With the objective of making it as effortless to use as possible, we designed our PDF editor. The process of preparing the employment verification form texas pdf is going to be very simple in the event you consider the next actions.

Step 1: Choose the orange button "Get Form Here" on the web page.

Step 2: At the moment, it is possible to change the employment verification form texas pdf. Our multifunctional toolbar helps you include, remove, adjust, highlight, as well as undertake other sorts of commands to the content material and fields inside the form.

The following sections will help make up the PDF form:

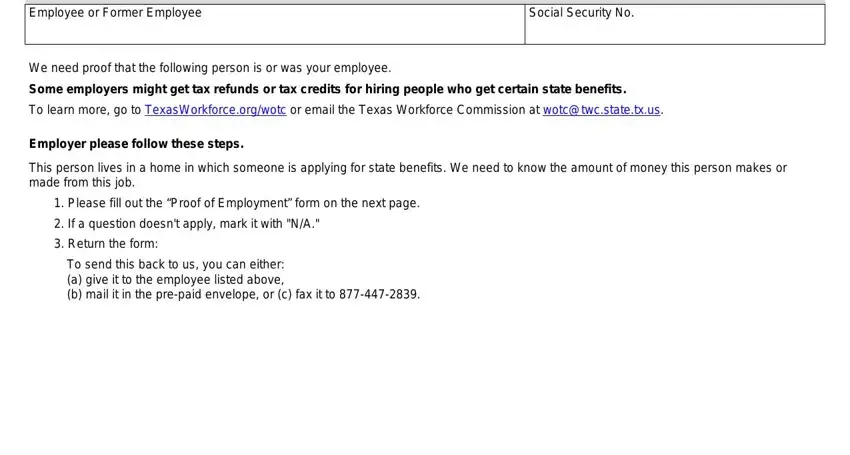

Jot down the data in Employer Your Help Is Needed, Employee or Former Employee, Social Security No, We need proof that the following, Some employers might get tax, To learn more go to, Employer please follow these steps, This person lives in a home in, Please fill out the Proof of, If a question doesnt apply mark, Return the form, and To send this back to us you can.

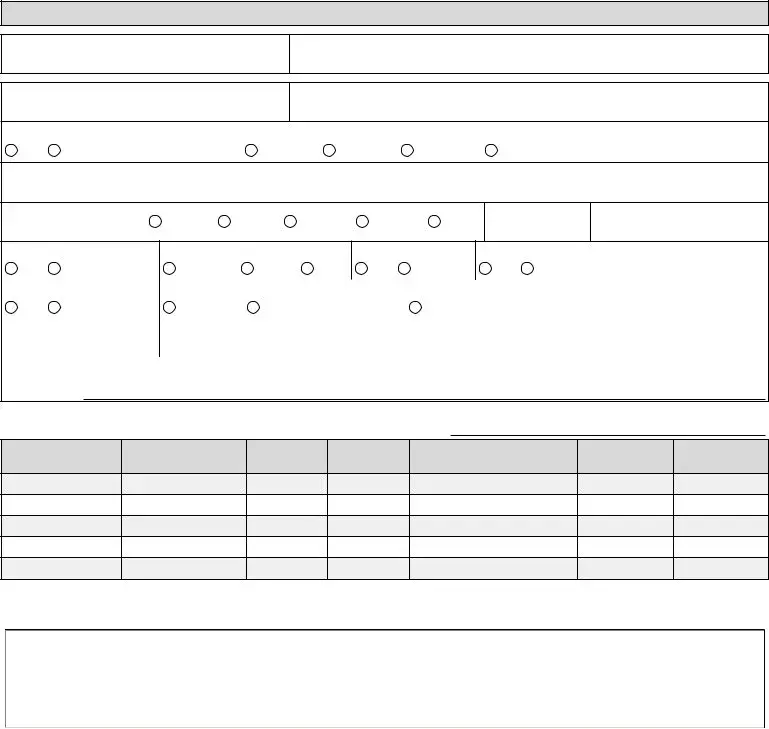

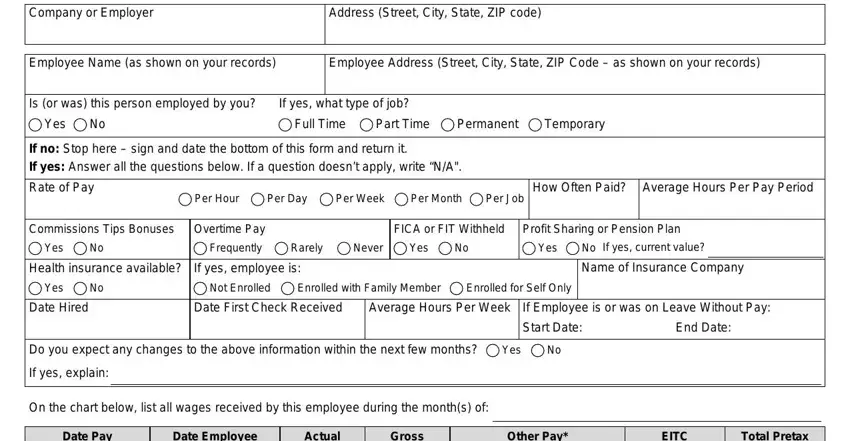

In the Company or Employer, Address Street City State ZIP code, Employee Name as shown on your, Employee Address Street City State, Is or was this person employed by, If yes what type of job, Yes, Full Time, Part Time, Permanent, Temporary, If no Stop here sign and date the, Rate of Pay, Per Hour, and Per Day field, emphasize the valuable particulars.

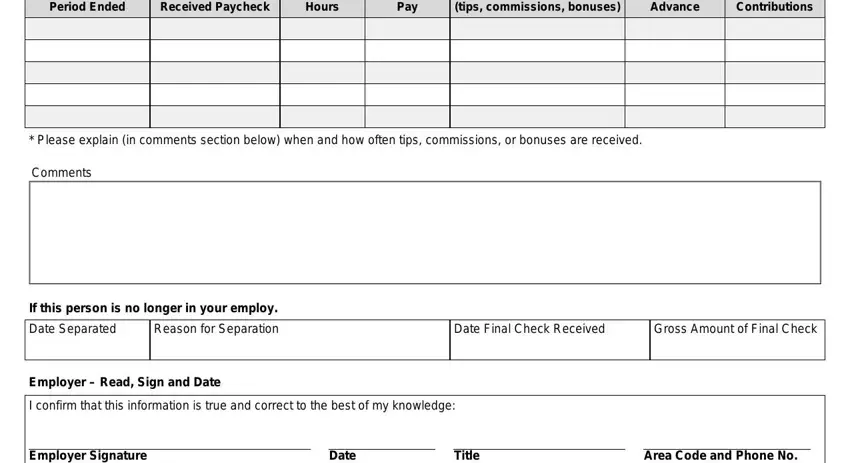

The Date Pay Period Ended, Date Employee Received Paycheck, Actual Hours, Gross Pay, Other Pay tips commissions bonuses, EITC Advance, Total Pretax Contributions, Please explain in comments, Comments, If this person is no longer in, Date Separated, Reason for Separation, Date Final Check Received, Gross Amount of Final Check, and Employer Read Sign and Date area is the place to indicate the rights and obligations of all sides.

Step 3: Press "Done". You can now export the PDF form.

Step 4: Get duplicates of the document. This will protect you from possible complications. We don't view or distribute the information you have, as a consequence feel comfortable knowing it is protected.