You could complete B14 instantly by using our PDF editor online. Our tool is constantly developing to give the best user experience achievable, and that is thanks to our resolve for constant development and listening closely to customer feedback. To get the ball rolling, consider these easy steps:

Step 1: Click the orange "Get Form" button above. It'll open up our pdf editor so that you can begin filling in your form.

Step 2: The editor will allow you to work with nearly all PDF files in many different ways. Enhance it by writing your own text, correct original content, and put in a signature - all within a couple of mouse clicks!

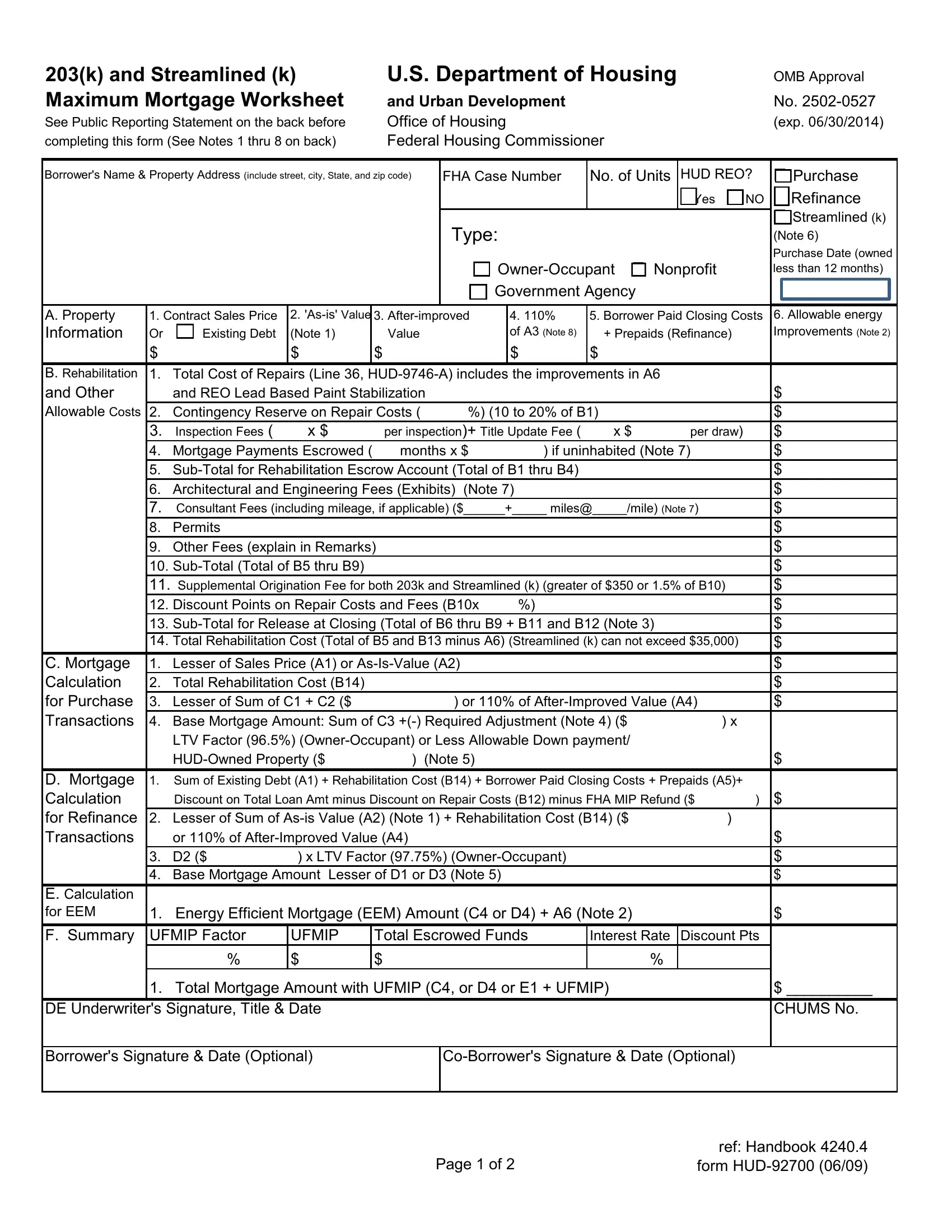

When it comes to fields of this specific form, here's what you should do:

1. Start filling out your B14 with a group of major fields. Collect all of the required information and ensure there's nothing forgotten!

