Are you one of the millions of taxpayers struggling to understand the new Itr 2 form? Don't worry, understanding the different sections and completing them correctly can be confusing. That is why we put together this blog post to help guide you through understanding and submitting your Itr 2 form. We will provide an overview of the important aspects, so that you can confidently complete your forms accurately while saving time in the process.

| Question | Answer |

|---|---|

| Form Name | Itr 2 Form |

| Form Length | 12 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 3 min |

| Other names | itr form 2 no No Download Needed needed, itr2 no No Download Needed needed, fillable itr 2 in india, dl form 2 non fillable pdf |

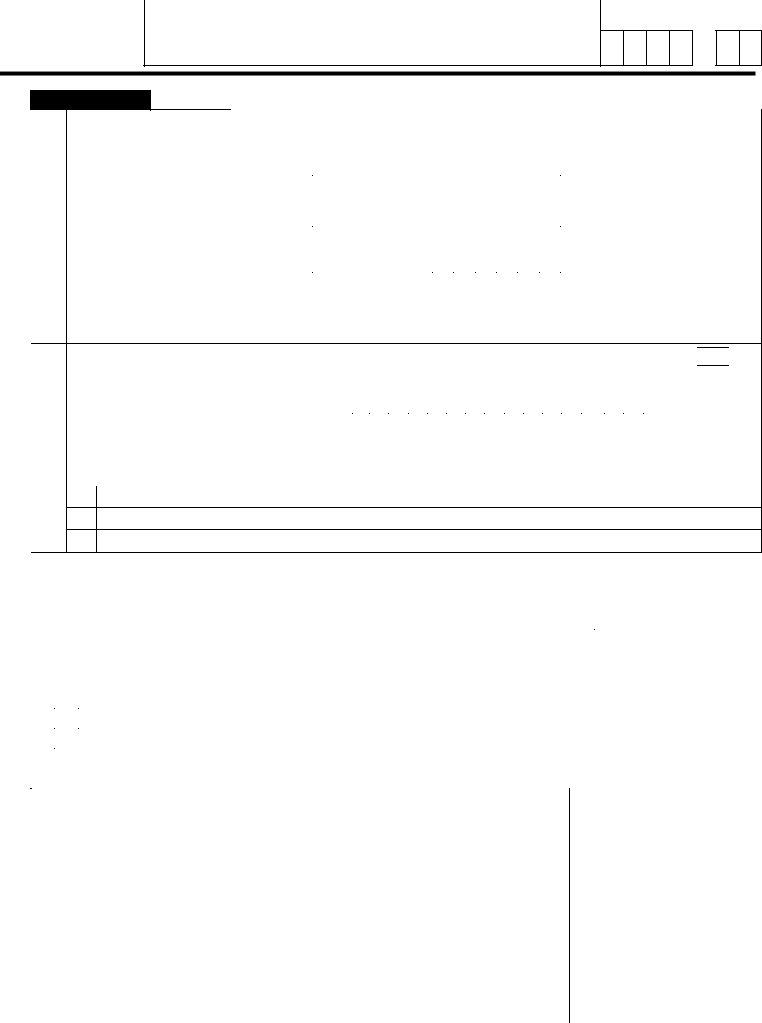

FORM

INDIAN INCOME TAX RETURN

[For Individuals and HUFs not having Income from Business or Profession]

(Please see Rule 12 of the

(Also see attached instructions)

Assessment Year

2 0 0 7 - 0 8

Part

GENERAL

PERSONAL INFORMATION

FILING STATUS

First name |

|

Middle name |

|

|

|

|

|

|

Last name |

|

|

|

|

|

|

PAN |

|

|

|

|

|

|

|

|

|

|

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Flat/Door/Block No |

|

Name Of Premises/Building/Village |

|

|

|

|

|

|

Status (Tick) |

|

|

|

|

|

|

|||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Individual |

HUF |

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

Road/Street/Post Office |

|

Area/locality |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Date of Birth (DD/MM/YYYY) |

||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

( in case of individual) |

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

/ |

|

/ |

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Town/City/District |

|

State |

|

|

|

|

|

Pin code |

|

|

|

|

|

|

Sex (in case of individual) (Tick) |

|||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Male |

|

|

|

|

Female |

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

Email Address |

|

|

|

(STD |

|

|

|

|

|

|

Employer Category(if in |

|

|

|

|

|

|

|||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

employment) (Tick) |

|

|

|

|

|

|

||||||||

|

|

|

|

|

( |

|

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Govt |

PSU |

Others |

|||||||||||||||||

Designation of Assessing Officer (Ward/Circle) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Return filed under Section |

|

|

|

|

|

|

|

|

|

|

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

[Please see instruction |

|

|

|

|

|

|

|

|||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

Whether original or Revised return? (Tick) |

|

|

|

|

|

Original |

|

|

|

|

|

|

Revised |

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

If revised, then enter Receipt No and Date of filing |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

