When you would like to fill out it consol form georgia, it's not necessary to download any kind of programs - just make use of our online PDF editor. To maintain our editor on the cutting edge of convenience, we work to integrate user-driven capabilities and enhancements regularly. We are at all times glad to get suggestions - assist us with remolding how we work with PDF forms. Starting is easy! Everything you need to do is follow the following easy steps down below:

Step 1: Hit the "Get Form" button above. It's going to open up our pdf tool so you can start completing your form.

Step 2: The editor will allow you to change PDF documents in various ways. Improve it with customized text, correct existing content, and place in a signature - all within a couple of clicks!

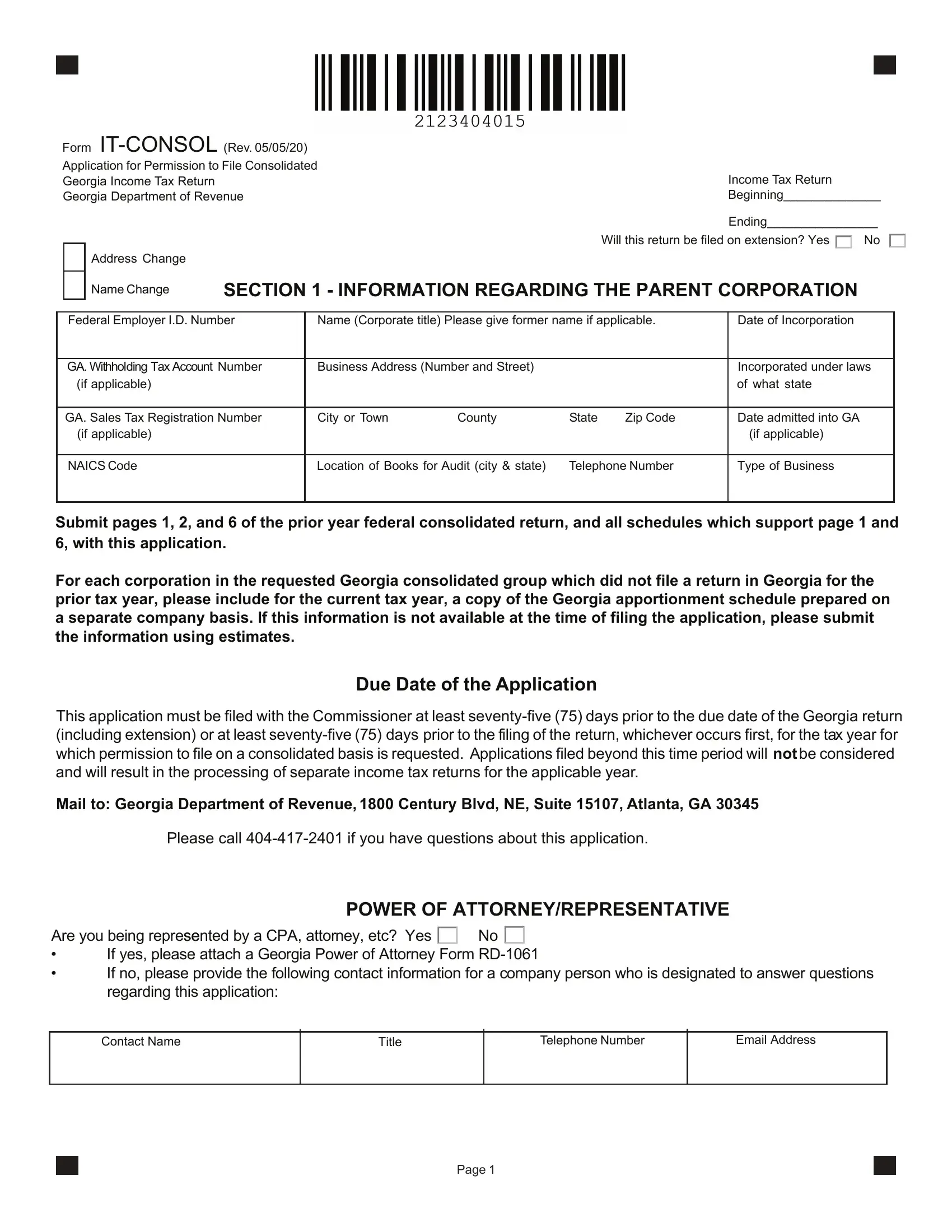

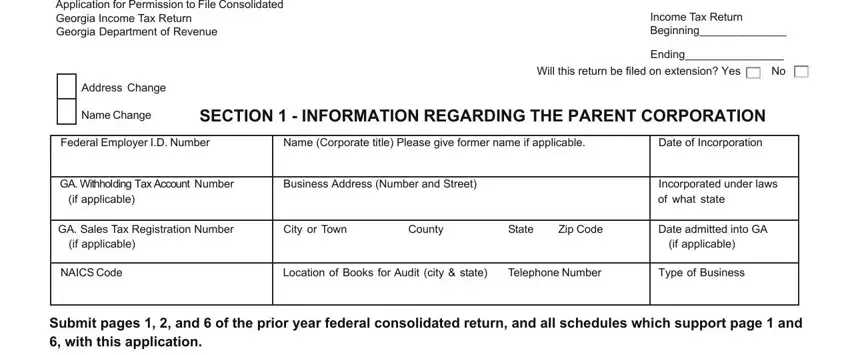

With regards to the fields of this precise document, here's what you should do:

1. Whenever filling out the it consol form georgia, be certain to include all needed blanks in its associated part. It will help facilitate the work, allowing your details to be handled efficiently and appropriately.

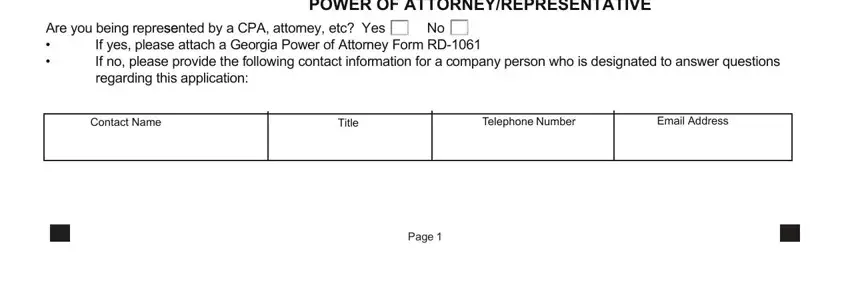

2. The third stage is to fill out the following fields: POWER OF ATTORNEYREPRESENTATIVE, Are you being represseented by a, If yes please attach a Georgia, Contact Name, Title, Telephone Number, Email Address, and Page.

