Our PDF editor allows you to fill out forms. You won't have to undertake much to update 1049 form documents. Simply keep up with all of these actions.

Step 1: To start with, select the orange "Get form now" button.

Step 2: Now, you're on the file editing page. You can add text, edit current details, highlight specific words or phrases, put crosses or checks, add images, sign the template, erase needless fields, etc.

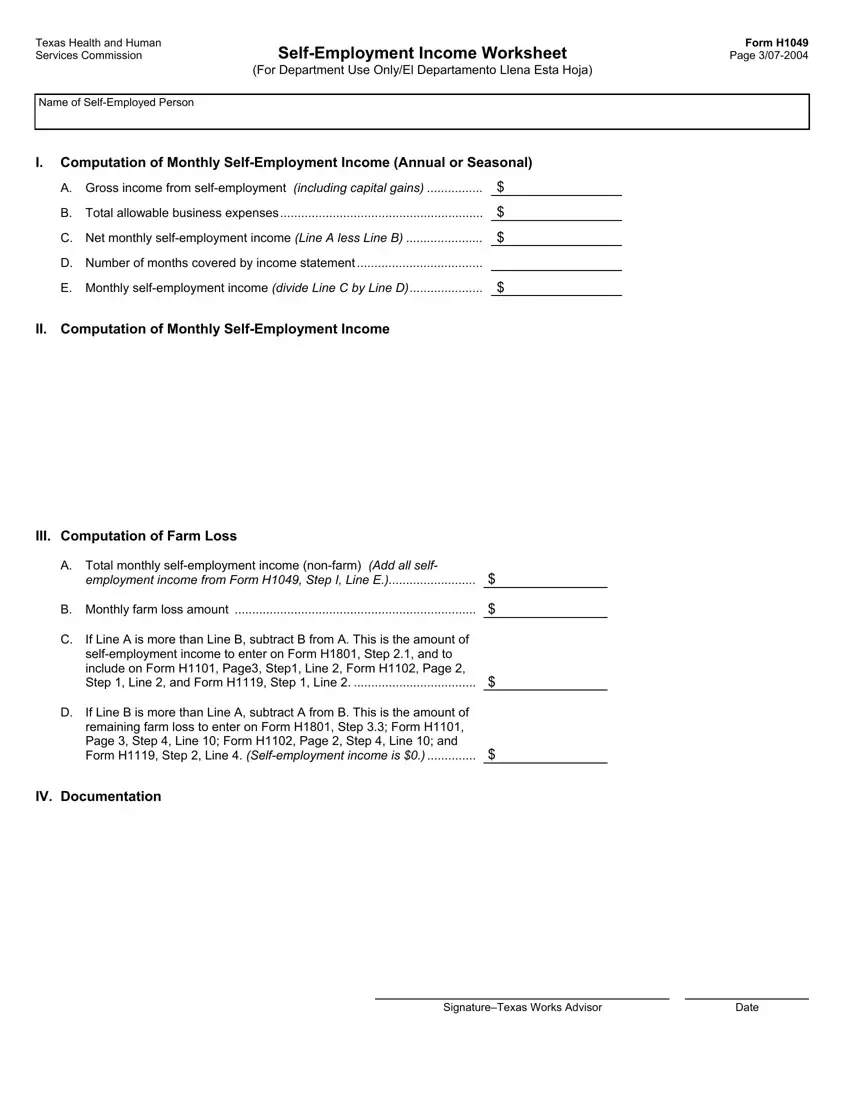

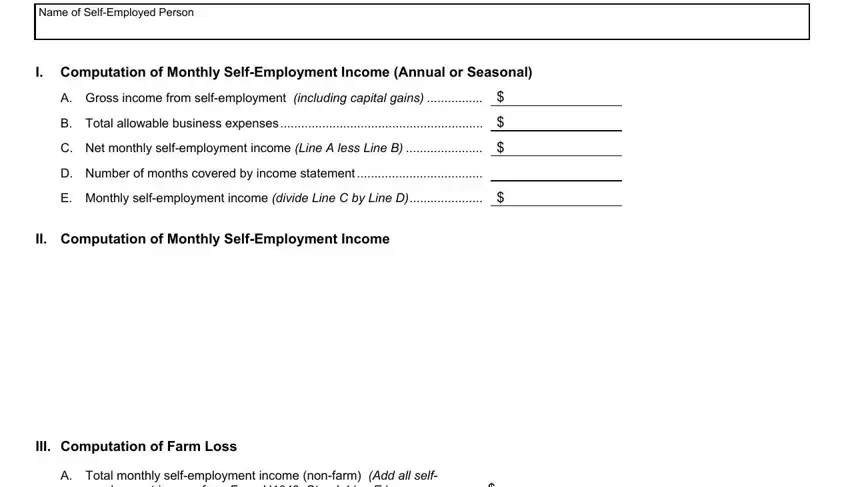

Enter the information requested by the application to fill in the form.

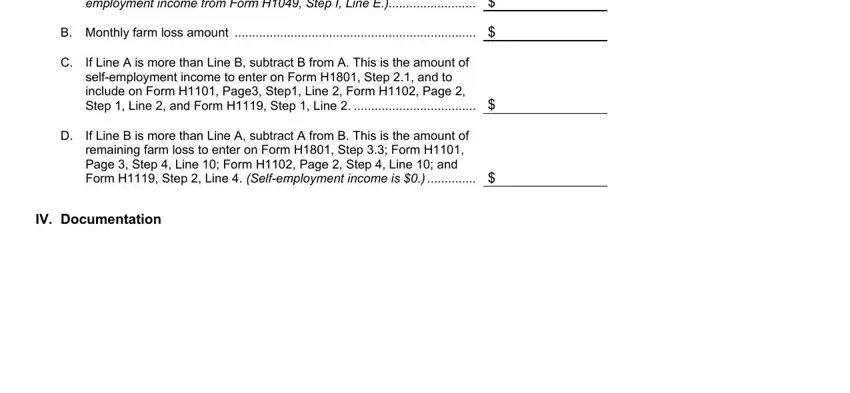

You have to write down the appropriate information in the employment income from Form H Step, B Monthly farm loss amount, If Line A is more than Line B, If Line B is more than Line A, and IV Documentation area.

In the field dealing with SignatureTexas Works Advisor, and Date, it's important to put in writing some required data.

Step 3: After you have selected the Done button, your form should be ready for upload to each gadget or email address you indicate.

Step 4: Come up with a minimum of a few copies of the document to remain away from any kind of possible concerns.