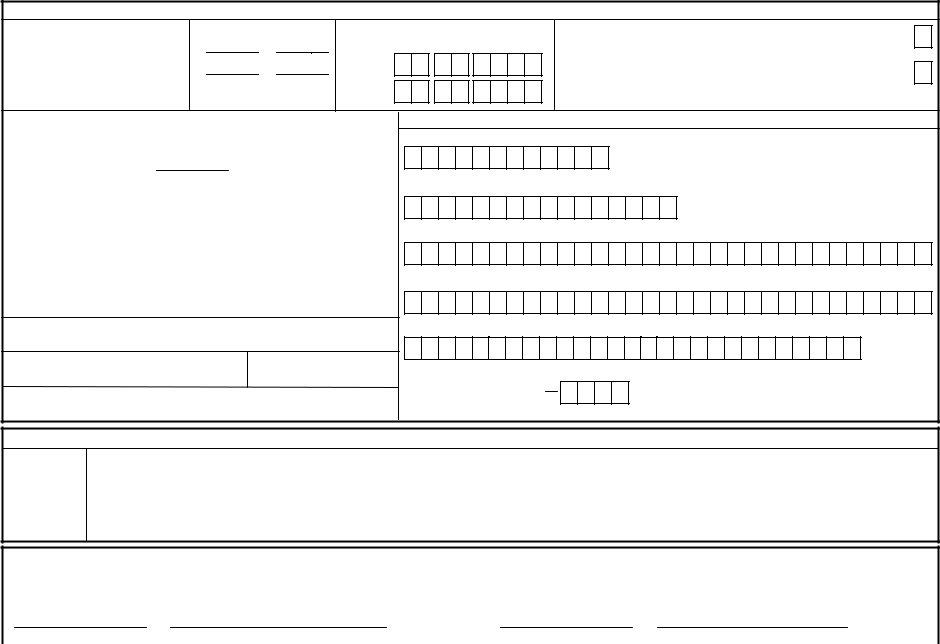

The landscape of labor organization reporting in the United States incorporates a vital document known as Form LM-4, a mandatory annual report endorsed by the Office of Labor-Management Standards, within the Department of Labor. Tailored specifically for labor organizations with annual receipts of less than $10,000, Form LM-4 serves as a concise summary of an organization's financial activity over a specified period, as outlined by the Public Law 86-257, as amended. This document meticulously records a range of financial information, from changes in the constitution and bylaws (excluding dues and fees adjustments) to the total income and expenditures within the reporting period. Moreover, it addresses other critical aspects such as the existence and amount of fidelity bonds, membership counts, asset and liability totals, and details surrounding losses or shortages of funds or property. Compliance with the reporting requirements is not only a matter of legal obligation—highlighted by the risk of criminal prosecution, fines, or civil penalties for failure to comply—but also a reflection of an organization's commitment to transparency and accountability. This comprehensive approach ensures that labor organizations remain faithful to the legal standards set forth by the Office of Management and Budget, Washington, D.C., thereby fostering an environment of trust and reliability amongst their members and stakeholders.

| Question | Answer |

|---|---|

| Form Name | Form Lm 4 |

| Form Length | 2 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 30 sec |

| Other names | lm 4 form, dol form lm4, dol lm 4, lm 4 |

U.S. Department of Labor |

FORM |

Form Approved |

||

Office of |

Office of Management and Budget |

|||

Washington, DC 20210 |

|

|

|

No. |

|

|

FOR USE ONLY BY LABOR ORGANIZATIONS WITH LESS THAN $10,000 IN TOTAL ANNUAL RECEIPTS |

|

Expires |

|

|

|

|

|

This report is mandatory under P.L.

READ THE INSTRUCTIONS CAREFULLY BEFORE PREPARING THIS REPORT.

For Official Use Only

1.FILE NUMBER

—

2. PERIOD COVERED

MO DAY YEAR

From

Through

3.(a) AMENDED — If this is an amended report correcting a previously filed report, check here:

(b)TERMINAL — If your organization ceased to exist and this is its terminal report, see Section X of the instructions and check here:

IMPORTANT

Peel off the address label from the back of the package and place it here.

If the label information is correct, leave Items 4 through 8 blank.

If any of the label information is incorrect, complete Items 4 through 8.

4. AFFILIATION OR ORGANIZATION NAME

5. DESIGNATION (Local, Lodge, etc.) |

6. DESIGNATION NUMBER |

7. UNIT NAME (if any)

8.MAILING ADDRESS (Type or print in capital letters.) First Name

Last Name

P.O. Box Building and Room Number (if any)

Number and Street

City

State |

|

ZIP Code + 4 |

|

||||

|

|

|

|

|

|

|

|

19.ADDITIONAL INFORMATION (If more space is needed, attach additional pages properly identified.)

Item Number

Eachoftheundersigned,dulyauthorizedofficersoftheabovelabororganization,declares,underpenaltyofperjuryandother applicablepenaltiesoflaw,thatalloftheinformationsubmittedinthisreport(includingtheinformation containedinanyaccompanyingdocuments)hasbeenexaminedbythesignatoryandis,tothebestoftheundersigned'sknowledgeandbelief,true,correct,andcomplete.(SeeSectionVIonpenaltiesintheinstructions.)

