This PDF editor was designed with the goal of allowing it to be as effortless and easy-to-use as possible. The following steps will make filling in the property inheritance document usa easy and fast.

Step 1: In order to start, press the orange button "Get Form Now".

Step 2: At the moment, you can begin editing the property inheritance document usa. The multifunctional toolbar is available to you - insert, eliminate, modify, highlight, and undertake many other commands with the content material in the document.

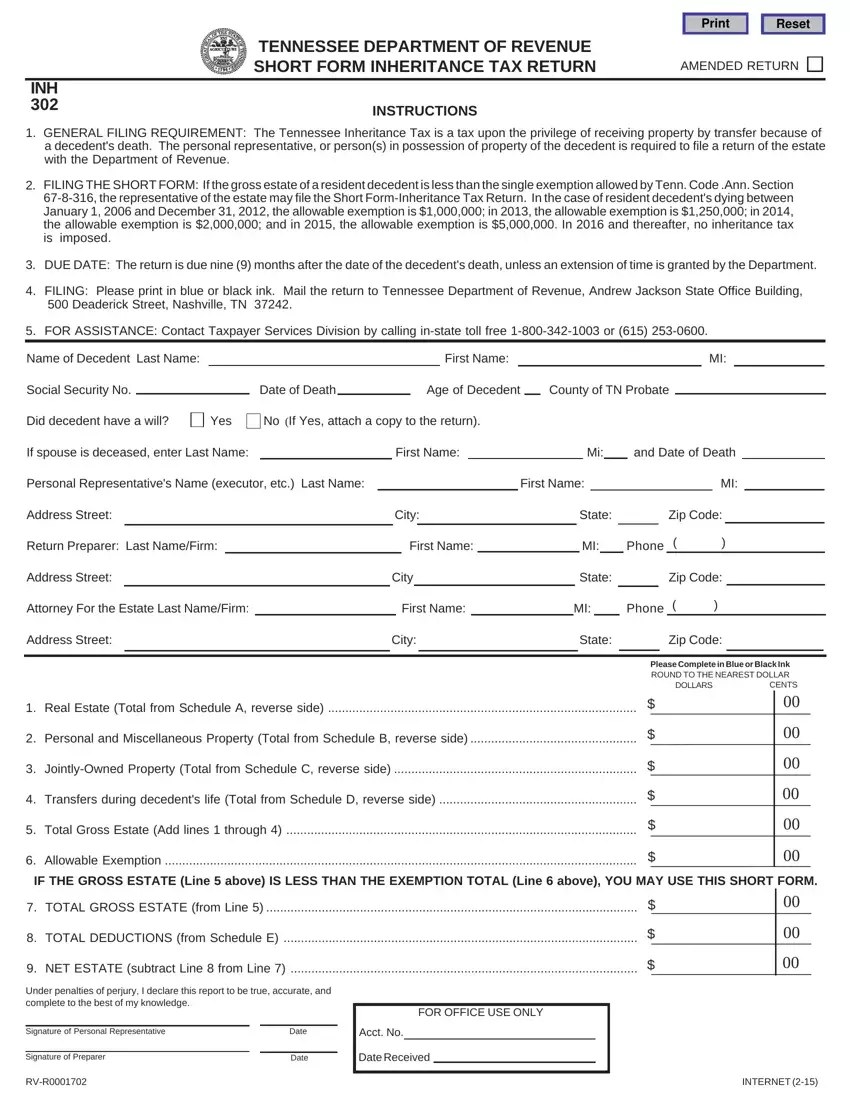

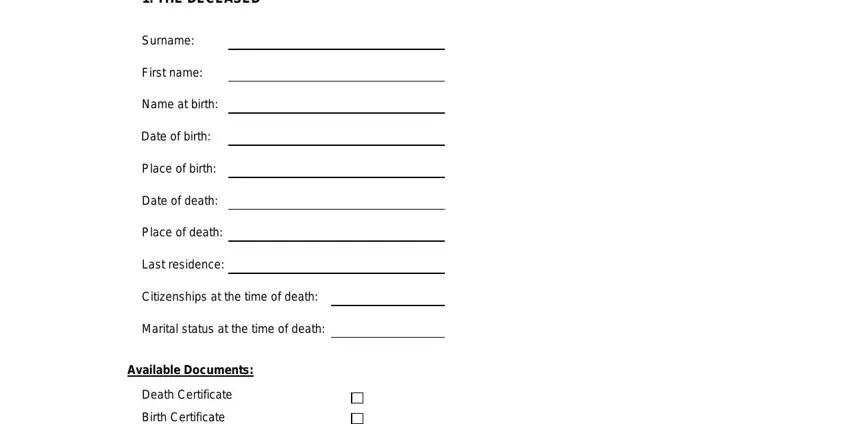

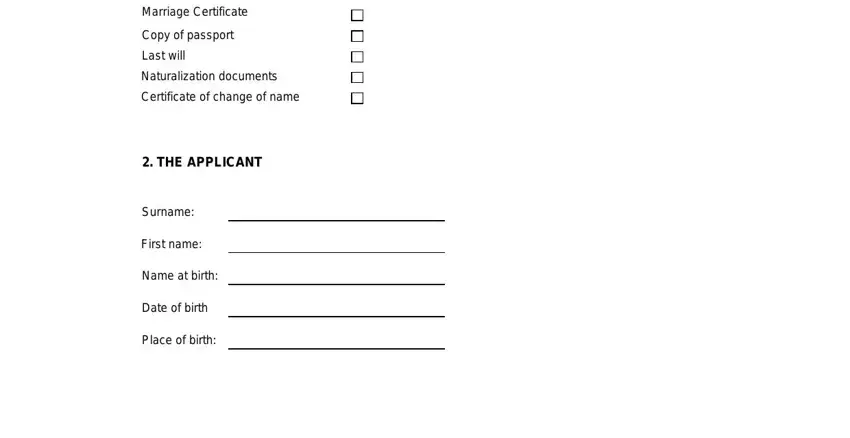

The next sections are in the PDF document you will be filling in.

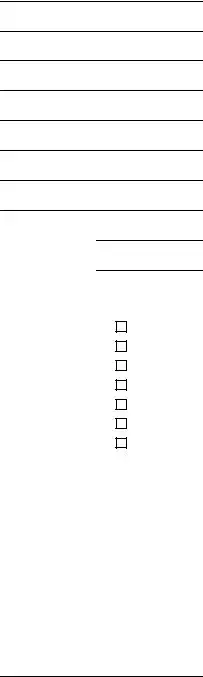

