Using the online tool for PDF editing by FormsPal, you can easily fill in or edit 11706 form here. To have our tool on the cutting edge of convenience, we work to put into operation user-oriented features and improvements regularly. We're routinely glad to receive feedback - play a vital part in remolding the way you work with PDF forms. By taking a few simple steps, you are able to begin your PDF journey:

Step 1: Just click the "Get Form Button" above on this site to access our pdf editing tool. Here you will find all that is necessary to fill out your file.

Step 2: The editor will let you change PDF forms in a range of ways. Improve it by writing your own text, adjust original content, and place in a signature - all readily available!

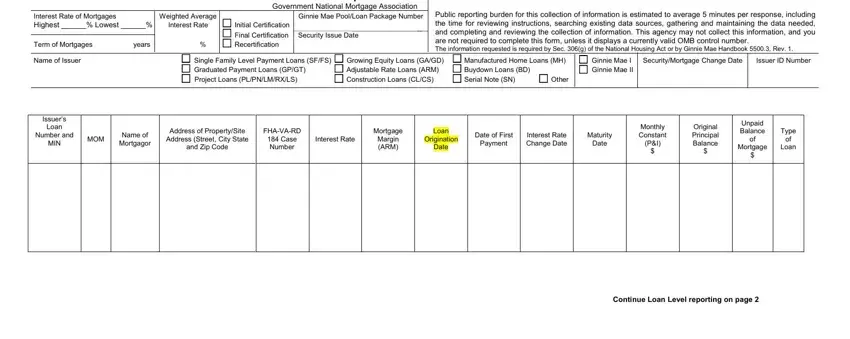

This PDF form requires some specific details; in order to ensure accuracy and reliability, be sure to consider the following suggestions:

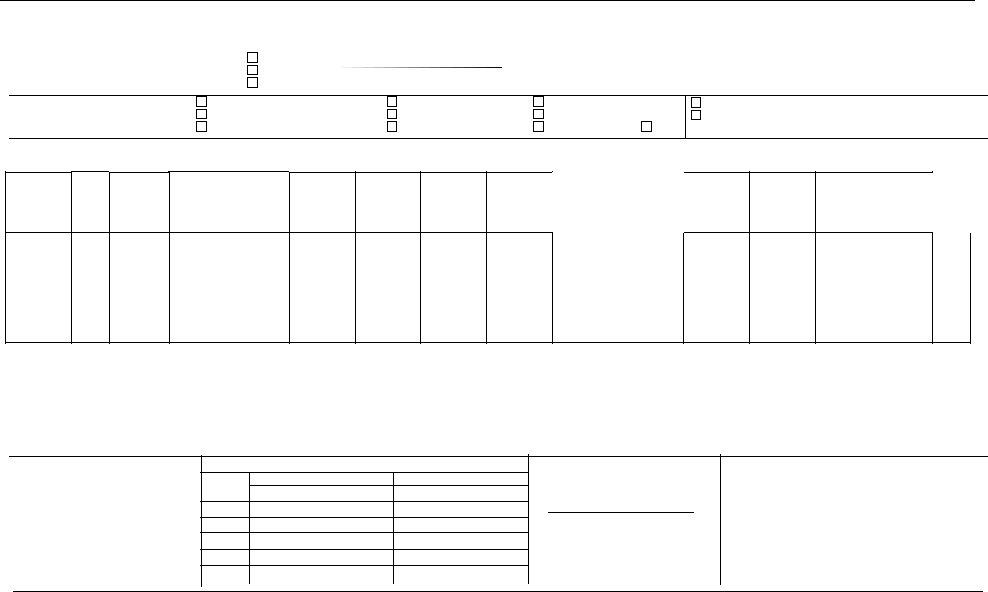

1. It is advisable to fill out the 11706 form accurately, so be mindful when filling out the sections comprising all these blank fields:

