The Form INS-7 is a critical document for licensed producers with surplus lines authority in Maine, necessitating a detailed annual reconciliation and return of surplus lines premiums tax for the specified period, specifically January 1 to December 31, 2010, with a due date of March 15, 2011. This form encompasses various sections including the producer's information, tax computation, estimated payments for the subsequent year, and declarations to ensure compliance under the 36 MRSA § 2521-A. Producers must report gross direct surplus line premiums, along with deductions such as return premiums and dividends, to calculate the taxable amount and determine the balance due or overpayment. The form also outlines the option for agencies to report on behalf of their employee producers and stipulates the necessity for estimated tax payments for insurers, pegged to specific percentages of the tax liabilities from the previous or current year. Additionally, the document sets forth the interest and penalties for late filings or payments, the importance of reporting in whole dollar amounts, and the imperative of maintaining supporting records accessible for at least six years. With provisions for electronic payments for taxpayers with large annual tax liabilities, the Form INS-7 plays a pivotal role in ensuring producers accurately fulfill their tax obligations, underpinning the tax framework for surplus lines in Maine.

| Question | Answer |

|---|---|

| Form Name | Form Ins 7 |

| Form Length | 2 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 30 sec |

| Other names | preparer, Insurers, 2010, 2011 |

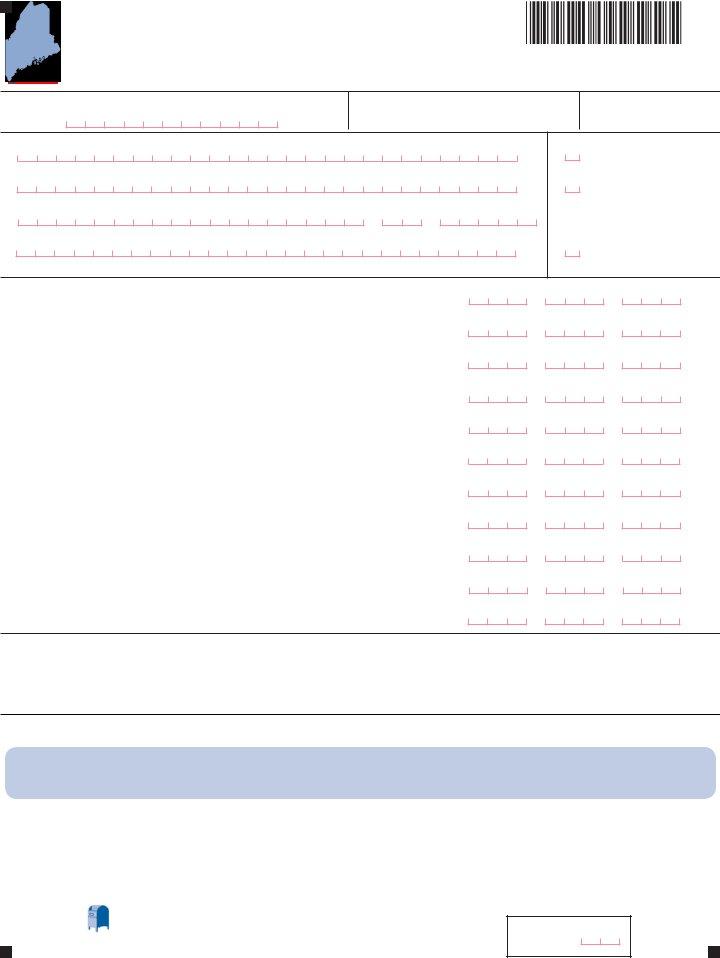

FORM

|

SURPLUS LINES PREMIUMS TAX |

99 |

|

|

|

2010 |

ANNUAL RECONCILIATION / RETURN |

*1032000* |

Maine Surplus Lines Account Number

Period Covered

January 1 - December 31, 2010

Due Date

March 15, 2011

PRODUCER’S NAME, ADDRESS AND NAME OF PRODUCER’S COMPANY OR EMPLOYER:

Producer’s Name

Street Address and/or Post Office Box

City |

State |

ZIP Code |

Name of Producer’s Company or Employer

CHECK ALL THAT APPLY:

Initial return

Amended return

Made estimated payments during the year

Change of name/address

|

|

Tax Computation |

|

$ |

1. |

Gross Direct Surplus Line Premiums |

1. |

||

2. |

DEDUCTIONS |

|

$ |

|

|

2a. |

Return premiums |

2a. |

|

|

2b. |

Dividends paid, credited or allowed on direct premiums |

2b. |

$ |

3. |

Total Deductions (line 2a plus line 2b) |

3. |

$ |

|

4. |

Amount Taxable (line 1 minus line 3) |

4. |

$ |

|

5. |

Premiums Tax (line 4 x 0.03) |

5. |

$ |

|

6. |

Less: Estimated Payments |

6. |

$ |

|

7. |

Balance Due (If line 5 is greater than line 6, line 5 minus line 6) |

7. |

$ |

|

8. |

Overpayment (If line 6 is greater than line 5, line 6 minus line 5) |

8. |

$ |

|

9a. |

Portion of overpayment on line 8 to be APPLIED to next year’s ESTIMATED tax |

9a. |

$ |

|

9b. |

Portion of overpayment on line 8 to be REFUNDED (line 8 minus line 9a) |

9b. |

$ |

|

,

,

,

,

,

,

,

,

,

,

,

,

,

,

,

,

,

,

,

,

,

,

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

2011 Quarterly Estimated Tax

The 2011 quarterly tax payments may be on an estimated basis, as long as the April 30 and June 25 installments each equal at least 35% of the total tax paid for 2010 or 35% of the total tax due for 2011. The October installment must equal 15% of the total tax paid for 2010 or 15% of the total tax due for 2011. See Form

