Handling PDF forms online is always quite easy using our PDF editor. Anyone can fill out remitted here and use many other functions we offer. The tool is continually upgraded by us, receiving cool features and becoming better. Starting is simple! All you have to do is stick to the next simple steps down below:

Step 1: Simply hit the "Get Form Button" at the top of this site to get into our pdf file editor. This way, you will find all that is necessary to work with your file.

Step 2: The tool will allow you to change your PDF in various ways. Change it by including personalized text, adjust what is originally in the document, and put in a signature - all when it's needed!

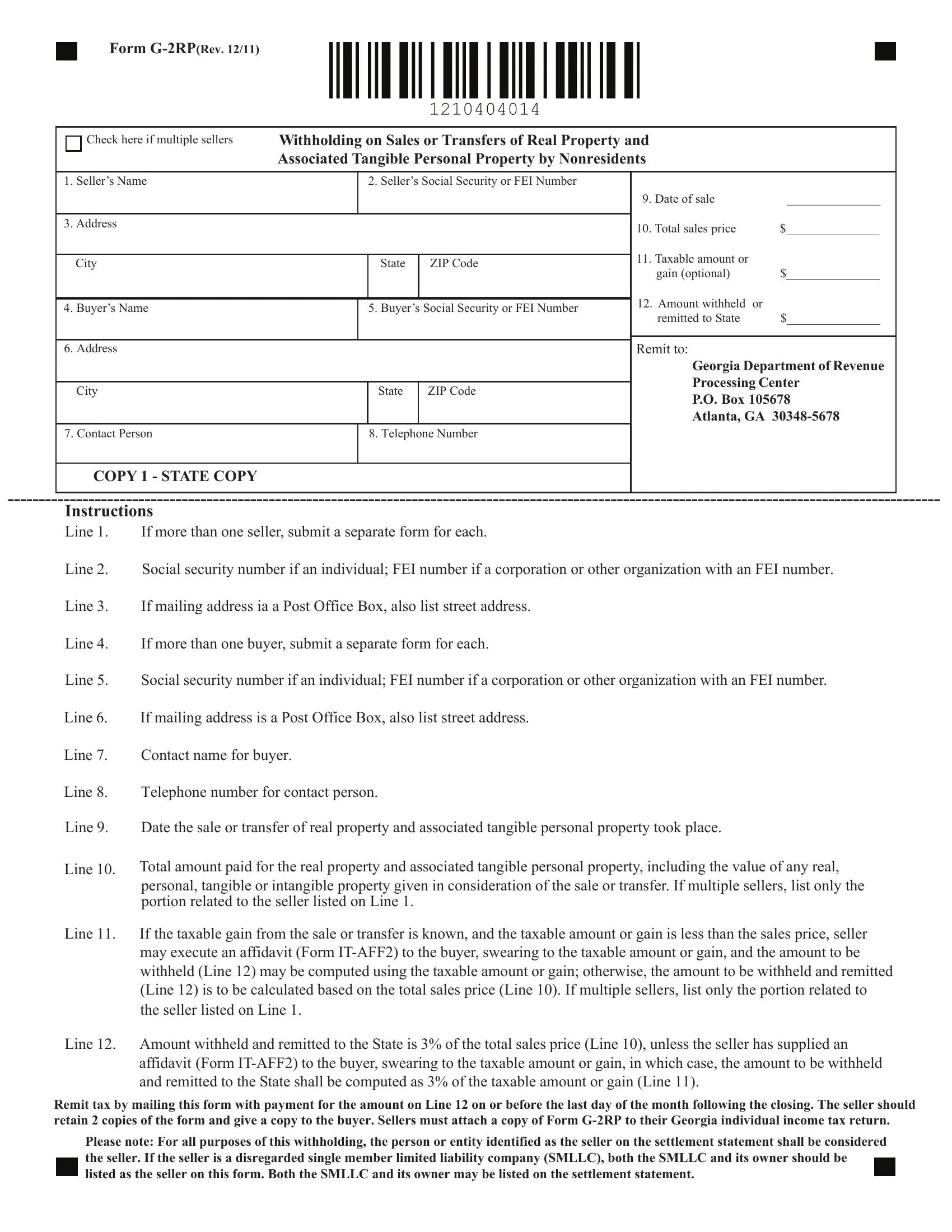

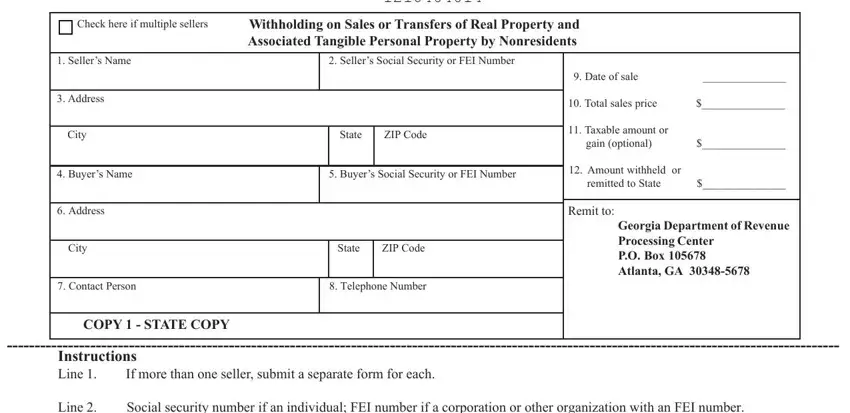

So as to fill out this PDF form, ensure that you provide the required details in every blank field:

1. Fill out your remitted with a group of essential fields. Note all the information you need and make certain there is nothing forgotten!

Step 3: As soon as you have reviewed the details in the fields, click "Done" to conclude your form. After setting up afree trial account with us, it will be possible to download remitted or send it through email without delay. The PDF will also be readily available from your personal account with your each modification. FormsPal is dedicated to the personal privacy of our users; we make sure all personal information used in our editor stays secure.