Dealing with PDF documents online is quite easy with this PDF editor. You can fill in CFA here and try out various other functions we provide. To retain our editor on the forefront of convenience, we work to adopt user-oriented capabilities and enhancements regularly. We are at all times thankful for any feedback - play a vital part in reshaping the way you work with PDF documents. Should you be looking to get going, here's what you will need to do:

Step 1: Press the "Get Form" button in the top part of this page to get into our PDF editor.

Step 2: With this online PDF editor, you can actually accomplish more than merely fill out blanks. Try all the functions and make your forms look sublime with customized text added, or optimize the original input to perfection - all supported by an ability to add just about any pictures and sign it off.

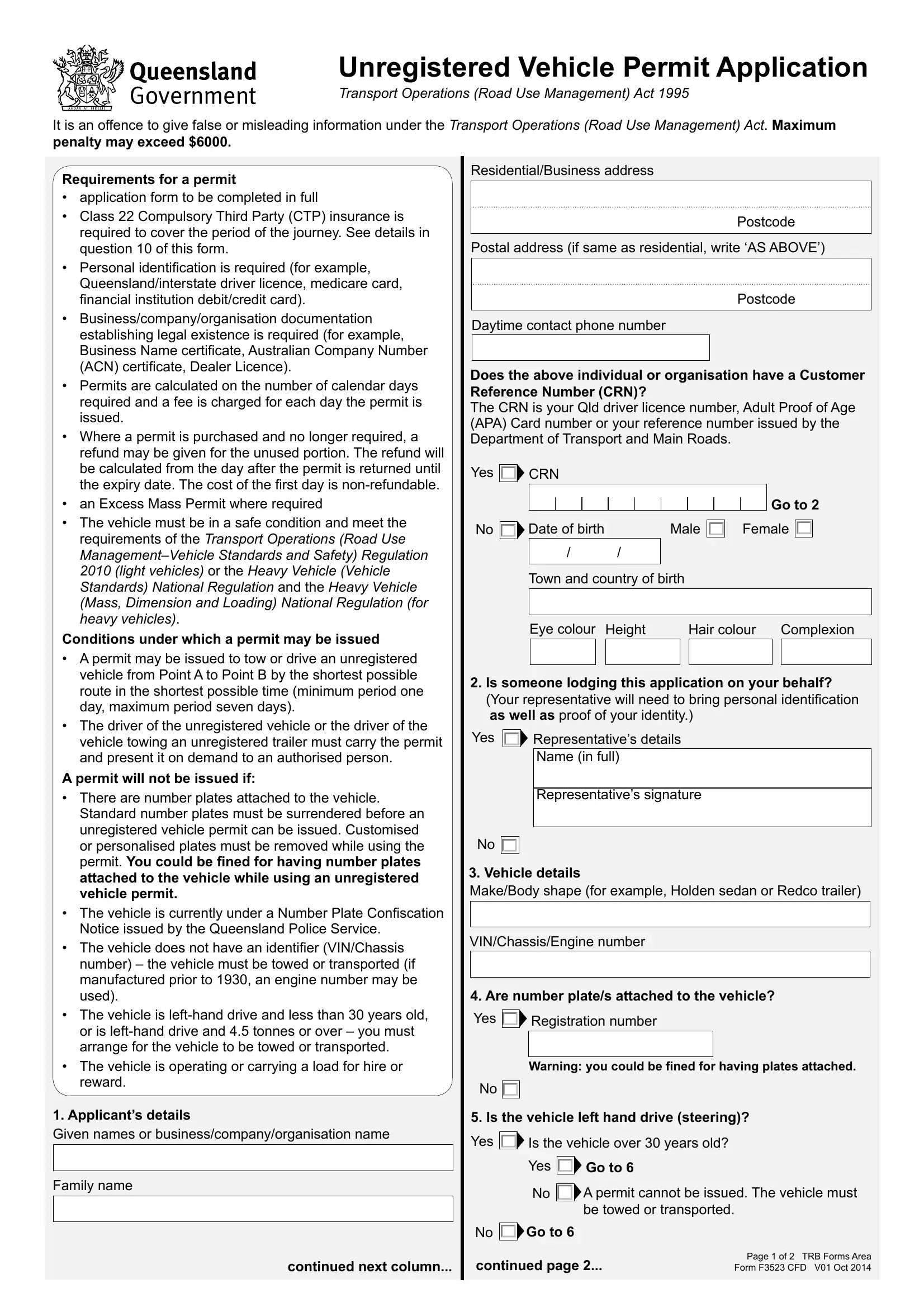

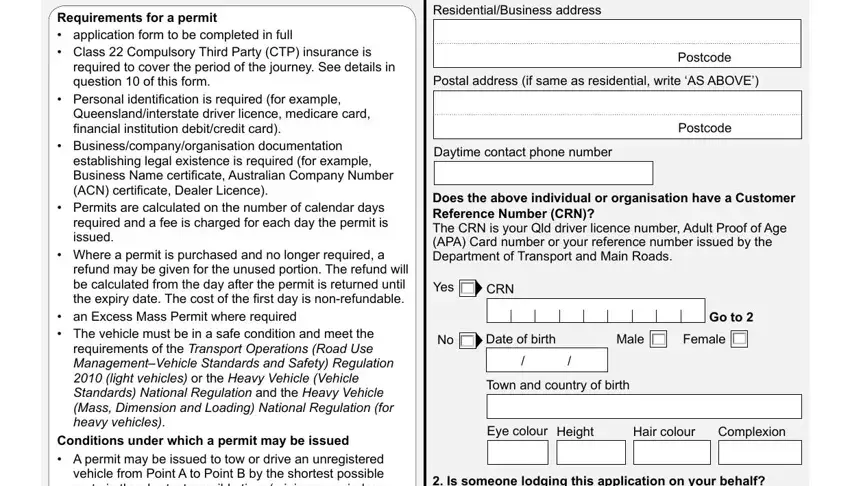

