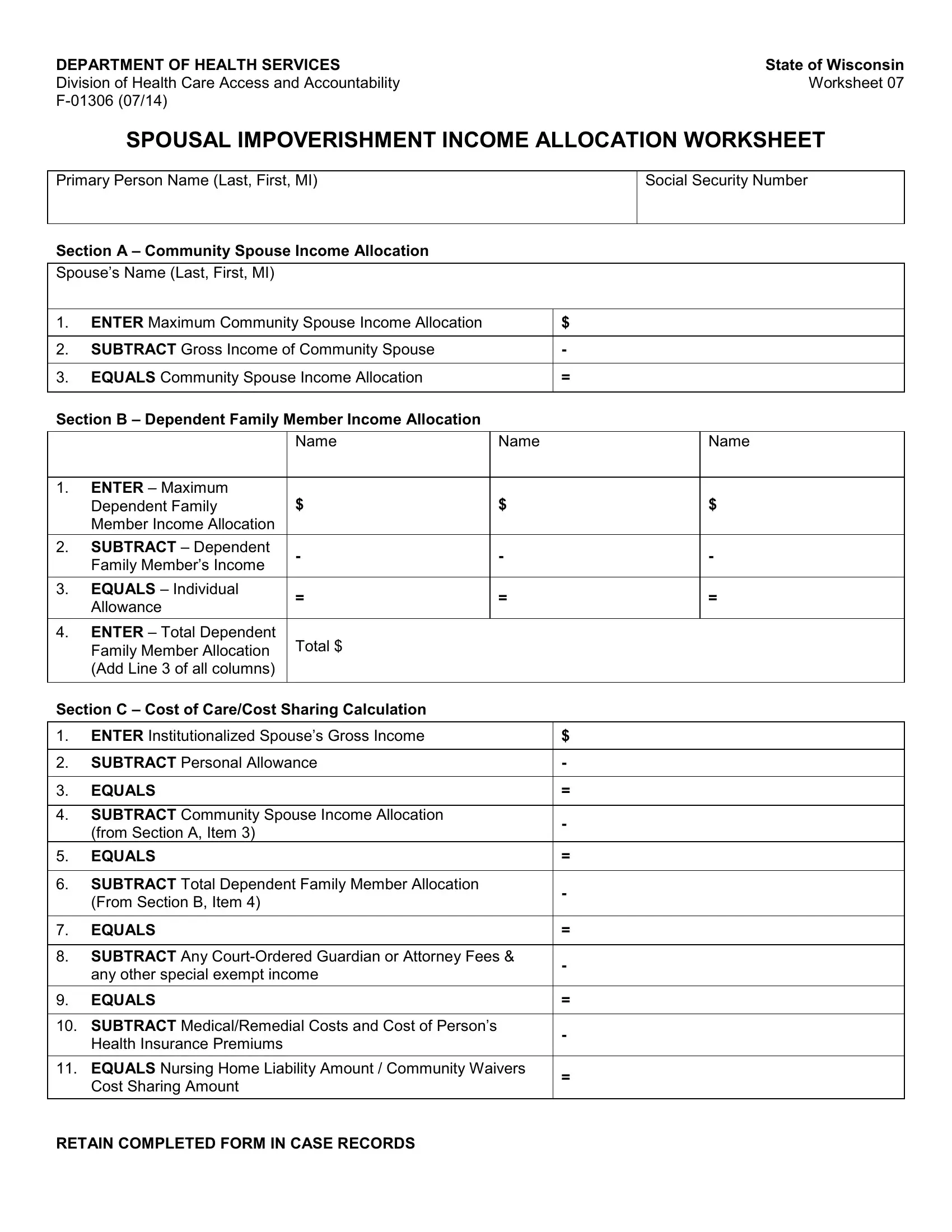

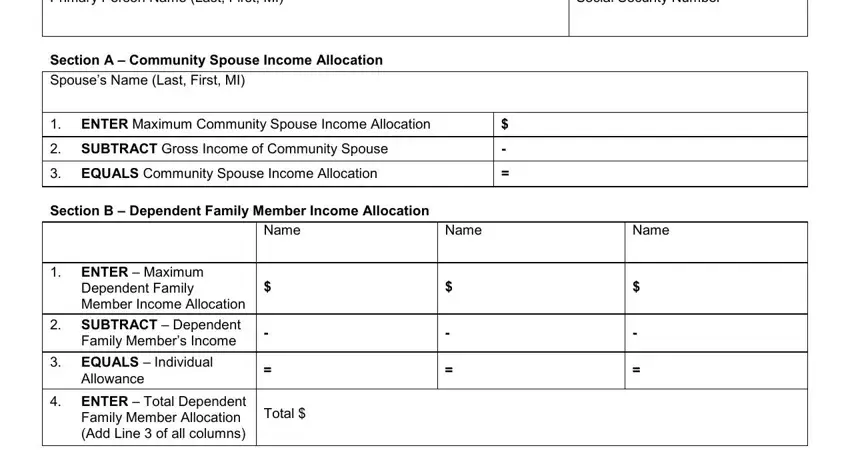

1. The spousal impoverishment income allocation illinois will require specific details to be entered. Make certain the subsequent blank fields are complete:

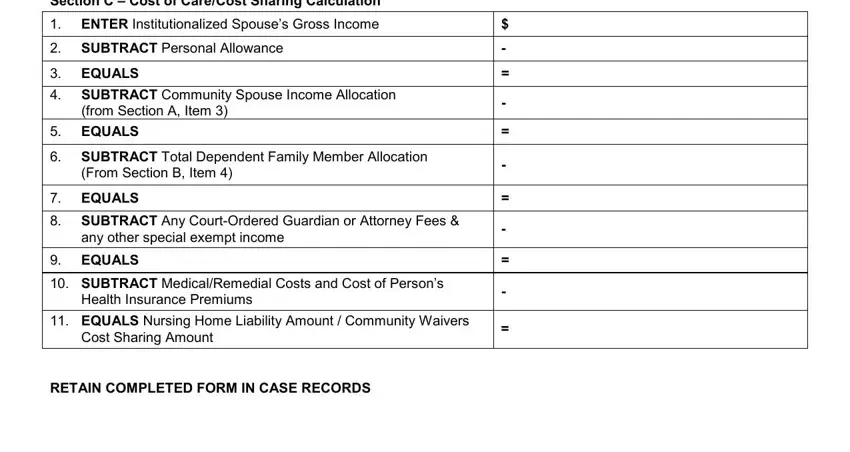

2. Right after this part is filled out, proceed to enter the suitable details in these: ENTER Maximum Dependent Family, any other special exempt income, Health Insurance Premiums, From Section B Item, from Section A Item, and Cost Sharing Amount.

When it comes to from Section A Item and Health Insurance Premiums, be certain that you don't make any mistakes in this current part. These two could be the most important ones in this PDF.

Step 3: Ensure your information is right and then press "Done" to complete the project. Download your spousal impoverishment income allocation illinois as soon as you join for a free trial. Immediately view the document inside your personal account page, together with any modifications and adjustments being all preserved! When you use FormsPal, you'll be able to complete documents without worrying about data incidents or records being shared. Our secure system helps to ensure that your personal details are kept safe.