FORM G-4 (REV. 05/13/21)

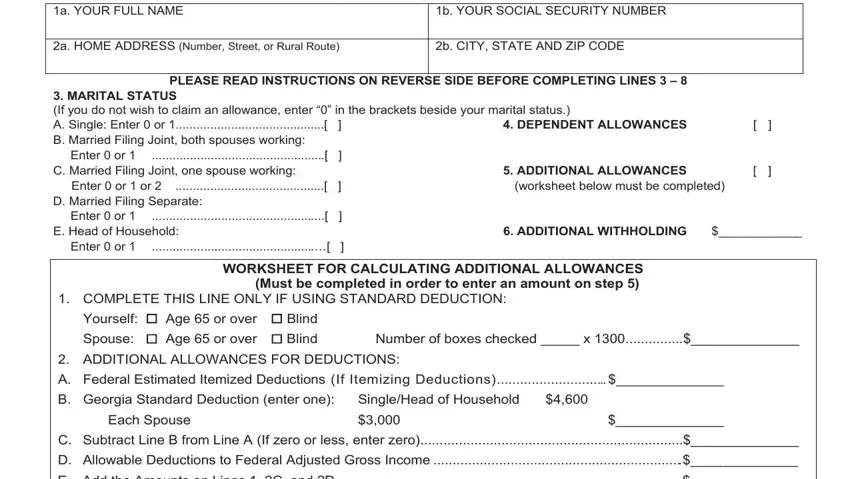

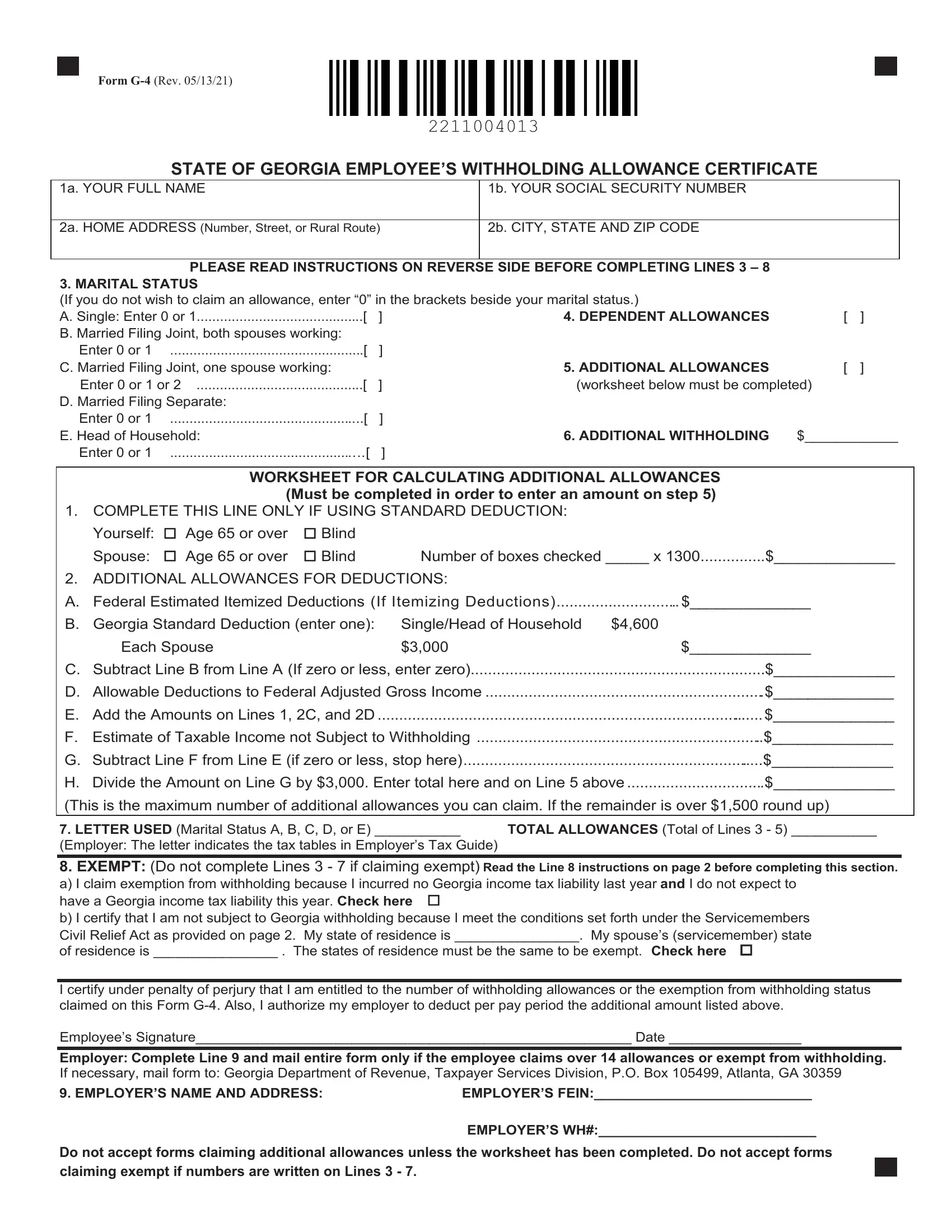

STATE OF GEORGIA EMPLOYEE’S WITHHOLDING ALLOWANCE CERTIFICATE

1b. YOUR SOCIAL SECURITY NUMBER

2a. HOME ADDRESS (Number, Street, or Rural Route)

