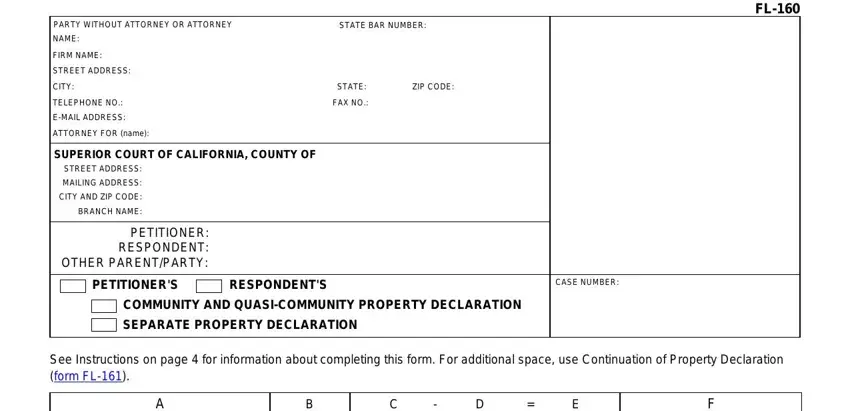

FL-160

INFORMATION AND INSTRUCTIONS FOR COMPLETING FORM FL-160

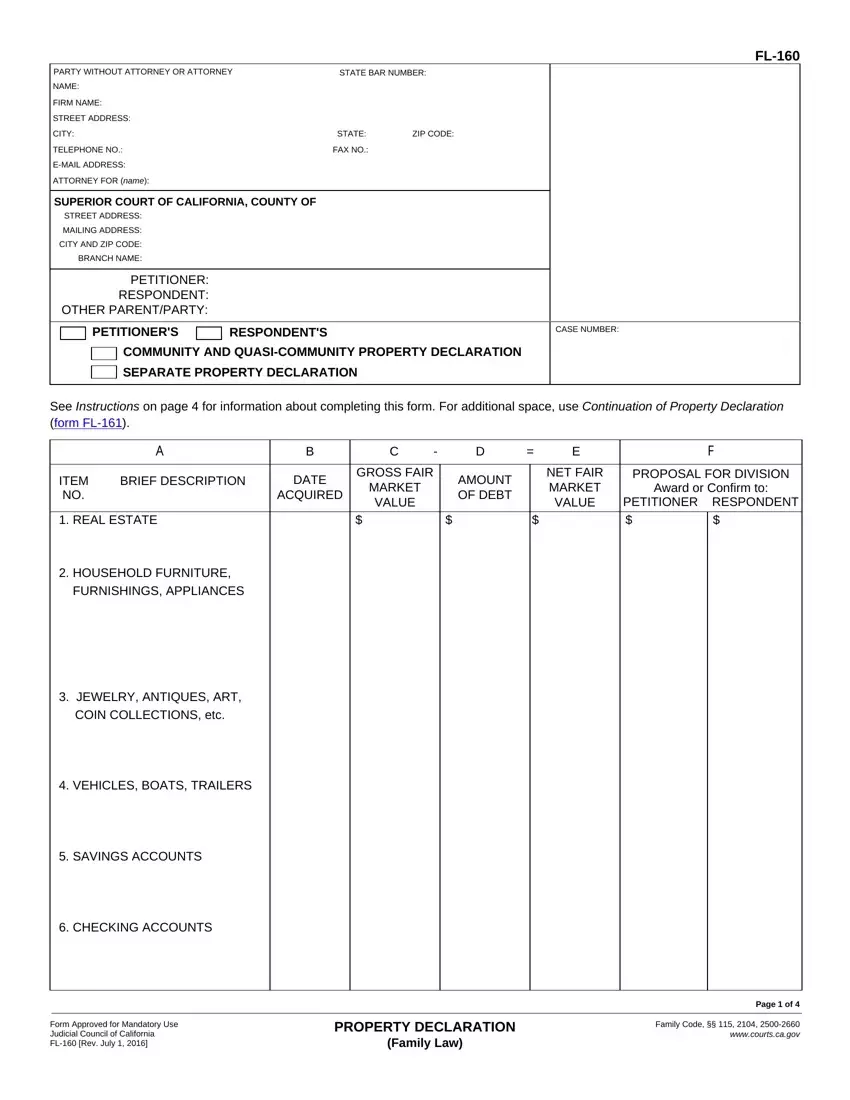

Property Declaration (form FL-160) is a multipurpose form, which may be filed with the court as an attachment to a Petition or Response or served on the other party to comply with disclosure requirements in place of a Schedule of Assets and Debts (form FL-142). Courts may also require a party to file a Property Declaration as an attachment to a Request to Enter Default (form FL-165) or Judgment (form FL-180).

When filing a Property Declaration with the court, do not include private financial documents listed below. Identify the type of declaration completed

1.Check "Community and Quasi-Community Property Declaration" on page 1 to use Property Declaration (form FL-160) to provide a combined list of community and quasi-community property assets and debts. Quasi-community property is property you own outside of California that would be community property if it were located in California.

2.Do not combine a separate property declaration with a community and quasi-community property declaration. Check "Separate Property Declaration" on page 1 when using Property Declaration to provide a list of separate property assets and debts.