/ |

/ |

|

|

|||||||||

original return (DD/MM/YYYY) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||

Residential Status (Tick) |

Resident |

|

Resident but Not Ordinarily Resident |

|||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||

Whether this return is being filed by a representative assessee? (Tick) Yes |

|

|

|

|

|

|

|

No |

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||

If yes, please furnish following information - |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

(a)Name of the representative

(b)Address of the representative

( c) Permanent Account Number (PAN) of the representative

|

|

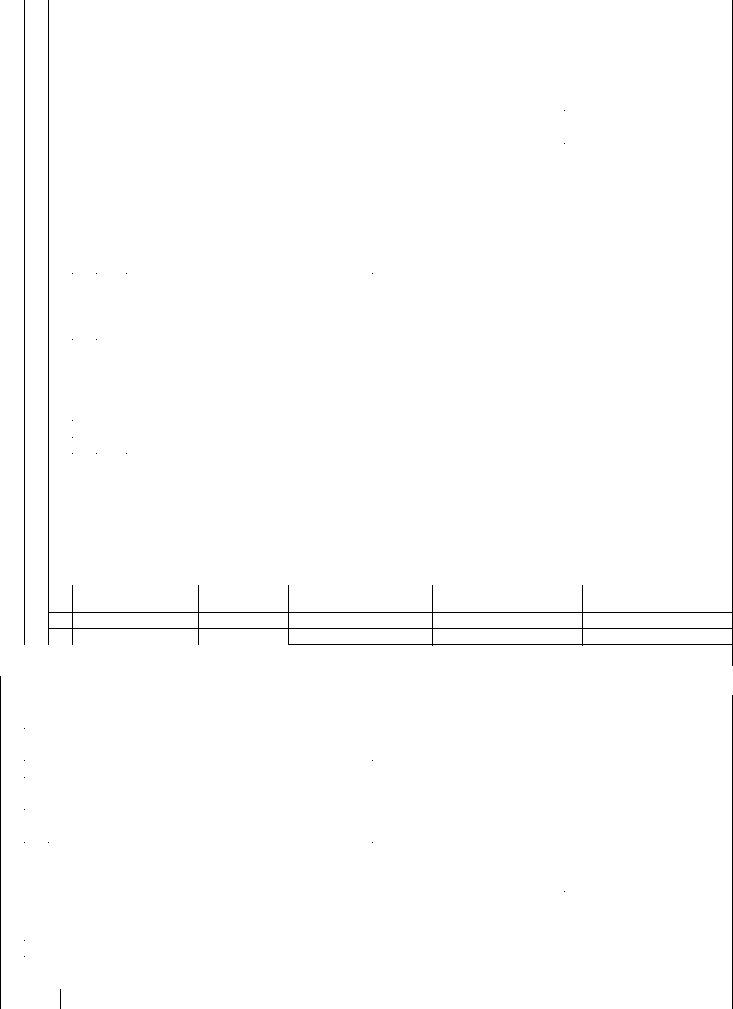

Part B - TI |

|

|

Computation of total income |

|

|

|

|

|||

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1 |

Salaries |

(6 of Schedule S) |

|

1 |

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2 |

Income from house property (3c of Schedule HP) (enter nil if loss) |

|

2 |

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

INCOME |

|

3 |

Capital gains |

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

a |

i |

3ai |

|

|

|||||

|

|

|

|

|

Short term |

|

|

|

|

|||

|

TOTAL |

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

iii |

Total |

3aiii |

|

|

|

||||

|

|

|

|

|

|

ii |

3aii |

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

b |

3b |

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

c |

Total capital gains (3aiii + 3b) |

|

|

3c |

|

||

|

|

|

|

|

|

|

|

|

||||

Do not write or stamp in this area (Space for bar code) |

|

|

For Office Use Only |

|||||||||

|

|

|

|

|

|

|

|

|

|

|

Receipt No |

|

Date

Seal and Signature of receiving official

|

|

|

|

4 |

Income from other sources |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

a |

from sources other than from owning race horses (3 of Schedule OS) (enter nil if loss) |

