Working with PDF documents online is definitely surprisingly easy with our PDF editor. Anyone can fill out fp 161 exempt property here within minutes. Our tool is consistently evolving to grant the best user experience achievable, and that's because of our resolve for continual enhancement and listening closely to feedback from users. By taking a few basic steps, you may begin your PDF editing:

Step 1: Press the "Get Form" button in the top area of this webpage to get into our PDF editor.

Step 2: The tool enables you to change the majority of PDF files in various ways. Modify it by adding your own text, adjust existing content, and place in a signature - all possible in no time!

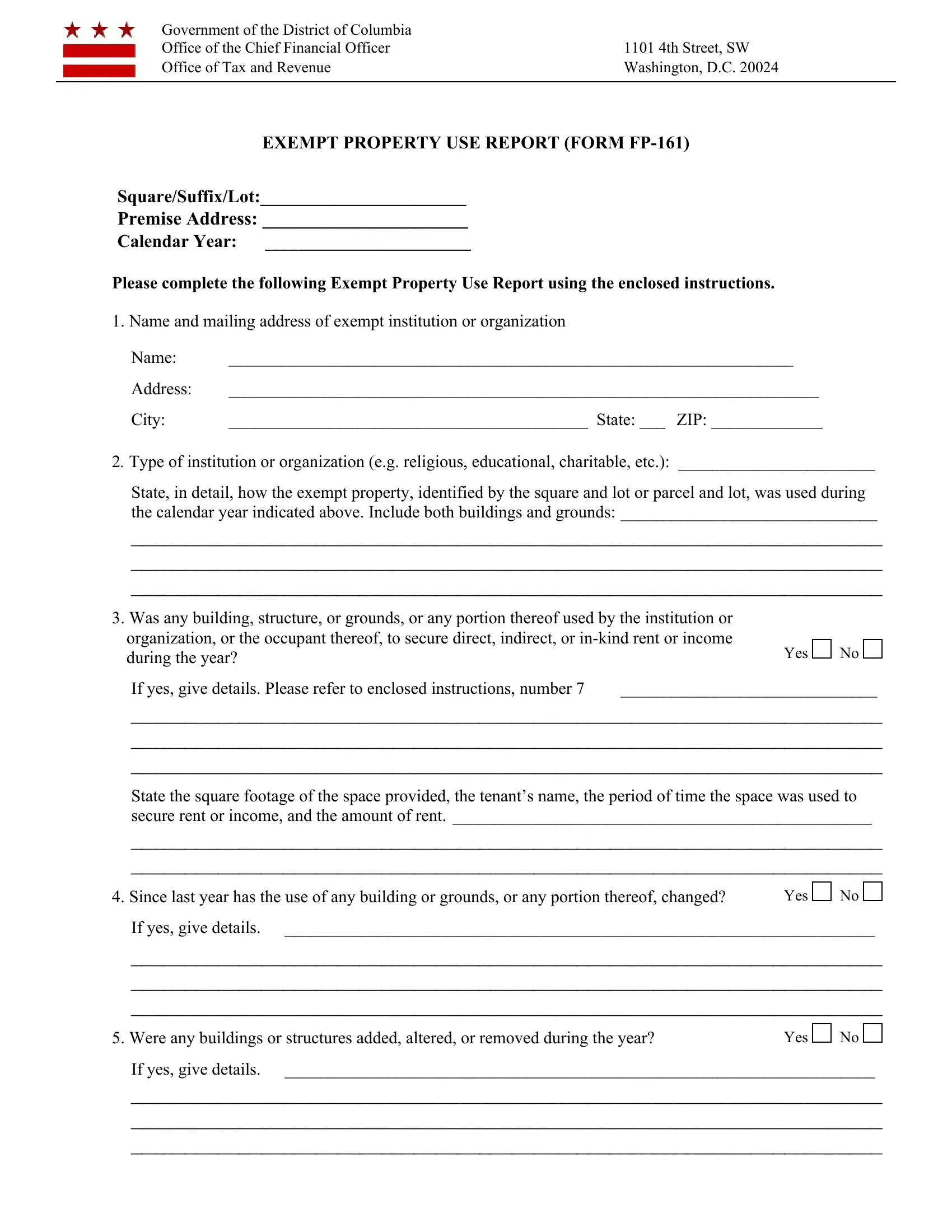

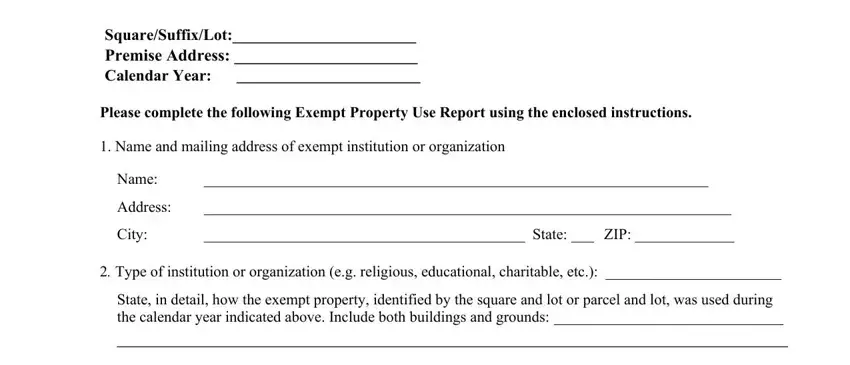

This form will require specific info to be filled out, so be sure you take the time to fill in what is asked:

