In navigating the complexities of business taxation within Tennessee, entities find themselves interacting with various procedural documents, one of which is the FAE 173 form. Constructed by the Tennessee Department of Revenue, this form serves as an application for businesses seeking an extension of time to file their Franchise and Excise Tax Return. The structure of this application outlines essential information including the tax year beginning and ending dates, account number, Federal Employer Identification Number (FEIN), and the legal name and address of the filing entity. A noteworthy aspect is the provision allowing a six-month extension, granted under specific conditions detailed within the instructions of the form. These conditions include the making of estimated tax payments for the current year, factoring in available tax credits, and considering overpayments from previous years. This delineation ensures entities are cognizant of their fiscal responsibilities and comply with state taxation regulations. Furthermore, the form accommodates electronic submissions and payments, reinforcing the state's commitment to leveraging technology for efficiency. Applicants are required to calculate the extension payment meticulously, factoring in estimated franchise and excise taxes for the current year, adjusting for prior payments and tax credits, and thereby determining the amount due with the extension request. This procedural step is underscored by a declaration under the penalties of perjury, emphasizing the legal bearing and the seriousness with which these declarations are to be made. The intricate details and procedural requirements embedded within the FAE 173 form highlight not just the bureaucratic process, but also the accountability and forethought expected from businesses in managing their tax liabilities within Tennessee.

| Question | Answer |

|---|---|

| Form Name | Form Fae 173 |

| Form Length | 2 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 30 sec |

| Other names | tennessee franchise excise, tennessee department extension, tennessee fae 173, tn fae |

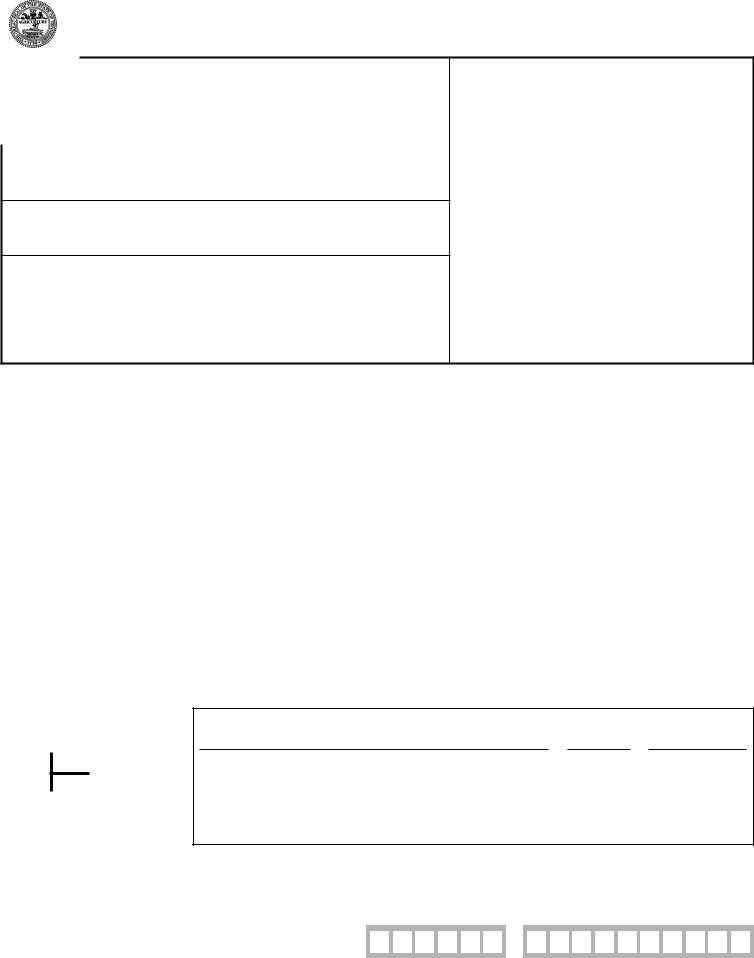

TEN N ES S EE D EP ARTMEN T OF REVEN U E

Ap p lic a tio n fo r Ex te n s io n o f Tim e to File Fra n c h is e a n d Ex c is e Ta x Re tu rn

F AE |

Tax Year Beginning |

Account Number |

|

|

|

17 3 |

|

|

|

Tax Year Ending |

FEIN |

|

|

|

Legal Name |

|

|

Mailing Address

City

State |

ZIP Code |

|

|

A six- month extension will be granted, provided you meet the requirements outlined in the

instructions.

Quarterly estimated tax payments made for the year, available tax credits, and overpayments from prior years should be deducted when computing the payment due.

You may file your extension and payment at: www.tn.gov/revenue.

Remit amount on Line 4 to:

Tennessee Department of Revenue

Andrew Jackson State Office Building

500 Deaderick Street, Nashville, TN 37242

Computation of Extension Payment

|

|

|

Round to the nearest dollar |

1. |

Estimated franchise tax current year |

(1) |

____________________________ |

2. |

Estimated excise tax current year |

(2) |

____________________________ |

3. |

Deduct prior year's overpayments and current year's estimated payments and |

|

|

|

tax credits |

(3) |

____________________________ |

4. |

Amount due with extension request (Lines 1 and 2, subtract Line 3) |

(4) |

____________________________ |

Under penalties of perjury, I declare that I have examined this report, and to the best of my knowledge and belief, it is true, correct, and complete.

Taxpayer's Signature |

|

|

|

|

|

|

Date |

|

|

|

Title |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Tax Preparer's Signature |

|

Preparer's PTIN |

|

Date |

|

|

|

Telephone |

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Preparer's Address |

|

|

|

|

City |

|

|

|

State |

ZIP Code |

|||

Preparer's Email Address |

|

|

|

|

|

|

|

|

|

|

|

|

|

FOR OFFICE U S E ON LY

Instructions: Application for Extension of Time to File Franchise and Excise Tax Return

You may file this extension along with your payment electronically at: www.tn.gov/revenue.

Required Payment:

Payments equal to the lesser of 100% of the prior year tax liability or 90% of the current year tax liability must be made by the original due date.

If the prior tax year covered less than 12 months, the prior period tax must be annualized when calculating the required payment.

If there was no liability for the prior year, the required payment is $100.

Quarterly estimated payments, prior year overpayments, and any other prepayments should be deducted on Line 3 of the application.

Extension requests should be made as follows:

If you are not required to make a payment, because you have already made sufficient payments on or before the original due date, you do not need to file this form.

If a payment is needed to meet the payment requirement and you do not file your federal return as part of a consolidated group, you can submit either this form or a copy of your federal extension request. This form or copy of your federal extension must be filed with the extension payment on or before the original due date of the return.

If a payment is required and you file your federal return as part of a consolidated group, you must use this form or file an extension request electronically. This form or the electronic version of this form must be filed with the extension payment on or before the original due date of the return.

Other important information:

Penalty will be computed as though no extension has been granted if: (1) the amount paid on or before the original due date does not satisfy the payment requirement indicated above, or (2) the franchise and excise tax return is not filed by the extended due date.

An approved extension does not affect interest. Interest will be computed on any unpaid tax from the original due date of the return until the date the tax is paid.