It really is very easy to complete the Form Llc 5. Our software was built to be easy-to-use and help you fill out any document swiftly. These are the basic steps to go through:

Step 1: The initial step should be to choose the orange "Get Form Now" button.

Step 2: At this point, you are on the form editing page. You may add content, edit present details, highlight particular words or phrases, insert crosses or checks, insert images, sign the document, erase unwanted fields, etc.

Fill out the Form Llc 5 PDF by typing in the text needed for each individual part.

In the Contact Person Please type or, First Name, Phone optional, Last Name, Entity Information Please type or, Name, Entity Number if applicable, Comments, and Submission Cover Sheet REV box, put in writing your data.

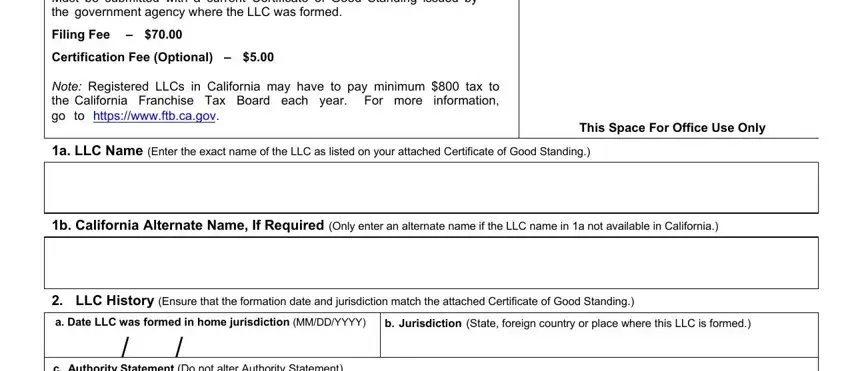

In the Must be submitted with a current, Filing Fee, Certification Fee Optional, Note Registered LLCs in California, This Space For Office Use Only, a LLC Name Enter the exact name of, b California Alternate Name If, LLC History Ensure that the, a Date LLC was formed in home, b Jurisdiction State foreign, and c Authority Statement Do not alter part, highlight the necessary details.

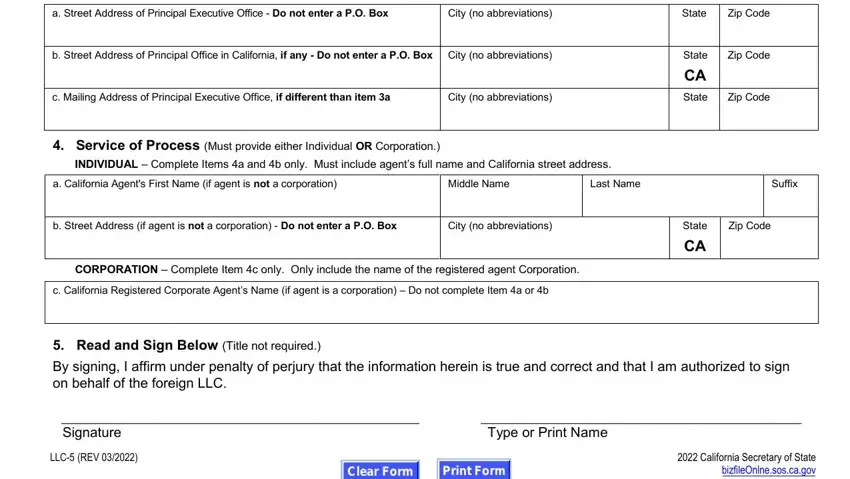

In box Business Addresses Enter the, a Street Address of Principal, City no abbreviations, State, Zip Code, b Street Address of Principal, State, Zip Code, c Mailing Address of Principal, City no abbreviations, CA State, Zip Code, Service of Process Must provide, INDIVIDUAL Complete Items a and b, and a California Agents First Name if, state the rights and obligations.

Step 3: In case you are done, select the "Done" button to export your PDF file.

Step 4: Just be sure to generate as many duplicates of the form as possible to keep away from future worries.