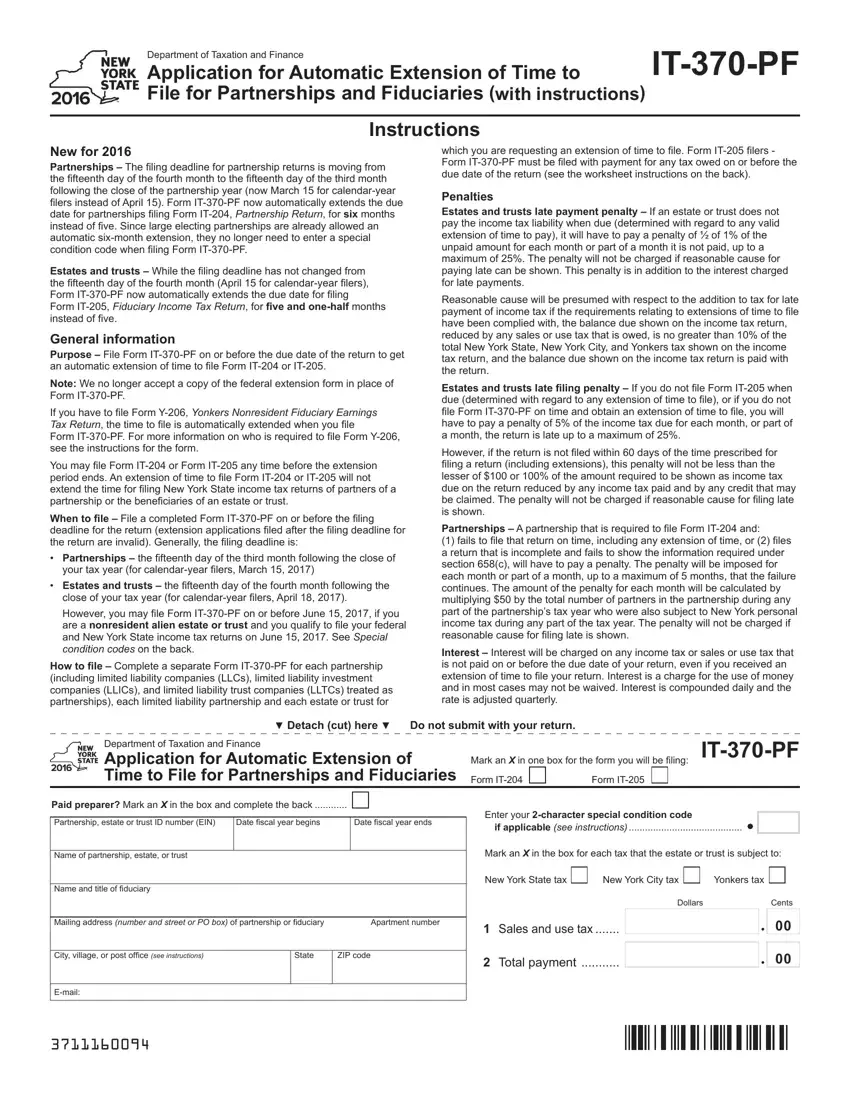

New for 2016

Partnerships – The filing deadline for partnership returns is moving from the fifteenth day of the fourth month to the fifteenth day of the third month following the close of the partnership year (now March 15 for calendar-year filers instead of April 15). Form IT-370-PF now automatically extends the due date for partnerships filing Form IT-204, Partnership Return, for six months instead of five. Since large electing partnerships are already allowed an automatic six-month extension, they no longer need to enter a special condition code when filing Form IT-370-PF.

Estates and trusts – While the filing deadline has not changed from the fifteenth day of the fourth month (April 15 for calendar-year filers), Form IT-370-PF now automatically extends the due date for filing Form IT-205, Fiduciary Income Tax Return, for five and one-half months instead of five.

