If you’re thinking about a cash distribution, know that taxes and penalties may apply. Visit www.JHCashOutCalculator.com to see how cashing out could affect your savings.

Includes: Withdrawal – Eligible for Rollover Form

Same goal. New choices.

Whether you’re changing jobs or retiring, it’s important to understand your options so you can make an informed decision about what to do with your retirement plan savings at John Hancock. Read more about your choices and next steps, then complete the attached form – or give us a call. We’re here to help.

You have two ways to take action:

Call John Hancock at 1-888-695-4472

Our Rollover Specialists will help answer questions about the options available to you:*

-Keep your money in the Plan

- Roll over to a John Hancock IRA - Roll over to another IRA

- Roll over to new employer-sponsored plan

-Take a cash distribution (see box at right)

We’ll introduce you to your plan’s financial representative if applicable

We’ll help you complete the process, including filling out any paperwork

Work with your financial representative or do-it-yourself

Review your options with your financial representative*

Fill out the attached Withdrawal – Eligible for Rollover Form

Return it based on the instructions provided to you by your plan administrator

Our Rollover Specialists are here to make your

transition a smooth one. Call us at 1-888-695-4472.

*Each distribution option has its own potential advantages, disadvantages and tax consequences. Anyone interested in these transactions or topics should seek advice based on his or her particular circumstances from independent professional advisors. There may be additional distribution options that are available only under your specific plan. Please check with your plan administrator for more information.

John Hancock Personal Financial Services, LLC, also referred to as “John Hancock”, is an affiliate of John Hancock Retirement Plan Services.

Group annuity contracts and recordkeeping agreements are issued by: John Hancock Life Insurance Company (U.S.A.) (“John Hancock USA”), Boston, MA (not licensed in New York) and John Hancock Life Insurance Company of New York (“John Hancock NY”), Valhalla, NY. Product features and availability may differ by state. John Hancock USA and John Hancock NY each make available a platform of investment alternatives to sponsors or administrators of retirement plans without regard to the individualized needs of any plan. Unless otherwise specifically stated in writing, John Hancock USA and John Hancock NY do not, and are not undertaking to, provide impartial investment advice or give advice in a fiduciary capacity.

NOT FDIC INSURED | MAY LOSE VALUE | NOT BANK GUARANTEED

© 2019 All rights reserved.

GP5479US (2/2021) |

G-P 37398-GE 01/19-37398 |

Reset Form

Withdrawal - Eligible for Rollover

Important Information about this Form

Your plan may require you to provide supporting documents or additional information before your request can be processed.

As the participant, you complete Sections 1 - 7 of this form and return it to your Plan Representative.

As the Plan Representative, you review Sections 1 - 7, and complete Sections 8 - 10 of this form.

If the participant address provided below is new or different than what is currently on record with John Hancock Retirement Plan Services, we will update our records accordingly. Ensure your next census submission includes revised employee information to avoid your file superseding the information supplied on this form.

A 1099R form will be issued for each distribution and loan default (if applicable) by January 31 of the following year.

This request is subject to the processing and procedure guidelines contained in John Hancock’s Administrative Guidelines for Financial Transactions (“AGFT”). The latest AGFT is available on the John Hancock plan sponsor website or you may contact your John Hancock representative for a copy.

All changes must be initialed in pen (including numbers crossed out or changed using correction fluid).

