By using the online tool for PDF editing by FormsPal, it is possible to fill in or change Form IT38S paper here and now. Our team is constantly working to enhance the tool and insure that it is much faster for people with its many functions. Discover an endlessly revolutionary experience now - explore and discover new possibilities along the way! All it takes is a few simple steps:

Step 1: Simply click on the "Get Form Button" above on this page to get into our pdf file editing tool. Here you will find everything that is needed to work with your document.

Step 2: When you start the PDF editor, you will find the form ready to be filled out. Other than filling out various fields, you might also do some other things with the PDF, such as adding your own textual content, modifying the original text, inserting images, affixing your signature to the PDF, and much more.

It is actually straightforward to fill out the pdf using this detailed tutorial! Here's what you want to do:

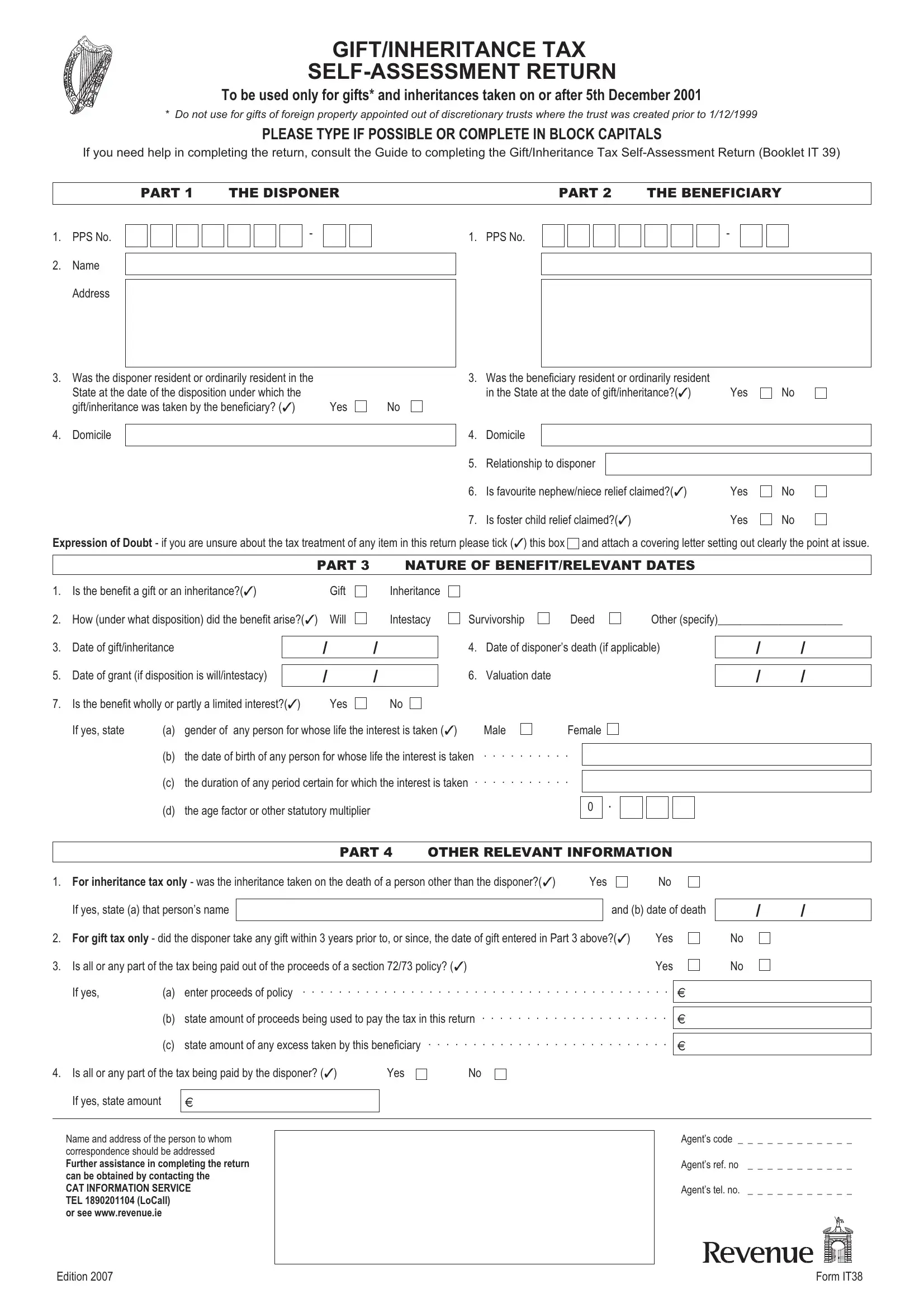

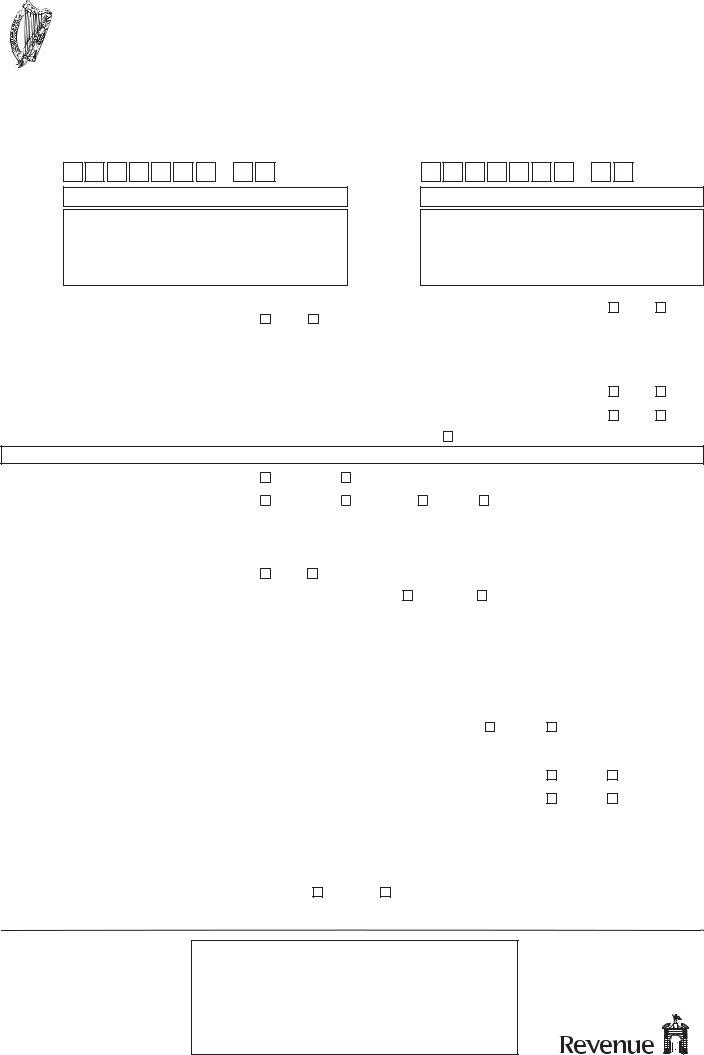

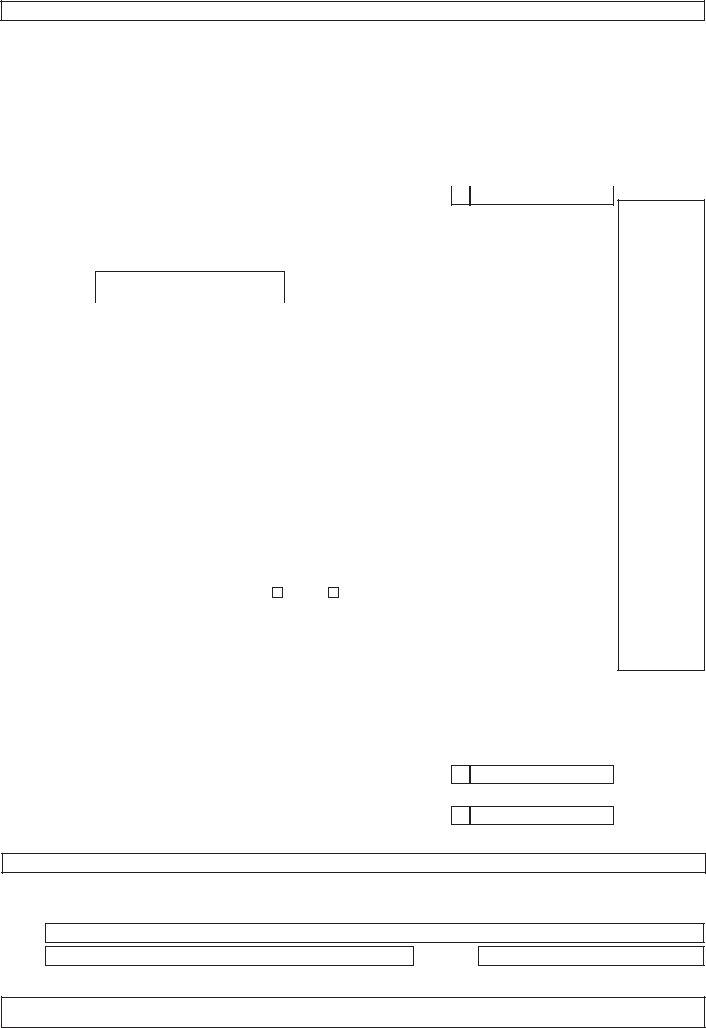

1. While filling out the Form IT38S paper, be certain to include all necessary blanks in its associated form section. This will help expedite the process, allowing for your details to be processed efficiently and appropriately.

