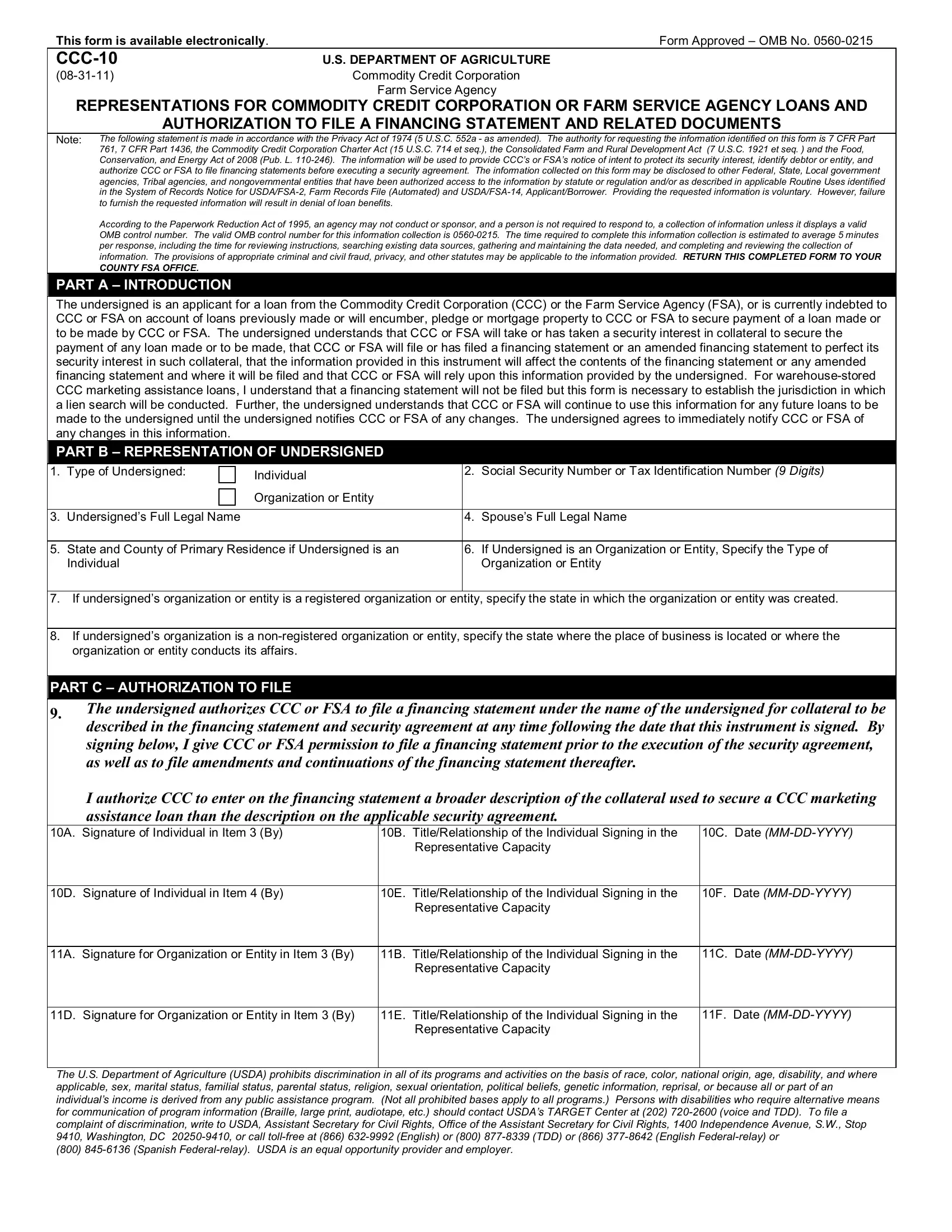

This form is available electronically. |

Form Approved – OMB No. 0560-0215 |

CCC-10 |

U.S. DEPARTMENT OF AGRICULTURE |

(08-31-11) |

Commodity Credit Corporation |

|

Farm Service Agency |

REPRESENTATIONS FOR COMMODITY CREDIT CORPORATION OR FARM SERVICE AGENCY LOANS AND

AUTHORIZATION TO FILE A FINANCING STATEMENT AND RELATED DOCUMENTS

Note: The following statement is made in accordance with the Privacy Act of 1974 (5 U.S.C. 552a - as amended). The authority for requesting the information identified on this form is 7 CFR Part 761, 7 CFR Part 1436, the Commodity Credit Corporation Charter Act (15 U.S.C. 714 et seq.), the Consolidated Farm and Rural Development Act (7 U.S.C. 1921 et seq. ) and the Food,