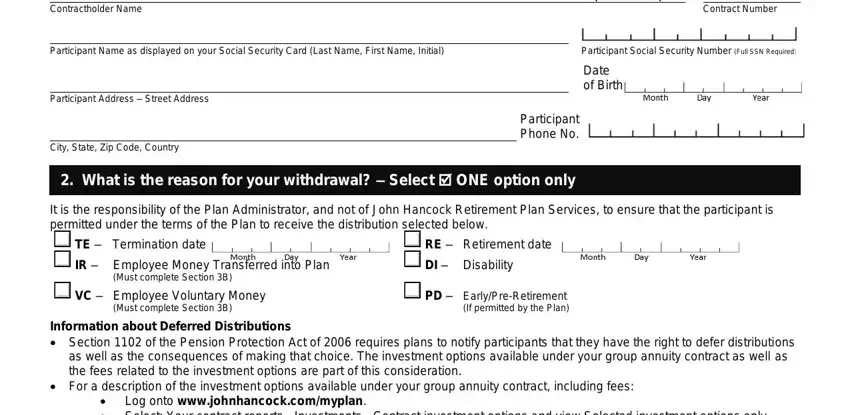

1. General Information

The Trustee of |

{Contractholder_name} |

Plan (“the Plan”) |

{ContractNum2} |

Contractholder Name |

|

|

|

|

|

Contract Number |

{Participant_name} |

|

|

|

{SSN} |

|

Participant Name as displayed on your Social Security Card (Last Name, First Name, Initial) |

|

|

Participant Social Security Number (Full SSN Required) |

|

|

|

|

Date |

|

{ppt_address} |

|

|

|

of Birth {DCCIASec3EffectiveDate} |

Participant Address – Street Address |

|

|

|

|

|

|

|

Participant |

{PhoneNumber} |

|

{ppt_cszip} |

|

Phone No. |

|

City, State, Zip Code, Country

2. What is the reason for your withdrawal? – Select ONE option only

It is the responsibility of the Plan Administrator, and not of John Hancock Retirement Plan Services, to ensure that the participant is permitted under the terms of the Plan to receive the distribution selected below.

TE – |

Termination date |

RE – |

Retirement date |

IR – |

Employee Money Transferred into Plan |

DI – |

Disability |

|

(Must complete Section 3B) |

|

|

VC – |

Employee Voluntary Money |

PD – |

Early/Pre-Retirement |

|

(Must complete Section 3B) |

|

(If permitted by the Plan) |

Information about Deferred Distributions

Section 1102 of the Pension Protection Act of 2006 requires plans to notify participants that they have the right to defer distributions as well as the consequences of making that choice. The investment options available under your group annuity contract as well as the fees related to the investment options are part of this consideration.

For a description of the investment options available under your group annuity contract, including fees:

Log onto www.johnhancock.com/myplan.

Select: Your contract reports - Investments - Contract investment options and view Selected investment options only. Alternatively, participants may obtain this information by calling our toll free service line at 1-800-395-1113.

You should also review your plan's Summary Plan Description (SPD) which may contain special provisions that may materially affect your decision to defer a distribution. For a copy of the SPD, please contact your Plan Administrator.

GP5479US (2/2021) |

Page 1 of 9 |

Group annuity contracts and recordkeeping agreements are issued by: John Hancock Life Insurance Company (U.S.A.) (“John Hancock USA”), Boston, MA (not licensed in New York) and John Hancock Life Insurance Company of New York (“John Hancock NY”), Valhalla, NY. Product features and availability may differ by state. John Hancock USA and John Hancock NY each make available a platform of investment alternatives to sponsors or administrators of retirement plans without regard to the individualized needs of any plan. Unless otherwise specifically stated in writing, John Hancock USA and John Hancock NY do not, and are not undertaking to, provide impartial investment advice or give advice in a fiduciary capacity.

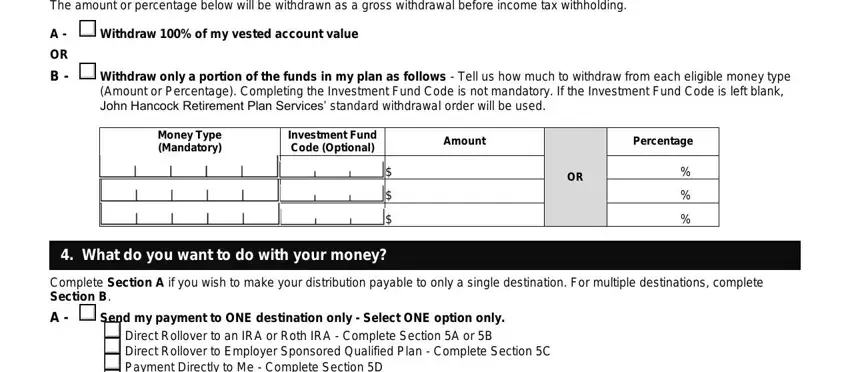

3. How much do you want to withdraw? Select ONE option only

If no option is selected a TOTAL withdrawal will be processed.