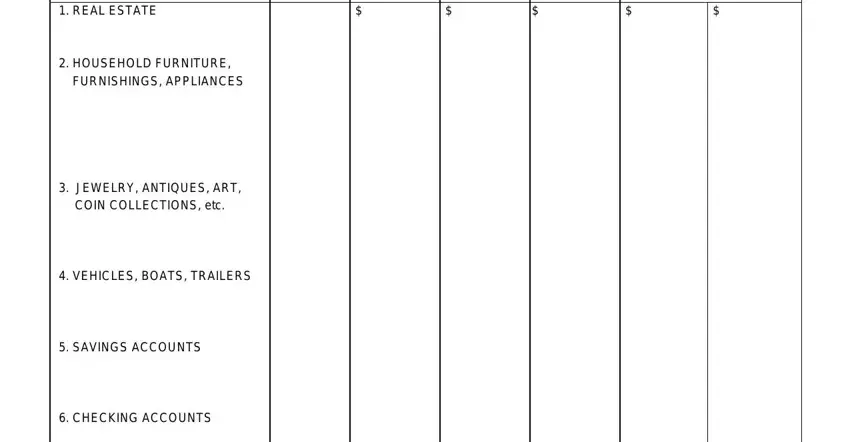

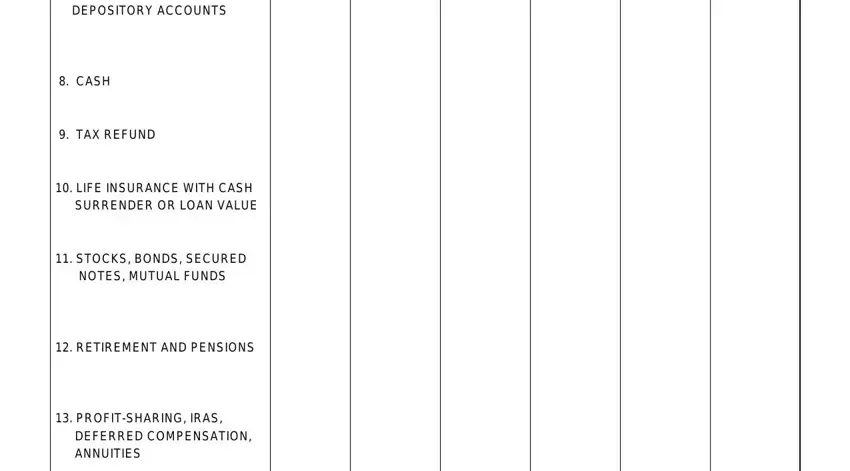

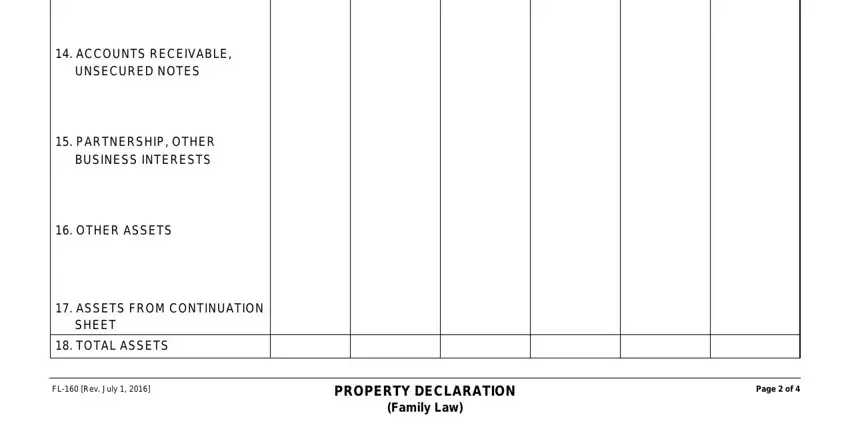

Description of the Property Declaration chart

Pages 1 and 2

1.Column A is used to provide a brief description of each item of separate or community or quasi-community property.

2.Column B is used to list the date the item was acquired.

3.Column C is used to list the item's gross fair market value (an estimate of the amount of money you could get if you sold the item to another person through an advertisement).

4.Column D is used to list the amount owed on the item.

5.Column E is used to indicate the net fair market value of each item. The net fair market value is calculated by subtracting the dollar amount in column D from the amount in column C ("C minus D").

6.Column F is used to show a proposal on how to divide (or confirm) the item described in column A.

Page 3

1.Column A is used to provide a brief description of each separate or community or quasi-community property debt.

2.Column B is used to list the date the debt was acquired.

3.Column C is used to list the total amount of money owed on the debt.

4.Column D is used to show a proposal on how to divide (or confirm) the item of debt described in column A.

When using this form only as an attachment to a Petition or Response

1.Attach a Separate Property Declaration (form FL-160) to respond to item 9. Only columns A and F on pages 1 and 2 and columns A and D on page 3 are required.

2.Attach a Community or Quasi-Community Declaration (form FL-160) to respond to item 10, and complete column A on all pages.

When serving this form on the other party as an attachment to Declaration of Disclosure (form FL-140)