General information

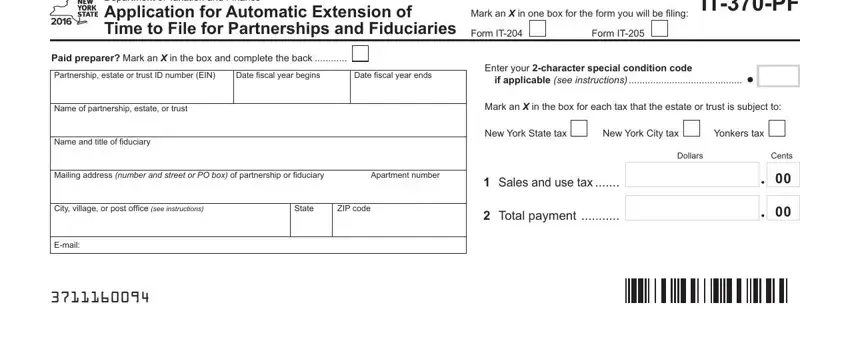

Purpose – File Form IT-370-PF on or before the due date of the return to get an automatic extension of time to file Form IT-204 or IT-205.

Note: We no longer accept a copy of the federal extension form in place of Form IT-370-PF.

If you have to file Form Y-206, Yonkers Nonresident Fiduciary Earnings Tax Return, the time to file is automatically extended when you file

Form IT-370-PF. For more information on who is required to file Form Y-206, see the instructions for the form.

You may file Form IT-204 or Form IT-205 any time before the extension period ends. An extension of time to file Form IT-204 or IT-205 will not extend the time for filing New York State income tax returns of partners of a partnership or the beneficiaries of an estate or trust.

When to file – File a completed Form IT-370-PF on or before the filing deadline for the return (extension applications filed after the filing deadline for the return are invalid). Generally, the filing deadline is:

•Partnerships – the fifteenth day of the third month following the close of your tax year (for calendar-year filers, March 15, 2017)

•Estates and trusts – the fifteenth day of the fourth month following the close of your tax year (for calendar-year filers, April 18, 2017).

However, you may file Form IT-370-PF on or before June 15, 2017, if you are a nonresident alien estate or trust and you qualify to file your federal and New York State income tax returns on June 15, 2017. See Special condition codes on the back.

How to file – Complete a separate Form IT-370-PF for each partnership (including limited liability companies (LLCs), limited liability investment companies (LLICs), and limited liability trust companies (LLTCs) treated as partnerships), each limited liability partnership and each estate or trust for

which you are requesting an extension of time to file. Form IT-205 filers - Form IT-370-PF must be filed with payment for any tax owed on or before the due date of the return (see the worksheet instructions on the back).

Penalties

Estates and trusts late payment penalty – If an estate or trust does not pay the income tax liability when due (determined with regard to any valid extension of time to pay), it will have to pay a penalty of ½ of 1% of the unpaid amount for each month or part of a month it is not paid, up to a maximum of 25%. The penalty will not be charged if reasonable cause for paying late can be shown. This penalty is in addition to the interest charged for late payments.

Reasonable cause will be presumed with respect to the addition to tax for late payment of income tax if the requirements relating to extensions of time to file have been complied with, the balance due shown on the income tax return, reduced by any sales or use tax that is owed, is no greater than 10% of the total New York State, New York City, and Yonkers tax shown on the income tax return, and the balance due shown on the income tax return is paid with the return.

Estates and trusts late filing penalty – If you do not file Form IT-205 when due (determined with regard to any extension of time to file), or if you do not file Form IT-370-PF on time and obtain an extension of time to file, you will have to pay a penalty of 5% of the income tax due for each month, or part of a month, the return is late up to a maximum of 25%.

However, if the return is not filed within 60 days of the time prescribed for filing a return (including extensions), this penalty will not be less than the lesser of $100 or 100% of the amount required to be shown as income tax due on the return reduced by any income tax paid and by any credit that may be claimed. The penalty will not be charged if reasonable cause for filing late is shown.

Partnerships – A partnership that is required to file Form IT-204 and:

(1) fails to file that return on time, including any extension of time, or (2) files a return that is incomplete and fails to show the information required under section 658(c), will have to pay a penalty. The penalty will be imposed for each month or part of a month, up to a maximum of 5 months, that the failure continues. The amount of the penalty for each month will be calculated by multiplying $50 by the total number of partners in the partnership during any part of the partnership’s tax year who were also subject to New York personal income tax during any part of the tax year. The penalty will not be charged if reasonable cause for filing late is shown.

Interest – Interest will be charged on any income tax or sales or use tax that is not paid on or before the due date of your return, even if you received an extension of time to file your return. Interest is a charge for the use of money and in most cases may not be waived. Interest is compounded daily and the rate is adjusted quarterly.