The amount or percentage below will be withdrawn as a gross withdrawal before income tax withholding.

A - Withdraw 100% of my vested account value

OR

B - Withdraw only a portion of the funds in my plan as follows - Tell us how much to withdraw from each eligible money type (Amount or Percentage). Completing the Investment Fund Code is not mandatory. If the Investment Fund Code is left blank, John Hancock Retirement Plan Services’ standard withdrawal order will be used.

|

Money Type |

Investment Fund |

Amount |

|

Percentage |

|

(Mandatory) |

Code (Optional) |

|

|

|

|

|

|

{PortionType1} |

{PortionFund1} |

${PortionAmt1} |

OR |

{PortionPct1}% |

|

|

{PortionType2} |

{PortionFund2} |

${PortionAmt2} |

{PortionPct2}% |

|

|

|

{PortionType3} |

{PortionFund3} |

${PortionAmt3} |

|

{PortionPct3}% |

4. What do you want to do with your money?

Complete Section A if you wish to make your distribution payable to only a single destination. For multiple destinations, complete Section B.

A - Send my payment to ONE destination only - Select ONE option only.

Direct Rollover to an IRA or Roth IRA - Complete Section 5A or 5B

Direct Rollover to Employer Sponsored Qualified Plan - Complete Section 5C Payment Directly to Me - Complete Section 5D

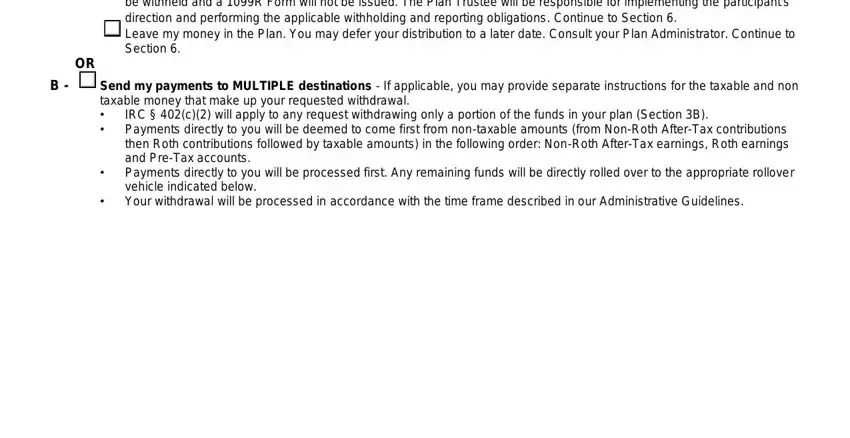

Pay to the Plan Trustee for Deposit into the Plan’s Trust Account - A check will be mailed to the Trustee address on record with John Hancock Retirement Plan Services unless EFT instructions are provided in Section 5C. Taxes will not be withheld and a 1099R Form will not be issued. The Plan Trustee will be responsible for implementing the participant's direction and performing the applicable withholding and reporting obligations. Continue to Section 6.

Leave my money in the Plan. You may defer your distribution to a later date. Consult your Plan Administrator. Continue to Section 6.

OR

B - Send my payments to MULTIPLE destinations - If applicable, you may provide separate instructions for the taxable and non taxable money that make up your requested withdrawal.

•IRC § 402(c)(2) will apply to any request withdrawing only a portion of the funds in your plan (Section 3B).

•Payments directly to you will be deemed to come first from non-taxable amounts (from Non-Roth After-Tax contributions then Roth contributions followed by taxable amounts) in the following order: Non-Roth After-Tax earnings, Roth earnings and Pre-Tax accounts.

•Payments directly to you will be processed first. Any remaining funds will be directly rolled over to the appropriate rollover vehicle indicated below.

•Your withdrawal will be processed in accordance with the time frame described in our Administrative Guidelines.

GP5479US (2/2021) |

Page 2 of 9 |

Group annuity contracts and recordkeeping agreements are issued by: John Hancock Life Insurance Company (U.S.A.) (“John Hancock USA”), Boston, MA (not licensed in New York) and John Hancock Life Insurance Company of New York (“John Hancock NY”), Valhalla, NY. Product features and availability may differ by state. John Hancock USA and John Hancock NY each make available a platform of investment alternatives to sponsors or administrators of retirement plans without regard to the individualized needs of any plan. Unless otherwise specifically stated in writing, John Hancock USA and John Hancock NY do not, and are not undertaking to, provide impartial investment advice or give advice in a fiduciary capacity.

