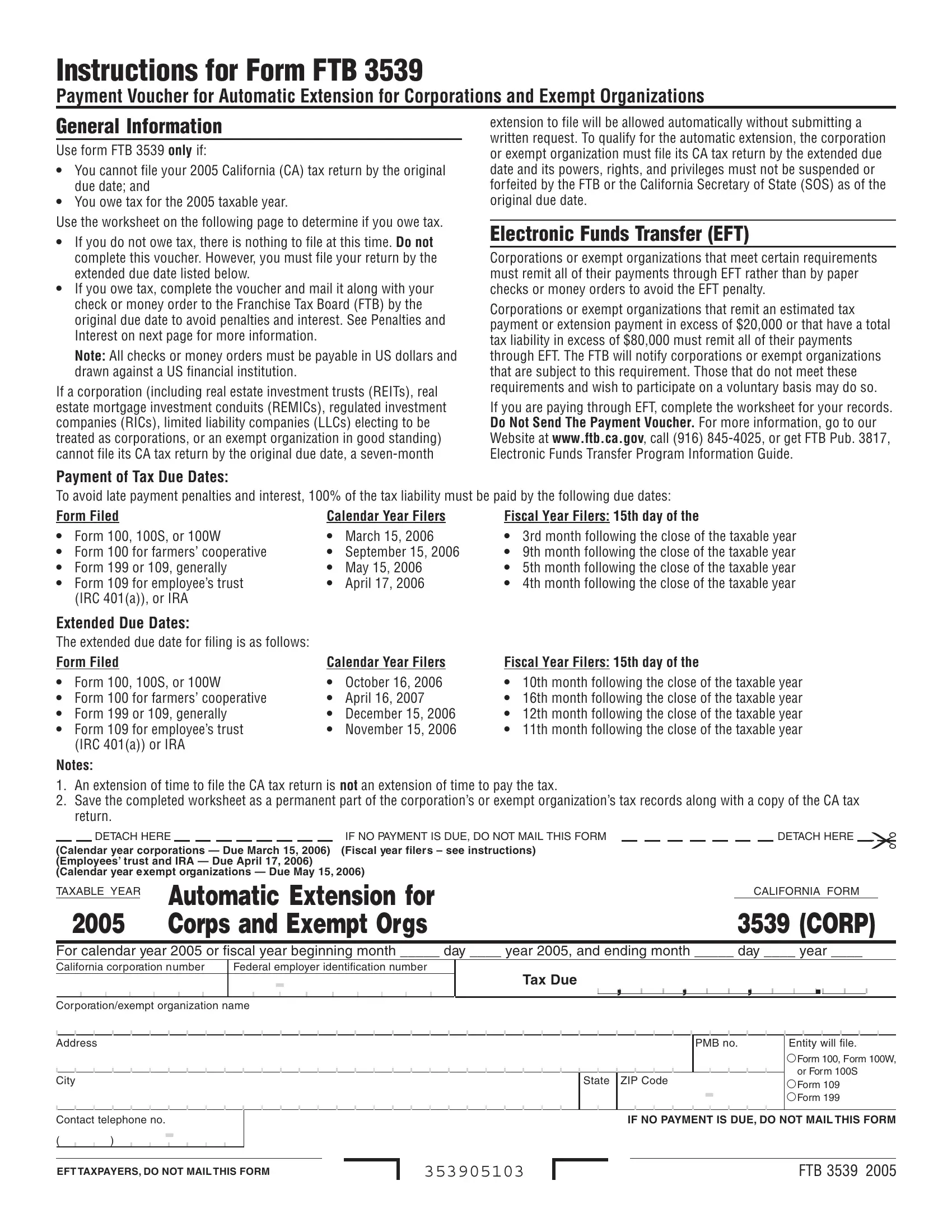

Dealing with PDF forms online is certainly quite easy with this PDF tool. Anyone can fill out ftb 3539 here within minutes. To make our tool better and simpler to utilize, we constantly come up with new features, with our users' suggestions in mind. Getting underway is easy! Everything you need to do is stick to the next easy steps below:

Step 1: Firstly, open the pdf editor by clicking the "Get Form Button" above on this page.

Step 2: The tool will let you work with your PDF file in many different ways. Change it by writing personalized text, correct original content, and include a signature - all at your convenience!

This form will require particular data to be filled in, therefore you must take the time to fill in what's required:

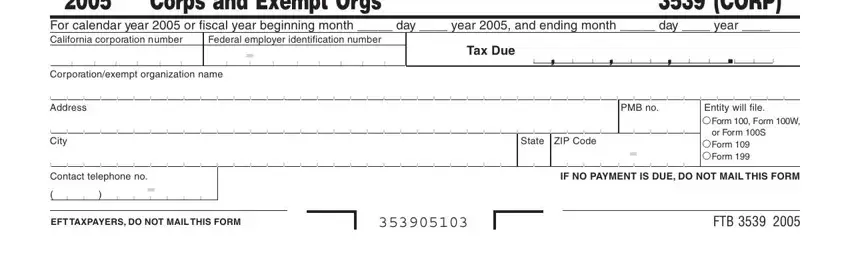

1. While completing the ftb 3539, make sure to incorporate all important blank fields in its corresponding area. It will help to speed up the process, enabling your information to be processed without delay and appropriately.

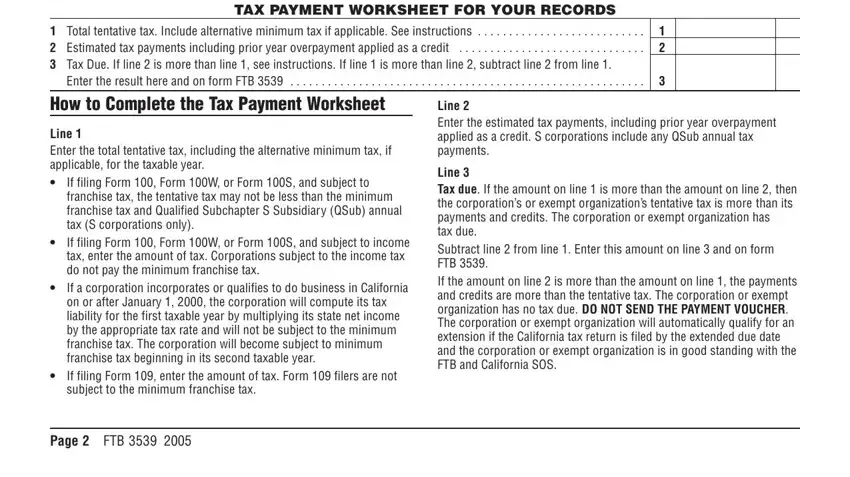

2. Once your current task is complete, take the next step – fill out all of these fields - TAX PAYMENT WORKSHEET FOR YOUR, Total tentative tax Include, Enter the result here and on form, How to Complete the Tax Payment, Line Enter the total tentative, If filing Form Form W or Form S, cid, cid, cid, Page, FTB, Line Enter the estimated tax, and Line Tax due If the amount on with their corresponding information. Make sure to double check that everything has been entered correctly before continuing!

When it comes to cid and cid, ensure you take another look in this current part. These two are the most significant ones in the page.

Step 3: Before submitting the file, check that blank fields have been filled out the proper way. As soon as you are satisfied with it, click on “Done." Go for a free trial subscription with us and acquire direct access to ftb 3539 - with all changes preserved and available from your personal account. At FormsPal, we do everything we can to be sure that your details are maintained private.