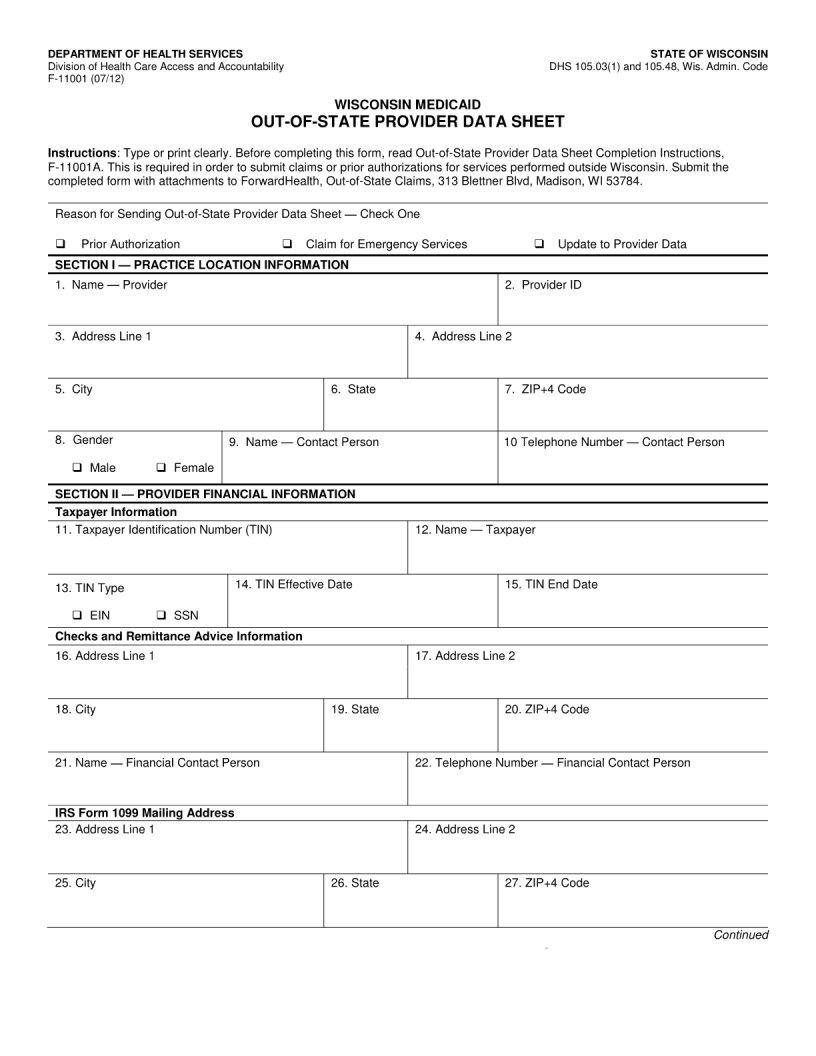

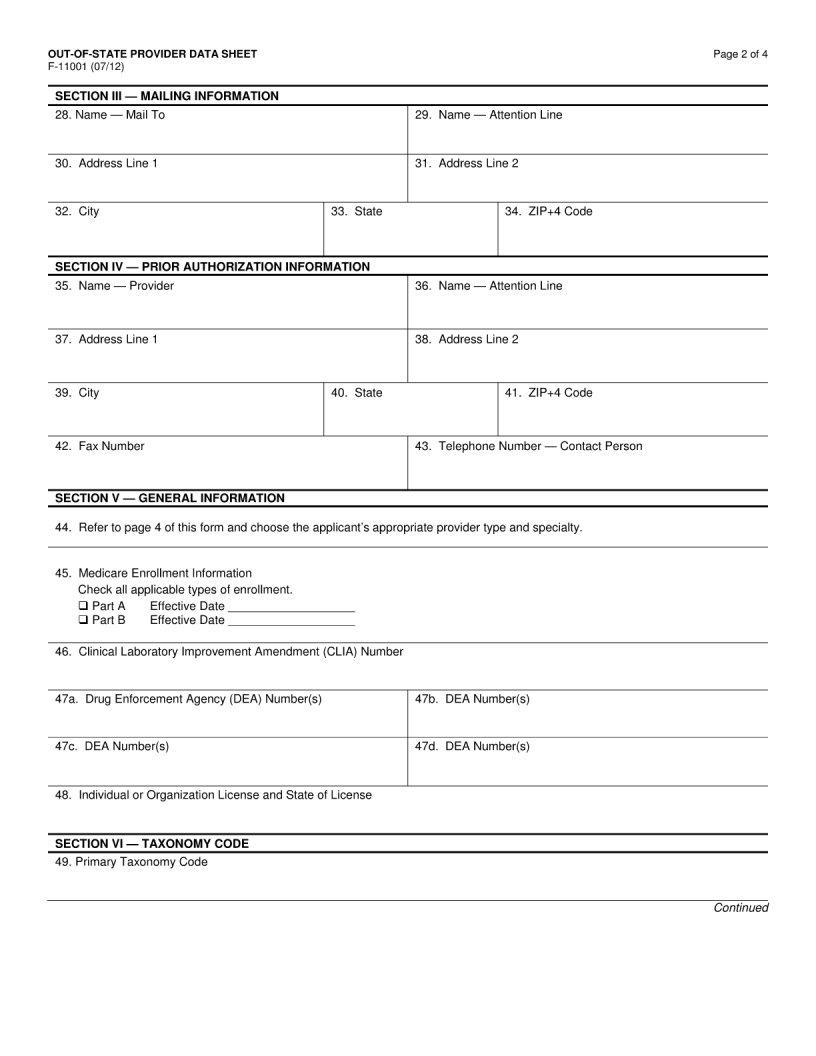

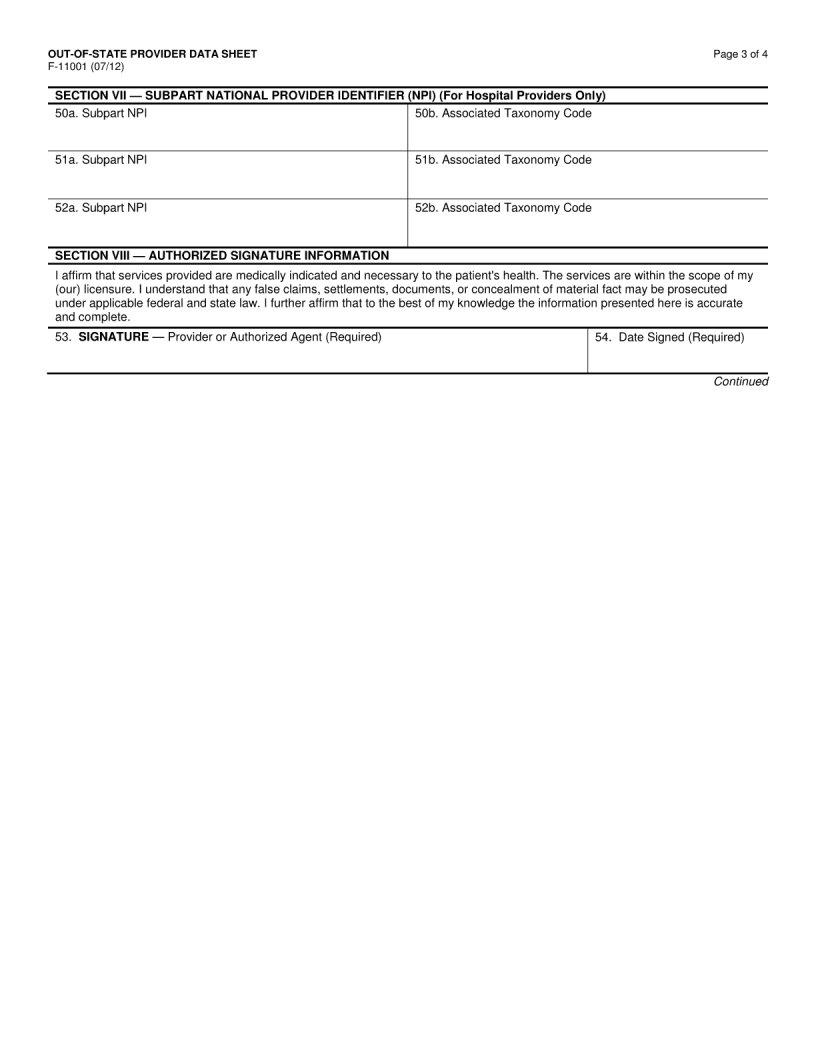

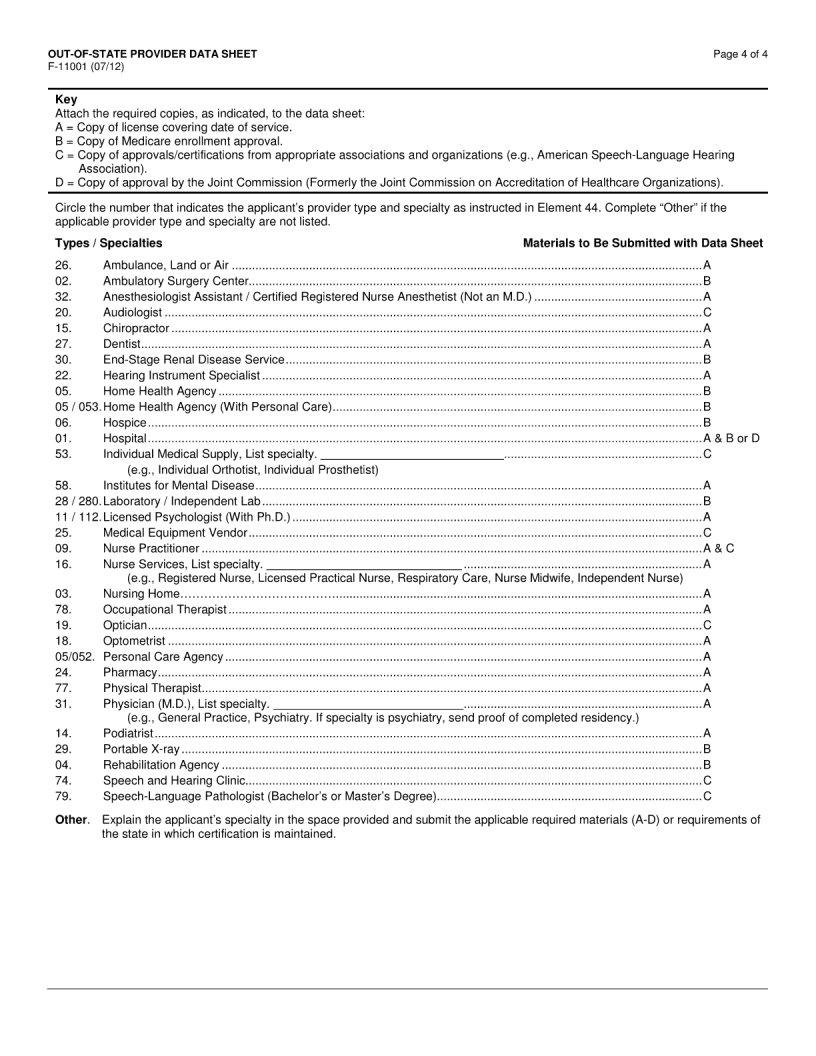

Form F 11001 can be used to request advance ruling from the IRS on whether a proposed transaction will result in tax-free treatment. This form can be especially useful for taxpayers who are considering complex transactions. In order to complete Form F 11001, you will need to provide a great deal of information about the proposed transaction. The IRS will use this information to determine whether the proposed transaction meets the requirements for tax-free treatment. If it does not, you may still be able to complete the transaction, but you will need to pay taxes on any taxable income or gain resulting from it. Form F 11001 can be a valuable tool for taxpayers who are looking to avoid paying taxes on their income or gain from a proposed transaction. By completing this form and submitting it to the IRS, you can get advance assurance that your proposed transaction will qualify for tax-free treatment. This can save you time and money down the road if things go as planned. However, note

| Question | Answer |

|---|---|

| Form Name | Form F 11001 |

| Form Length | 4 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 1 min |

| Other names | F11001 wisconsin medicaid out of state provider data sheet form |