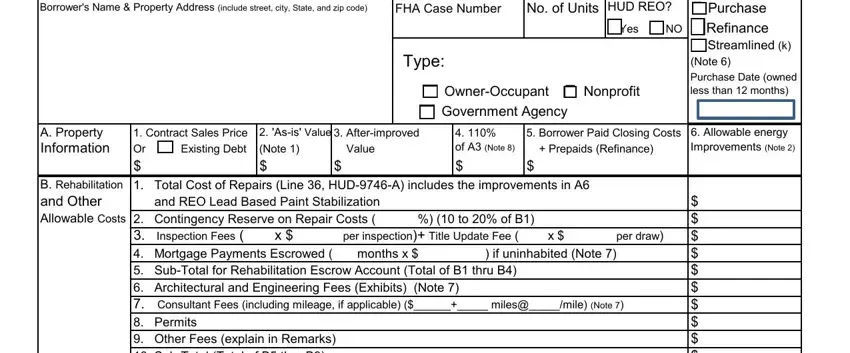

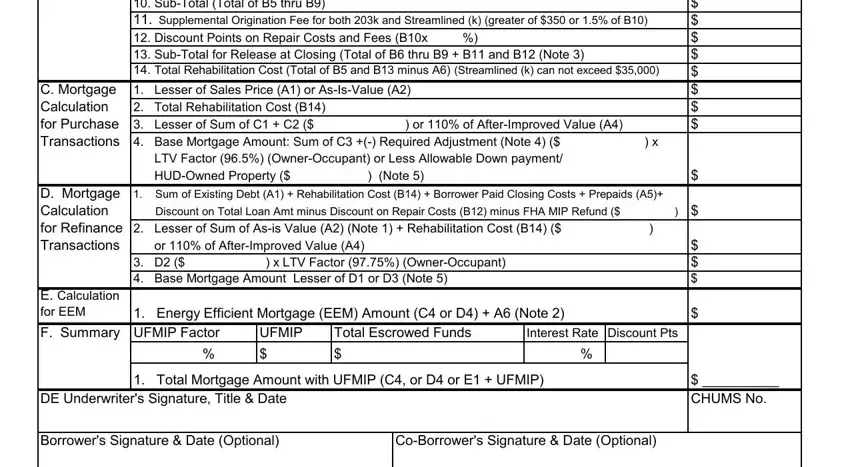

2. Just after the first selection of blank fields is completed, go on to type in the suitable information in all these - Inspection Fees x per, Lesser of Sales Price A or, C Mortgage Calculation for, LTV Factor OwnerOccupant or Less, D Mortgage Sum of Existing Debt A, Discount on Total Loan Amt minus, D x LTV Factor OwnerOccupant, E Calculation for EEM, Energy Efficient Mortgage EEM, F Summary UFMIP Factor, UFMIP, Total Escrowed Funds, Interest Rate Discount Pts, Total Mortgage Amount with UFMIP, and DE Underwriters Signature Title.

3. Completing Remarks Continue on separate page is essential for the next step, make sure to fill them out in their entirety. Don't miss any details!

Many people often make some mistakes when completing Remarks Continue on separate page in this section. You should definitely read again what you enter here.

Step 3: Before moving forward, make certain that blanks were filled in right. Once you are satisfied with it, click on “Done." Make a free trial account with us and get immediate access to B14 - download or edit in your personal account. At FormsPal.com, we aim to be certain that all of your details are stored private.