4a |

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

b |

from owning race horses (4c of Schedule OS) (enter nil if loss) |

4b |

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

c |

Total (a + b) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

4c |

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

5 |

Total (1+2+3c +4c) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

5 |

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

6 |

Losses of current year set off against 5 (total of 2vi and 3vi of Schedule CYLA) |

6 |

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

7 |

Balance after set off current year losses |

7 |

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

8 |

Brought forward losses set off against 7 (2vi of Schedule BFLA) |

8 |

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

9 |

Gross Total income |

|

|

|

|

|

|

|

|

|

9 |

|

|

|

|

|

|

|

|

|

|||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

10 |

Deductions under Chapter |

|

|

|

|

|

|

|

|

|

10 |

|

|

|

|

|

|

|

|

|

|||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

11 |

Total income |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

11 |

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

12 |

Net agricultural income/ any other income for rate purpose (4 of Schedule EI) |

12 |

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

13 |

‘Aggregate income’ (11+12) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

13 |

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

14 |

Losses of current year to be carried forward (total of row xi of Schedule CFL) |

14 |

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

Computation of tax liability on total income |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

|

|

Part B - TTI |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1 |

Tax payable on total income |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

a |

Tax at normal rates |

|

|

|

|

|

|

|

|

1a |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

b |

Tax at special rates (11 of Schedule SI) |

|

1b |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

c |

Tax Payable on Total Income (1a + 1b) |

|

|

|

|

|

|

|

|

|

1c |

|

|

|

|

|

|

|

|

|

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

LIABILITY |

|

2 |

Surcharge on 1c |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2 |

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

5 |

Tax relief |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

3 |

Education Cess on (1c + 2) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3 |

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

4 |

Gross tax liability (1c+ 2 + 3) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

4 |

|

|

|

|

|

|

|

|

|

|||||||

|

|

TAX |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

a |

Section 89 |

|

|

|

|

|

|

|

|

5a |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

OF |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

b |

Section 90 |

|

|

|

|

|

|

|

|

5b |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

COMPUTATION |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

c |

Section 91 |

|

|

|

|

|

|

|

|

5c |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

d |

Total (5a + 5b+5c) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

5d |

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

6 |

Net tax liability (4 – 5d) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

6 |

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

7 |

Interest payable |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

a |

For default in furnishing the return (section 234A) |

|

7a |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

b |

For default in payment of advance tax (section 234B) |

|

7b |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

c |

For deferment of advance tax (section 234C) |

|

7c |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

d |

Total Interest Payable (7a+7b+7c) |

|

|

|

|

|

|

|

|

|

7d |

|

|

|

|

|

|

|

|

|

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

8 |

Aggregate liability (6 + 7d) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

8 |

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

9 |

Taxes Paid |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

PAID |

|

|

a |

Advance Tax (from |

|

9a |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

b |

TDS (total of column 7 of |

|

9b |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

|

|

TAXES |

|

|

|

of |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

c |

Self Assessment Tax(from |

|

9c |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

|

|

|

|

|

d |

Total Taxes Paid (9a+9b+9c) |

|

|

|

|

|

|

|

|

|

9d |

|

|

|

|

|

|

|

|

|

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

10 |

Amount payable (Enter if 8 is greater than 9d, else enter 0) |

|

|

|

|

|

|

|

|

|

10 |

|

|

|

|

|

|

|

|

|

|||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

11 |

Refund (If 9d is greater than 8, also |

give Bank Account details below) |

11 |

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||

|

|

REFUND |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

12 |

Enter your bank account number (mandatory in case of refund) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

13 |

Do you want your refund by cheque, or deposited directly into your bank account? (tick as applicable ) |

|

|

|

|

|

|||||||||||||||||||||||||||||

|

|

|

|

14 |

In case of direct deposit to your bank account give additional details |

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

|

|

|

|

MICR Code |

|

|

|

|

|

|

|

|

|

|

Type of Account (tick as applicable ) |

Savings |

|

Current |

|||||||||||||||||||||

15

Date(DD/MM/YYYY)

