Through the online tool for PDF editing by FormsPal, it is possible to fill in or modify hi gew ta rv5 right here. FormsPal expert team is continuously working to improve the tool and ensure it is even better for people with its extensive features. Enjoy an ever-evolving experience now! To get the ball rolling, consider these easy steps:

Step 1: Click on the "Get Form" button above. It's going to open our pdf tool so that you could start filling out your form.

Step 2: This tool provides the capability to change your PDF file in various ways. Improve it with your own text, adjust what's originally in the document, and put in a signature - all within several clicks!

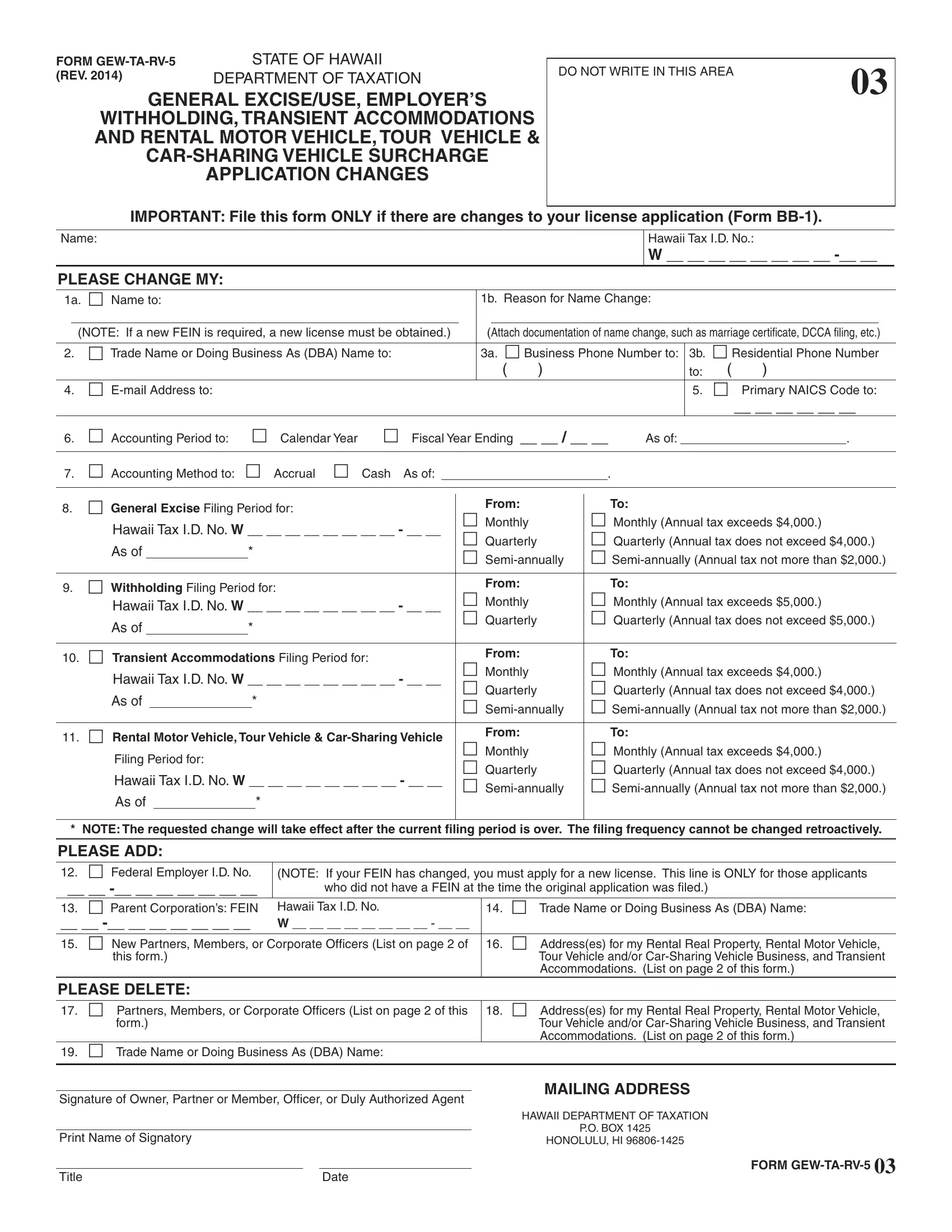

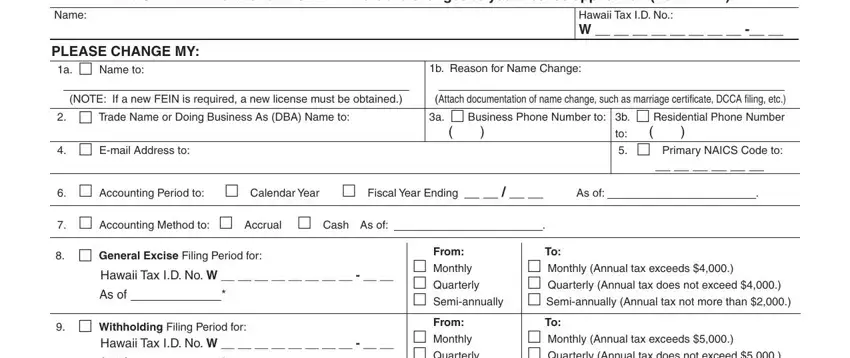

This form requires specific details; in order to guarantee correctness, please be sure to take heed of the subsequent tips:

1. Fill out your hi gew ta rv5 with a group of essential blanks. Consider all the information you need and make certain not a single thing forgotten!

