Working with PDF files online is definitely very simple using our PDF editor. Anyone can fill in it213 here painlessly. Our editor is continually developing to deliver the best user experience possible, and that's thanks to our dedication to continuous enhancement and listening closely to customer comments. With just a few basic steps, it is possible to start your PDF editing:

Step 1: Just click on the "Get Form Button" above on this site to launch our pdf form editor. There you'll find all that is necessary to fill out your file.

Step 2: Once you launch the online editor, you will see the document ready to be filled in. In addition to filling in different blank fields, you may also perform some other things with the PDF, including adding your own text, modifying the initial textual content, inserting illustrations or photos, putting your signature on the form, and much more.

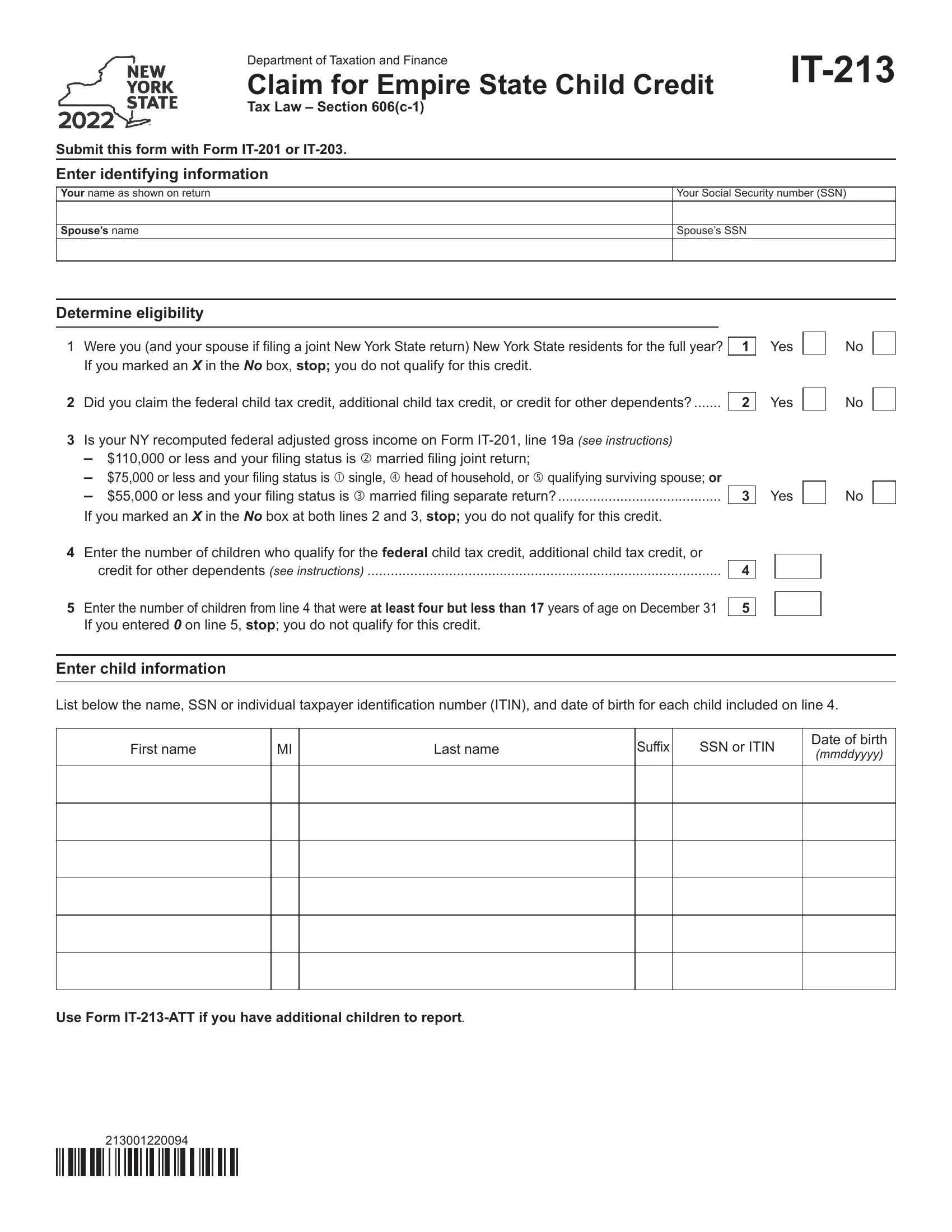

This PDF form requires particular data to be filled in, thus be sure to take your time to type in exactly what is required:

1. It's vital to fill out the it213 properly, so be mindful while working with the sections including all of these blank fields:

2. Just after performing the previous section, head on to the subsequent part and fill out the necessary details in all these blanks - Use Form ITATT if you have.