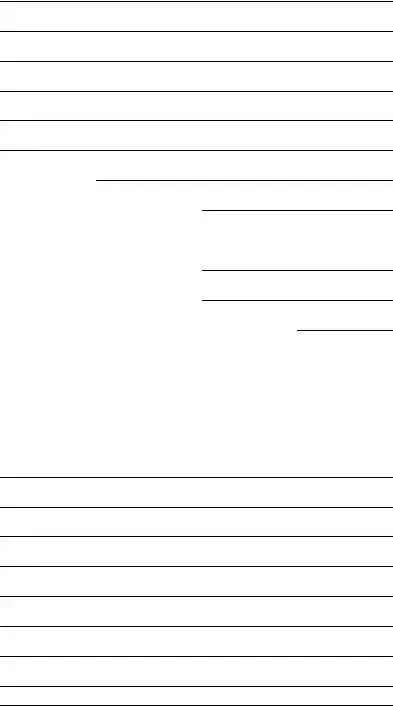

Write the appropriate information in the Birth Certificate, Marriage Certificate, Copy of passport, Last will, Naturalization documents, Certificate of change of name, THE APPLICANT, Surname, First name, Name at birth, Date of birth, and Place of birth field.

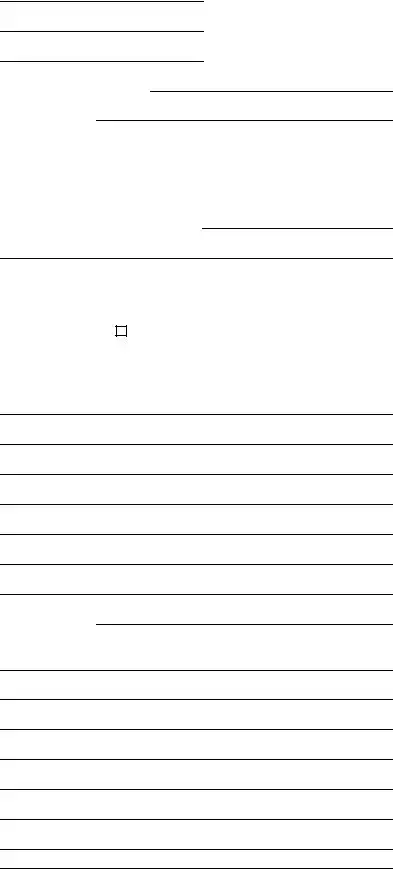

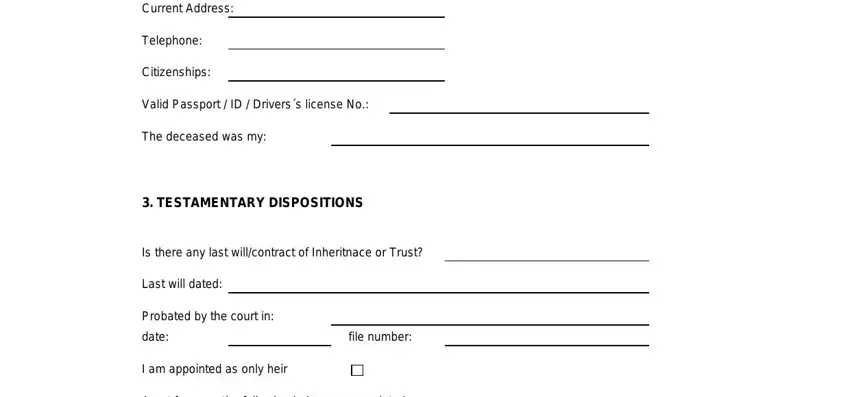

Record all particulars you are required within the box Current Address, Telephone, Citizenships, Valid Passport ID Driverss, The deceased was my, TESTAMENTARY DISPOSITIONS, Is there any last willcontract of, Last will dated, Probated by the court in, date, file number, I am appointed as only heir, and Apart from me the following heirs.