/ /

VERIFICATION

I,son/ daughter ofsolemnly declare that to the best of my knowledge and belief, the information given in the return and schedules thereto is correct and complete and that the amount of total income and other particulars shown therein are truly stated and are in accordance with the provisions of the

income chargeable to |

||

Place |

Date |

Sign here |

16If the return has been prepared by a Tax Return Preparer (TRP) give further details as below:

Identification No. of TRP |

Name of TRP |

Counter Signature of TRP |

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

If TRP is entitled for any reimbursement from the Government, amount thereof

17

|

Schedule S |

|

Details of Income from Salary |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Name of Employer |

|

|

|

|

|

|

|

|

|

PAN of Employer (optional) |

|||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Address of employer |

|

|

Town/City |

|

|

State |

|

|

|

|

|

|

|

Pin code |

|||||||||||||||

|

SALARIES |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

1 |

Salary (Excluding all allowances, perquisites & profit in lieu of salary).. |

|

|

|

1 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

2 |

Allowances exempt under section 10 |

|

|

2 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3 |

Allowances not exempt |

|

|

|

|

|

|

|

|

|

|

3 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

4 |

Value of perquisites |

|

|

|

|

|

|

|

|

|

|

4 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

5 |

Profits in lieu of salary |

|

|

|

|

|

|

|

|

|

|

5 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

6 |

Income chargeable under the Head ‘Salaries’ (1+3+4+5) |

|

|

|

|

|

|

6 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

Schedule HP |

|

Details of Income from House Property |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

Address of property 1 |

|

|

|

Town/ City |

|

|

|

State |

|

|

|

PIN Code |

||||||||||||||||

|

|

|

1 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

(Tick) |

if let out |

|

Name of Tenant |

PAN of Tenant (optional) |

||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

a |

Annual letable value/ rent received or receivable (higher if let out for whole of the year, lower |

1a |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

|

|

|

if let out for part of the year) |

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

b |

The amount of rent which cannot be realized |

1b |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

c |

Tax paid to local authorities |

|

|

1c |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

d |

Total (1b + 1c) |

|

|

|

|

1d |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

e |

Balance (1a – 1d) |

|

|

|

|

|

|

|

|

|

|

1e |

|

|||||||||||||||

|

PROPERTY |

|

f |

30% of 1e |

|

|

|

|

1f |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

g |

Interest payable on borrowed capital |

|

|

1g |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

h |

Total (1f + 1g) |

|

|

|

|

|

|

|

|

|

|

1h |

|

|||||||||||||||

|

|

|

|

i |

Income from house property 1 (1e – 1h) |

|

|

|

|

|

|

|

|

1i |

|

|||||||||||||||||

|

HOUSE |

|

Address of property 2 |

|

|

|

Town/ City |

|

|

|

State |

|

|

|

PIN Code |

|||||||||||||||||

|

2 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

|

|

|

|

(Tick) |

if let out |

|

Name of Tenant |

PAN of Tenant (optional) |

||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

a |

Annual letable value/ rent received or receivable (higher if let out for whole of the year, lower |

2a |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

|

|

|

if let out for part of the year) |

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

b |

The amount of rent which cannot be realized |

2b |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

c |

Tax paid to local authorities |

|

|

2c |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

d |

Total (2b + 2c) |

|

|

|

|

2d |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

e |

Balance (2a – 2d) |

|

|

|

|

|

|

|

|

|

|

2e |

|

|||||||||||||||

|

|

|

|

f |

30% of 2e |

|

|

|

|

2f |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

g |

Interest payable on borrowed capital |

|

|

2g |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

h |

Total (2f + 2g) |

|

|

|

|

|

|

|

|

|

|

2h |

|

|||||||||||||||

|

|

|

|

i |

Income from house property 2 (2e – 2h) |

|

|

|

|

|

|

|

|

2i |

|

|||||||||||||||||

|

|

|

3 |

Income under the head “Income from house property” |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

a |

Rent of earlier years realized under section 25A/AA |

|

|

|

|

|

|

3a |

|

|||||||||||||||||||

|

|

|

|

b |

Arrears of rent received during the year under section 25B after deducting 30% |

|

|

|

3b |

|

||||||||||||||||||||||

|

|

|

|

c |

Total (3a + 3b + 1i + 2i) |

|

|

|

|

|

|

|

|

3c |

|

|||||||||||||||||

NOTE

Please include the income of the specified persons referred to in Schedule SPI while computing the income under this head

