Once you open the online editor for PDFs by FormsPal, you are able to fill in or modify 2006 right here. Our development team is relentlessly working to expand the editor and insure that it is even easier for clients with its multiple functions. Enjoy an ever-improving experience now! To get started on your journey, consider these easy steps:

Step 1: Access the form in our editor by pressing the "Get Form Button" at the top of this webpage.

Step 2: As soon as you start the file editor, you will find the document ready to be filled in. Besides filling out different fields, you could also do various other things with the Document, such as adding custom textual content, changing the initial textual content, adding images, placing your signature to the form, and much more.

It is an easy task to complete the document using this practical guide! This is what you must do:

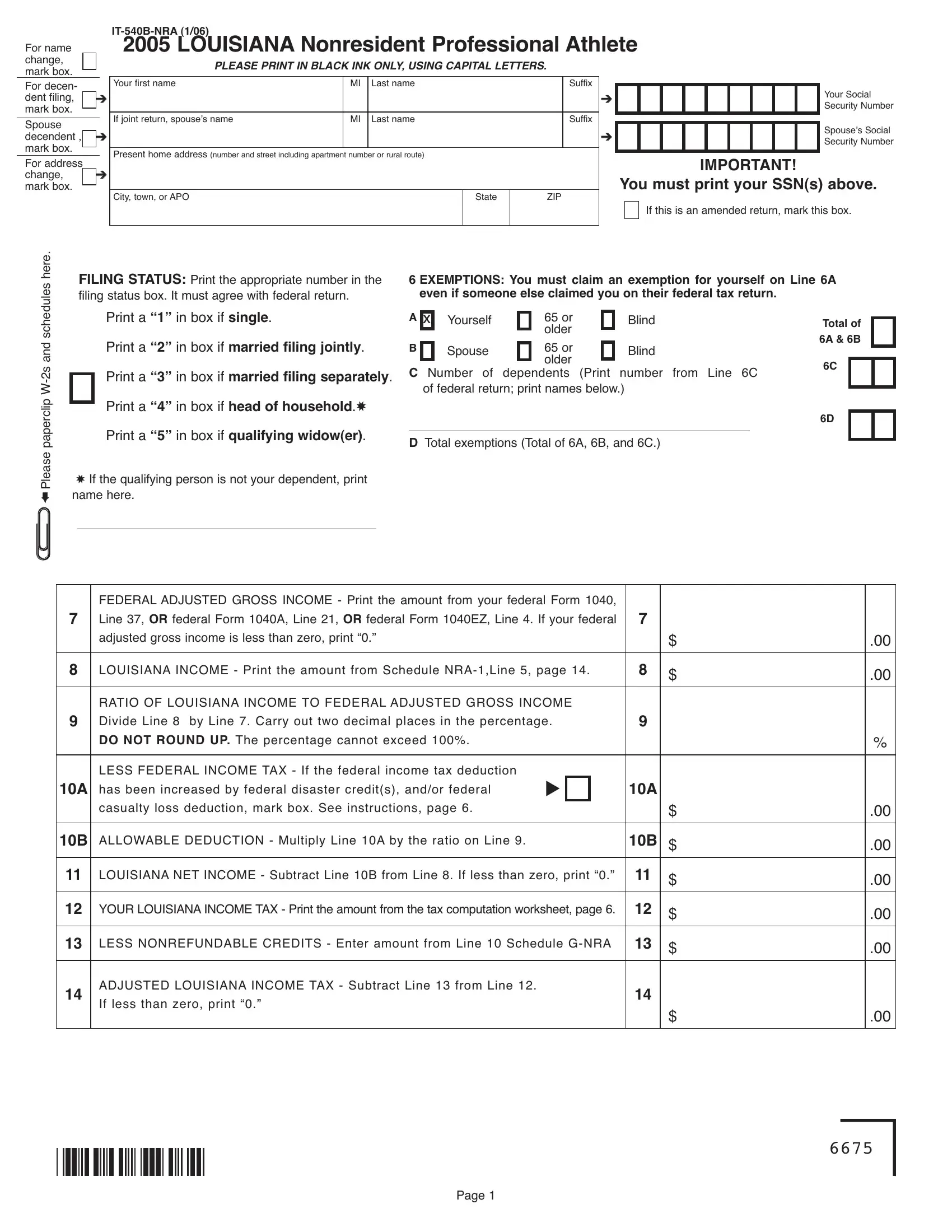

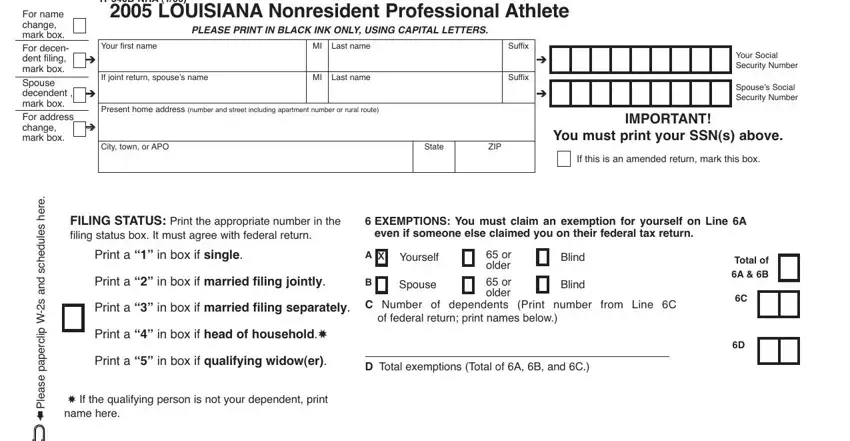

1. It's essential to fill out the 2006 accurately, thus be mindful when filling in the areas containing all these blank fields:

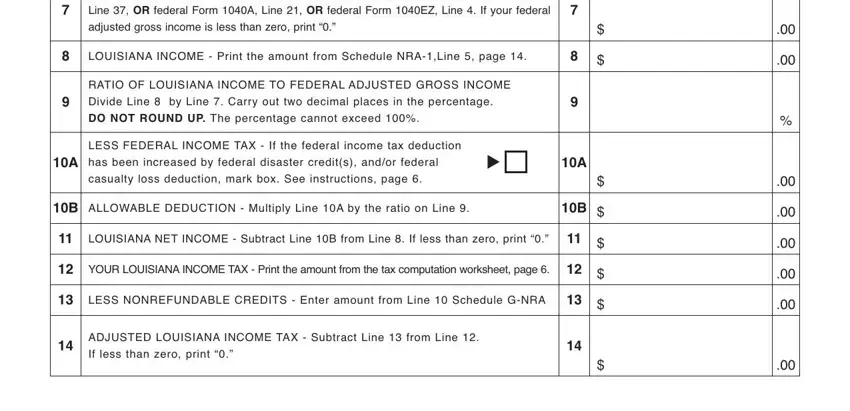

2. Right after completing the last part, go on to the subsequent stage and complete the essential details in these blanks - FEDERAL ADJUSTED GROSS INCOME, Line OR federal Form A Line OR, adjusted gross income is less than, LOUISIANA INCOME Print the amount, RATIO OF LOUISIANA INCOME TO, Divide Line by Line Carry out, DO NOT ROUND UP The percentage, LESS FEDERAL INCOME TAX If the, has been increased by federal, cid, casualty loss deduction mark box, B ALLOWABLE DEDUCTION Multiply, LOUISIANA NET INCOME Subtract, YOUR LOUISIANA INCOME TAX Print, and LESS NONREFUNDABLE CREDITS Enter.

