Using PDF files online is quite easy with our PDF tool. Anyone can fill in NR here and try out many other options we offer. The editor is consistently maintained by our staff, receiving new functions and turning out to be much more convenient. It just takes several easy steps:

Step 1: First of all, access the tool by pressing the "Get Form Button" at the top of this site.

Step 2: Using our handy PDF file editor, it is possible to do more than merely complete forms. Edit away and make your forms seem professional with customized text put in, or modify the file's original content to perfection - all comes with an ability to insert your personal photos and sign the file off.

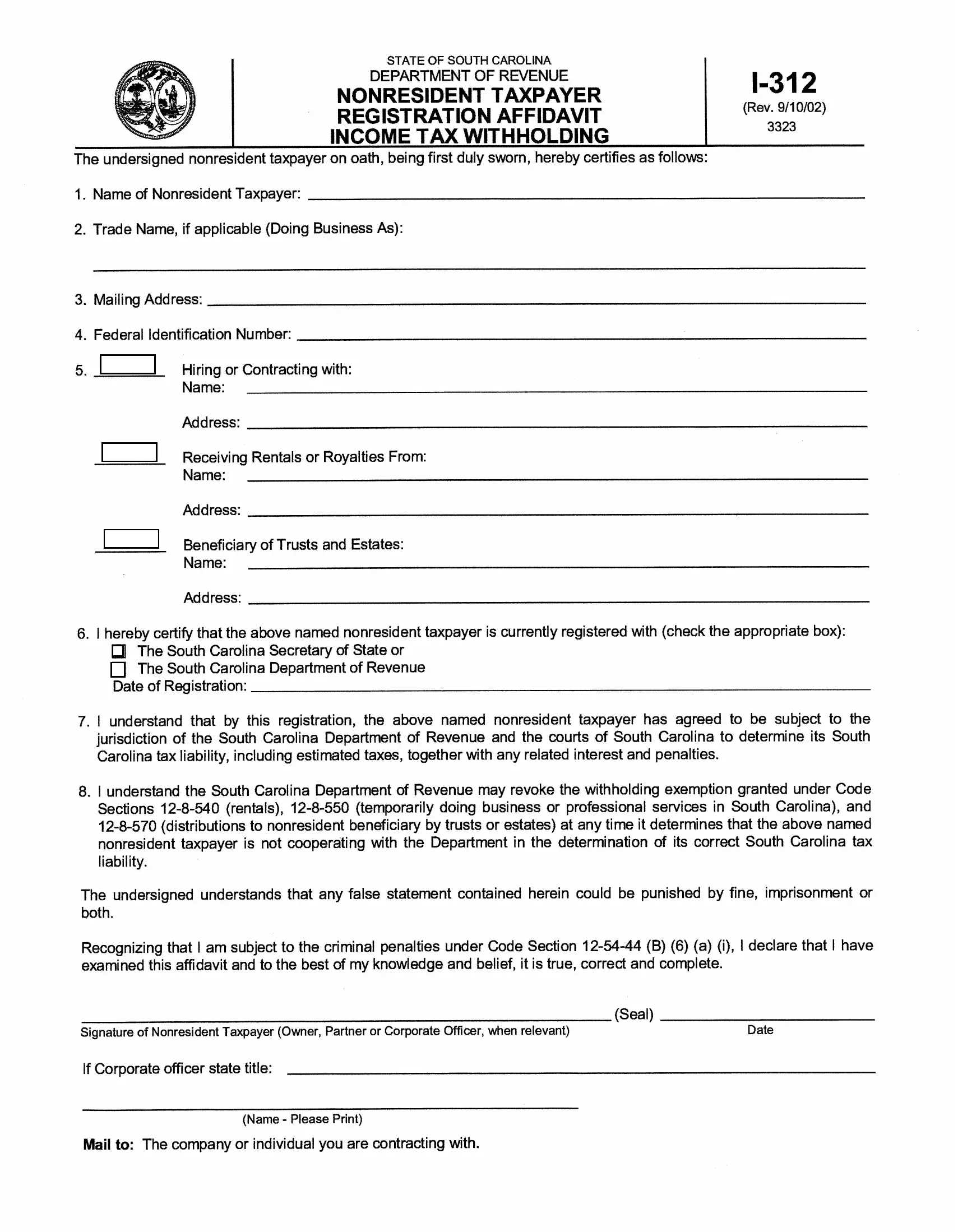

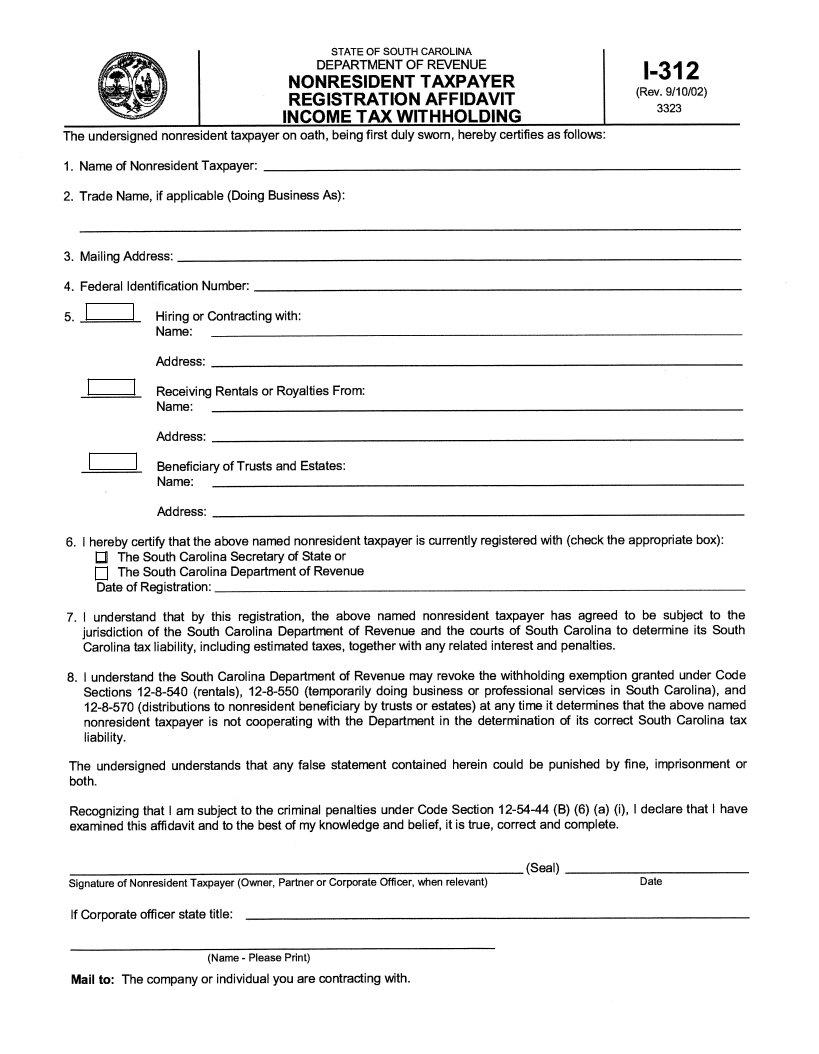

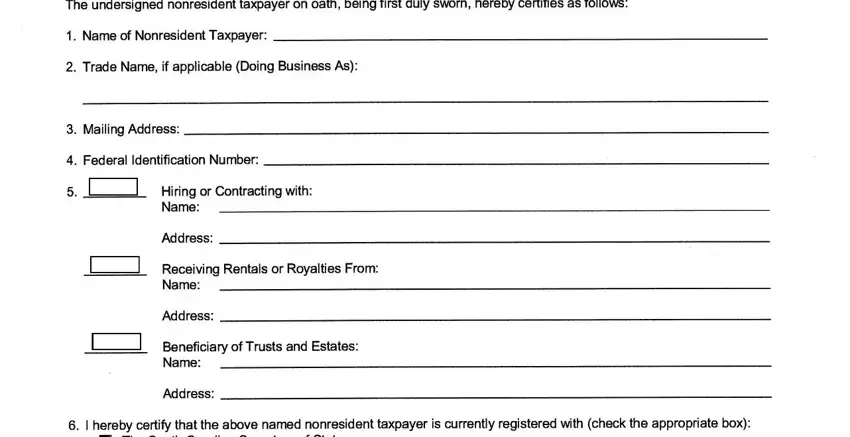

Completing this form requires thoroughness. Ensure that all mandatory fields are filled in correctly.