1. The fp 161 exempt property will require particular details to be inserted. Be sure that the subsequent blanks are completed:

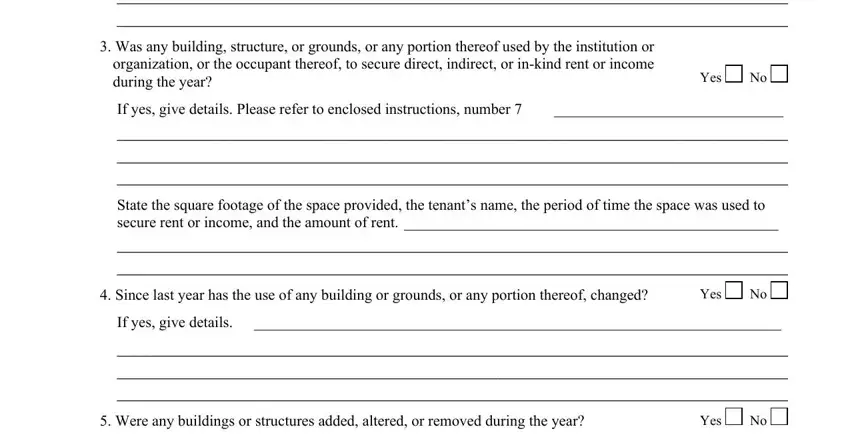

2. Once your current task is complete, take the next step – fill out all of these fields - State in detail how the exempt, Was any building structure or, Yes, If yes give details Please refer, State the square footage of the, Since last year has the use of, Yes, If yes give details, Were any buildings or structures, and Yes with their corresponding information. Make sure to double check that everything has been entered correctly before continuing!

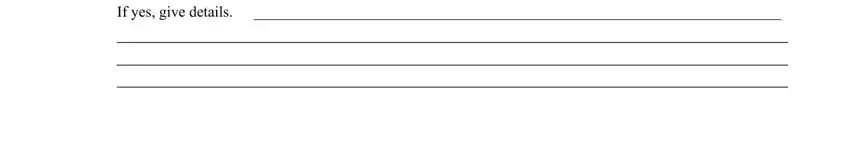

3. The next part is typically fairly easy, If yes give details - all these form fields is required to be filled in here.

As for If yes give details and If yes give details, be sure that you double-check them here. Both of these could be the most important ones in the file.

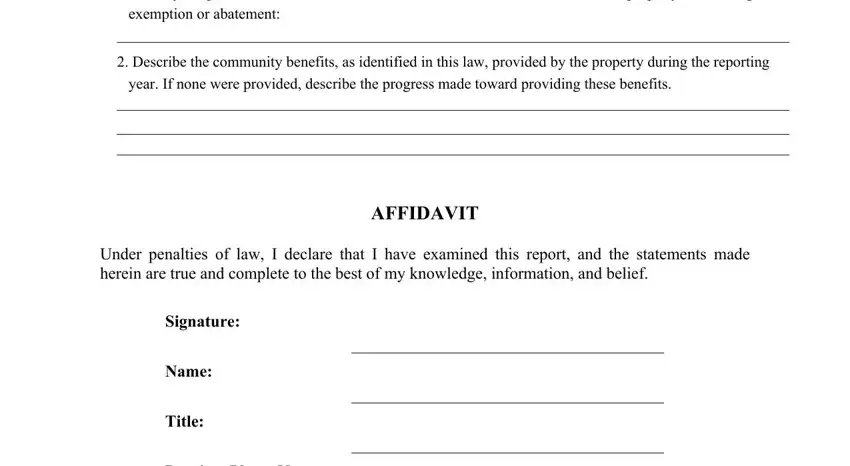

4. You're ready to complete the next segment! Here you've got these Identify the provision of the, exemption or abatement, Describe the community benefits, year If none were provided, AFFIDAVIT, Under penalties of law I declare, Signature, Name, and Title fields to do.

5. Last of all, this final subsection is what you will need to complete before closing the PDF. The blanks in question are the following: Daytime Phone No, Date, Below is the return address for, is visible in the window of the, Instructions for completing the, and Government of the District of.

Step 3: Proofread all the details you've typed into the blank fields and then press the "Done" button. Right after starting a7-day free trial account with us, you'll be able to download fp 161 exempt property or email it without delay. The document will also be available in your personal account menu with your each edit. At FormsPal, we aim to be sure that all your details are stored protected.