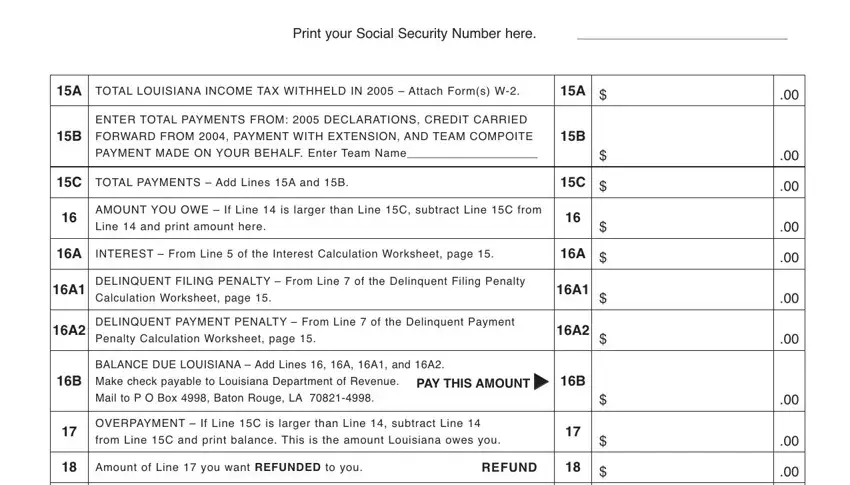

3. The following part is considered fairly straightforward, Print your Social Security Number, A TOTAL LOUISIANA INCOME TAX, ENTER TOTAL PAYMENTS FROM, FORWARD FROM PAYMENT WITH, PAYMENT MADE ON YOUR BEHALF Enter, C TOTAL PAYMENTS Add Lines A and B, AMOUNT YOU OWE If Line is larger, Line and print amount here, A INTEREST From Line of the, DELINQUENT FILING PENALTY From, Calculation Worksheet page, DELINQUENT PAYMENT PENALTY From, Penalty Calculation Worksheet page, BALANCE DUE LOUISIANA Add Lines, and Make check payable to Louisiana - every one of these form fields is required to be completed here.

As to DELINQUENT FILING PENALTY From and DELINQUENT PAYMENT PENALTY From, be sure that you double-check them here. These two are the key ones in the file.

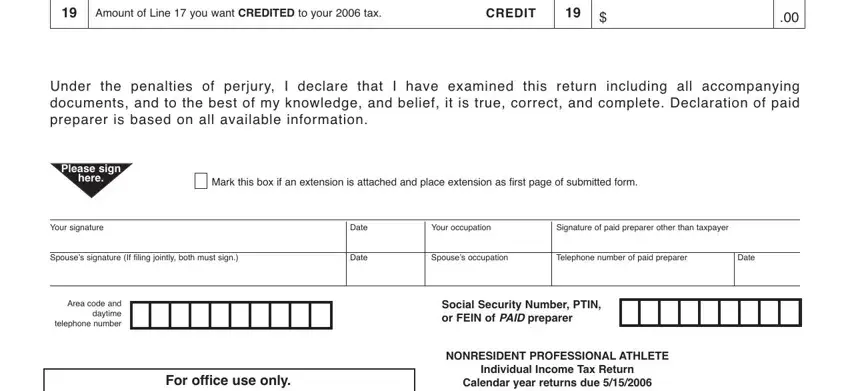

4. To move forward, this form section will require typing in a few blank fields. These include Amount of Line you want CREDITED, CREDIT, Under the penalties of perjury I, Mark this box if an extension is, Please sign, here, Your signature, Spouses signature If filing, Area code and daytime telephone, For office use only, Date, Date, Your occupation, Signature of paid preparer other, and Spouses occupation, which are crucial to going forward with this particular document.

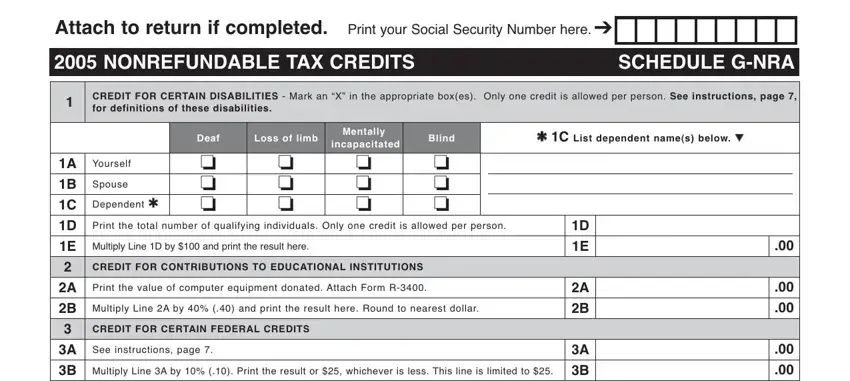

5. The form has to be finished by filling in this segment. Further there can be found a detailed listing of form fields that have to be filled in with appropriate details in order for your document usage to be complete: Attach to return if completed, Print your Social Security Number, NONREFUNDABLE TAX CREDITS, SCHEDULE GNRA, CREDIT FOR CERTAIN DISABILITIES, C List dependent names below, Deaf, Loss of limb, Mentally, incapacitated, A Yourself, B Spouse C Dependent, Blind, D Print the total number of, and E Multiply Line D by and print.

Step 3: Ensure that the information is accurate and press "Done" to finish the project. Try a free trial option with us and acquire instant access to 2006 - available from your FormsPal cabinet. FormsPal offers risk-free form completion devoid of personal data recording or any type of sharing. Feel at ease knowing that your data is secure with us!