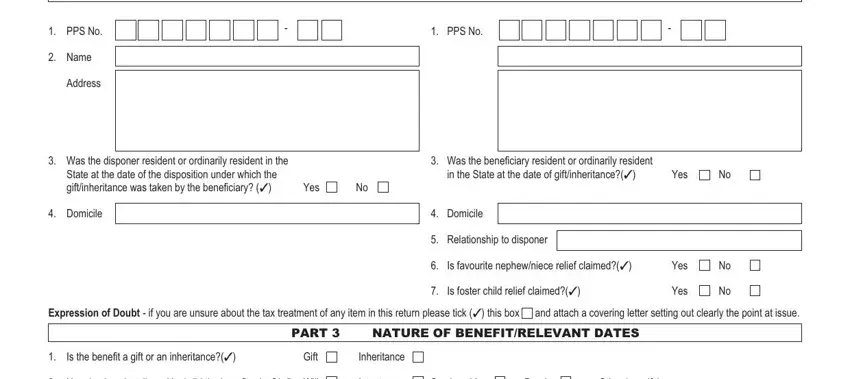

2. Just after finishing the last part, go on to the next stage and enter the essential details in these fields - How under what disposition did, Intestacy, Survivorship, Deed, Other specify, Date of giftinheritance, Date of grant if disposition is, Date of disponers death if, Valuation date, Is the benefit wholly or partly a, Yes, If yes state, a gender of any person for whose, Male, and Female.

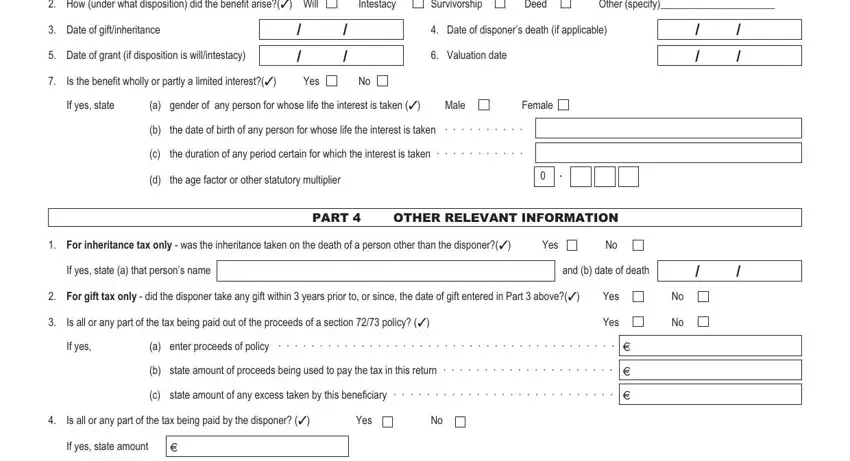

3. This next step is related to Name and address of the person to, Agents code, Agents ref no, Agents tel no, Edition, and Form IT - complete all of these blanks.

