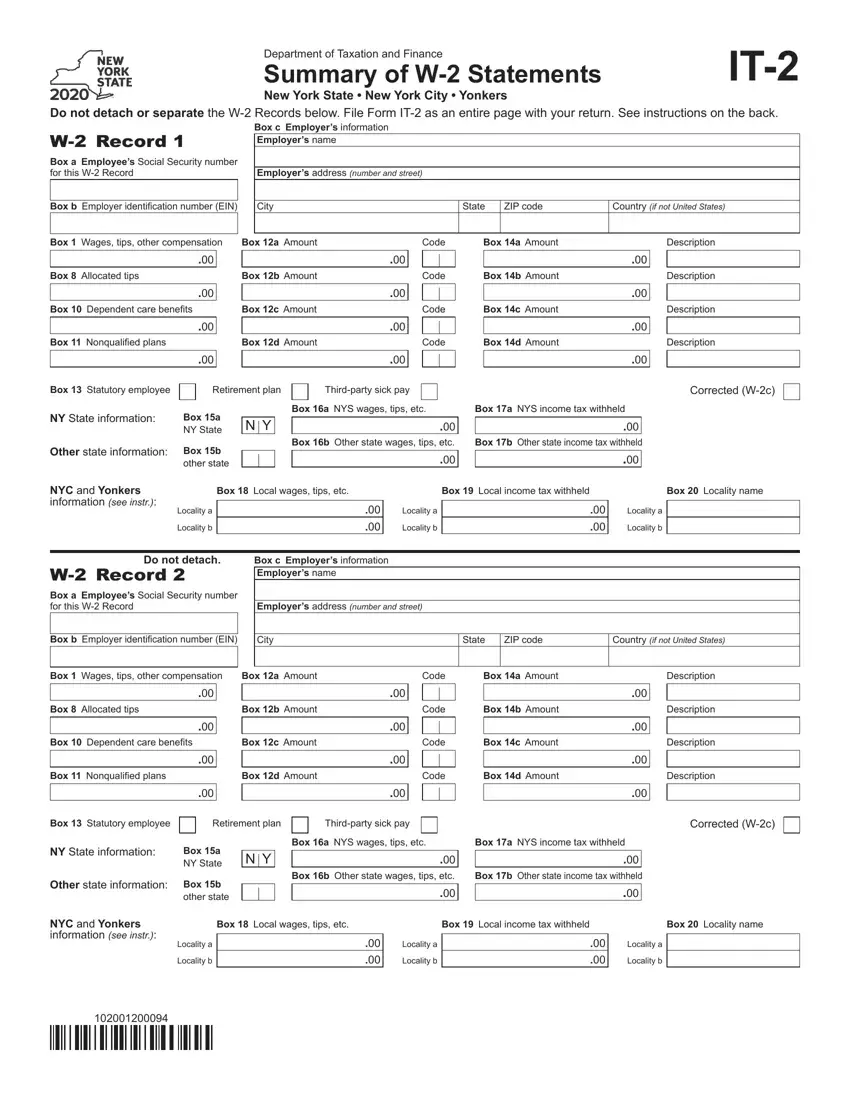

General instructions

Who must file this form – You must complete Form IT-2, Summary of W-2 Statements, if you file a New York State (NYS) income

tax return and you received federal Form(s) W-2, Wage and Tax Statement. Complete one W-2 Record section for each federal Form W-2 you (and if filing jointly, your spouse) received even if your federal Form W-2 does not show any NYS, New York City (NYC), or Yonkers wages or tax withheld.

If you received foreign earned income but did not receive a federal Form W-2 you must also complete Form IT-2. Foreign earned income includes, but is not limited to salaries, wages, commissions, bonuses, professional fees, certain noncash income, and allowances or reimbursements.

