Understanding the GL3817E Lh form is crucial for members or dependents engaging with group benefits plans, requiring a comprehensive yet clear breakdown of its complexities. This form serves as a critical tool for enrolment or amendment of information in group benefits plans, necessitating precise completion and submission within specific time frames to maintain or alter coverage without undue hassle. It encompasses various aspects, from personal to coverage information, highlighting the need for accuracy and attention to details such as plan member and certificate numbers, employment details, and types of coverage desired. The form extends to optional coverage choices, dependent information—which is key for those electing family coverage—and crucially, the declaration of beneficiaries, reflecting forethought for future contingencies. Notably, it embodies sections on spousal coordination of benefits, changes affecting coverage eligibility, and an explicit waiver of benefits for those opting out, coupled with an authorization segment signifying consent to the collection and use of personal information for plan administration. This deep dive underscores the importance of a well-informed approach towards filling out the GL3817E Lh form, illustrating its role in securing comprehensive coverage while navigating the nuances of group benefits enrollment or changes.

| Question | Answer |

|---|---|

| Form Name | Form Gl3817E Lh |

| Form Length | 3 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 45 sec |

| Other names | groupbenefits, gl3817e lh, reinsurers, Manulife |

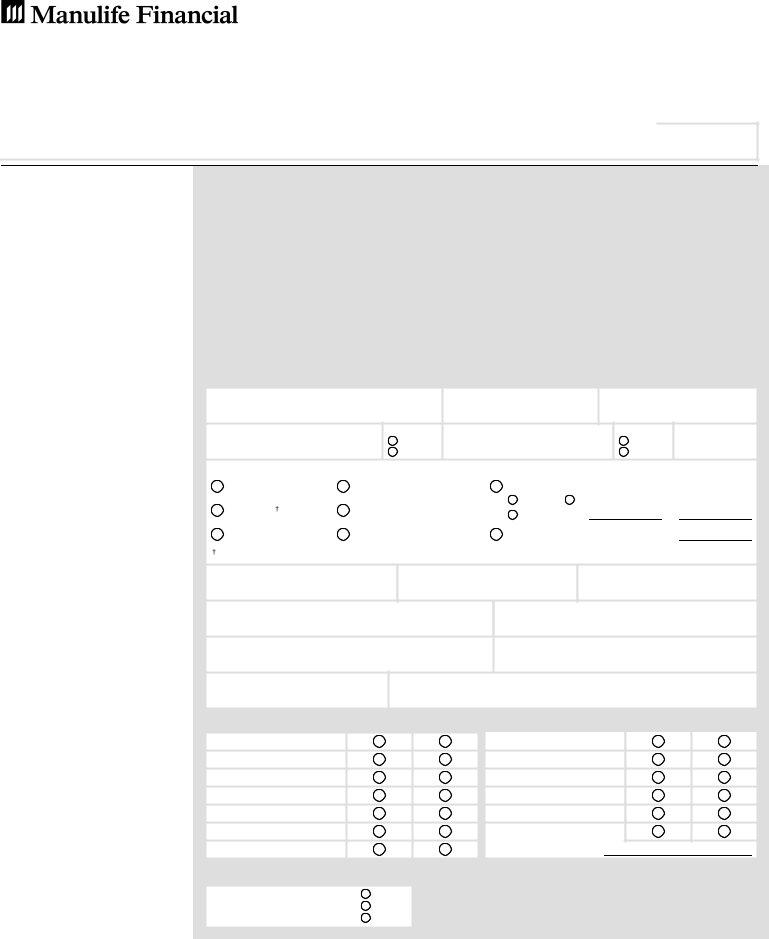

Group Benefits

Plan member/Dependant Enrolment/Change

Please print clearly, complete all pages and ensure form is signed. Mandatory fields ( * ) must be completed.

Plan sponsor name |

Completed by (Print) |

Title |

Completed by (Signature) |

|

|

|

|

Date (dd/mmm/yyyy)

1Plan member information

To be completed by plan sponsor

Plan contract number * |

Plan member certificate number (maximum of 9 characters) * |

|

|||

|

|

|

|

|

|

Plan sponsor name |

|

Class |

Division |

Plan member occupation |

|

|

|

|

|

|

|

Plan member’s name (last, first, middle initial) |

|

|

|

||

|

|

|

|

|

|

Address |

|

|

|

|

|

|

|

|

|

|

|

City |

|

|

Province |

Postal code |

|

|

|

|

|

|

|

All changes must be submitted within 31 days from the effective date of the change, or Manulife Financial will require evidence of insurability.