Schedule CG

Capital Gains

CAPITAL GAINS

A |

|

|

|

|

||

1 |

From assets in case of |

1 |

|

|||

|

|

|

|

|

|

|

2 |

From other assets |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

a Full value of consideration |

2a |

|

|

|

|

|

|

|

|

|

|

bDeductions under section 48

|

i |

Cost of acquisition |

bi |

|

|

|

|

|

|

|

ii |

Cost of Improvement |

bii |

|

|

|

|

|

|

|

iii |

Expenditure on transfer |

biii |

|

|

|

|

|

|

|

|

|

|

iv |

Total ( i + ii + ii) |

|

biv |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

c |

Balance (3a – biv) |

|

2c |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

d |

Loss, if any, to be ignored under section 94(7) or |

2d |

|

|

|

|

||

|

|

|

|

94(8) |

|

|

|

|

|

|

|

|

|

|

e |

Exemption under section 54/54B/54D/54EC/54F |

2e |

|

|

|

|

||

|

|

|

f |

|

|

|

|

2f |

|

||

|

|

|

|

|

|

|

|

|

|

||

|

3 |

Amount deemed to be short term capital gains under sections 54/54B/54D/54EC/54ED/54F |

3 |

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

4 |

Total short term capital gain (1 + 2f +3 +4) |

|

|

|

|

4 |

|

|||

|

|

|

|

|

|

|

|

|

|

||

|

5 |

Short term capital gain under section 111A included in 4 |

|

A5 |

|

||||||

|

|

|

|

|

|

|

|

|

|||

|

6 |

Short term capital gain other than referred to in section 111A (4 – 5) |

|

A6 |

|

||||||

|

|

|

|

|

|

|

|

|

|

||

|

B Long term capital gain |

|

|

|

|

|

|

||||

|

1 |

Asset in case of |

|

1 |

|

||||||

|

|

|

|

|

|

|

|

|

|

||

|

2 |

Other assets where proviso to section 112(1) not applicable |

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

a |

Full value of consideration |

|

2a |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

b |

Deductions under section 48 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

i |

Cost of acquisition after indexation |

|

bi |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ii |

Cost of improvement after indexation |

|

bii |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

iii |

Expenditure on transfer |

|

biii |

|

|

|

|

|

|

|

|

iv |

|

|

|

|

|

|

|

|

|

|

|

Total (bi + bii +biii) |

|

biv |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

c |

Balance (2a – biv) |

|

2c |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

d |

Deduction under sections 54/54B/54D/54EC/54F |

2d |

|

|

|

|

||

|

|

|

e |

Net balance (2c – 2d) |

|

|

|

|

2e |

|

|

|

|

|

|

|

|

|

|

|

|||

|

3 |

Other assets where proviso to section 112(1) is applicable |

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

a |

Full value of consideration |

|

3a |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

b |

Deductions under section 48 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

i |

Cost of acquisition without indexation |

|

Bi |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ii |

Cost of improvement without indexation |

bii |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

iii |

Expenditure on transfer |

|

biii |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

iv |

Total (bi + bii +biii) |

|

biv |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

c |

Balance (3a – biv) |

|

3c |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

d |

Deduction under sections 54/54B/54D/54EC/54F |

3d |

|

|

|

|

||

|

|

|

e |

Net balance |

|

|

|

|

3e |

|

|

|

|

|

|

|

|

|

|

||||

|

4 |

Amount deemed to be long term capital gains under sections 54/54B/54D/54EC/54ED/54F |

4 |

|

|||||||

|

|

|

|

|

|

|

|

|

|

||

|

5 |

Total long term capital gain (1 + 2e + 3e + 4) |

|

|

|

|

B5 |

|

|||

|

|

|

|

|

|

|

|||||

|

C Income chargeable under the head “CAPITAL GAINS” (A4 + B5) |

|

C |

|

|||||||

|

|

|

|

|

|

|

|

||||

|

D Information about accrual/receipt of capital gain |

|

|

|

|

|

|

||||

|

|

|

Date |

|

Upto 15/9 |

16/9 to 15/12 |

16/12 to 15/3 |

|

16/3 to 31/3 |

||

|

|

|

|

|

(i) |

|

(ii) |

(iii) |

|

(iv) |

|

1Long- term

2

|

|

|

|

NOTE |

Please include the income of the specified persons referred to in Schedule SPI while computing the income under this head |