1.Complete columns A through E on pages 1 and 2, and columns A through C on page 3.

2.Copies of the following documents must be attached and served on the other party:

(a)For real estate (item 1): deeds with legal descriptions and the latest lender's statement.

(b)For vehicles, boats, trailers (item 4): the title documents.

(c)For all bank accounts (item 5, 6, 7): the latest statement.

(d)For life insurance policies with cash surrender or loan value (item 10): the latest declaration page.

(e)For stocks, bonds, secured notes, mutual funds (item 11): the certificate or latest statement.

(f)For retirement and pensions (item 12): the latest summary plan document and latest benefit statement.

(g)For profit-sharing, IRAs, deferred compensation, and annuities (item 13): the latest statement.

(h)For each account receivable and unsecured note (item 14): documentation of the account receivable or note.

(i)For partnerships and other business interests (item 15): the most current K-1 and Schedule C.

(j)For other assets (item 16): the most current statement, title document, or declaration.

(k)For support arrearages (item 21): orders and statements.

(l)For credit cards and other debts (items 23 and 24): the latest statement.

3.Do not file copies of the above private financial documents with the court.

When filing this form with the court as a attachment to Request to Enter Default (FL-165) or Judgment (FL-180) Complete all columns on the form.

For more information about forms required to process and obtain a judgment in dissolution, legal separation, and nullity cases, see http://www.courts.ca.gov/8218.htm.

COMMUNITY AND

COMMUNITY AND

SEPARATE PROPERTY DECLARATION

SEPARATE PROPERTY DECLARATION

A

A