With regards to the blank fields of this particular document, here's what you want to do:

1. When completing the CFA, be sure to include all essential blank fields in their associated form section. It will help hasten the process, enabling your details to be handled fast and appropriately.

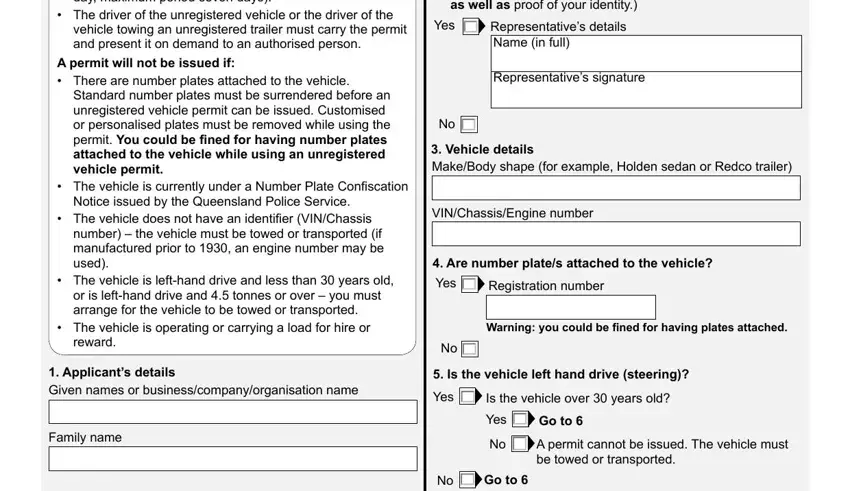

2. Just after filling in the last step, head on to the subsequent part and fill in all required particulars in all these blank fields - Conditions under which a permit, The driver of the unregistered, vehicle towing an unregistered, A permit will not be issued if, Standard number plates must be, The vehicle is currently under a, Notice issued by the Queensland, The vehicle does not have an, number the vehicle must be towed, The vehicle is lefthand drive and, or is lefthand drive and tonnes, The vehicle is operating or, reward, Applicants details Given names or, and Family name.