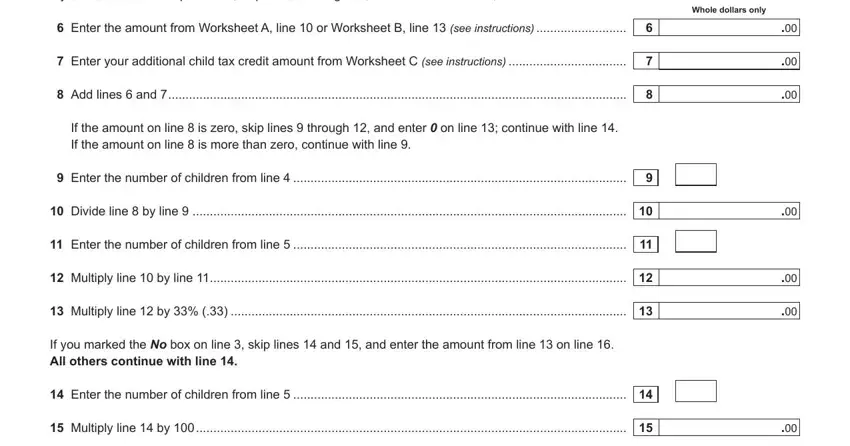

3. In this step, review If you answered Yes to question, Whole dollars only, Enter the amount from Worksheet A, Enter your additional child tax, Add lines and, If the amount on line is zero, Enter the number of children from, Divide line by line, Enter the number of children from, Multiply line by line, Multiply line by, If you marked the No box on line, Enter the number of children from, and Multiply line by. Each of these should be completed with highest awareness of detail.

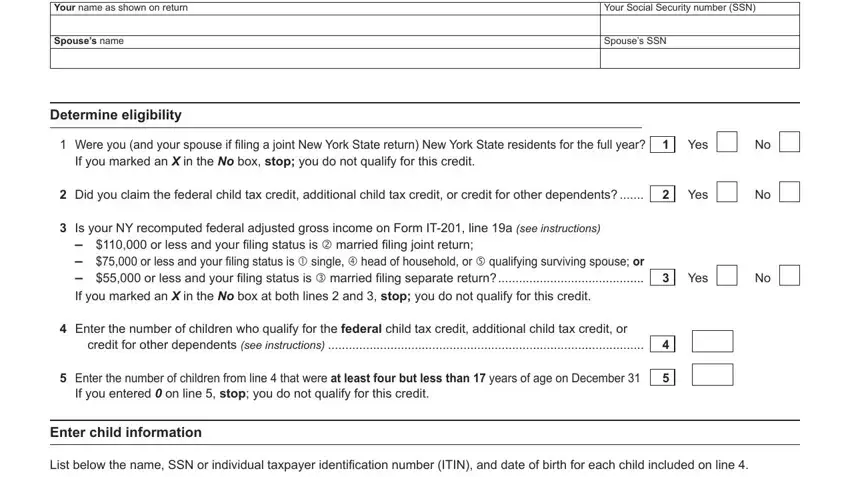

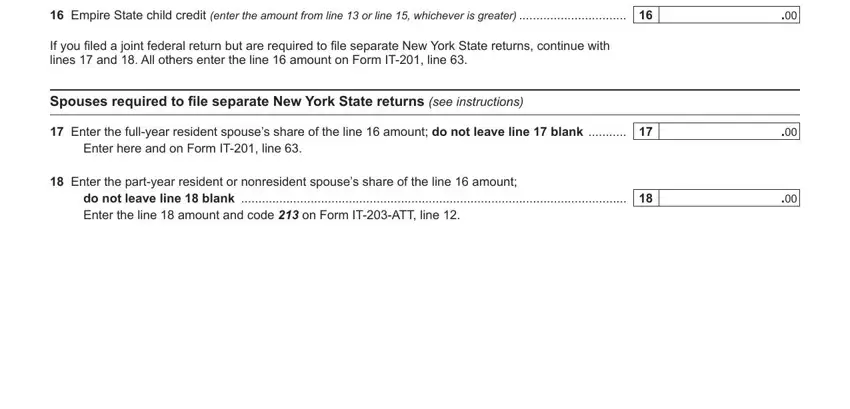

4. It is time to proceed to the next part! Here you'll have all of these Empire State child credit enter, If you filed a joint federal, Spouses required to file separate, Enter the fullyear resident, Enter here and on Form IT line, Enter the partyear resident or, and do not leave line blank Enter blank fields to fill in.

Be really attentive while filling out If you filed a joint federal and Enter the partyear resident or, since this is where a lot of people make some mistakes.

Step 3: Reread the information you have inserted in the form fields and then click on the "Done" button. Get your it213 when you register online for a free trial. Quickly use the pdf file inside your FormsPal cabinet, with any modifications and changes being automatically preserved! We do not share any details that you provide when working with documents at FormsPal.