Effective date of change (dd/mmm/yyyy) |

|

Coverage code(s) |

Distribution code |

|

Date of hire (dd/mmm/yyyy) |

Sex |

Date of birth (dd/mmm/yyyy) |

Language |

Hours |

|

Male |

|

English |

worked |

|

Female |

|

French |

per week |

|

|

|

Type of change - Check ( )

Add new member |

Terminate benefit(s) |

Change |

|

|

|

|

Single |

Family |

|

Reinstate |

Add benefit(s) |

Transfer from |

to |

|

|

|

|||

Student |

Late entrant dependant |

Left employment on (dd/mmm/yyyy) |

||

Please indicate reason for reinstatement (mandatory) on separate page |

|

|

||

Change of plan member certificate number Transfer to plan contract number |

To coverage code(s) |

|||

(maximum of 9 characters) |

|

|

|

|

If applying for coverage due to loss of coverage under |

(dd/mmm/yyyy) |

|

|

|

|

|

|

||

spouse’s plan, please provide date coverage terminated: |

|

|

|

|

Marital status |

|

Retired (dd/mmm/yyyy) |

|

|

Deceased (dd/mmm/yyyy) |

Other (please specify) |

|

|

|

Add |

Delete |

|

|

Health

Dental

Prescription Drugs

Life

Dependant Life

AD&D

Weekly Indemnity

|

Add |

Delete |

|

|

|

Travel

Hospital

Vision

Long term disability

Critical illness

Managed dental care

Dental centre number

Complete for Life and Income Replacement Benefits

Earnings |

Annual |

|

Monthly |

$ |

Weekly |

The Manufacturers Life Insurance Company |

Page 1 of 3 |

GL3817E(LH) (10/2007) |

1 Plan member information |

Optional coverages |

|

Add |

Change |

Delete |

|

|

|

|

(continued) |

Life (state total amt.) |

|

Plan member |

|

Spouse |

|

|

|

|

|

|

$ |

|

$ |

|

|

|

||

|

|

|

|

|

|

|

|

||

|

AD&D (state total amt.) |

|

Single |

Family |

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Dependant life |

|

Yes |

No |

|

|

|

|

|

|

Critical illness |

|

|

Plan member amount |

Spouse amount |

|

|

|

|

|

|

|

$ |

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

||

|

Smoker |

Yes |

No |

Plan member |

Yes |

No |

Spouse |

Yes |

No |

|

|||||||||

|

RAMQ - If you are a resident of Quebec and 65 years of age or older, are you covered under RAMQ? |

|

|||||||

Yes (Manulife Financial is second payer)

