It's easy to fill out the hawaii general excise tax form empty lines. Our PDF tool will make it almost effortless to edit any type of PDF file. Down below are the basic four steps you'll want to take:

Step 1: Seek out the button "Get Form Here" and click it.

Step 2: Now you're on the form editing page. You may modify and add content to the document, highlight words and phrases, cross or check particular words, include images, sign it, delete unrequired areas, or eliminate them completely.

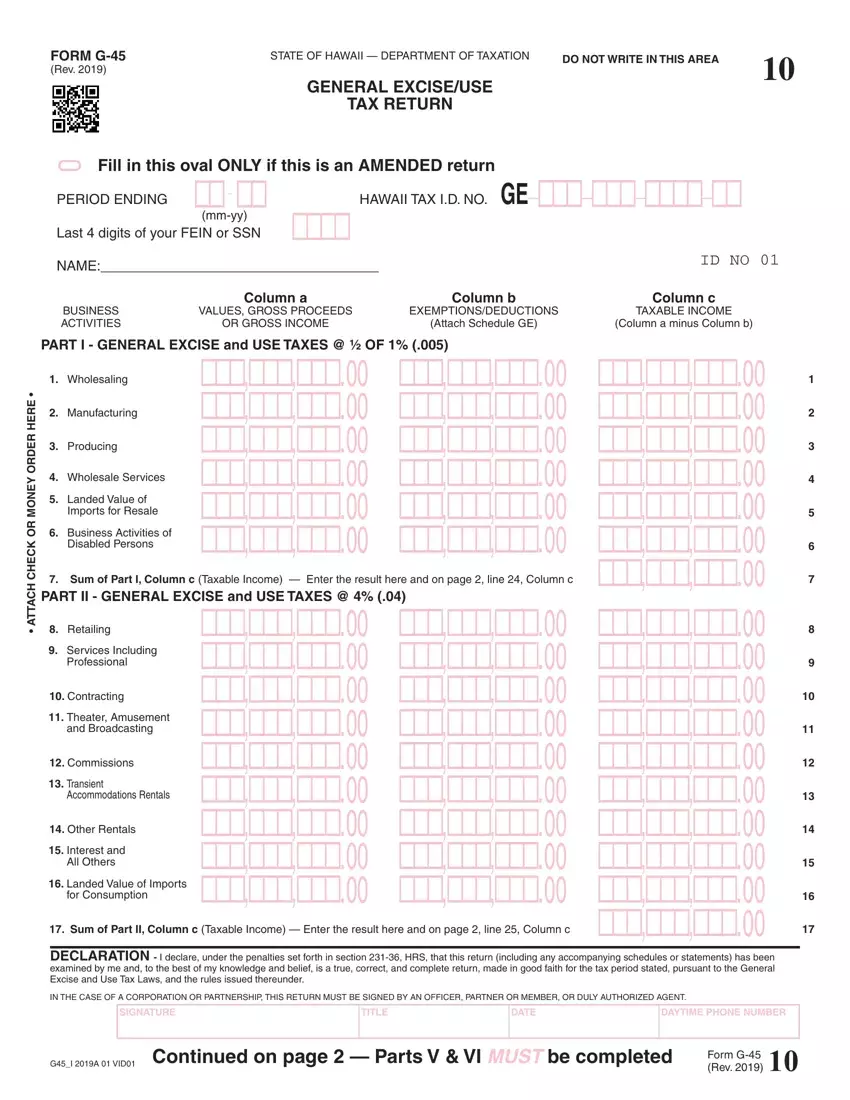

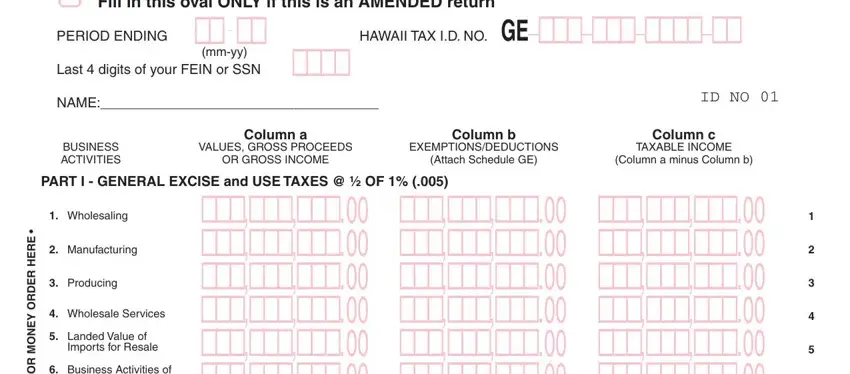

Provide the content requested by the system to fill out the document.