Conservation, and Energy Act of 2008 (Pub. L. 110-246). The information will be used to provide CCC’s or FSA’s notice of intent to protect its security interest, identify debtor or entity, and authorize CCC or FSA to file financing statements before executing a security agreement. The information collected on this form may be disclosed to other Federal, State, Local government agencies, Tribal agencies, and nongovernmental entities that have been authorized access to the information by statute or regulation and/or as described in applicable Routine Uses identified in the System of Records Notice for USDA/FSA-2, Farm Records File (Automated) and USDA/FSA-14, Applicant/Borrower. Providing the requested information is voluntary. However, failure to furnish the requested information will result in denial of loan benefits.

According to the Paperwork Reduction Act of 1995, an agency may not conduct or sponsor, and a person is not required to respond to, a collection of information unless it displays a valid OMB control number. The valid OMB control number for this information collection is 0560-0215. The time required to complete this information collection is estimated to average 5 minutes per response, including the time for reviewing instructions, searching existing data sources, gathering and maintaining the data needed, and completing and reviewing the collection of information. The provisions of appropriate criminal and civil fraud, privacy, and other statutes may be applicable to the information provided. RETURN THIS COMPLETED FORM TO YOUR

COUNTY FSA OFFICE.

PART A – INTRODUCTION

The undersigned is an applicant for a loan from the Commodity Credit Corporation (CCC) or the Farm Service Agency (FSA), or is currently indebted to

CCCor FSA on account of loans previously made or will encumber, pledge or mortgage property to CCC or FSA to secure payment of a loan made or to be made by CCC or FSA. The undersigned understands that CCC or FSA will take or has taken a security interest in collateral to secure the payment of any loan made or to be made, that CCC or FSA will file or has filed a financing statement or an amended financing statement to perfect its security interest in such collateral, that the information provided in this instrument will affect the contents of the financing statement or any amended financing statement and where it will be filed and that CCC or FSA will rely upon this information provided by the undersigned. For warehouse-stored CCC marketing assistance loans, I understand that a financing statement will not be filed but this form is necessary to establish the jurisdiction in which a lien search will be conducted. Further, the undersigned understands that CCC or FSA will continue to use this information for any future loans to be made to the undersigned until the undersigned notifies CCC or FSA of any changes. The undersigned agrees to immediately notify CCC or FSA of any changes in this information.

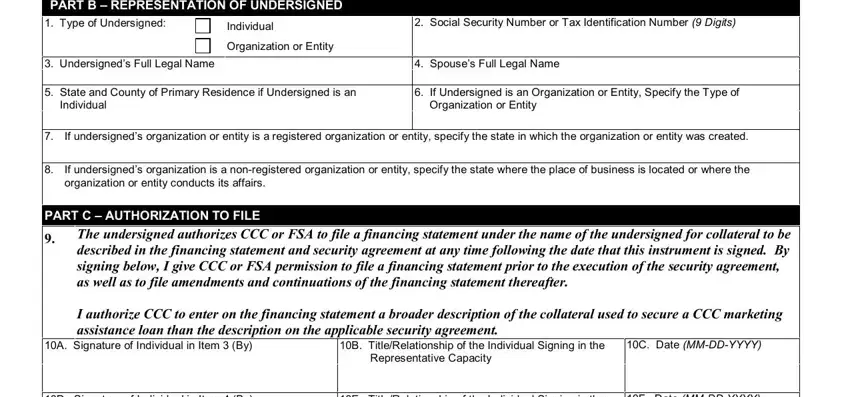

PART B – REPRESENTATION OF UNDERSIGNED

1. |

Type of Undersigned: |

Individual |

2. |

Social Security Number or Tax Identification Number (9 Digits) |

|

|

|

|

|

|

Organization or Entity |

|

|

|

|

|

|

|

3. |

Undersigned’s Full Legal Name |

|

4. |

Spouse’s Full Legal Name |

|

|

|

|

5. |

State and County of Primary Residence if Undersigned is an |

6. |

If Undersigned is an Organization or Entity, Specify the Type of |

|

Individual |

|

|

Organization or Entity |

7.If undersigned’s organization or entity is a registered organization or entity, specify the state in which the organization or entity was created.

