4562A can be completed very easily. Simply try FormsPal PDF editing tool to get it done without delay. Our editor is constantly developing to grant the very best user experience attainable, and that's thanks to our commitment to continuous enhancement and listening closely to user comments. With just several basic steps, it is possible to start your PDF journey:

Step 1: Press the orange "Get Form" button above. It is going to open our pdf tool so that you could start filling in your form.

Step 2: When you access the PDF editor, you'll notice the document prepared to be filled out. Other than filling in different blank fields, it's also possible to perform many other things with the Document, namely putting on custom textual content, changing the original textual content, inserting illustrations or photos, placing your signature to the PDF, and more.

This PDF form will require specific information; to ensure correctness, be sure to adhere to the following recommendations:

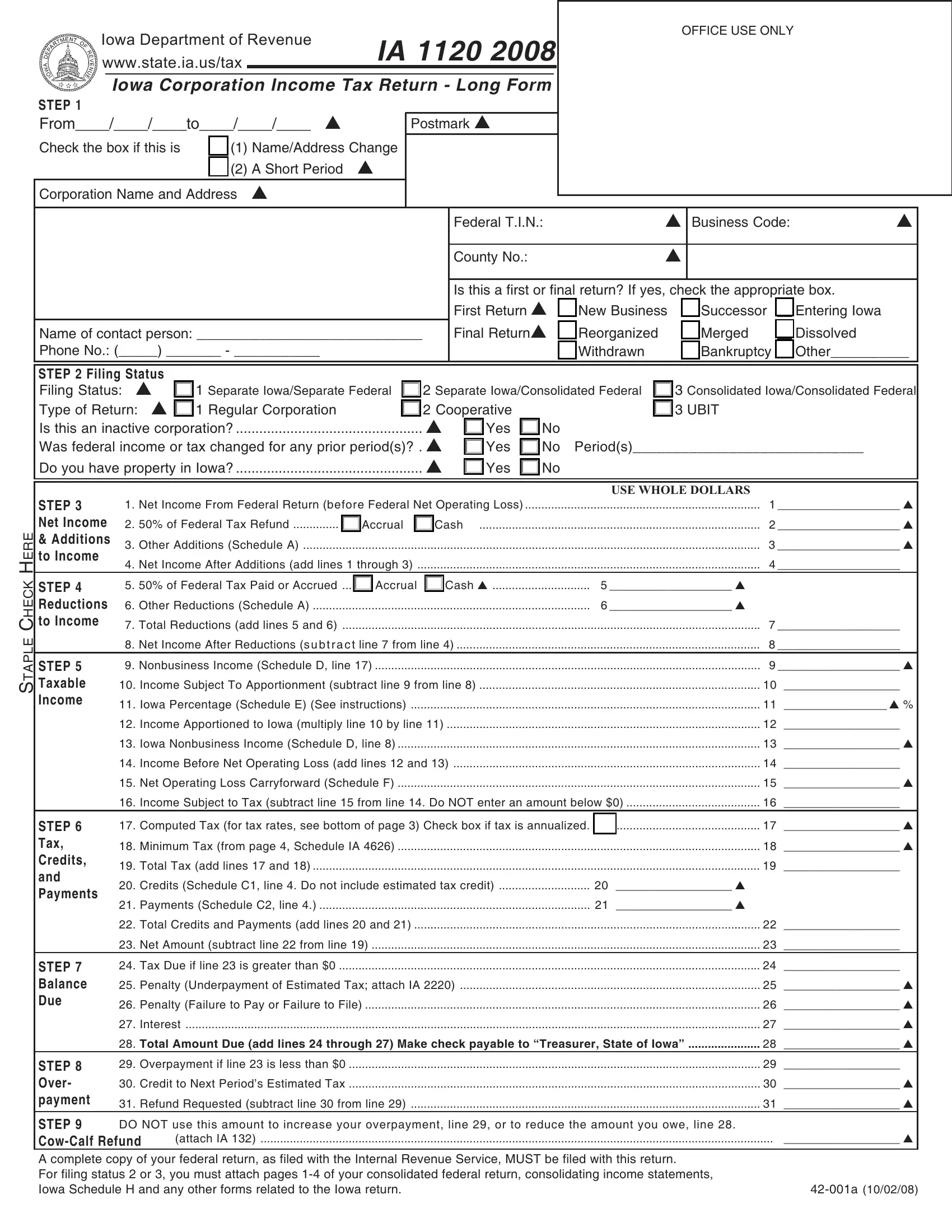

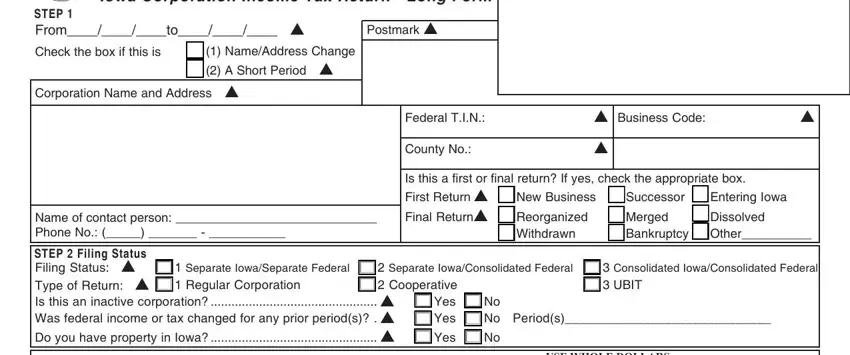