||

|

|

|

|

|

|

|

|

|

Schedule OS |

|

|

Income from other sources |

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1 |

Income other than from owning race horse(s):- |

|

|

|

|

|||

|

|

|

|

a |

Dividends, Gross |

1a |

|

|

|

||

|

|

|

|

b |

Interest, Gross |

1b |

|

|

|

||

|

|

|

|

c |

Rental income from machinery, plants, buildings, |

1c |

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

d |

Others, Gross |

1d |

|

|

|

||

|

|

|

|

e |

Total (1a + 1b + 1c + 1d) |

|

|

1e |

|

||

|

SOURCES |

|

f |

Deductions under section 57:- |

|

|

|

|

|||

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

i |

Expenses |

fi |

|

|

|

|

|

|

|

|

|

ii |

Depreciation |

fii |

|

|

|

|

|

OTHER |

|

|

iii |

Total |

fiii |

|

|

|

||

|

|

g |

Balance (1e – fiii) |

|

|

1g |

|

||||

|

2 |

Winnings from lotteries, crossword puzzles, races, etc. |

|

|

2 |

|

|||||

|

|

|

3 |

Income from other sources (other than from owning race horses) (1g + 2) |

3 |

|

|||||

|

|

|

4 |

Income from owning and maintaining race horses |

|

|

|

|

|||

|

|

|

|

a |

Receipts |

4a |

|

|

|

||

|

|

|

|

b |

Deductions under section 57 in relation to (4) |

4b |

|

|

|

||

|

|

|

|

c |

Balance (4a – 4b) |

|

|

4c |

|

||

|

|

|

5 |

Income chargeable under the head “Income from other sources” (1g + 2 + 3 + 4c) |

5 |

|

|||||

NOTE |

Please include the income of the specified persons referred to in Schedule SPI while computing the income under this head. |