8.If undersigned’s organization is a non-registered organization or entity, specify the state where the place of business is located or where the organization or entity conducts its affairs.

PART C – AUTHORIZATION TO FILE

9.The undersigned authorizes CCC or FSA to file a financing statement under the name of the undersigned for collateral to be described in the financing statement and security agreement at any time following the date that this instrument is signed. By signing below, I give CCC or FSA permission to file a financing statement prior to the execution of the security agreement, as well as to file amendments and continuations of the financing statement thereafter.

I authorize CCC to enter on the financing statement a broader description of the collateral used to secure a CCC marketing

assistance loan than the description on the applicable security agreement.

10A. |

Signature of Individual in Item 3 (By) |

10B. |

Title/Relationship of the Individual Signing in the |

10C. |

Date (MM-DD-YYYY) |

|

|

|

Representative Capacity |

|

|

|

|

|

|

|

|

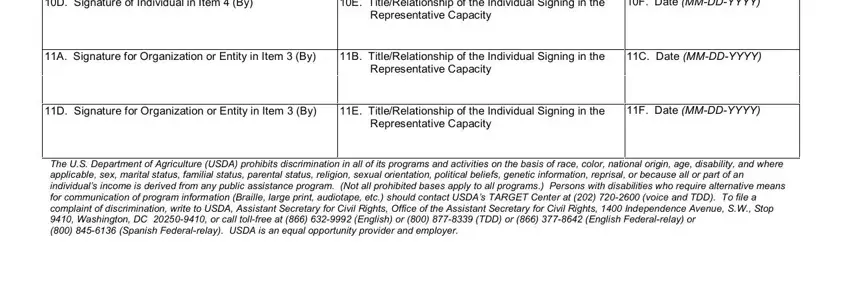

10D. |

Signature of Individual in Item 4 (By) |

10E. |

Title/Relationship of the Individual Signing in the |

10F. |

Date (MM-DD-YYYY) |

|

|

|

Representative Capacity |

|

|

|

|

|

|

|

|

11A. |

Signature for Organization or Entity in Item 3 (By) |

11B. |

Title/Relationship of the Individual Signing in the |

11C. |

Date (MM-DD-YYYY) |

|

|

|

Representative Capacity |

|

|

|

|

|

|

|

|

11D. |

Signature for Organization or Entity in Item 3 (By) |

11E. |

Title/Relationship of the Individual Signing in the |

11F. |

Date (MM-DD-YYYY) |

|

|

|

Representative Capacity |

|

|

|

|

|

|

|

|

The U.S. Department of Agriculture (USDA) prohibits discrimination in all of its programs and activities on the basis of race, color, national origin, age, disability, and where applicable, sex, marital status, familial status, parental status, religion, sexual orientation, political beliefs, genetic information, reprisal, or because all or part of an individual’s income is derived from any public assistance program. (Not all prohibited bases apply to all programs.) Persons with disabilities who require alternative means for communication of program information (Braille, large print, audiotape, etc.) should contact USDA’s TARGET Center at (202) 720-2600 (voice and TDD). To file a complaint of discrimination, write to USDA, Assistant Secretary for Civil Rights, Office of the Assistant Secretary for Civil Rights, 1400 Independence Avenue, S.W., Stop 9410, Washington, DC 20250-9410, or call toll-free at (866) 632-9992 (English) or (800) 877-8339 (TDD) or (866) 377-8642 (English Federal-relay) or

(800) 845-6136 (Spanish Federal-relay). USDA is an equal opportunity provider and employer.