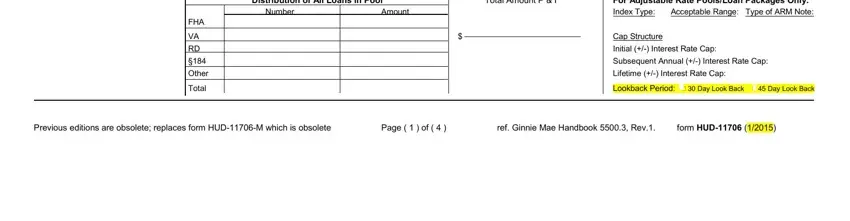

2. After performing the previous part, go on to the next stage and fill out the necessary particulars in all these fields - Distribution of All Loans in Pool, Number, Amount, Total Amount P I, For Adjustable Rate PoolsLoan, Acceptable Range Type of ARM Note, Cap Structure, Initial Interest Rate Cap, Subsequent Annual Interest Rate, Lifetime Interest Rate Cap, Lookback Period, Day Look Back, Day Look Back, FHA, and Other.

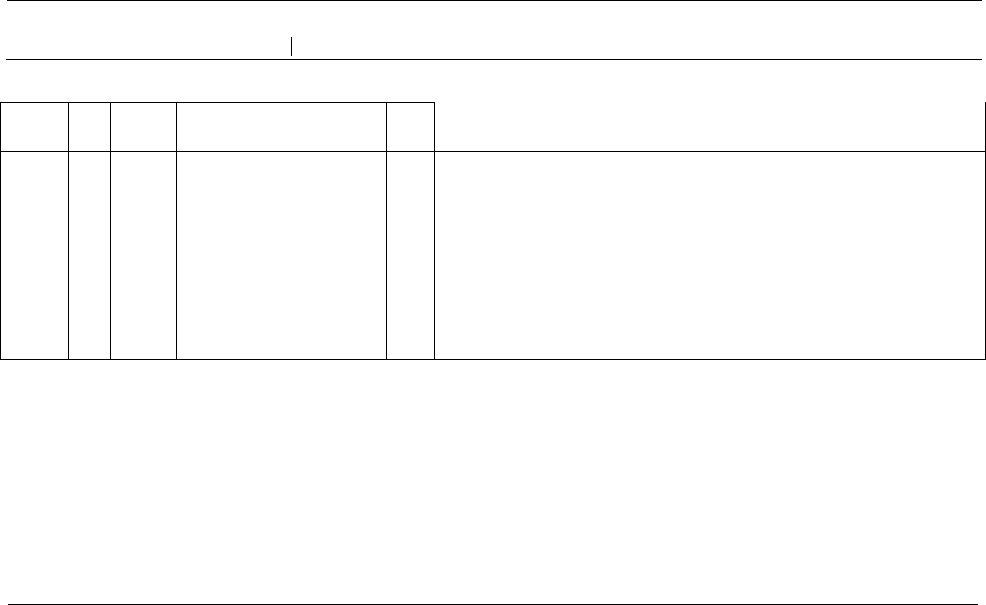

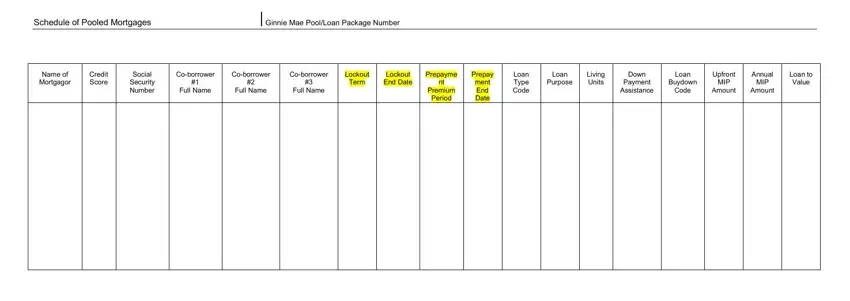

3. This third step is usually easy - fill out all of the empty fields in Schedule of Pooled Mortgages, Ginnie Mae PoolLoan Package Number, Name of Mortgagor, Credit Score, Social Security Number, Coborrower, Coborrower, Coborrower, Full Name, Full Name, Full Name, Lockout, Term, Lockout End Date, and Prepayme to complete this process.

4. This next section requires some additional information. Ensure you complete all the necessary fields - Previous editions are obsolete, Page of, ref Ginnie Mae Handbook Rev form, and HUD - to proceed further in your process!