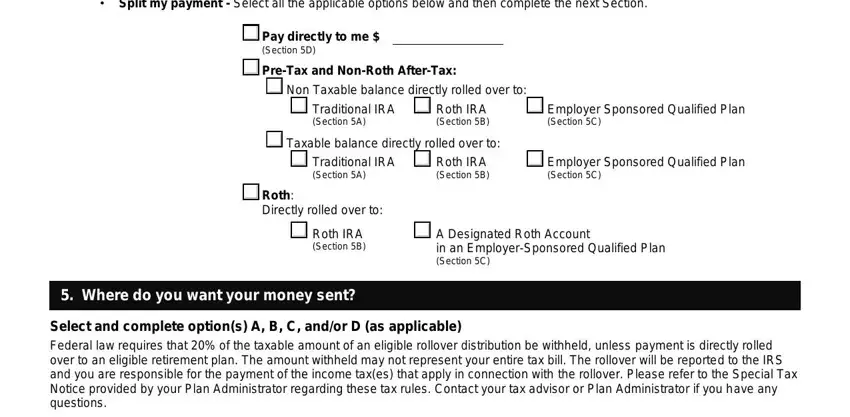

•Split my payment - Select all the applicable options below and then complete the next Section.

Pay directly to me $ {TaxDollar}

(Section 5D)

Pre-Tax and Non-Roth After-Tax: |

|

|

{F37} |

Non Taxable balance directly rolled over to: |

|

|

{F38} |

Traditional IRA |

{F39} |

Roth IRA |

{F40} |

Employer Sponsored Qualified Plan |

|

|

(Section 5A) |

|

(Section 5B) |

|

(Section 5C) |

{F41} |

Taxable balance directly rolled over to: |

|

|

|

{F42} |

Traditional IRA |

{F43} |

Roth IRA |

{F44} |

Employer Sponsored Qualified Plan |

|

|

(Section 5A) |

|

(Section 5B) |

|

(Section 5C) |

Roth: |

|

|

|

|

|

Directly rolled over to: |

|

|

|

|

|

{F46} |

Roth IRA |

{F47} |

A Designated Roth Account |

|

|

(Section 5B) |

|

in an Employer-Sponsored Qualified Plan |

(Section 5C)

5. Where do you want your money sent?

Select and complete option(s) A, B, C, and/or D (as applicable)

Federal law requires that 20% of the taxable amount of an eligible rollover distribution be withheld, unless payment is directly rolled over to an eligible retirement plan. The amount withheld may not represent your entire tax bill. The rollover will be reported to the IRS and you are responsible for the payment of the income tax(es) that apply in connection with the rollover. Please refer to the Special Tax Notice provided by your Plan Administrator regarding these tax rules. Contact your tax advisor or Plan Administrator if you have any questions.

A - Traditional IRA

{F51} Direct Rollover to the following John Hancock product. Your funds will be transferred automatically by wire. You must provide the account number. For more information contact John Hancock at 1-888-695-4472.

Elect one:

John Hancock Investments Rollover IRA |

Account Number: {AccNum1} |

|

|

|

John Hancock Managed IRA |

Account Number: {AccNum2} |

|

|

|

John Hancock GIFL Rollover Variable Annuity IRA |

Account Number: {AccNumG1} |

|

|

|

OR |

|

|

|

{F55} Direct Rollover to another Financial Institution |

Account Number: {AccNum3} |

|

|

{RO_ Inst_Name} |

|

|

|

|

Financial Institution Name |

|

|

|

|

{RO_ Inst_Addr} |

|

|

|

|

Financial Institution Address – Street, City, State, Zip Code, Country |

|

|

|

Electronic Fund Transfer Information (REQUIRED)

You must provide electronic fund transfer information below, unless the financial institution requires a check be issued. Where a check is issued it will be mailed according to the standard mailing instructions on file with John Hancock Retirement Plan Services, as established by the Plan Trustee.

