We used the top-rated web programmers to implement our PDF editor. Our app will let you complete the g 49 form form with no trouble and won't require a great deal of your energy. This straightforward guide will allow you to begin.

Step 1: Select the button "Get Form Here" and select it.

Step 2: When you have entered your g 49 form edit page, you will notice all actions you can take with regards to your document within the upper menu.

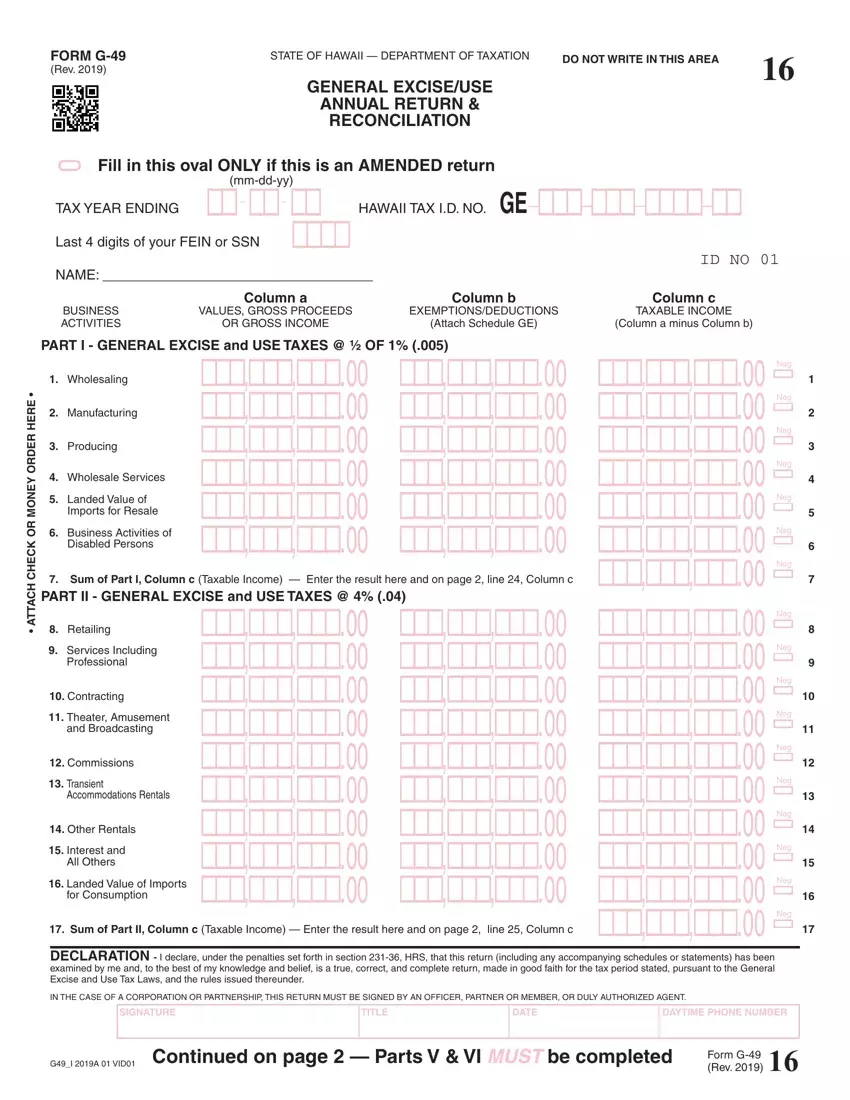

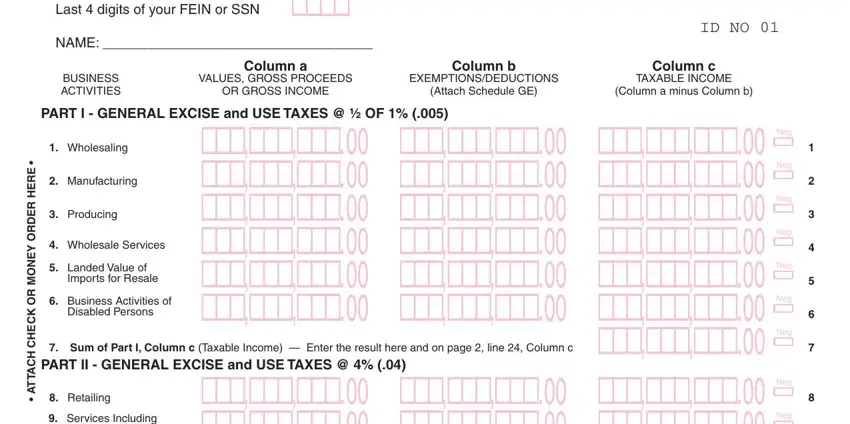

To complete the form, provide the data the system will require you to for each of the next sections:

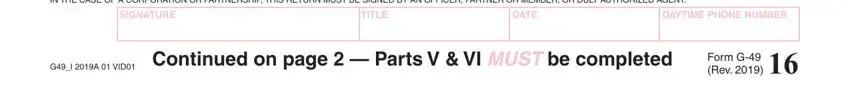

Complete the GI A VID space with the details requested by the software.

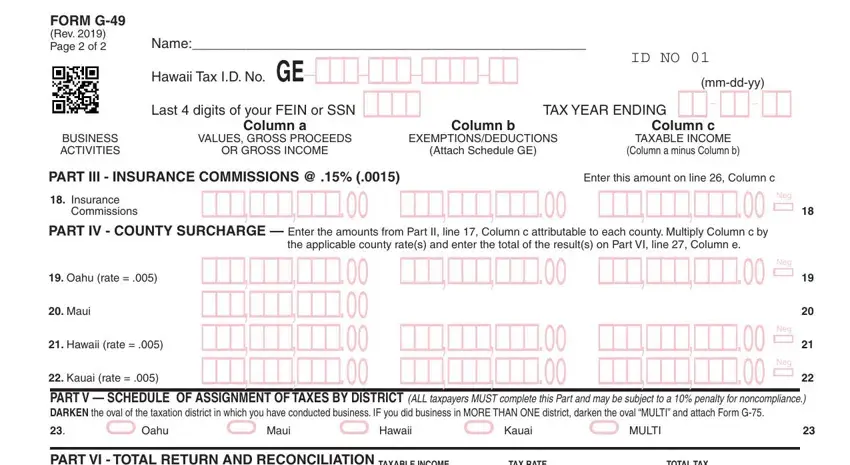