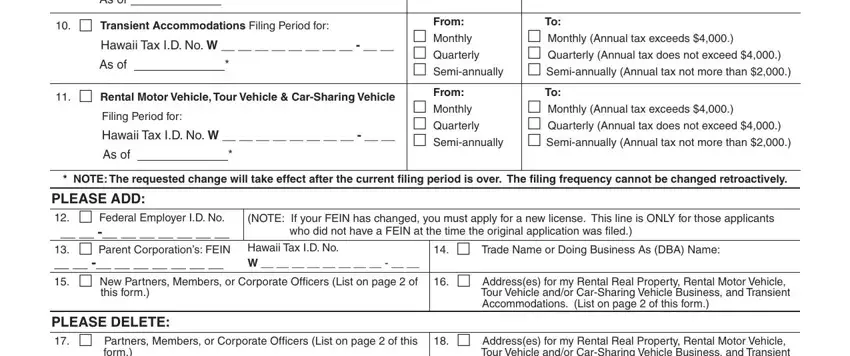

2. Now that the previous section is done, you should put in the needed details in As of, Transient Accommodations Filing, As of, Rental Motor Vehicle Tour, Hawaii Tax ID No W, As of, From Monthly Quarterly, From Monthly Quarterly, From Monthly Quarterly, Monthly Annual tax exceeds, Monthly Annual tax exceeds, Monthly Annual tax exceeds, NOTE The requested change will, NOTE If your FEIN has changed you, and who did not have a FEIN at the in order to progress further.

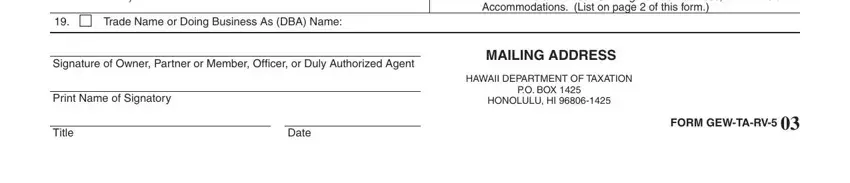

3. Completing PLEASE DELETE Partners Members, Trade Name or Doing Business As, Signature of Owner Partner or, Print Name of Signatory, Title, Date, Addresses for my Rental Real, MAILING ADDRESS, HAWAII DEPARTMENT OF TAXATION, PO BOX, HONOLULU HI, and FORM GEWTARV is essential for the next step, make sure to fill them out in their entirety. Don't miss any details!