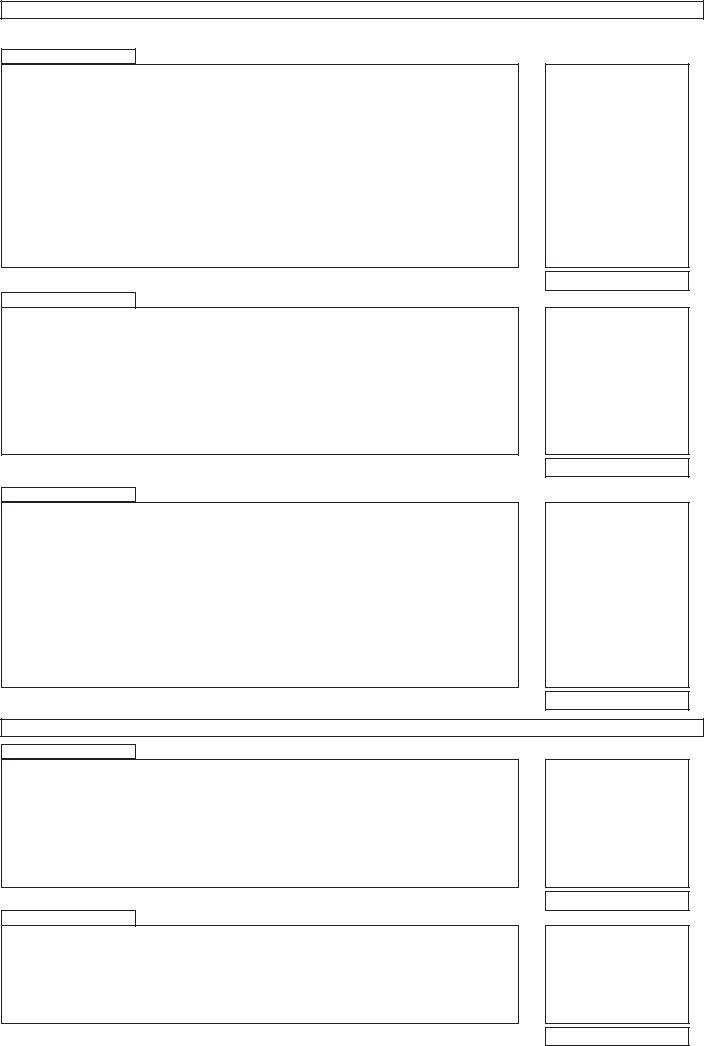

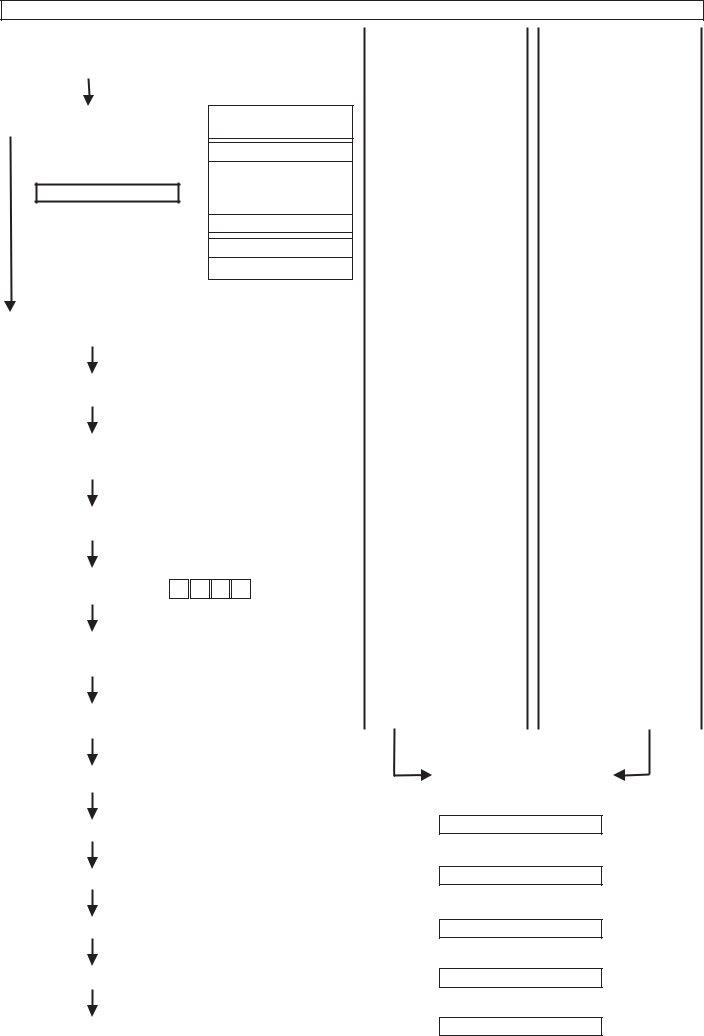

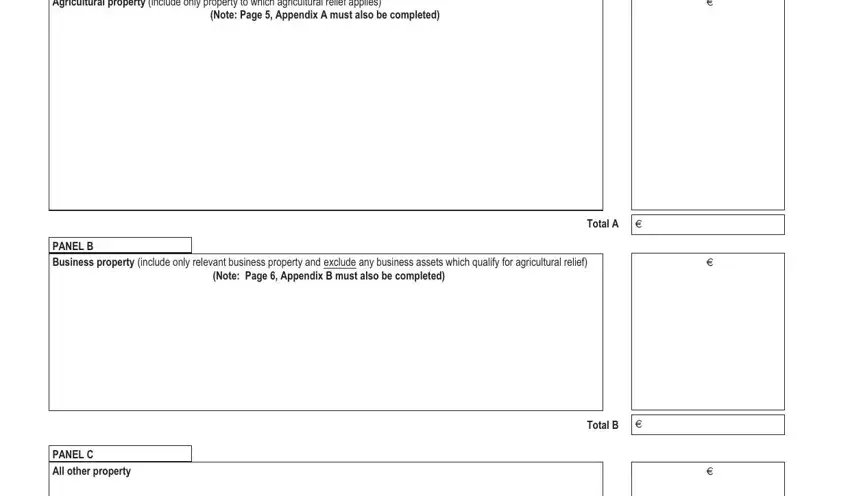

4. To go ahead, the following part will require filling out a few empty form fields. These comprise of Agricultural property include only, Note Page Appendix A must also be, PANEL B, Business property include only, Note Page Appendix B must also be, Total A, PANEL C, All other property, and Total B, which are essential to moving forward with this particular process.

Always be extremely careful when filling out Agricultural property include only and Total B, since this is the part in which many people make errors.

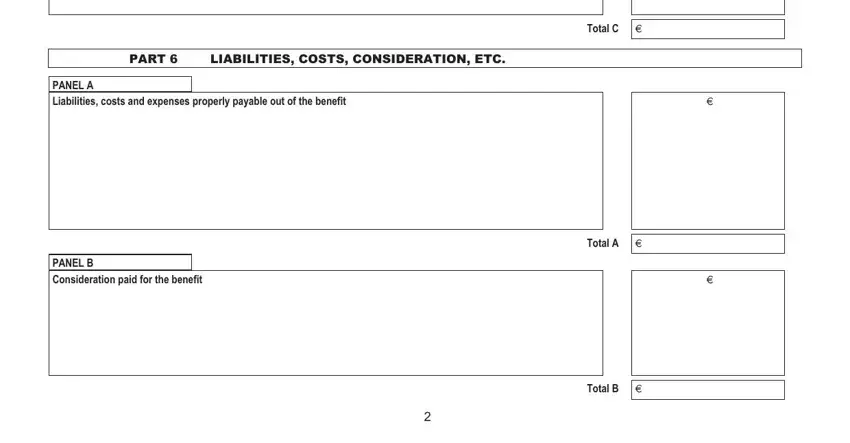

5. While you reach the end of your file, you'll find just a few more things to do. Particularly, PART, LIABILITIES COSTS CONSIDERATION ETC, PANEL A, Liabilities costs and expenses, PANEL B, Consideration paid for the benefit, Total C, Total A, and Total B must all be filled out.

Step 3: Before moving on, check that blanks are filled out correctly. The moment you think it is all good, click on “Done." After starting afree trial account at FormsPal, you will be able to download form it38 paper or email it directly. The file will also be at your disposal in your personal cabinet with all of your modifications. We don't share the details that you type in when working with forms at FormsPal.