|

No (Manulife Financial is first payer) |

|

|

|

|

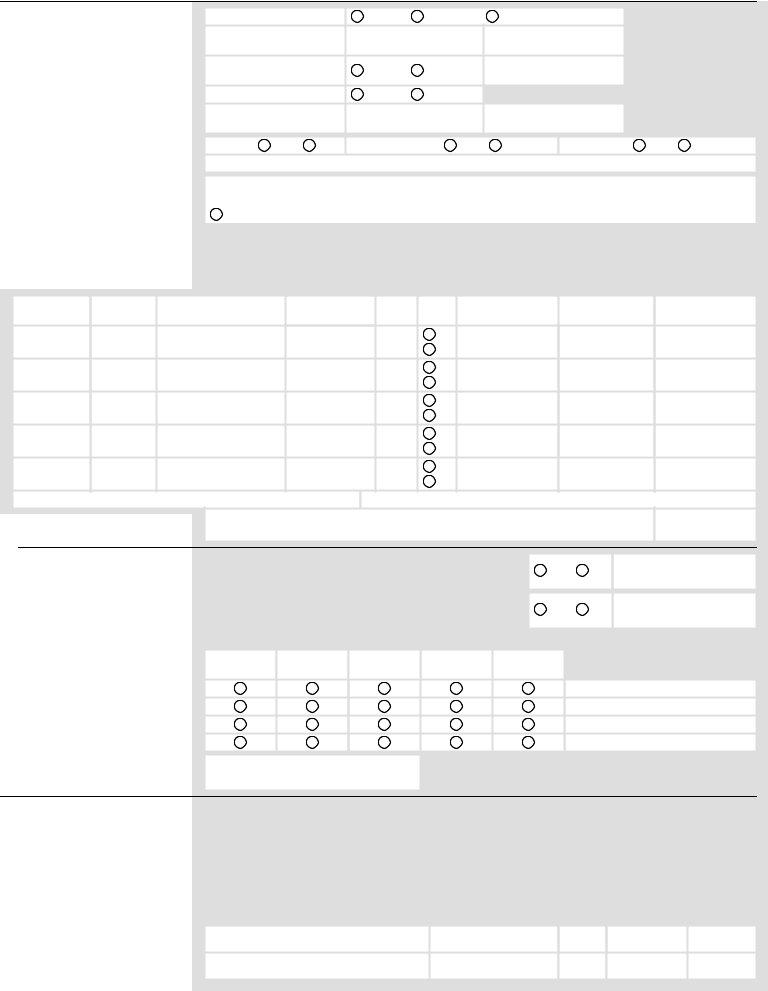

2 Dependant information |

If application to add dependant coverage is not made within 31 days of marriage, birth/adoption of a child, or the |

|

date of loss of spousal coverage, evidence of insurability of the dependant(s) will be required. |

To be completed by plan member only

if family coverage has been elected.For

Type of change |

Relationship |

Last name (if different) |

First name |

Middle |

Sex |

Date of birth |

Dependant status |

Effective date |

A/C/T |

|

|

|

initial |

(M/F) |

(dd/mmm/yyyy) |

G/C |

(dd/mmm/yyyy) |

Spouse** |

M |

|

F |

|

|

|

|

|

Child |

M |

|

F |

|

|

|

|

|

Child |

M |

|

F |

|

|

|

|

|

Child |

M |

|

F |

|

|

|

|

|

Child |

M |

|

F |

|

|

|

|

|

Type of change: A = Add, C = Change, T = Terminate |

Dependant status codes: G = Student (College/University), |

C = Disabled |

** If |

School year |

|

If you do not have a spouse, this section does not apply.

Spousal Health |

Does your spouse have health coverage |

Effective date (dd/mmm/yyyy) |

|||

Coverage |

under his/her own insurance plan? |

Yes |

No |

||

|

|

||||

Spousal Dental |

Does your spouse have dental coverage |

Effective date (dd/mmm/yyyy) |

|||

Coverage |

under his/her own insurance plan? |

Yes |

No |

||

|

|

||||

Does your spouse's health/dental plan cover: |

|

|

|||

Health |

Dental |

Hospital |

Prescription |

Vision |

|

Drugs |

|

||||

|

|

|

|

|

|

|

|

|

|

|

Your spouse only |

|

|

|

|

|

Your spouse and yourself only |

|

|

|

|

|

Your spouse and children only |

|

|

|

|

|

Your spouse, you and your children |

Spouse's date of birth (dd/mmm/yyyy)

3Change of beneficiary

If more space is required, please complete a second form and attach.

Percentages must total 100% to be valid.

In accordance with the terms and conditions of the Group Life Contract between the plan sponsor indicated below and Manulife Financial, I revoke all previous appointments of beneficiary and hereby appoint the following as beneficiary entitled to receive the proceeds arising by reason of my death.

Beneficiary's last name |

First name |

Middle |

Relationship |

Percentage |

|

initial |

|||||

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

% |

|

|

|

|

|

|

|

|

|

|

|

% |

|

|

|

|

|

|

%

% |

The Manufacturers Life Insurance Company |

Page 2 of 3 |

GL3817E(LH) (10/2007) |

3Change of beneficiary (continued)

Under the laws of the Province of Quebec, any designation of a spouse as a beneficiary is irrevocable unless stipulated to be revocable.

I hereby declare and stipulate that the beneficiary designations made on this form are revocable.

Note: If you designate a minor child as the beneficiary of your insurance proceeds, these proceeds will be paid into court, unless a trustee is appointed to receive such benefits on behalf of such child.

