We have used the efforts of the best developers to design the PDF editor you are about to take advantage of. The software will help you create the income expense form with ease and don’t waste precious time. All you should do is follow the next easy-to-follow steps.

Step 1: At first, choose the orange "Get form now" button.

Step 2: As soon as you have accessed the income expense edit page, you'll see all functions you can take with regards to your document at the top menu.

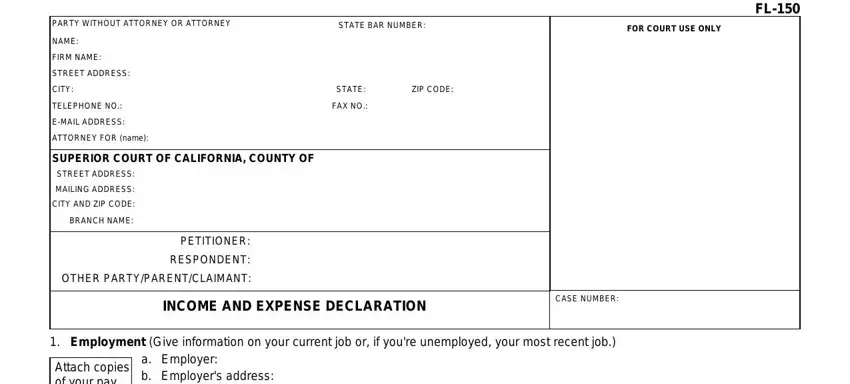

The next sections will compose the PDF template that you will be creating:

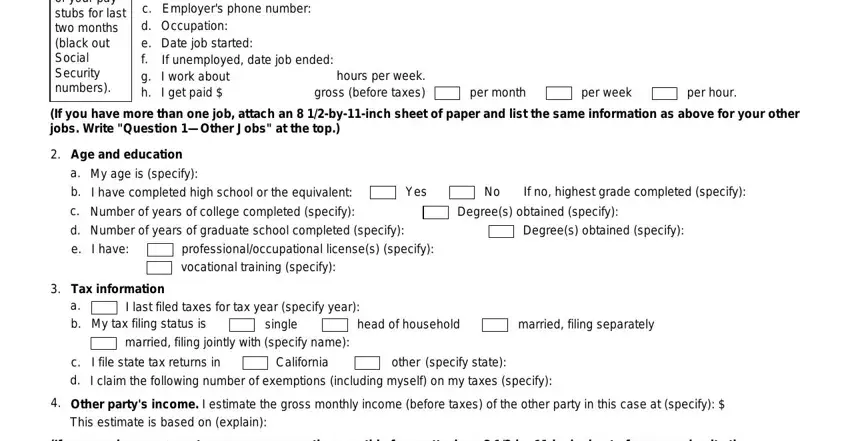

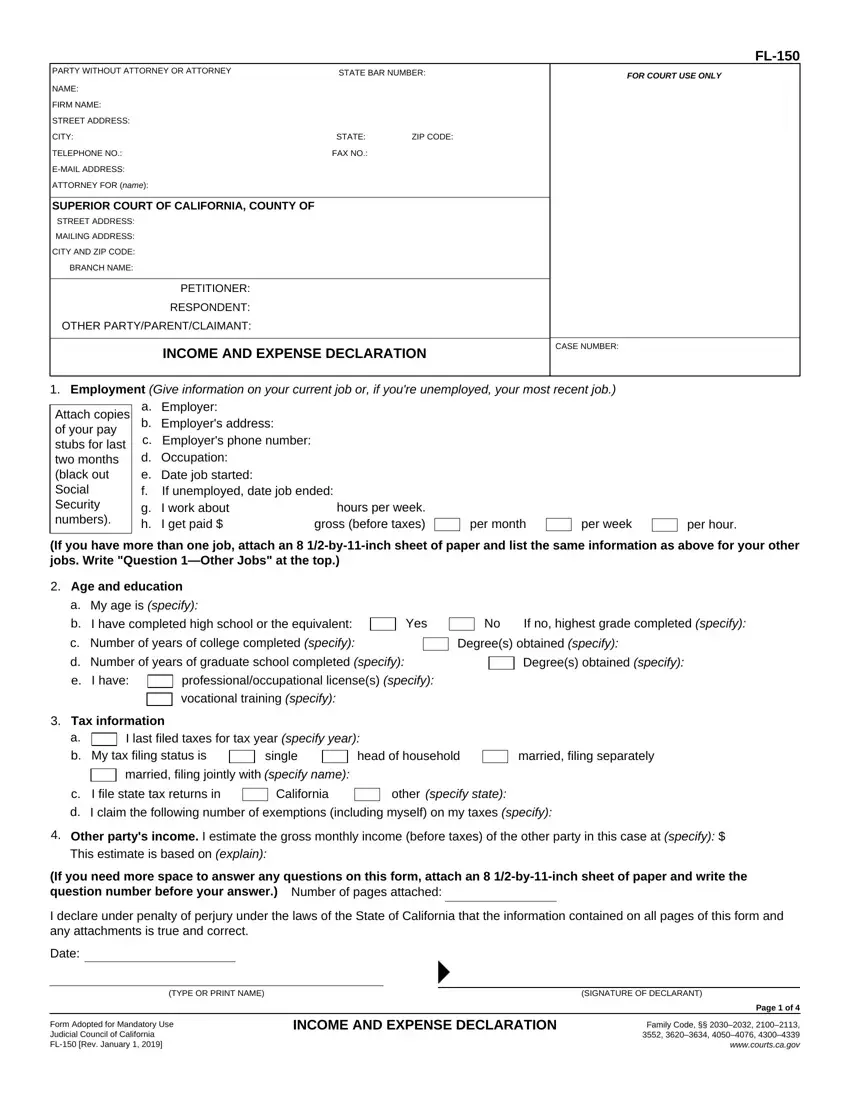

Jot down the details in the Attach copies of your pay stubs, a b c d e f g h, Employer Employers address, hours per week gross before taxes, per month, per week, per hour, If you have more than one job, Age and education, My age is specify I have completed, Yes, If no highest grade completed, Number of years of college, Degrees obtained specify, and Number of years of graduate school field.