You can certainly make errors while filling in the Page of, therefore be sure to go through it again before you'll submit it.

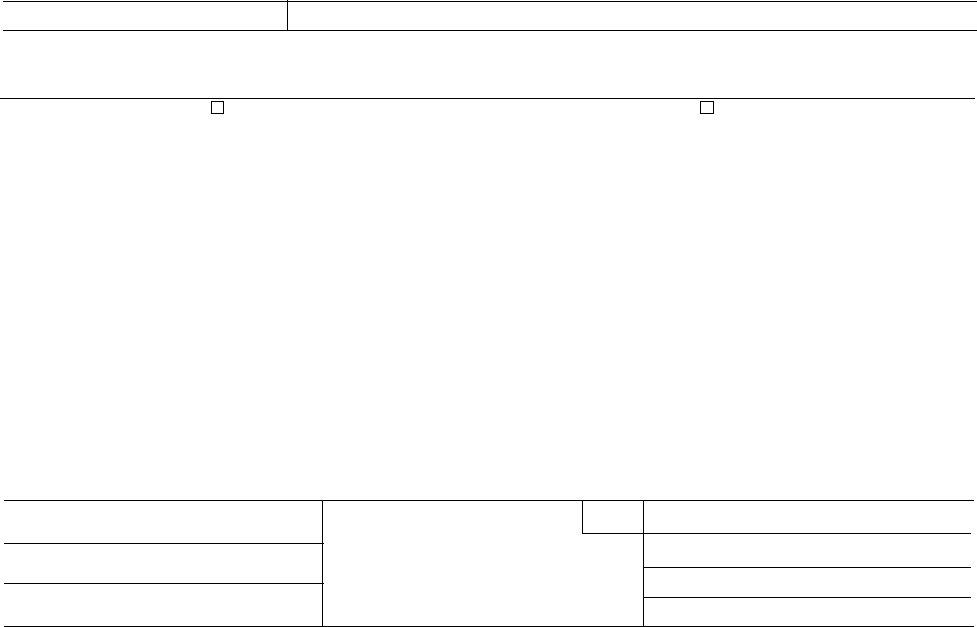

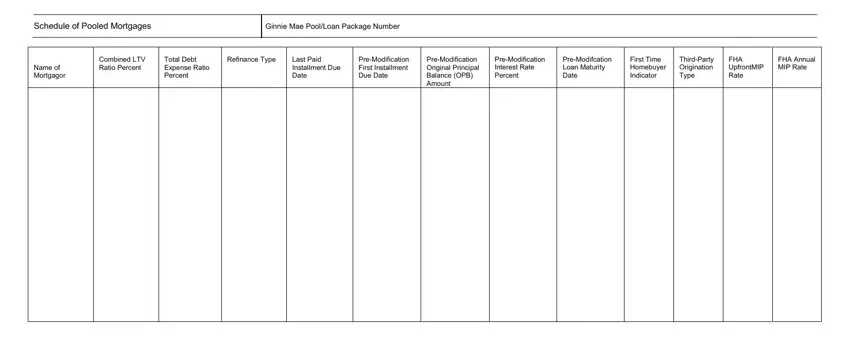

5. To conclude your form, this particular part has a number of extra fields. Typing in Schedule of Pooled Mortgages, Ginnie Mae PoolLoan Package Number, Name of Mortgagor, Combined LTV Ratio Percent, Total Debt Expense Ratio Percent, Refinance Type, Last Paid Installment Due Date, PreModification First Installment, PreModification Original Principal, PreModification Interest Rate, PreModifcation Loan Maturity Date, First Time Homebuyer Indicator, ThirdParty Origination Type, FHA UpfrontMIP Rate, and FHA Annual MIP Rate should finalize everything and you'll be done in the blink of an eye!

Step 3: Proofread all the details you have typed into the blank fields and then press the "Done" button. Join FormsPal today and instantly use 11706 form, prepared for download. Every single edit you make is conveniently preserved , meaning you can modify the document at a later stage when necessary. We do not sell or share any information you type in whenever completing forms at our website.