Trustee appointment (you may wish to consult a lawyer before appointing a Trustee).

Complete if the beneficiary is |

I appoint |

|

as Trustee to receive any amount due to any |

|

under the age of majority. |

||||

beneficiary under the age of majority (not applicable in Quebec). |

|

|||

|

|

|||

|

|

|

|

|

Proceeds payable to a minor in Quebec will be paid out in accordance with the provisions of the Quebec Civil code. The appointment of a Trustee is not applicable in Quebec. You may wish to consult a lawyer before appointing a minor beneficiary.

4 Status change |

When a plan member requests a change from single to family coverage within 31 days of marriage, or 31 days of |

|

|

loss of coverage under your spouse's plan, family coverage will become effective as outlined in the Manulife |

|

|

Financial group benefits contract. If applying after more than 31 days a statement of health satisfactory to Manulife |

|

|

Financial will be required. |

|

|

Date of change in marital status or loss of spousal coverage |

|

|

(dd/mmm/yyyy) |

|

|

|

|

|

If spouse currently has Manulife Financial benefits, please complete |

|

Plan contract number

Plan member certificate number

Last name

5Waiver of Benefits

(To be completed and signed by plan member - If not applying for coverage)

I have been given the opportunity to apply for coverage but do not wish to participate. I understand that if I wish to request coverage at a later date, I will be required to furnish, at my own expense, for myself (and if applicable, for my eligible dependant(s)) evidence of insurability satisfactory to Manulife Financial. For Dental coverage, benefits will be limited during the first 12 months of coverage.

I wish to waive the following benefit(s): |

Health |

Dental |

6Authorization

To be signed by plan member

I hereby apply for coverage ("Coverage") under the Group Benefits plan issued to my plan sponsor by

Manulife Financial ("Manulife"). I understand that certain aspects of such Coverage may extend to my spouse and eligible dependants (collectively, "Dependants"). I certify that the information in this form is true and complete to the best of my knowledge. I understand that as the applicant, it is my responsibility to ensure that any further verbal or written statement provided by me, and/or my Dependants, in the future is true and complete to the best of our knowledge. I acknowledge and agree that this Coverage or any portion of this Coverage, and future claims thereunder may be denied or terminated as a result of the provision of false, incomplete, or misleading information. I authorize Manulife to collect, use, maintain and disclose personal information relevant to this application ("Information") for the purposes of Group Benefits plan administration, audit, assessment, investigation, claim management, underwriting and for determining plan eligibility ("Purposes"). I authorize any person or organization with Information, including any medical and health professionals, facilities or providers, professional regulatory bodies, any employer, group plan administrator, insurer, investigative agency, and any administrators of other benefits programs to collect, use, maintain and exchange this information with each other and with Manulife, its reinsurers and/or its service providers, for the Purposes. I am authorized by my Dependants to consent to this Authorization, on their behalf as if they were signing it themselves, and to disclose and receive their Information, for the Purposes. I authorize my plan sponsor to make deductions from my pay for my Group Benefits plan, if applicable. I authorize the use of my Social Insurance Number ("SIN") for the purposes of identification and administration, if my SIN is used as my plan member certificate number. I agree a photocopy or electronic version of this authorization is valid. I designate the person(s) named above under Beneficiary Designation, as my beneficiary.

I understand that any Information provided to or collected by Manulife in accordance with this authorization, will be kept in a Group Benefits life, health or disability file. Access to my Information will be limited to:

•Manulife employees, representatives, reinsurers, and service providers in the performance of their jobs;

•Persons to whom I have granted access; and

•Persons authorized by law.

I have the right to request access to the personal information in my file, and, where appropriate, to have any inaccurate information corrected.

I acknowledge that more specific details regarding how and why Manulife collects, uses, maintains, and discloses my personal information can be found in Manulife's Privacy Policy and Privacy Information Package, available at www.manulife.ca/groupbenefits, or from my Plan Sponsor.

Plan member's signature |

Date signed (dd/mmm/yyyy) |

|

|

Plan Member Administration

Manulife Financial

PO BOX 2026

HALIFAX NS B3J 2Z1

Website: www.manulife.ca/groupbenefits/secureserve

The Manufacturers Life Insurance Company |

Page 3 of 3 |

GL3817E(LH) (10/2007) |