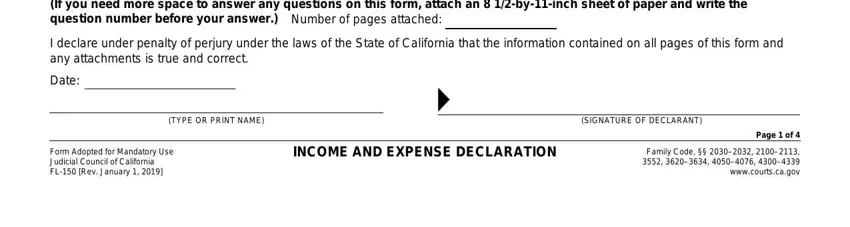

Note down all information you may need inside the box If you need more space to answer, Number of pages attached, I declare under penalty of perjury, Date, TYPE OR PRINT NAME, SIGNATURE OF DECLARANT, Form Adopted for Mandatory Use, INCOME AND EXPENSE DECLARATION, Page of, and Family Code wwwcourtscagov.

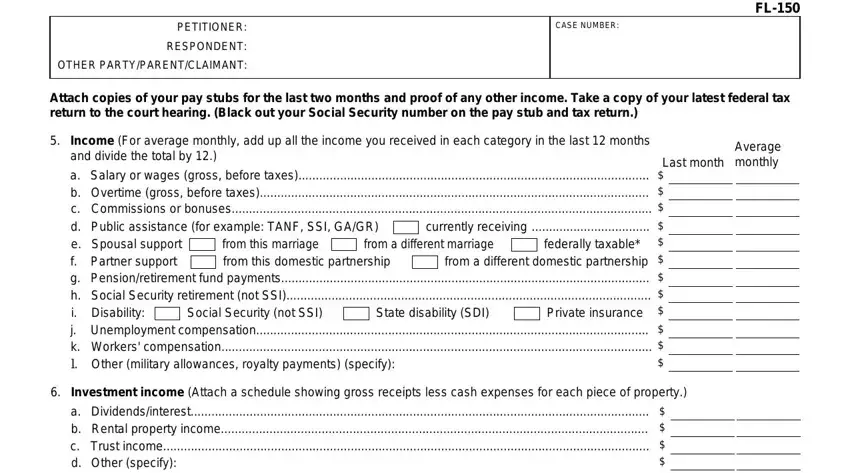

The area PETITIONER, RESPONDENT, OTHER PARTYPARENTCLAIMANT, CASE NUMBER, Attach copies of your pay stubs, Income For average monthly add up, Salary or wages gross before taxes, a b c d e f g h i j k l Other, from this marriage from this, Social Security not SSI, from a different marriage, State disability SDI, currently receiving, federally taxable, and Average monthly will be where you include both parties' rights and obligations.

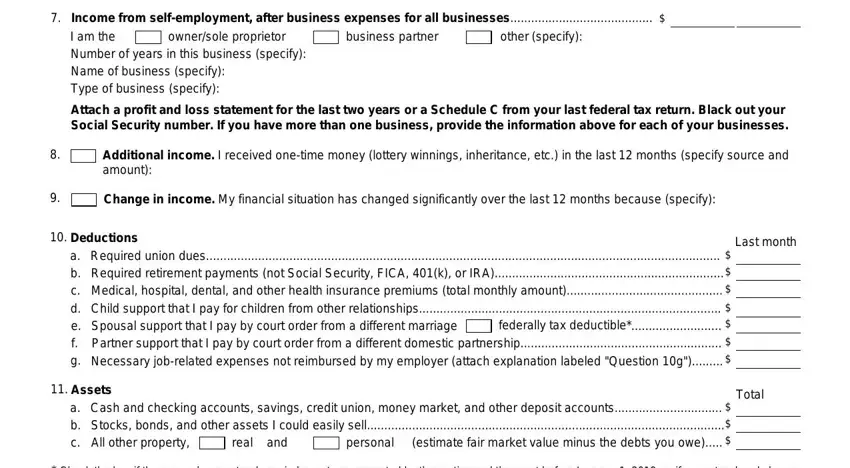

Terminate by reviewing the next fields and completing them accordingly: ownersole proprietor, Income from selfemployment after, business partner, other specify, Attach a profit and loss statement, Additional income I received, Change in income My financial, Deductions, a b c d e f g, Required union dues Required, federally tax deductible, Assets a b c, Cash and checking accounts savings, real and, and personal.

Step 3: In case you are done, press the "Done" button to transfer the PDF file.

Step 4: Generate duplicates of the document. This should save you from forthcoming issues. We cannot view or distribute the information you have, for that reason feel comfortable knowing it will be safe.

No If no, highest grade completed

No If no, highest grade completed

Rent or

Rent or