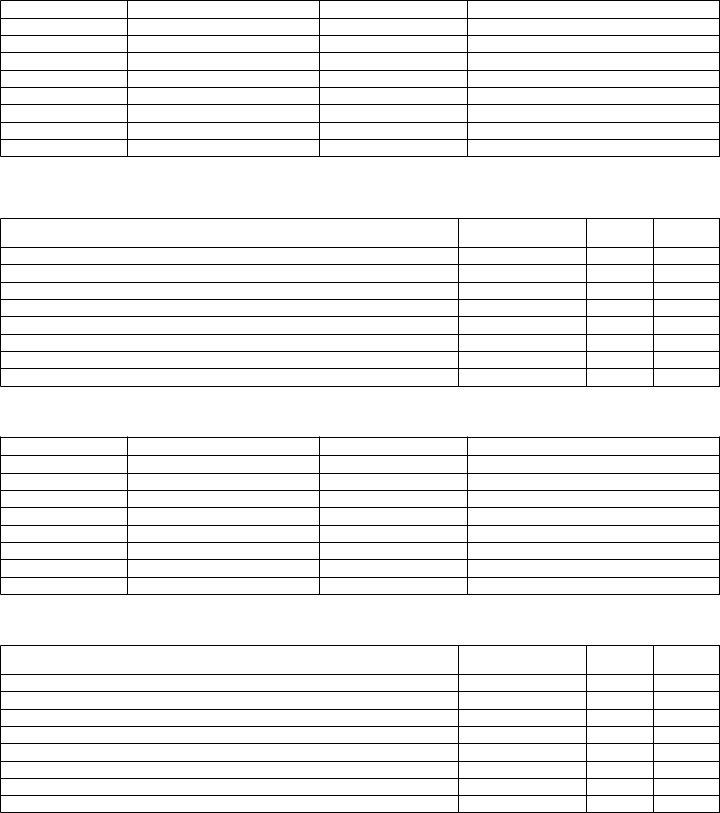

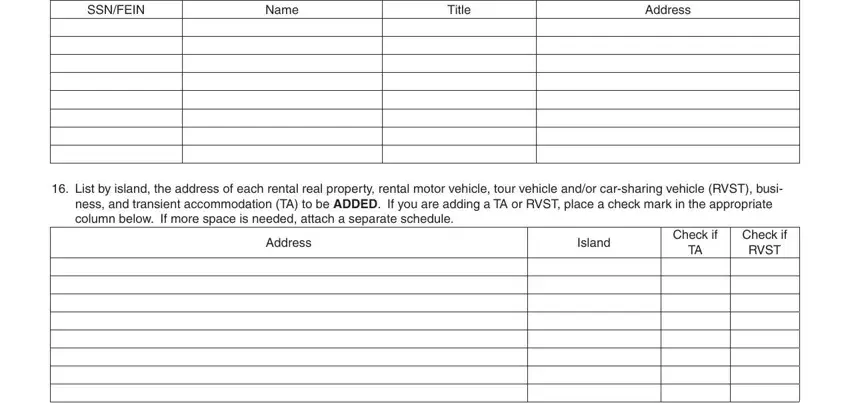

4. Filling out SSNFEIN, Name, Title, Address, List by island the address of, ness and transient accommodation, Address, Island, Check if, and Check if RVST is crucial in the fourth section - ensure that you take the time and fill in each and every field!

Be very mindful while filling out SSNFEIN and Address, because this is the section where most users make some mistakes.

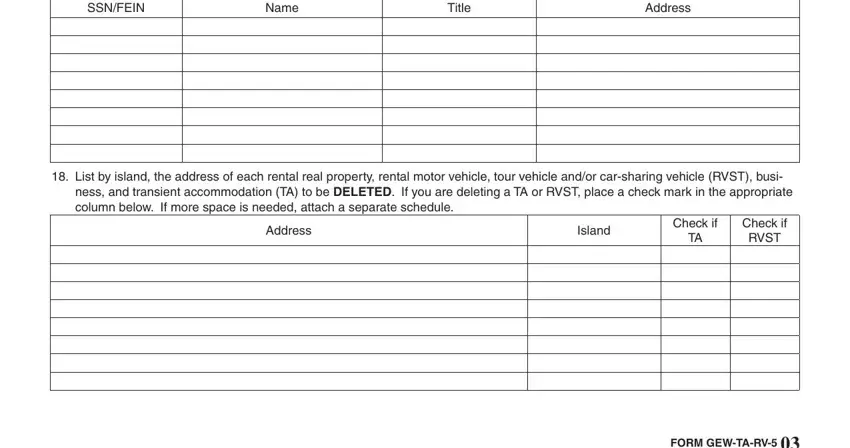

5. Since you approach the finalization of your document, you'll notice several more requirements that must be met. Particularly, SSNFEIN, Name, Title, Address, List by island the address of, ness and transient accommodation, Address, Island, Check if, Check if RVST, and FORM GEWTARV must be filled out.

Step 3: Right after proofreading your fields and details, press "Done" and you're all set! Try a free trial option with us and acquire immediate access to hi gew ta rv5 - download, email, or change from your personal cabinet. FormsPal guarantees secure form tools with no personal information recording or distributing. Rest assured that your data is safe with us!