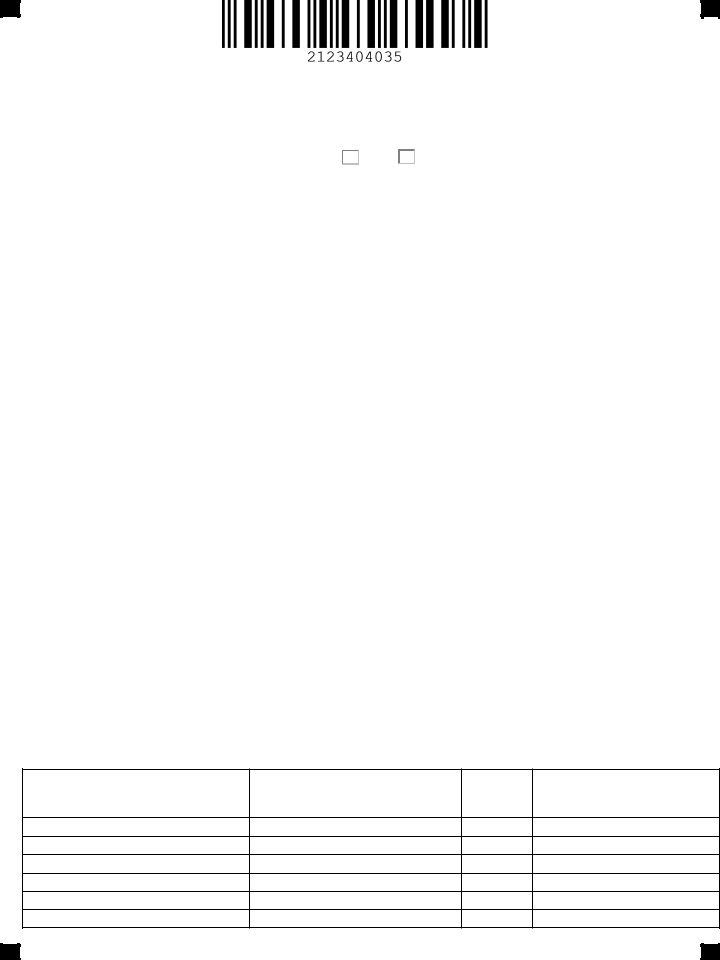

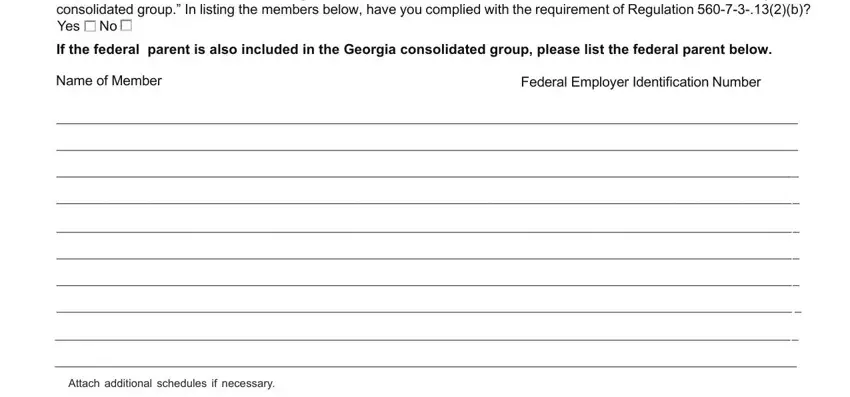

3. This subsequent step is considered quite uncomplicated, In order to file a consolidated, If the federal parent is also, Name of Member, Federal Employer Identification, and Attach additional schedules if - every one of these blanks needs to be filled out here.

Be extremely mindful when completing Attach additional schedules if and In order to file a consolidated, because this is where a lot of people make a few mistakes.

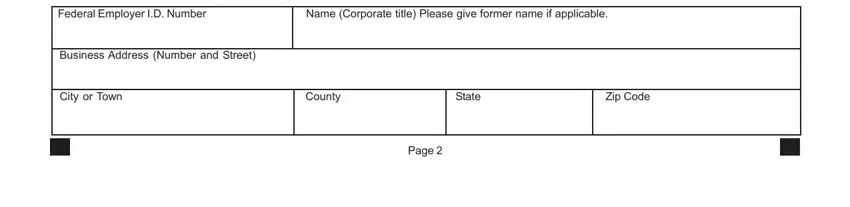

4. It's time to proceed to this next portion! In this case you will have all these Federal Employer ID Number, Name Corporate title Please give, Business Address Number and Street, City or Town, County, State, Zip Code, and Page fields to complete.

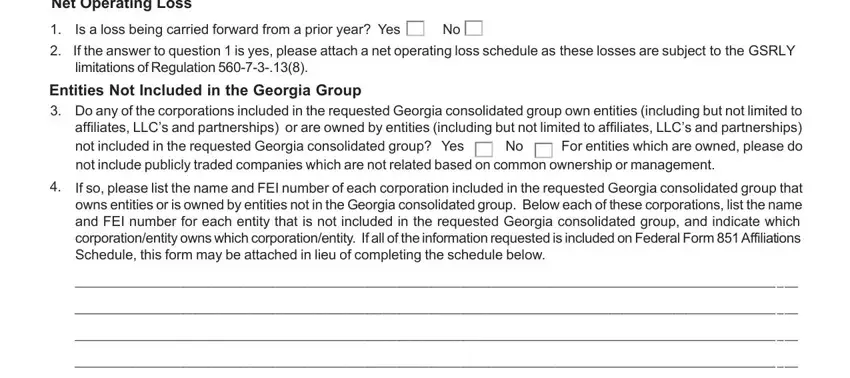

5. As a final point, this last subsection is what you'll want to complete prior to finalizing the PDF. The blanks here include the following: Net Operating Loss, Is a loss being carried forward, If the answer to question is yes, Entities Not Included in the, and If so please list the name and FEI.

Step 3: Right after looking through the entries, press "Done" and you're all set! After registering afree trial account at FormsPal, it will be possible to download it consol form georgia or send it through email right away. The file will also be available from your personal account with your every single edit. When using FormsPal, you can easily complete documents without being concerned about personal data leaks or entries getting shared. Our protected software makes sure that your personal information is stored safe.