|

|

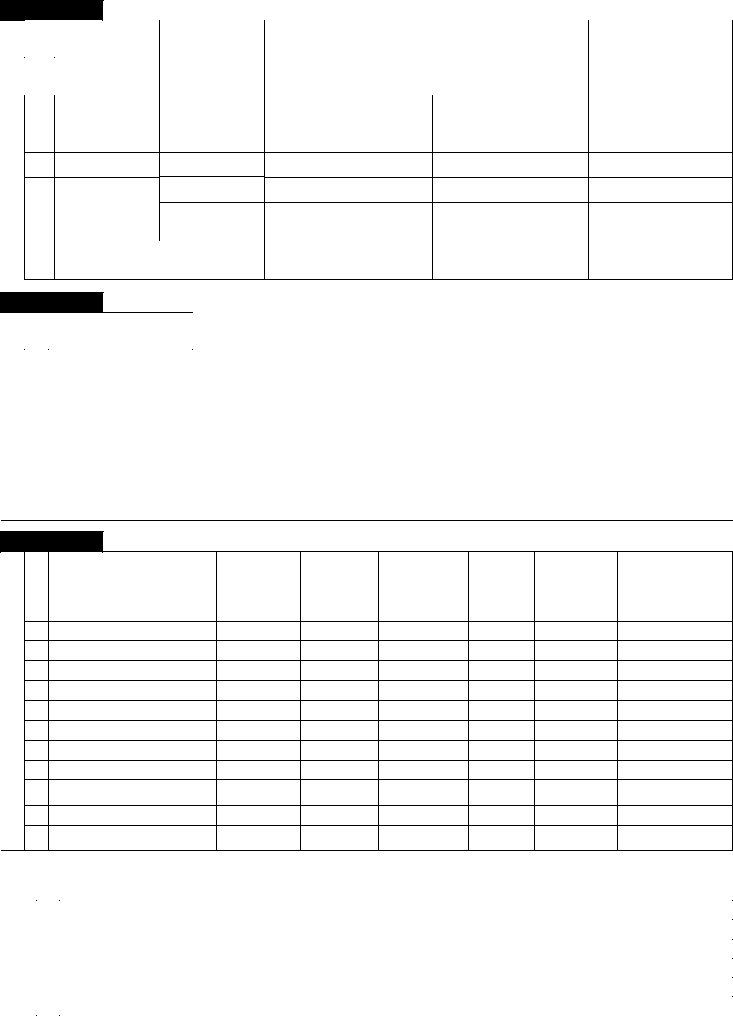

Schedule CYLA

Details of Income after Set off of current year losses

CURRENT YEAR LOSS ADJUSTMENT

Sl.No |

Head/ Source of |

Income of current |

House property loss of the current |

Other sources loss (other than |

Current year’s Income |

||

|

Income |

year |

year set off |

loss from race horses) of the |

remaining after set off |

||

|

|

(Fill this column only |

|

|

current year set off |

|

|

|

|

if income is zero or |

Total loss |

|

Total loss |

|

|

|

|

positive) |

(3c of Schedule |

|

(3 of Schedule- |

|

|

|

|

|

|

OS) |

|

|

|

|

|

1 |

2 |

3 |

|||

|

|

|

|

|

|

|

|

i |

Salaries |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ii |

House property |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

iii

ivLong term capital gain

v |

Other sources (incl |

|

|

|

|

|

profit from owning |

|

|

|

|

|

race horses) |

|

|

||

vi |

Total loss set off |

|

|||

|

|

|

|

|

|

vii |

Loss remaining after |

|

|||

|

|

|

|

|

|

Schedule BFLA

Details of Income after Set off of Brought Forward Losses of earlier years

BROUGHT FORWARD LOSS

|

Sl. |

Head/ Source of Income |

Income after set off, if any, of |

|

Brought forward loss set off |

Current year’s income |

|

No. |

|

current year’s losses as per 4 of |

|

|

remaining after set off |

|

|

|

Schedule CYLA |

|

|

|

|

|

|

1 |

|

2 |

3 |

|

|

|

|

|

|

|

DJUSTMENTA |

i |

Salaries |

|

|

|

|

|

|

|

|

|

|

|

v |

Other sources (including |

|

|

|

|

|

|

ii |

House property |

|

|

|

|

|

iii |

|

|

|

|

|

|

iv |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

profit from owning race |

|

|

|

|

|

|

horses) |

|

|

|

|

|

vi |

Total of brought forward loss set off |

|

|

|

|

|

|

|

|

|

|

|

|

vii |

Current year’s income remaining after set off Total (i3 + ii3 + iii3 + iv3 + v3) |

|

|

||

|

|

|

|

|

|

|

Schedule CFL

Details of Losses to be carried forward to future years

CARRY FORWARD OF LOSS

Assessment Year |

Date of Filing |

House property |

Other sources |

Other sources loss |

||

|

(DD/MM/YYYY) |

loss |

loss |

Capital loss |

loss (other than |

(from owning race |

|

|

|

|

|

loss from race |

horses) |

|

|

|

|

|

horses) |

|

i

vii

ix Total of earlier year losses

xAdjustment of above losses in Schedule BFLA

xi

xiiTotal loss Carried Forward to future years

|

Schedule VIA |

|

Deductions under Chapter |

||||||||

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

a |

80C |

|

|

h |

80G |

|

|

|

|

DEDUCTIONS |

|

|

|

|

|

|

|

|

|

|

|

b |

80CCC |

|

|

|

i |

80GG |

|

|

|

||

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

c |

80CCD |

|

|

j |

80GGA |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

d |

80D |

|

|

k |

80GGC |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

e |

80DD |

|

|

l |

80RRB |

|

|

|

|

TOTAL |

|

|

|

|

|

|

|

|

|

|

|

f |

80DDB |

|

|

|

m |

80U |

|

|

|

||

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

g |

80E |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

n |

Total deductions (total of a to m) |

|

|

|

n |

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

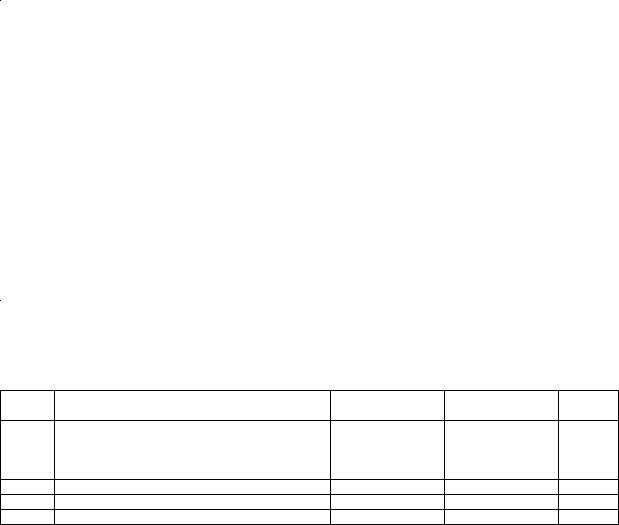

Schedule SPI