Specific instructions

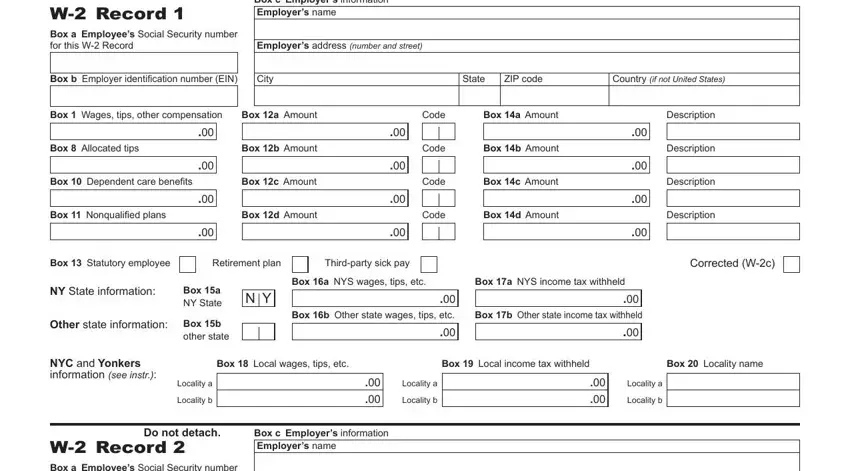

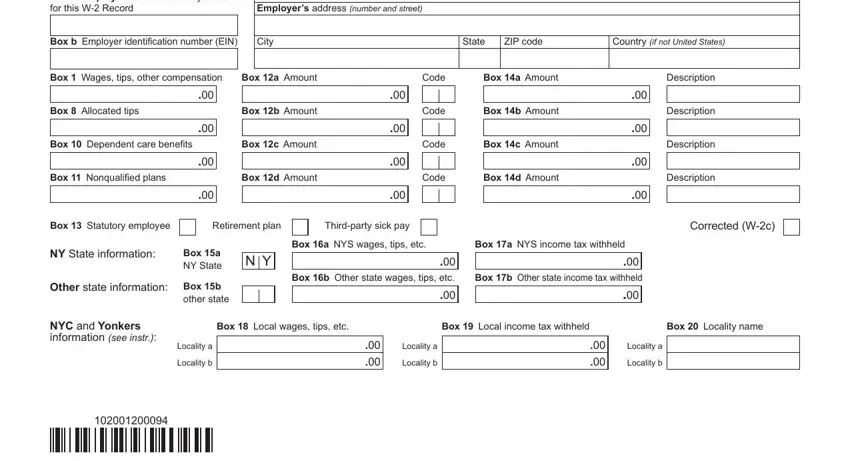

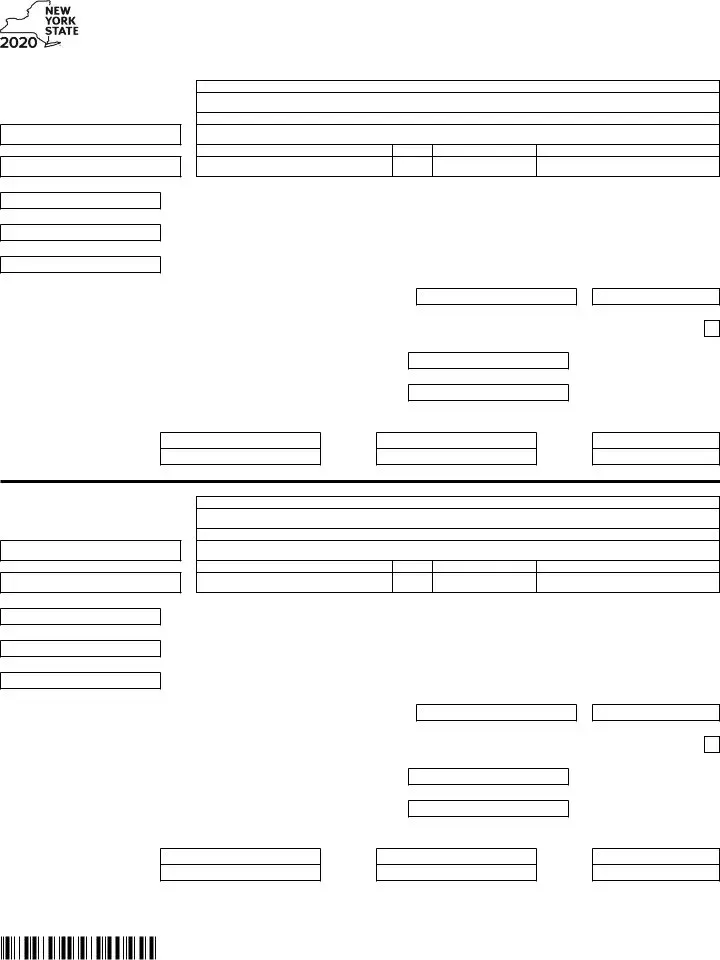

How to complete each W-2 Record – each box in the W-2 Record corresponds to a similarly named or numbered box or area on federal Form W-2. Enter the amount, code, or description provided on your federal Form W-2 in the corresponding boxes in the

W-2 Record. Enter only the information requested on Form IT-2. Complete additional Forms IT-2 if necessary.

