california qualified domestic relations order form can be completed without difficulty. Just try FormsPal PDF tool to finish the job right away. To make our tool better and more convenient to use, we continuously come up with new features, considering suggestions coming from our users. Here's what you'll have to do to begin:

Step 1: Click on the "Get Form" button at the top of this page to get into our PDF editor.

Step 2: When you start the file editor, you will get the form all set to be filled out. Besides filling in different fields, you can also do other actions with the file, including adding your own words, modifying the original textual content, inserting illustrations or photos, affixing your signature to the form, and more.

This form will need specific details; in order to ensure accuracy, remember to take note of the next tips:

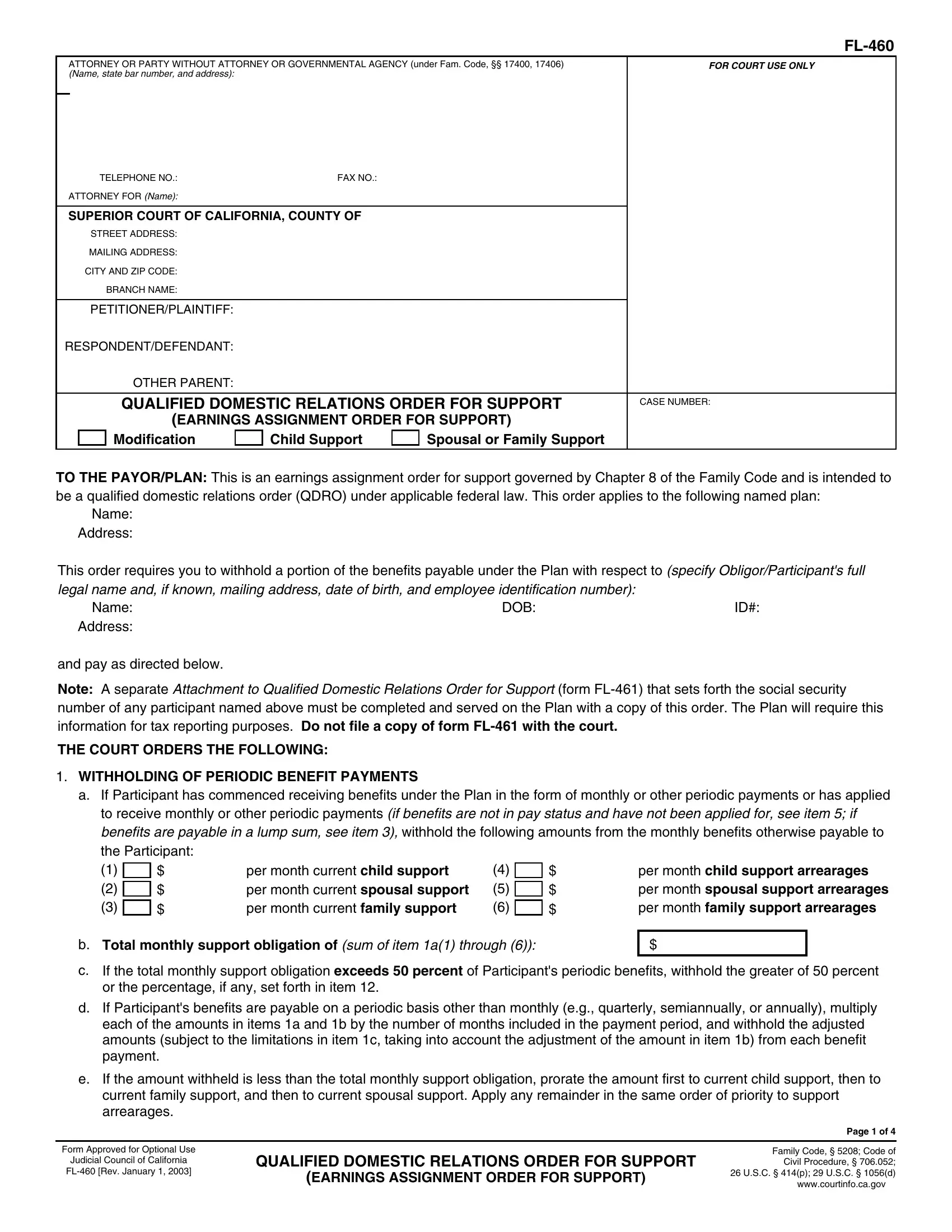

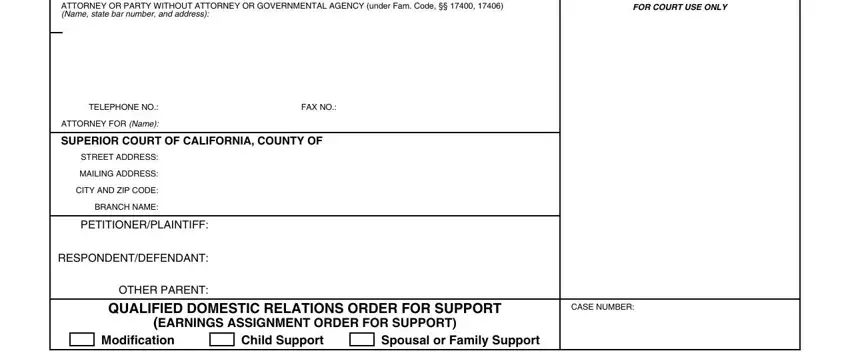

1. You will need to complete the california qualified domestic relations order form accurately, so be attentive when filling in the parts containing these blank fields:

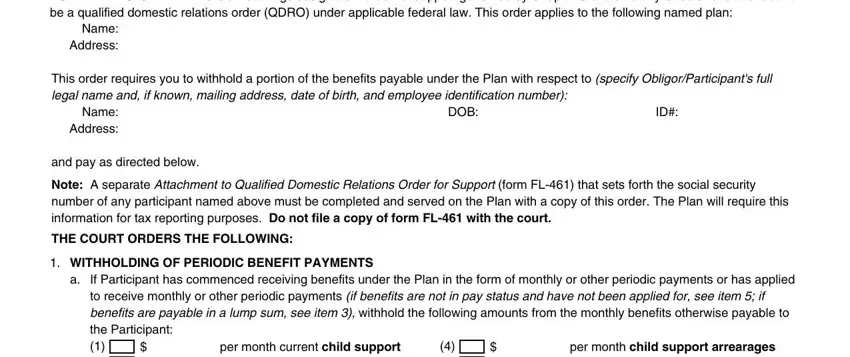

2. Given that the last array of fields is finished, you'll want to put in the necessary details in TO THE PAYORPLAN This is an, Name Address, This order requires you to, Name Address, and pay as directed below, DOB, Note A separate Attachment to, THE COURT ORDERS THE FOLLOWING, WITHHOLDING OF PERIODIC BENEFIT, If Participant has commenced, per month child support arrearages, and per month current child support in order to proceed further.

3. This next section will be about If Participant has commenced, per month child support arrearages, per month current child support, b Total monthly support obligation, If the total monthly support, If the amount withheld is less, Form Approved for Optional Use, Judicial Council of California FL, QUALIFIED DOMESTIC RELATIONS ORDER, EARNINGS ASSIGNMENT ORDER FOR, Page of, Family Code Code of Civil, and wwwcourtinfocagov - fill in each of these empty form fields.

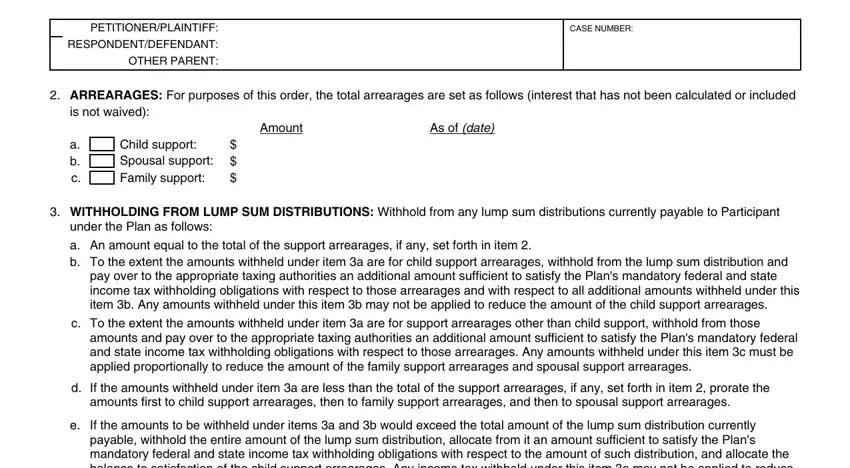

4. To go onward, the following stage will require filling in a handful of blanks. Examples include PETITIONERPLAINTIFF, RESPONDENTDEFENDANT, OTHER PARENT, CASE NUMBER, ARREARAGES For purposes of this, Amount, As of date, a b c, Child support Spousal support, WITHHOLDING FROM LUMP SUM, An amount equal to the total of, If the amounts withheld under item, and If the amounts to be withheld, which you'll find vital to carrying on with this particular PDF.

As for If the amounts withheld under item and Amount, be sure that you do everything correctly in this current part. These two could be the key fields in the page.

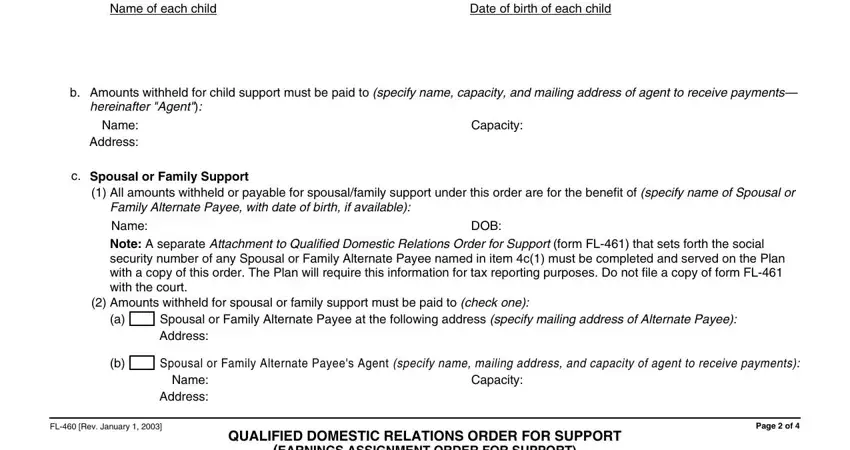

5. The very last stage to complete this form is critical. You'll want to fill out the necessary blanks, consisting of Name of each child, Date of birth of each child, Amounts withheld for child support, Name Address, Capacity, Spousal or Family Support, All amounts withheld or payable, Spousal or Family Alternate Payee, DOB, Spousal or Family Alternate Payees, Name Address, FL Rev January, Capacity, QUALIFIED DOMESTIC RELATIONS ORDER, and EARNINGS ASSIGNMENT ORDER FOR, before finalizing. Otherwise, it might lead to an unfinished and possibly incorrect form!

Step 3: After you have reviewed the information provided, press "Done" to complete your FormsPal process. Sign up with FormsPal now and immediately use california qualified domestic relations order form, set for downloading. All changes you make are preserved , letting you change the document later as required. We do not sell or share the details that you enter whenever working with documents at our website.