2b. CITY, STATE AND ZIP CODE

|

PLEASE READ INSTRUCTIONS ON REVERSE SIDE BEFORE COMPLETING LINES 3 – 8 |

|

|

3. MARITAL STATUS |

|

|

|

|

|

|

|

(If you do not wish to claim an allowance, enter “0” in the brackets beside your marital status.) |

|

|

|

A. Single: Enter 0 or 1 |

[ |

] |

4. DEPENDENT ALLOWANCES |

[ |

] |

B. Married Filing Joint, both spouses working: |

|

|

|

|

|

|

Enter 0 or 1 |

|

[ |

] |

|

|

|

|

C. Married Filing Joint, one spouse working: |

|

|

5. ADDITIONAL ALLOWANCES |

[ |

] |

Enter 0 or 1 or 2 |

........................................... |

[ |

] |

(worksheet below must be completed) |

|

D. Married Filing Separate: |

|

|

|

|

|

|

|

Enter 0 or 1 |

|

[ |

] |

|

|

|

|

E. Head of Household: |

|

|

|

6. ADDITIONAL WITHHOLDING |

$____________ |

Enter 0 or 1 |

|

[ |

] |

|

|

|

|

|

|

|

|

|

|

WORKSHEET FOR CALCULATING ADDITIONAL ALLOWANCES |

|

|

|

|

(Must be completed in order to enter an amount on step 5) |

|

|

|

1. COMPLETE THIS LINE ONLY IF USING STANDARD DEDUCTION: |

|

|

|

Yourself: |

Age 65 or over |

Blind |

|

|

|

|

|

|

Spouse: |

Age 65 or over |

Blind |

|

|

Number of boxes checked _____ x 1300 |

$______________ |

2.ADDITIONAL ALLOWANCES FOR DEDUCTIONS:

A. Federal Estimated Itemized Deductions (If Itemizing Deductions) |

$______________ |

|

B. Georgia Standard Deduction (enter one): |

Single/Head of Household |

$4,600 |

|

|

Each Spouse |

$3,000 |

|

|

$______________ |

|

C. Subtract Line B from Line A (If zero or less, enter zero) |

|

$______________ |

|

D. Allowable Deductions to Federal Adjusted Gross Income |

|

$______________ |

|

E. Add the Amounts on Lines 1, 2C, and 2D |

.......................................................................................... |

|

$______________ |

|

F. Estimate of Taxable Income not Subject to Withholding |

|

$______________ |

|

G. Subtract Line F from Line E (if zero or less, stop here) |

|

$______________ |

|

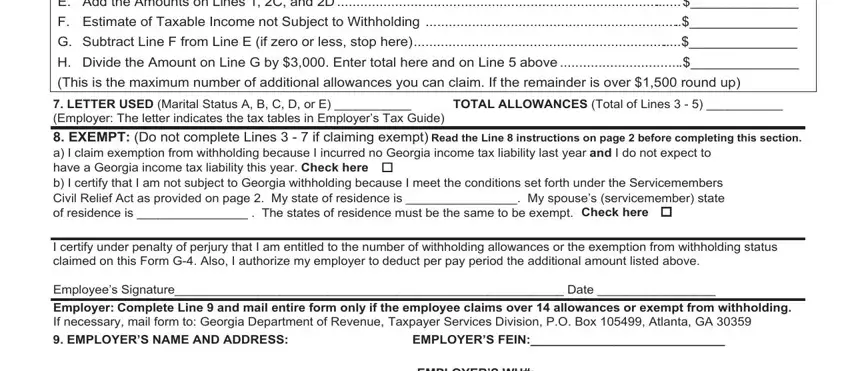

H. Divide the Amount on Line G by $3,000. Enter total here and on Line 5 above |

$ |

|

(This is the maximum number of additional allowances you can claim. If the remainder is over $1,500 round up) |

|

|

|

7. LETTER USED (Marital Status A, B, C, D, or E) ___________ |

TOTAL ALLOWANCES (Total of Lines 3 - 5) ___________ |

(Employer: The letter indicates the tax tables in Employer’s Tax Guide) |

|

|

|

|

8.EXEMPT: (Do not complete Lines 3 - 7 if claiming exempt) Read the Line 8 instructions on page 2 before completing this section. a) I claim exemption from withholding because I incurred no Georgia income tax liability last year and I do not expect to

have a Georgia income tax liability this year. Check here

b)I certify that I am not subject to Georgia withholding because I meet the conditions set forth under the Servicemembers Civil Relief Act as provided on page 2. My state of residence is ________________. My spouse’s (servicemember) state

of residence is ________________ . The states of residence must be the same to be exempt. Check here

I certify under penalty of perjury that I am entitled to the number of withholding allowances or the exemption from withholding status claimed on this Form G-4. Also, I authorize my employer to deduct per pay period the additional amount listed above.

