In case you need to fill out form forbearance request, you won't have to download any programs - just give a try to our online PDF editor. To make our editor better and simpler to utilize, we continuously work on new features, taking into consideration suggestions coming from our users. Here is what you'll need to do to get going:

Step 1: Just hit the "Get Form Button" in the top section of this page to access our pdf editing tool. Here you'll find everything that is needed to work with your file.

Step 2: With our state-of-the-art PDF editor, you can accomplish more than simply fill in blank fields. Express yourself and make your docs appear great with customized textual content put in, or modify the original input to perfection - all supported by an ability to incorporate almost any pictures and sign the document off.

As a way to fill out this form, be certain to provide the right information in every single blank field:

1. You have to fill out the form forbearance request correctly, so take care when filling out the segments containing all these blank fields:

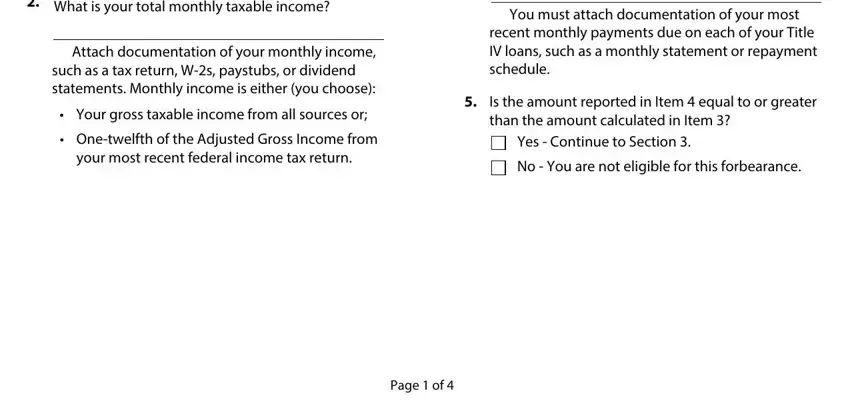

2. After performing this step, head on to the next part and enter the necessary particulars in all these blanks - What is your total monthly, Attach documentation of your, such as a tax return Ws paystubs, Your gross taxable income from, Onetwelfth of the Adjusted Gross, your most recent federal income, You must attach documentation of, recent monthly payments due on, Is the amount reported in Item, Yes Continue to Section, No You are not eligible for this, and Page of.

It's very easy to make an error while filling in your You must attach documentation of, thus be sure to reread it before you send it in.

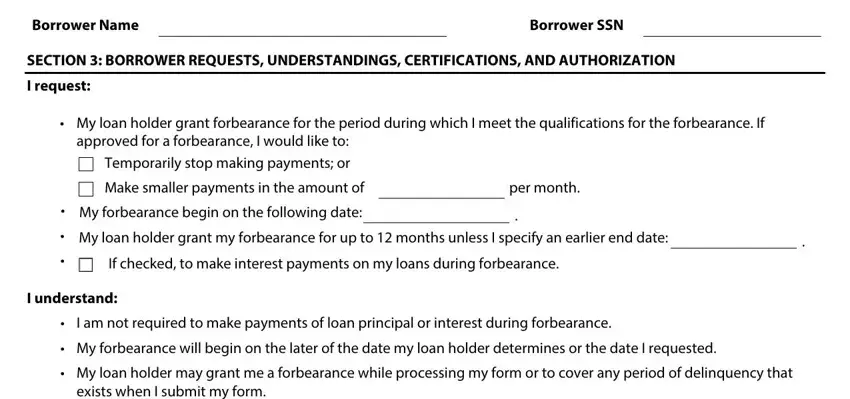

3. This third stage is going to be straightforward - fill in every one of the form fields in Borrower Name, Borrower SSN, SECTION BORROWER REQUESTS, I request, My loan holder grant forbearance, approved for a forbearance I would, Make smaller payments in the, per month, My loan holder grant my, If checked to make interest, I understand, I am not required to make payments, My forbearance will begin on the, and My loan holder may grant me a to conclude this segment.

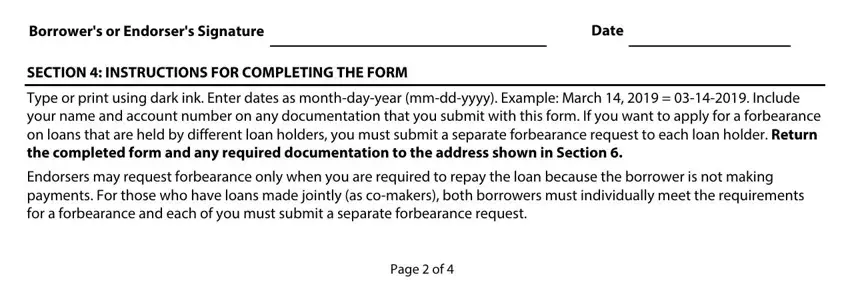

4. This next section requires some additional information. Ensure you complete all the necessary fields - Borrowers or Endorsers Signature, Date, SECTION INSTRUCTIONS FOR, Type or print using dark ink Enter, Endorsers may request forbearance, and Page of - to proceed further in your process!

5. Lastly, this final subsection is what you will need to complete before submitting the document. The blanks at issue include the following: Page of.

Step 3: Proofread the information you've inserted in the blanks and then hit the "Done" button. Go for a 7-day free trial subscription at FormsPal and obtain direct access to form forbearance request - download or edit inside your personal account page. We don't share or sell the details that you type in whenever dealing with documents at FormsPal.