AFFIDAVIT AND SIGNATURE

This return is made in compliance with the provisions of 36 MRSA §

Date: _________________________ Signature: ___________________________________________ Phone #: ___________________________

Must be signed by the Producer with Surplus Lines Authority.

Preparer’s

Date: _________________________ Signature: ___________________________________________ ID Number: _________________________

If enclosing a check, make check payable to: Treasurer, State of Maine

and MAIL WITH RETURN TO:

MAINE REVENUE SERVICES

P.O. BOX 1065

AUGUSTA, ME

If not enclosing a check,

MAIL RETURN TO:

MAINE REVENUE SERVICES P.O. BOX 1064 AUGUSTA, ME

Office use only

Rev. 11/10

GENERAL INSTRUCTIONS

WHO MUST FILE

Every licensed producer with surplus lines authority who provides contracts written on risks located or resident in the State of Maine.

Election to Report on Behalf of Employee Producers. An agency may elect to report and pay surplus lines premiums tax on behalf of all of its employee producers. To make this election, the agency must file an Application for Tax Registration, completing sections 1 and 11. Enter the name and federal ID number of the agency in section 1 and enter a note in section 11 stating that the agency is electing to file on behalf of its producers.

WHEN TO FILE

The annual return and the final tax payment for 2010 are due March 15, 2011.

ESTIMATED PAYMENT OF TAX

Insurers must make estimated tax payments for the calendar year. Required estimated payments for 2011 may be based either on the 2011 tax liability or the 2010 tax liability. April and June installments must each equal at least 35% of either the 2010 total tax liability or 35% of the 2011 tax due. The October installment must equal 15% of either the 2010 total tax liability or 15% of the 2011 tax due and the balance due must be submitted with the 2011 Form INS-

7.An insurance company with an annual tax liability not exceeding $1,000 may file only an annual return with payment.

INTEREST AND PENALTIES

For calender year 2011, the interest rate is 7% , compounded monthly. The penalty for failure to file a return on time is the

greater of $25 or 10% of the tax due, unless the return is filed more than 30 days after the receipt of a demand notice from the State Tax Assessor, in which case the

WHOLE DOLLAR AMOUNTS

Enter money items as whole dollar amounts. Drop any amount under 50 cents to the lower dollar amount and increase any amount 50 cents through 99 cents to the higher dollar amount.

FOR INFORMATION AND FORMS

Web site:www.maine.gov/revenue

Address: |

Maine Revenue Services |

|

PO Box 1060 |

|

Augusta, ME |

Telephone: |

(207) |

|

|

Order Forms: |

(207) |

STATUTORY REFERENCES

Title 36 MRSA §§ 2512 through 2530.

SUPPORTING RECORDS

Taxpayers should be prepared to provide supporting documentation for reported amounts. Adequate records must be maintained in a manner that ensures their accessibility by the State Tax Assessor for a period of at least six years.

NOTE: Certain taxpayers with large annual tax liabilities are required to remit tax payments electronically. See Maine Rule 102 on the MRS web site (select Laws & Rules) for details.

LINE INSTRUCTIONS

Line 1. Gross Direct Surplus Lines Premiums

Enter the gross direct premiums upon risks located or resident in Maine. A premium is an amount paid or payable for an insurance policy, including all fees, such as membership, policy, survey, inspection, service and finance fees in

consideration for an insurance policy.

NOTE: Agencies reporting on behalf of employee producers must attach a schedule indicating the name, social security number and portion of taxable premiums attributable to each producer for whom the agency is filing.

DEDUCTIONS

2a. Return premiums

Enter the amount of direct return premiums that were returned to the policyholder during the tax year. Include return premiums that were paid and subject to the Maine surplus lines premiums tax in a prior year, as well as those that were paid in 2010 and included on Line 1.

2b. Dividends paid, credited or allowed on direct premiums

Enter the amount of direct dividends paid to the policyholder during the tax year. Include dividends paid that were subject to the Maine surplus lines premiums tax in a prior year, as well as those that were paid in 2010 and included on Line 1.

Lines 6. Prior Payments

Enter the overpayment carried forward from the previous tax year and any estimated payments made for the current tax year.

Line 9a. Portion of overpayment to be APPLIED to next year’s ESTIMATED tax

Use this line only if you want to have all or part of the overpayment on line 8 applied as an estimated payment to next year’s Maine surplus lines premiums tax.