When you need to fill out Form Fbmc 403 B, you won't need to install any applications - simply use our PDF editor. Our tool is consistently developing to grant the very best user experience attainable, and that's thanks to our commitment to continuous improvement and listening closely to feedback from users. It merely requires several simple steps:

Step 1: Just click the "Get Form Button" in the top section of this webpage to access our pdf form editing tool. There you will find everything that is necessary to work with your document.

Step 2: After you launch the editor, you will get the form ready to be filled in. Apart from filling out different fields, you can also do some other actions with the file, that is putting on custom words, modifying the initial text, inserting images, affixing your signature to the form, and much more.

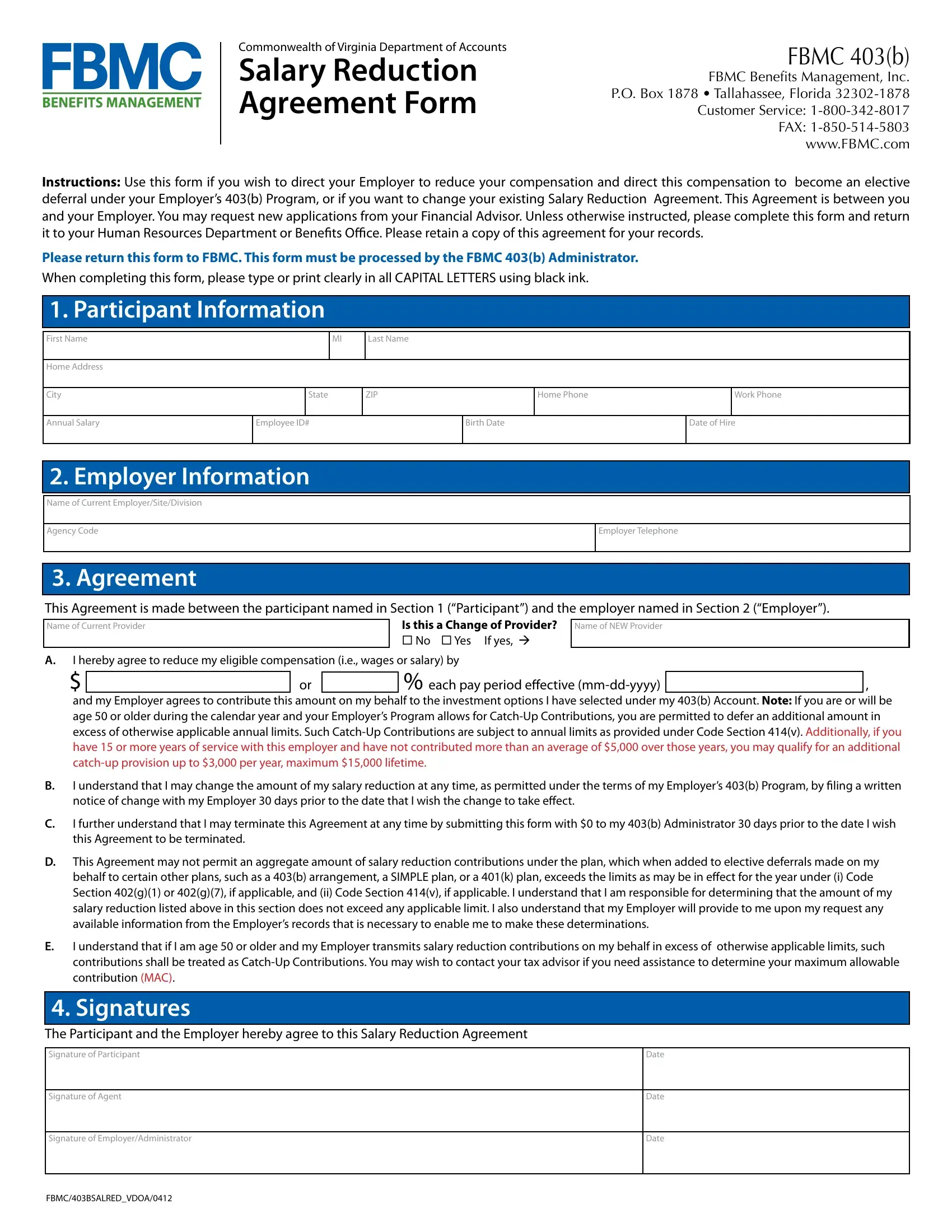

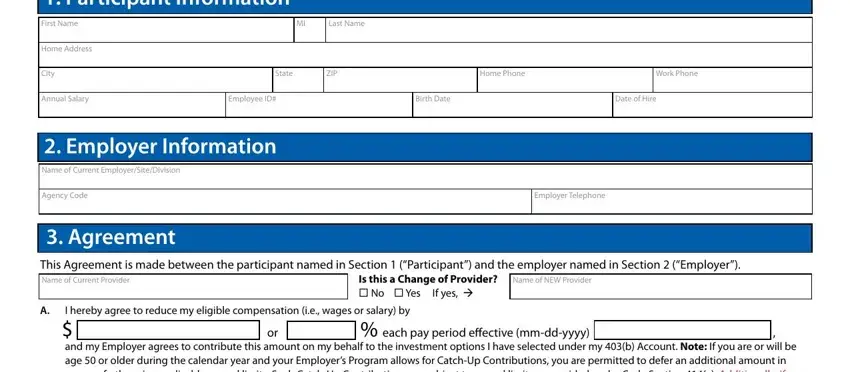

If you want to fill out this PDF document, ensure that you provide the required details in each blank:

1. Whenever filling out the Form Fbmc 403 B, make sure to include all of the necessary blank fields in the associated form section. It will help hasten the work, which allows your information to be handled quickly and accurately.

Step 3: Just after double-checking the fields, click "Done" and you are done and dusted! Try a free trial account at FormsPal and gain direct access to Form Fbmc 403 B - with all adjustments preserved and accessible in your personal account. FormsPal is dedicated to the privacy of all our users; we ensure that all personal data coming through our tool is kept protected.