Employee’s Signature________________________________________________________ Date _________________

Employer: Complete Line 9 and mail entire form only if the employee claims over 14 allowances or exempt from withholding.

If necessary, mail form to: Georgia Department of Revenue, Taxpayer Services Division, P.O. Box 105499, Atlanta, GA 30359

9. EMPLOYER’S NAME AND ADDRESS: |

EMPLOYER’S FEIN:____________________________ |

|

EMPLOYER’S WH#:____________________________ |

Do not accept forms claiming additional allowances unless the worksheet has been completed. Do not accept forms claiming exempt if numbers are written on Lines 3 - 7.

G-4 (REV. 05/13/21)

INSTRUCTIONS FOR COMPLETING FORM G-4

Enter your full name, address and social security number in boxes 1a through 2b.

Line 3: Write the number of allowances you are claiming in the brackets beside your marital status.

A.Single – enter 1 if you are claiming yourself

B.Married Filing Joint, both spouses working – enter 1 if you claim yourself

C.Married Filing Joint, one spouse working – enter 1 if you claim yourself or 2 if you claim yourself and your spouse

D.Married Filing Separate – enter 1 if you claim yourself

E.Head of Household – enter 1 if you claim yourself

Line 4: Enter the number of dependent allowances you are entitled to claim.

Line 5: Complete the worksheet on Form G-4 if you claim additional allowances. Enter the number on Line H here.

Failure to complete and submit the worksheet will result in automatic denial on your claim.

Line 6: Enter a specific dollar amount that you authorize your employer to withhold in addition to the tax withheld based on your marital status and number of allowances.

Line 7: Enter the letter of your marital status from Line 3. Enter total of the numbers on Lines 3-5. Line 8:

a)Check the first box if you qualify to claim exempt from withholding. You can claim exempt if you filed a Georgia income tax return last year and the amount of Line 4 of Form 500EZ or Line 16 of Form 500 was zero, and you expect to file a Georgia tax return this year and will not have a tax liability. You cannot claim exempt if you did not file a Georgia income tax return for the previous tax year. Receiving a refund in the previous tax year does not qualify you to claim exempt.

EXAMPLES: Your employer withheld $500 of Georgia income tax from your wages. The amount on Line 4 of Form 500EZ (or Line 16 of Form 500) was $100. Your tax liability is the amount on Line 4 (or Line 16); therefore, you do not qualify to claim exempt.

Your employer withheld $500 of Georgia income tax from your wages. The amount on Line 4 of Form 500EZ (or Line 16 of Form 500) was $0 (zero). Your tax liability is the amount on Line 4 (or Line 16) and you filed a prior year income tax return; therefore you qualify to claim exempt.

b)Check the second box if you are not subject to Georgia withholding and meet the conditions set forth under the Servicemembers Civil Relief Act. Under the Act, a spouse of a servicemember may be exempt from Georgia income tax on income from services performed in Georgia if:

1.The servicemember is present in Georgia in compliance with military orders;

2.The spouse is in Georgia solely to be with the servicemember;

3.The servicemember maintains domicile in another state; and

4.The domicile of the spouse is the same as the domicile of the servicemember or the spouse of the servicemember has elected to use the same residence for purposes of taxation as the servicemember.

Additional information for employers regarding the Military Spouses Residency Relief Act:

1.On the W-2 the employer should not report any of the wages as Georgia wages.

2.If the spouse of a servicemember is entitled to the protection of the Military Spouses Residency Relief Act in another state and files a withholding exemption form in such other state, the spouse is required to submit a Georgia Form G-4 so that withholding will occur as is required by Georgia Law when a Georgia domiciliary works in another state and withholding is not required by such other state. If the spouse does not fill out the form, the employer shall withhold Georgia income tax as if the spouse is single with zero allowances.

Worksheet for calculating additional allowances. Enter the information as requested by each line. For Line 2D, enter items such as Retirement Income Exclusion, U.S. Obligations, and other allowable deductions per Georgia Law, see the IT-511 booklet for more information.

Do not complete Lines 3-7 if claiming exempt.

O.C.G.A. § 48-7-102 requires you to complete and submit Form G-4 to your employer in order to have tax withheld from your wages. By correctly completing this form, you can adjust the amount of tax withheld to meet your tax liability. Failure to submit a properly completed Form G-4 will result in your employer withholding tax as though you are single with zero allowances.

Employers are required to mail any Form G-4 claiming more than 14 allowances or exempt from withholding to the Georgia Department of Revenue. Employers should honor the properly completed form as submitted unless otherwise notified by the Department. Such forms remain in effect until changed or until February 15 of the following year. Employers who know that a G-4 is erroneous should not honor the form and should withhold as if the employee is single claiming zero allowances until a corrected form has been received.