20. SIGNED: ________________________________________________________ PRESIDENT |

21. SIGNED: ______________________________________________________ TREASURER |

||||||||||

|

|

|

|

|

(If other title, |

|

|

|

|

|

(If other title, |

/ |

/ |

( |

) |

see instructions.) |

/ |

/ |

( |

) |

see instructions.) |

||

|

Date |

|

|

Telephone Number |

|

|

Date |

|

|

Telephone Number |

|

Form |

|

|

|

4 - 1 |

|

|

|

|

|

Page 1 of 2 |

|

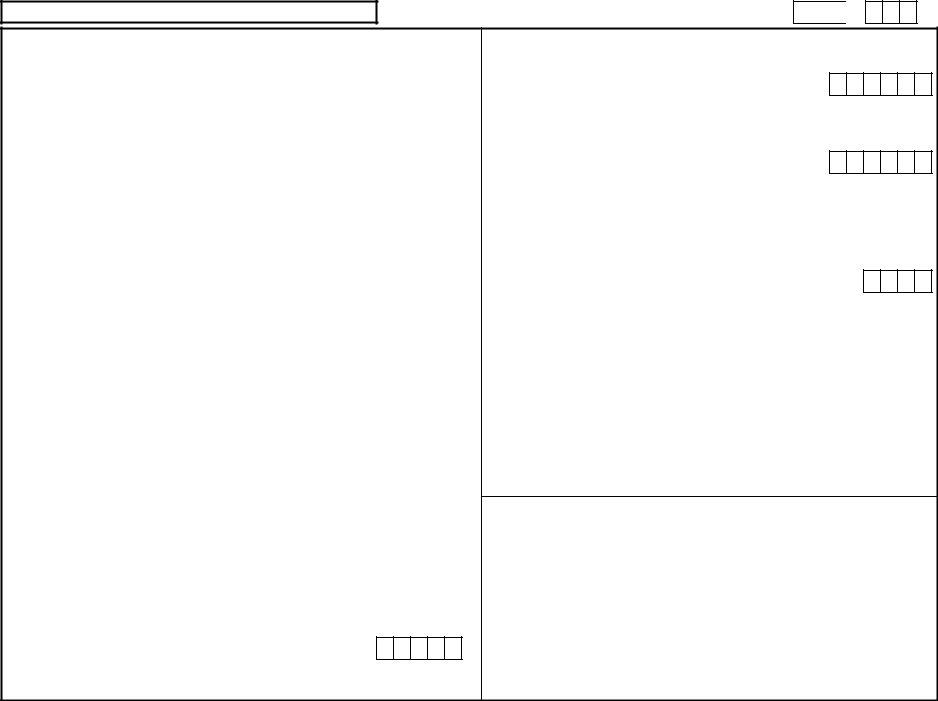

Enter Amounts in Dollars Only — Do Not Enter Cents

FILE NUMBER:

—

Complete Items 9 through 18.

9. |

During the reporting period, did your organization |

|

|

|

|

|

|

|

|

|

|

have any changes in its constitution and bylaws |

|

|

|

|

|

|

|

|

|

|

(other than rates of dues and fees) or in practices/ |

|

|

Yes |

No |

|||||

|

procedures listed in the instructions? |

|

|

|

|

|

|

|

|

|

|

(If the constitution and bylaws have changed, |

|

|

|

|

|

|

|

|

|

|

attach two new dated copies. If practices/ |

|

|

|

|

|

|

|

|

|

|

procedures have changed, see the instructions.) |

|

|

|

|

|

|

|

|

|

10. |

Did your organization change its rates of dues |

|

|

|

Yes |

No |

||||

|

and fees during the reporting period? |

|

|

|

|

|

|

|

|

|

|

(If “Yes,” report the new rates in Item 19 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

on page 1.) |

|

|

|

|

|

|

|

|

|

11. |

Did your organization discover any loss or |

|

|

|

|

|

|

|

|

|

|

shortage of funds or property during the |

|

|

Yes |

No |

|||||

|

reporting period? |

|

|

|

|

|

|

|

|

|

|

(If “Yes,” provide details in Item 19 on page 1. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Answer “Yes” even if there has been repayment |

|

|

|

|

|

|

|

|

|

|

or recovery.) |

|

|

|

|

|

|

|

|

|

12. |

Was your organization insured by a |

|

|

|

Yes |

No |

||||

|

fidelity bond during the reporting period? |

|

|

|

|

|

|

|

|

|

|

If “Yes,” enter the maximum amount |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

recoverable under the bond for loss |

|

|

|

|

|

|

|

|

|

|

caused by any person. |

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

13.How many members did your organization have at the end of the reporting period?

14. |

Enter the total value of your organization’s |

|

|

assets at the end of the reporting period |

|

|

(cash, bank accounts, equipment, etc.) |

$ |

15. |

Enter the total liabilities (debts) of your |

|

|

organization at the end of the reporting |

|

|

period (unpaid bills, loans owed, etc.) |

$ |

16.Enter the total receipts of your organization during the reporting period (dues, fees, interest received, etc.). (If $10,000 or more,

your organization must file Form |

|

$ |

17. |

Enter the total disbursements made by your |

|

|

|

|

|

|

|

|

organization during the reporting period (per |

|

|

|

|

|

|

|

|

capita tax, loans made, net payment to |

|

|

|

|

|

|

|

|

officers, payments for office supplies, etc.). |

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

18. |

Enter the total payments to officers and |

|

|

|

|

|

|

|

|

employees during the reporting period |

|

|

|

|

|

|

|

|

(gross salaries, lost time payments, |

|

|

|

|

|

|

|

|

allowances, expenses, etc.). |

$ |

|

|

|

|

|

|

Please be sure to:

•Enter your union’s

•Report a time period of no more than one year in Item 2.

•Have your union’s president and treasurer sign the Form

•FILE ON TIME. Form

Form |

4 - 2 |

Pa g e 2 o f 2 |