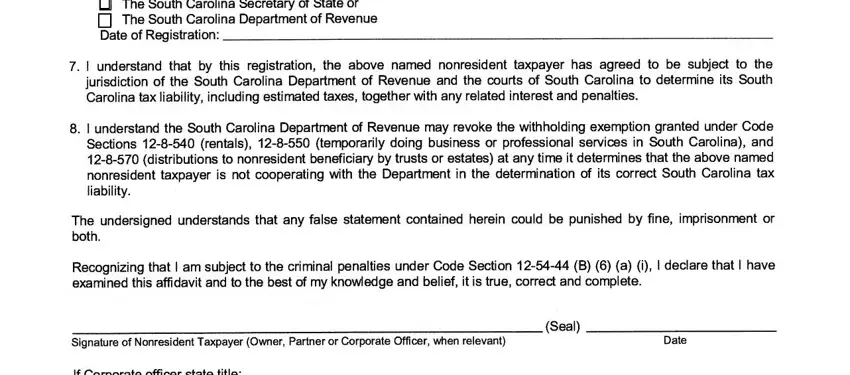

1. The NR requires specific information to be typed in. Make certain the next fields are filled out:

2. Soon after finishing the last part, head on to the subsequent step and enter all required particulars in these fields - .

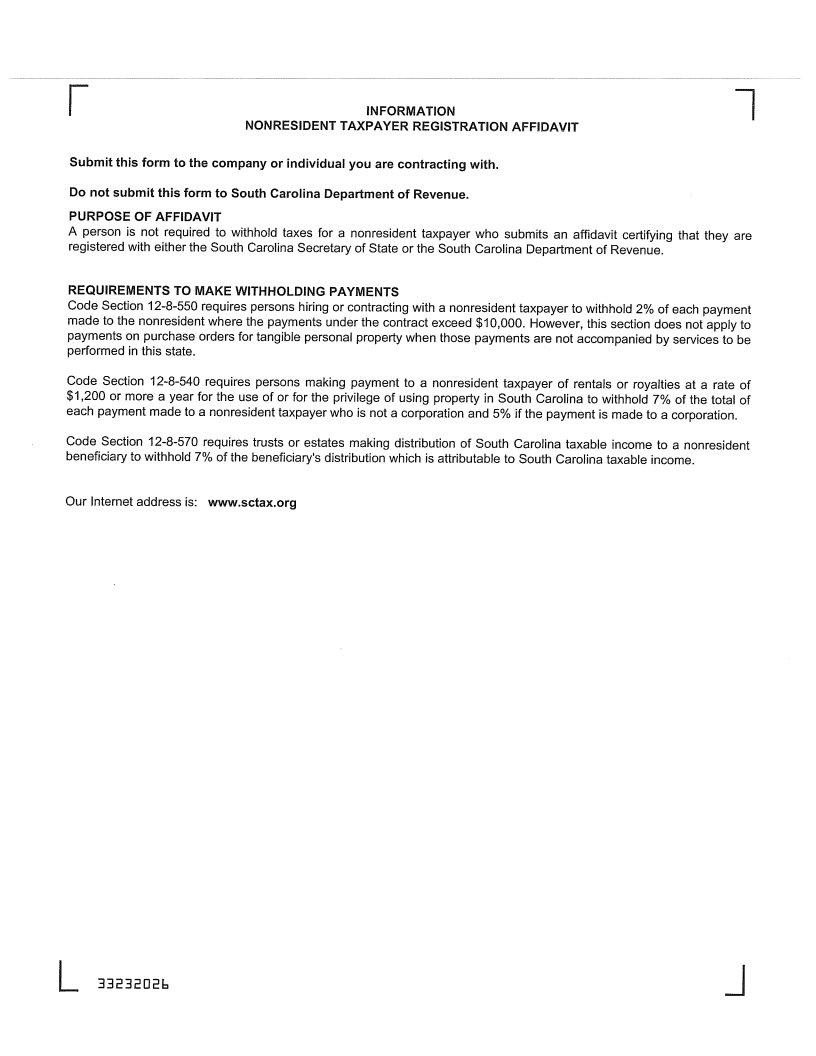

3. Completing For information about other, and This notice is for informational is essential for the next step, make sure to fill them out in their entirety. Don't miss any details!

As to For information about other and For information about other, be sure you double-check them in this current part. Both of these are certainly the key fields in the file.

Step 3: Before moving forward, you should make sure that blanks were filled in the proper way. When you think it is all fine, press “Done." Obtain the NR after you join for a 7-day free trial. Easily use the pdf in your personal account, together with any edits and changes being all synced! FormsPal offers protected document editing with no personal information record-keeping or any type of sharing. Rest assured that your data is in good hands with us!