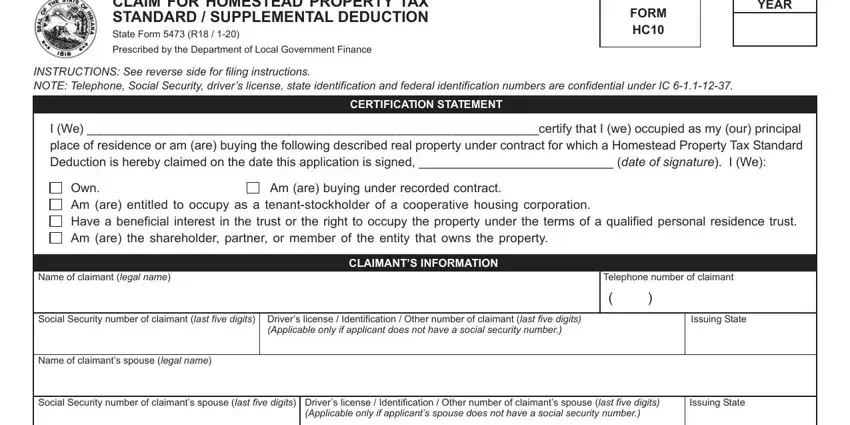

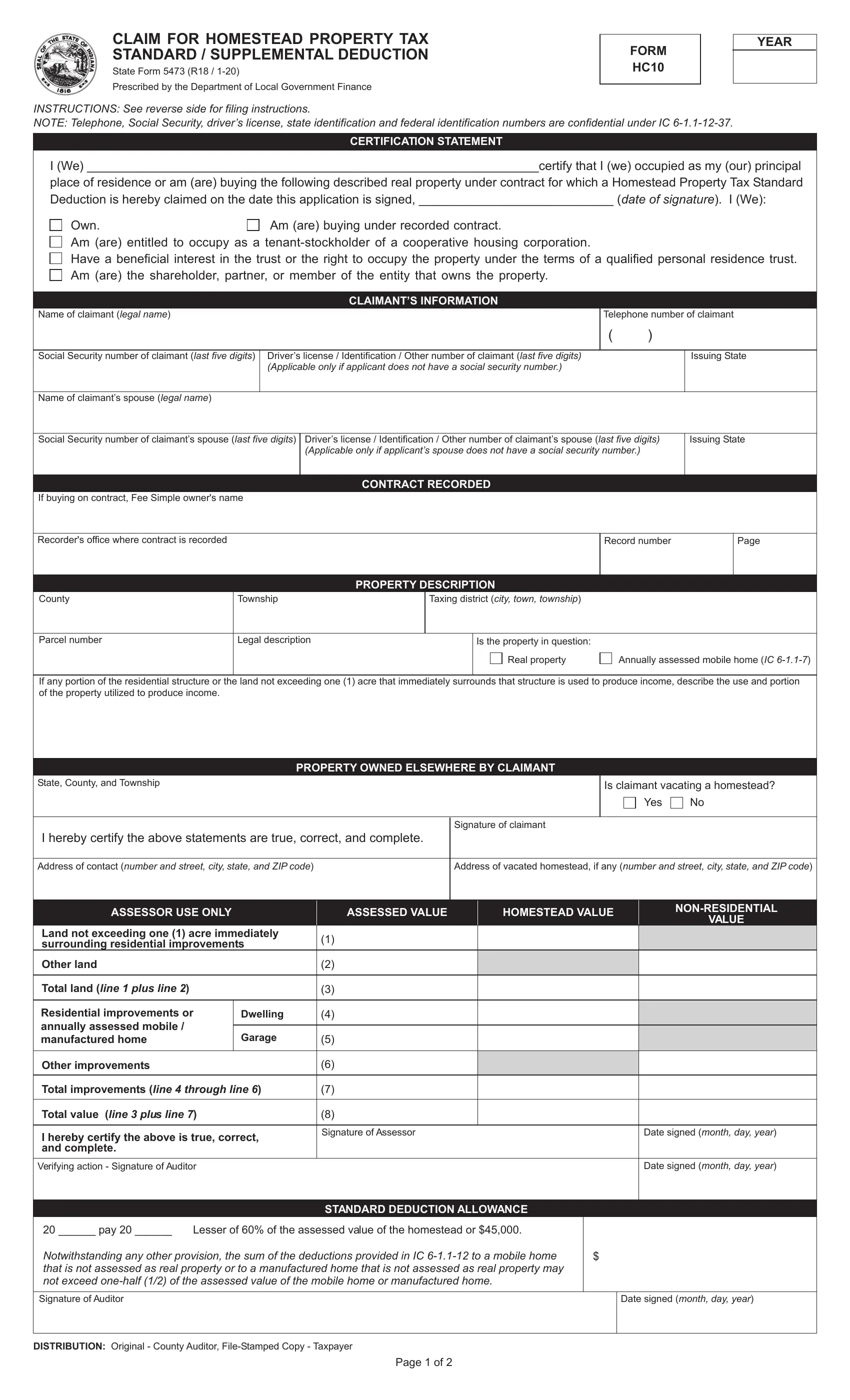

NOTICE OF HOMESTEAD STANDARD DEDUCTION

IC 6-1.1-12-37

The homestead standard deduction has been enacted to allow a property tax deduction for each qualified homestead. Read carefully the qualifying guidelines below:

DEFINITIONS: “Homestead” means an individual’s principal place of residence:

1.that is located in Indiana;

2.that:

a.the individual owns;

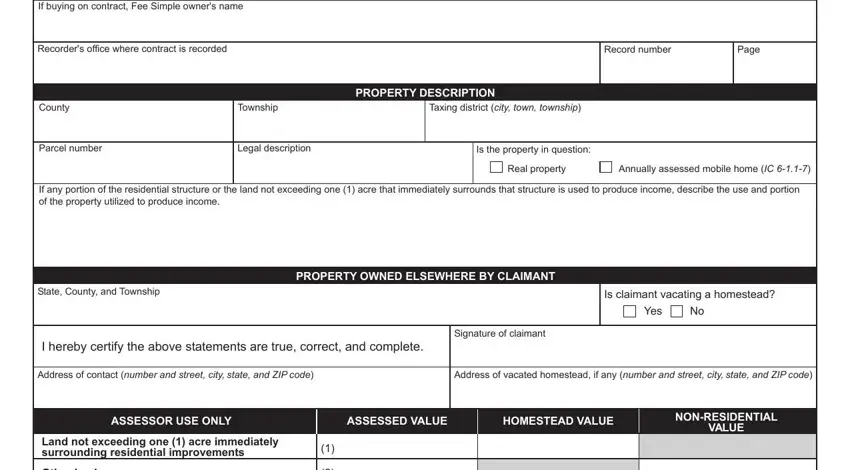

b.the individual is buying under a contract, recorded in the County Recorder’s office, that provides that the individual is to pay the property taxes on the residence and that obligates the seller to convey title to the individual upon completion of all of the individual’s contract obligations;

c.the individual is entitled to occupy as a tenant-stockholder (as defined in 26 USC 216) of a cooperative housing corporation (as defined in 26 USC 216);

d.is a residence described in IC 6-1.1-12-17.9 that is owned by a trust if the individual is an individual described in IC 6-1.1-12-17.9; or

e.is a residence owned by a corporation, partnership, limited liability company, or other entity and the requirements of IC 6-1.1-12-37(k) are met; and

3.the principal place of residence consists of a dwelling and the real estate (up to one (1) acre) that immediately surrounds that dwelling.

“Dwelling” means any of the following:

1.Residential real property improvements that an individual uses as the individual’s residence, including a house or garage;

2.A mobile home that is not assessed as real property that an individual uses as the individual’s residence; or

3.A manufactured home that is not assessed as real property that an individual uses as the individual’s residence.

WHO MAY QUALIFY: An individual who: owns a homestead, is buying a homestead under a recorded contract that requires the individual to pay the property taxes and that obligates the seller to convey title to the individual upon completion of all of the individual’s contract obligations, or is entitled to occupy the homestead as a tenant-stockholder of a cooperative housing corporation.

A trust is entitled to the homestead standard deduction for real property owned by the trust and occupied by an individual if the county auditor determines that the individual:

1.upon verification in the body of the deed or otherwise, has either:

a.A beneficial interest in the trust; or

b.The right to occupy the real property rent free under the terms of a qualified personal residence trust created by the individual under United States Treasury Regulation 25.2702-5(c)(2);

2.otherwise qualifies for the deduction; and

3.would be considered the owner of the real property under IC 6-1.1-1-9(f) or IC 6-1.1-1-9(g).