|

Expected Delivery: • |

Checks: 7-10 business days • Direct Deposit: 2-3 business days • Wires: 1-2 business days |

|

Electronic Fund Transfer Details |

|

|

|

|

Direct Deposit |

OR |

Wire – Verify with receiving bank if they accept wires and/or charge a fee |

|

Provide Domestic Bank details: |

|

|

|

{BankName} |

|

|

|

|

|

Bank Name |

|

|

|

|

|

{BankABA} |

|

|

{BankAcctNo} |

|

|

Bank ABA/Routing (9 digits) |

|

|

Bank Account No. |

|

{F64} |

For international banks, complete and attach the International Banking Instructions form. |

GP5479US (2/2021) |

|

|

|

Page 3 of 9 |

Group annuity contracts and recordkeeping agreements are issued by: John Hancock Life Insurance Company (U.S.A.) (“John Hancock USA”), Boston, MA (not licensed in New York) and John Hancock Life Insurance Company of New York (“John Hancock NY”), Valhalla, NY. Product features and availability may differ by state. John Hancock USA and John Hancock NY each make available a platform of investment alternatives to sponsors or administrators of retirement plans without regard to the individualized needs of any plan. Unless otherwise specifically stated in writing, John Hancock USA and John Hancock NY do not, and are not undertaking to, provide impartial investment advice or give advice in a fiduciary capacity.

B - Roth IRA

{F62} Direct Rollover to the following John Hancock product. Your funds will be transferred automatically by wire. You must provide the account number. For more information contact John Hancock at 1-888-695-4472.

Elect one:

John Hancock Investments Rollover IRA |

Account Number: {AccNumR1} |

|

|

|

John Hancock Managed IRA |

Account Number: {AccNumR2} |

|

|

|

John Hancock GIFL Rollover Variable Annuity IRA |

Account Number: {AccNumRG1} |

|

|

|

OR |

|

|

|

{F72} Direct Rollover to another Financial Institution |

Account Number: {AccNumR3} |

|

|

{RO_ Inst_NameR} |

|

|

|

|

Financial Institution Name |

|

|

|

|

{RO_ Inst_AddrR} |

|

|

|

|

Financial Institution Address – Street, City, State, Zip Code, Country |

|

|

|

Electronic Fund Transfer Information (REQUIRED)

You must provide electronic fund transfer information below, unless the financial institution requires a check be issued. Where a check is issued it will be mailed according to the standard mailing instructions on file with John Hancock Retirement Plan Services, as established by the Plan Trustee.

Expected Delivery: • |

Checks: 7-10 business days • Direct Deposit: 2-3 business days • Wires: 1-2 business days |

Electronic Fund Transfer Details |

|

|

|

Direct Deposit |

OR |

Wire – Verify with receiving bank if they accept wires and/or charge a fee |

Provide Domestic Bank details: |

|

|

{BankNameR} |

|

|

|

|

Bank Name |

|

|

|

|

{BankABAR} |

|

|

{BankAcctNoR} |

|

Bank ABA/Routing (9 digits) |

|

|

Bank Account No. |

{F82} |

For international banks, complete and attach the International Banking Instructions form. |

C - Employer Sponsored Qualified Plan

The Trustee of {Trustee_Name} |

|

{PContractNum} |

|

Plan Name |

|

Plan Account Number |

{RO_ Inst_NameEP} |

|

|

Financial Institution Name |

|

|

{RO_ Inst_AddrEP} |

|

|

Financial Institution Address – Street, City, State, Zip Code, Country |

|

|

GP5479US (2/2021) |

Page 4 of 9 |

Group annuity contracts and recordkeeping agreements are issued by: John Hancock Life Insurance Company (U.S.A.) (“John Hancock USA”), Boston, MA (not licensed in New York) and John Hancock Life Insurance Company of New York (“John Hancock NY”), Valhalla, NY. Product features and availability may differ by state. John Hancock USA and John Hancock NY each make available a platform of investment alternatives to sponsors or administrators of retirement plans without regard to the individualized needs of any plan. Unless otherwise specifically stated in writing, John Hancock USA and John Hancock NY do not, and are not undertaking to, provide impartial investment advice or give advice in a fiduciary capacity.