1. Start filling out your 4562A with a selection of essential blanks. Consider all of the required information and be sure not a single thing neglected!

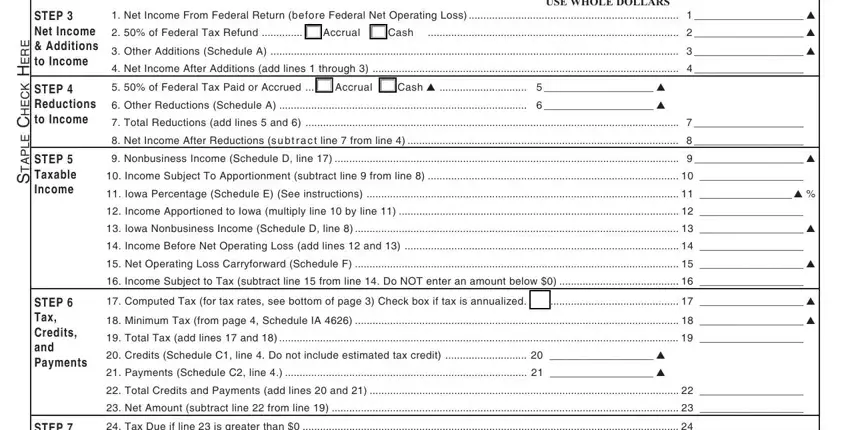

2. Soon after filling out the last step, head on to the subsequent stage and enter the necessary details in these fields - USE WHOLE DOLLARS, STEP Net Income Additions to, STEP Reductions to Income, STEP Taxable Income, E R E H K C E H C E L P A T S, STEP Tax Credits and Payments, STEP Balance Due, Net Income From Federal Return, of Federal Tax Refund, Accrual, Cash, cid, Other Additions Schedule A cid, Net Income After Additions add, and of Federal Tax Paid or Accrued.

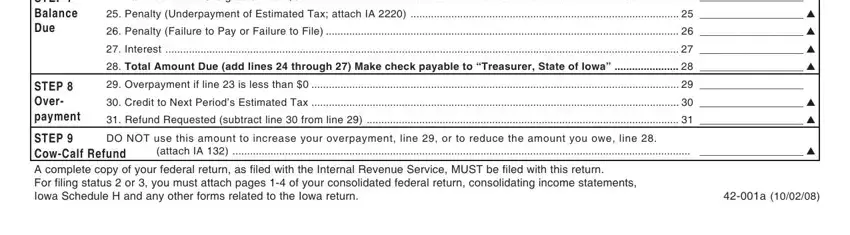

3. Your next step is generally straightforward - fill in all of the empty fields in STEP Balance Due, STEP Over payment, Tax Due if line is greater than, Penalty Underpayment of Estimated, Penalty Failure to Pay or Failure, Interest cid, Total Amount Due add lines, Overpayment if line is less than, Credit to Next Periods Estimated, Refund Requested subtract line, DO NOT use this amount to increase, STEP CowCalf Refund A complete, and attach IA cid to complete this process.