No portion of a residential dwelling that is income-producing is eligible for the homestead standard deduction, including, but not limited to, one-half of a duplex side or rented apartment that is a part of the structure, a beauty shop or crafts shop in one or two rooms of the structure, a dry cleaners or electronics shop beneath an apartment, or an auto repair shop in the garage.

Property owned by a corporation, partnership, limited liability company, or other entity is not entitled to the homestead standard deduction unless the requirements of IC 6-1.1-12-37(k) are met.

For assessment dates after 2009, the term “homestead” includes a deck or patio, a gazebo, and certain other residential yard structures (other than a swimming pool) assessed as real property and attached to the dwelling.

WHEN TO FILE: This application must be completed and dated in the calendar year for which the applicant desires to obtain the deduction and filed or postmarked with the county auditor on or before January 5 of the calendar year in which the property taxes are first due and payable. The application applies for that first year and any succeeding year for which the deduction is allowed.

HOW TO FILE: Forms must be filed at the county auditor’s office in the county where the homestead is located. If an individual mails this form and desires to have a file-stamped copy returned, the individual must provide a self-addressed, stamped envelope to the county auditor’s office.

Only one individual or married couple may receive a homestead deduction for a particular homestead in a particular year. The portion above the “Signature of claimant” must be completed in full before the deduction will be considered.

For additional filing information, please see IC 6-1.1-12-37.

DISALLOWANCE OF MULTIPLE CLAIMS: The county auditor may not grant an individual or married couple a homestead deduction if:

1.for the same year, the individual or married couple claims the homestead deduction on two (2) or more different deduction applications; and

2.the applications claim the homestead deduction for different property.

If a person moves from his Indiana principal place of residence (for which he is receiving a homestead deduction) after the assessment date to a new principal place of residence later that year, the homestead deduction on the first property will stay in place for that tax cycle and the person can apply for and potentially receive a homestead deduction on the new property for that same tax cycle. For the next assessment date, the homestead deduction would be removed from the first property. See IC 6-1.1-12-37(h).

A person must actually be eligible for the deduction at the time the application is signed, meaning the property is being used as his or her principal place of residence at the time of signing.

NOTICE OF SUPPLEMENTAL DEDUCTION

IC 6-1.1-12-37.5

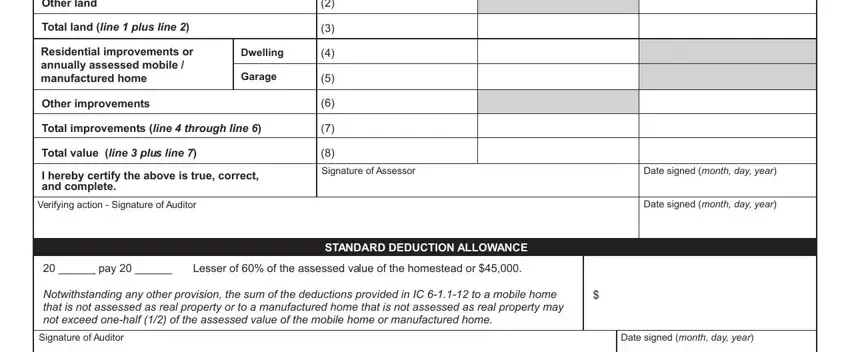

A person who is entitled to a homestead standard deduction is also entitled to receive a supplemental deduction from the assessed value of the homestead to which the standard deduction applies after the application of the standard deduction, but before the application of any other deduction, exemption, or credit for which the person is eligible.

The amount of the supplemental deduction is equal to the sum of the following:

1.Thirty-five percent (35%) of the assessed value that is not more than six hundred thousand dollars ($600,000).

2.Twenty-five percent (25%) of the assessed value that is more than six hundred thousand dollars ($600,000)

The county auditor is required to record and make the deduction for the person qualifying for the supplemental deduction.

The statutory limit of one-half (1/2) of the assessed value that applies to the sum of the deductions provided under IC 6-1.1-12 to a mobile home that is not assessed as real property or to a manufactured home that is not assessed as real property does not apply to the supplemental deduction.

INELIGIBILITY PENALTY: If an individual whose property becomes ineligible for the homestead deduction fails to file a certified statement with the county auditor notifying the auditor of the ineligibility within sixty (60) days after the date of the change, the individual is liable for the amount of the deduction allowed for that real property, plus a civil penalty equal to ten percent (10%) of the additional taxes due.