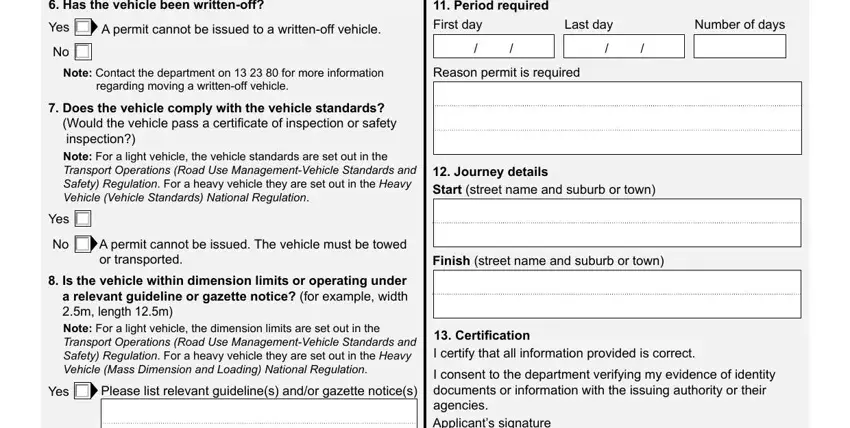

3. The following part is focused on Unregistered Vehicle Permit, A permit cannot be issued to a, Period required, First day, Last day, Number of days, Note Contact the department on, regarding moving a writtenoff, Does the vehicle comply with the, Note For a light vehicle the, Reason permit is required, Journey details Start street name, Yes, A permit cannot be issued The, and Finish street name and suburb or - complete each of these empty form fields.

Always be extremely mindful while filling in Does the vehicle comply with the and Period required, because this is the part where most people make a few mistakes.

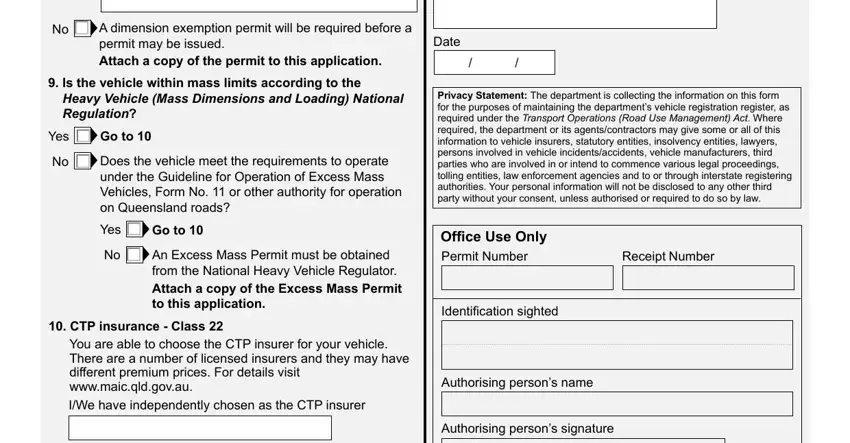

4. Completing A dimension exemption permit will, Date, Is the vehicle within mass limits, Yes, Go to, Does the vehicle meet the, Yes, Go to, An Excess Mass Permit must be, CTP insurance Class, You are able to choose the CTP, IWe have independently chosen as, Privacy Statement The department, Ofice Use Only Permit Number, and Receipt Number is essential in this section - ensure to be patient and fill in each empty field!

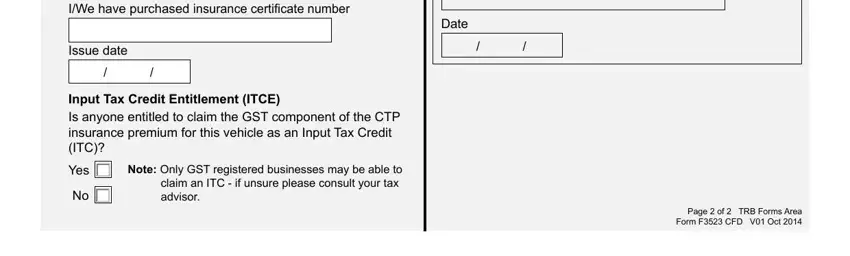

5. Since you approach the conclusion of this form, there are a couple more points to undertake. In particular, or IWe have purchased insurance, Issue date, Input Tax Credit Entitlement ITCE, Yes, Note Only GST registered, Date, and Page of TRB Forms Area Form F must be filled out.

Step 3: Once you've looked over the details entered, just click "Done" to finalize your FormsPal process. Go for a free trial plan with us and acquire direct access to CFA - with all adjustments kept and accessible from your FormsPal account. At FormsPal, we do everything we can to be sure that all of your details are maintained protected.