With the online editor for PDFs by FormsPal, it is easy to complete or change printable w9 here and now. Our editor is constantly evolving to deliver the best user experience attainable, and that's because of our resolve for continual enhancement and listening closely to customer comments. With some simple steps, you may start your PDF journey:

Step 1: Just click the "Get Form Button" above on this page to open our pdf editor. There you will find all that is necessary to fill out your file.

Step 2: As you access the online editor, you will notice the form prepared to be filled in. Other than filling out different fields, you might also do various other things with the Document, that is writing any textual content, editing the initial textual content, adding graphics, signing the form, and much more.

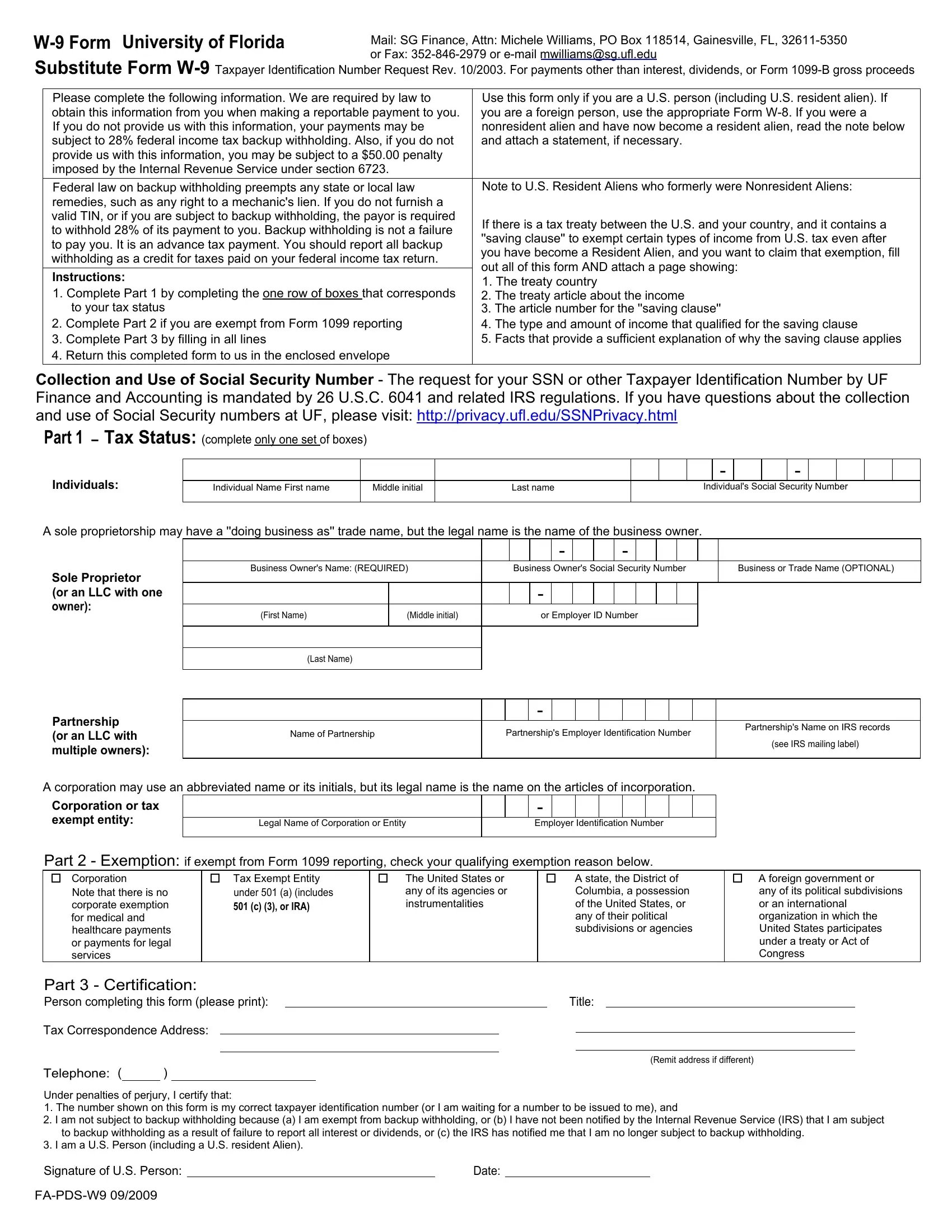

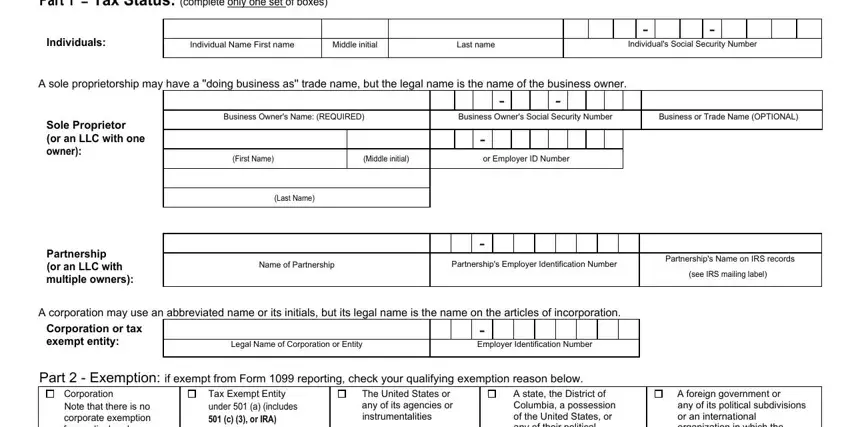

As for the fields of this specific form, here is what you should do:

1. To get started, when filling in the printable w9, start in the part with the next blank fields:

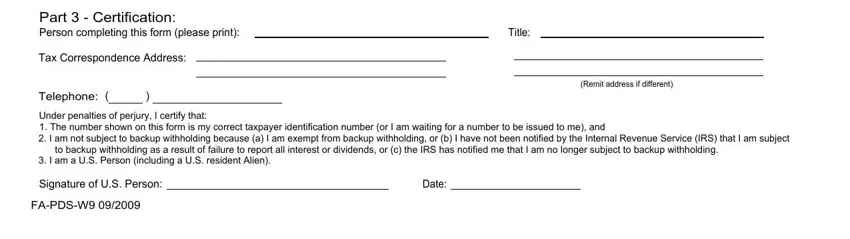

2. Just after the last array of blanks is completed, go on to type in the suitable information in these - Part Certification Person, Tax Correspondence Address, Title, Telephone Under penalties of, to backup withholding as a result, I am a US Person including a US, Remit address if different, Signature of US Person, FAPDSW, and Date.

A lot of people generally make some mistakes while filling in Part Certification Person in this section. Don't forget to revise what you enter right here.

Step 3: Soon after going through your entries, click "Done" and you are all set! Right after setting up a7-day free trial account here, it will be possible to download printable w9 or send it via email directly. The file will also be readily available via your personal account menu with your each change. FormsPal is invested in the confidentiality of all our users; we make sure all information processed by our tool continues to be protected.