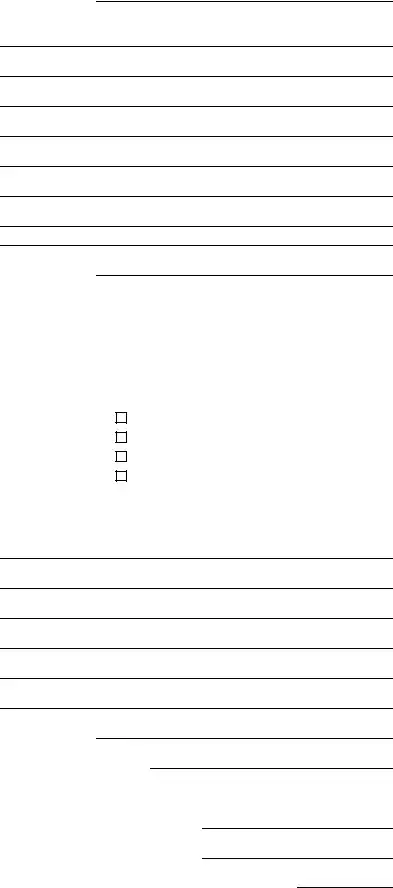

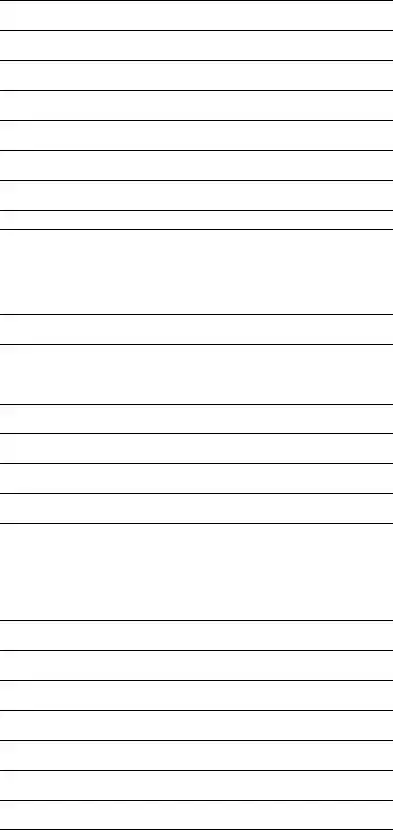

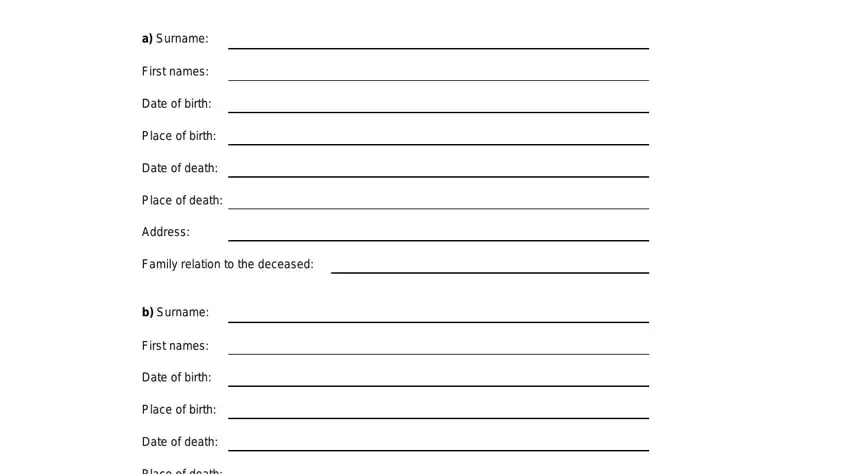

For field a Surname, First names, Date of birth, Place of birth, Date of death, Place of death, Address, Family relation to the deceased, b Surname, First names, Date of birth, Place of birth, Date of death, and Place of death, indicate the rights and obligations.

Finalize by reading the next areas and filling them out as needed: Place of death, and Address.

Step 3: As you press the Done button, your finalized form may be exported to any kind of your gadgets or to email chosen by you.

Step 4: It's going to be easier to maintain duplicates of the file. There is no doubt that we are not going to share or read your data.