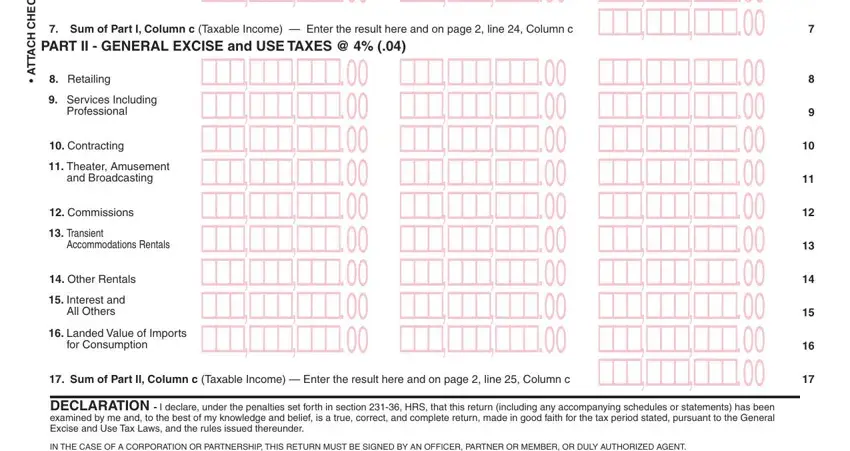

Write the necessary particulars in the Sum of Part I Column c Taxable, PART II GENERAL EXCISE and USE, cid E R E H R E D R O Y E N O M R, cid, Retailing, Services Including, Professional, Contracting, Theater Amusement and Broadcasting, Commissions, Transient, Accommodations Rentals, Other Rentals, Interest and All Others, and Landed Value of Imports box.

You'll be required specific key information in order to prepare the IN THE CASE OF A CORPORATION OR, SIGNATURE, TITLE, DATE, DAYTIME PHONE NUMBER, GI A VID, Continued on page Parts V VI, Form G, and Rev field.

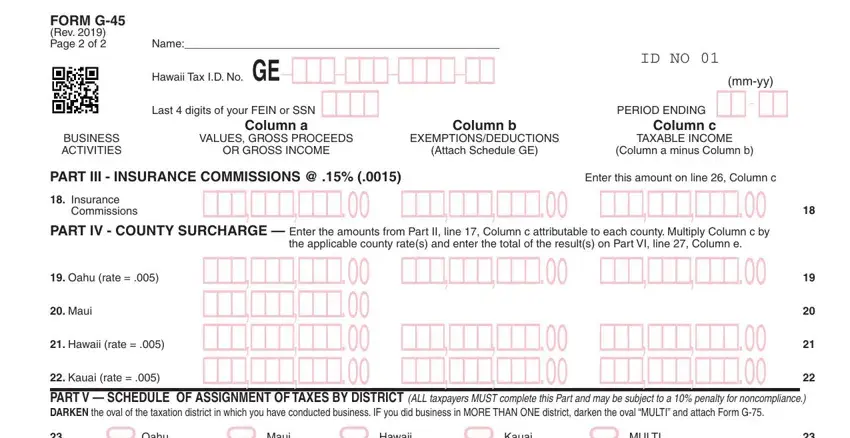

Spell out the rights and obligations of the parties inside the section FORM G Rev Page of, Name, Hawaii Tax ID No GE, Last digits of your FEIN or SSN, BUSINESS ACTIVITIES, Column a VALUES GROSS PROCEEDS OR, Column b EXEMPTIONSDEDUCTIONS, ID NO, mmyy, PERIOD ENDING, Column c TAXABLE INCOME Column a, PART III INSURANCE COMMISSIONS, Enter this amount on line Column c, Insurance, and Commissions.

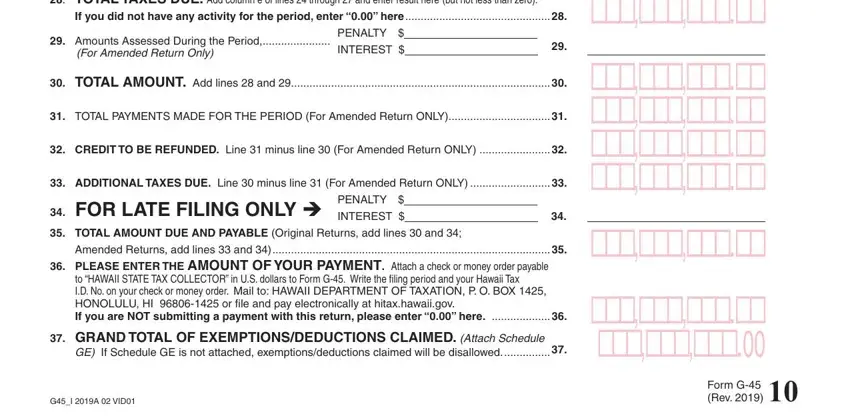

Review the areas COUNTY SURCHARGE TAX See, If you did not have any activity, Amounts Assessed During the Period, For Amended Return Only, INTEREST, PENALTY, TOTAL AMOUNT Add lines and, TOTAL PAYMENTS MADE FOR THE, CREDIT TO BE REFUNDED Line minus, ADDITIONAL TAXES DUE Line minus, FOR LATE FILING ONLY TOTAL, PENALTY INTEREST, Amended Returns add lines and, PLEASE ENTER THE AMOUNT OF YOUR, and GRAND TOTAL OF and thereafter fill them out.

Step 3: Hit the Done button to be certain that your completed document may be exported to each gadget you end up picking or sent to an email you indicate.

Step 4: Make sure you keep away from upcoming difficulties by creating no less than a couple of copies of the file.