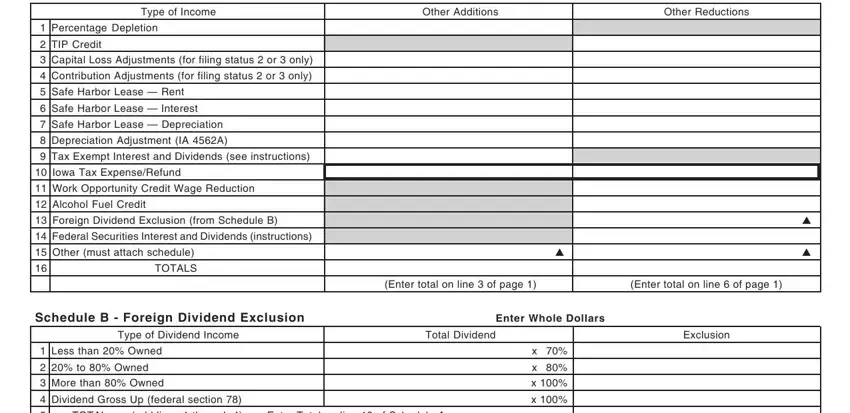

4. To go ahead, the following step requires typing in a few form blanks. These comprise of Schedule A Other Additions and, Enter Whole Dollars, Type of Income, Other Additions, Other Reductions, Percentage Depletion, TIP Credit, Capital Loss Adjustments for, Contribution Adjustments for, Safe Harbor Lease Rent, Safe Harbor Lease Interest, Safe Harbor Lease Depreciation, Depreciation Adjustment IA A, Tax Exempt Interest and Dividends, and Iowa Tax ExpenseRefund, which are fundamental to carrying on with this particular form.

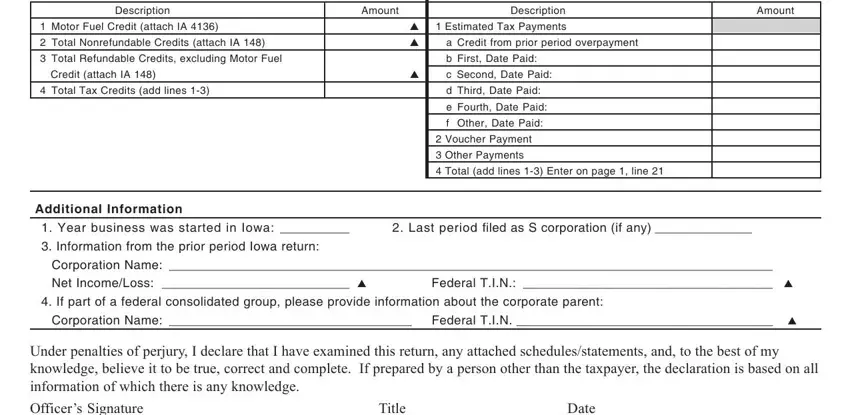

5. This form should be wrapped up by filling out this part. Below you will notice an extensive set of form fields that require appropriate details to allow your form usage to be complete: Schedule C Credits, Description, Whole Dollars, Schedule C Payments, Amount, Description, Whole Dollars, Amount, Motor Fuel Credit attach IA, Total Nonrefundable Credits, Total Refundable Credits, Credit attach IA, Total Tax Credits add lines, cid, and cid.

It's very easy to make a mistake when completing the Credit attach IA, therefore you'll want to reread it prior to deciding to submit it.

Step 3: Before finishing the form, ensure that all blank fields are filled out the right way. Once you establish that it's correct, click “Done." After creating a7-day free trial account here, it will be possible to download 4562A or send it through email directly. The PDF will also be accessible in your personal account with your each and every change. At FormsPal.com, we strive to guarantee that all of your details are maintained private.