Multiple W-2 Records for one federal Form W-2 – If your federal Form W-2 shows more than four items in box 12 or box 14, complete an additional W-2 Record. Fill in boxes a, b, and c with the same information as on the first W-2 Record for the same federal Form W-2. Then enter the additional items in box 12 or box 14. Do not fill in additional W-2 Records to report withholding by more than one other state for the same wages.

Entering whole dollar amounts – When entering amounts, enter whole dollar amounts only (zeros have been preprinted). Use the following rounding rules when entering your amounts; drop amounts below 50 cents and increase amounts from 50 to 99 cents to the next dollar. For example, $1.39 becomes $1 and $2.50 becomes $3.

Enter in box a your entire 9-digit SSN (or your spouse’s SSN) depending on whose federal Form W-2 it is. Enter in boxes b and c the EIN and employer’s name and address (including ZIP code) as they appear on the federal Form W-2. Filers with foreign earned income: if the employer’s identification number exceeds the space allowed, leave box b blank.

Box 1 – Enter federal wages, tips, and other compensation shown in Box 1 of federal Form W-2.

Boxes 8, 10, and 11 – If applicable, enter the amounts from federal Form W-2 for allocated tips, dependent care benefits, and nonqualified plans.

Boxes 12a through 12d – Enter the amount(s) and code(s), if any, shown in the corresponding boxes on federal Form W-2 (such as code J, nontaxable sick pay, or code AA, designated Roth contributions under a section 401(k) plan, etc.). If there are more than four coded amounts, see Multiple W-2 Records for one federal Form W-2 above.

Box 13 – If your federal Form W-2 has a check mark in any of the following boxes: Statutory employee, Retirement plan, or Third-party sick pay, mark an X in the corresponding box of the W-2 Record. Otherwise, leave blank.

Corrected (W-2c) box – Mark an X in this box if the W-2 Record is for a federal Form W-2c, Corrected Wage and Tax Statement. Enter the corrected information from the W-2c in addition to all other requested information from your federal Form W-2.

Boxes 14a through 14d – Enter the amount(s) and description(s), if any, shown in box 14 of federal Form W-2 (such as 414(h) or IRC 125 contributions, union dues, or uniform allowances, etc.). If there are more than four amounts and descriptions, see Multiple W-2 Records for one federal Form W-2 above.

Boxes 15a through 17a (NYS only) – Complete only for New York State wage and withholding information (the corresponding box 15a has been prefilled with NY). Enter in box 16a the New York State wages exactly as reported on federal Form W-2. Enter in box 17a the NYS withholding, labeled as State income tax on federal Form W-2. If you have no New York State wages or withholding, leave boxes 16a and 17a blank.

Boxes 15b through 17b (Other state information) – If the federal Form W-2 has wages and withholding for a state other than New York, complete boxes 15b, 16b, and 17b with the corresponding W-2 box information for the other state information only.

Boxes 18 through 20 (NYC or Yonkers only) – Complete the locality boxes 18 through 20 only for NYC or Yonkers (or both) wages and withholding, if reported on federal Form W-2. Do not enter locality information from any other state. If applicable, enter in the Locality a boxes the local wages, income tax, and locality name (write NYC for New York City or Yonkers for Yonkers) from Form W-2. To report both localities, enter the other local wages, income tax, and locality name (NYC or Yonkers) in the Locality b boxes.

Transfer the tax withheld amounts to your income tax return. Include the total NYS tax withheld amounts, the total NYC tax withheld amounts, and the total Yonkers tax withheld amounts from all your Form(s) IT-2 as follows:

•NYS tax withheld – Include on Form IT-201, line 72; Form IT-203, line 62; or Form IT-205, line 34.

•NYC tax withheld – Include on Form IT-201, line 73; Form IT-203, line 63; or Form IT-205, line 35.

•Yonkers tax withheld – Include on Form IT-201, line 74; Form IT-203, line 64; or Form IT-205, line 36.

Submit Form(s) IT-2 (as an entire page; do not separate records; however, you do not need to submit instructions from the back page) with your New York State income tax return. Do not submit your federal Form(s) W-2; keep them for your records. See the instructions for Form IT-201, IT-203, or IT-205 for information on assembling your return.