In the section dealing with ID NO, BUSINESS ACTIVITIES, Column a VALUES GROSS PROCEEDS OR, Column b EXEMPTIONSDEDUCTIONS, Column c TAXABLE INCOME Column a, PART III INSURANCE COMMISSIONS, Enter this amount on line Column c, Insurance, Commissions, PART IV COUNTY SURCHARGE Enter, the applicable county rates and, Oahu rate, Maui, Hawaii rate, and Kauai rate, you need to put in writing some essential details.

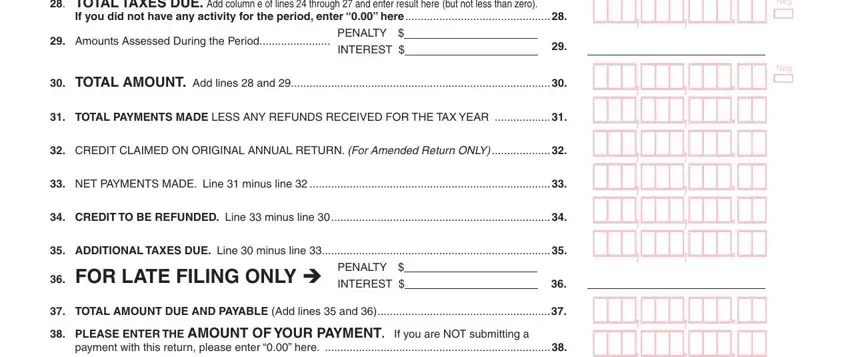

The field can be used to point out the rights and responsibilities of each party.

Step 3: Choose the "Done" button. So now, you can transfer the PDF file - download it to your electronic device or forward it by using electronic mail.

Step 4: Create duplicates of your file. This should prevent potential future misunderstandings. We do not watch or publish your information, thus be certain it's going to be safe.