Dealing with PDF documents online is always surprisingly easy with our PDF tool. Anyone can fill in Form Ls 1 here and use a number of other functions available. In order to make our tool better and easier to work with, we consistently work on new features, with our users' suggestions in mind. All it takes is just a few simple steps:

Step 1: Press the "Get Form" button above on this page to access our PDF editor.

Step 2: With this advanced PDF tool, you'll be able to do more than merely fill in blank form fields. Express yourself and make your docs look high-quality with custom text added, or adjust the file's original content to perfection - all that backed up by an ability to incorporate your own graphics and sign the PDF off.

This PDF form will require you to enter some specific details; in order to guarantee accuracy and reliability, take the time to consider the suggestions directly below:

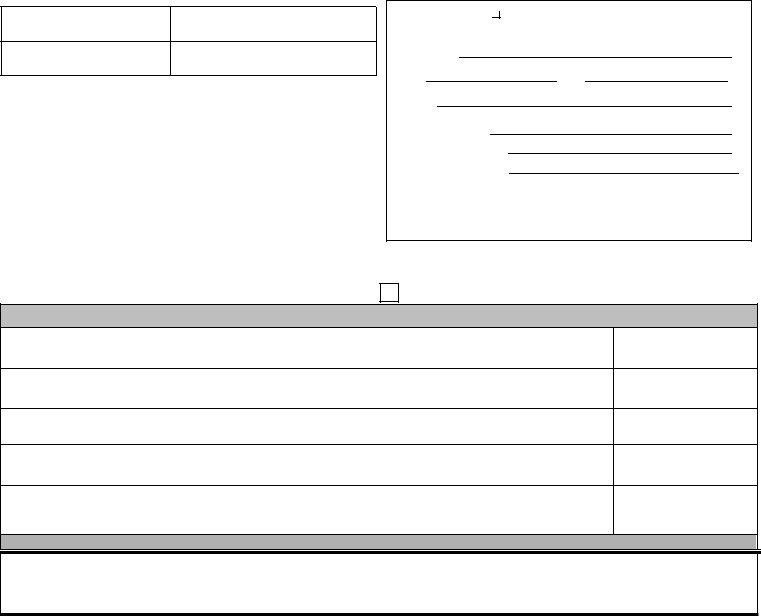

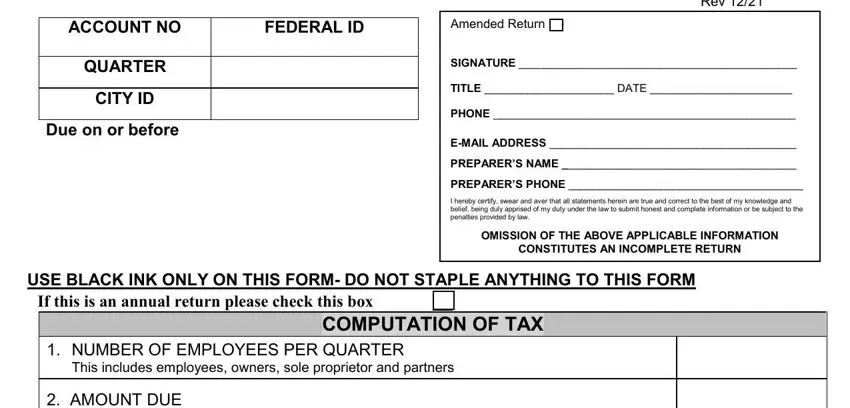

1. The Form Ls 1 will require certain details to be entered. Be sure the next fields are finalized:

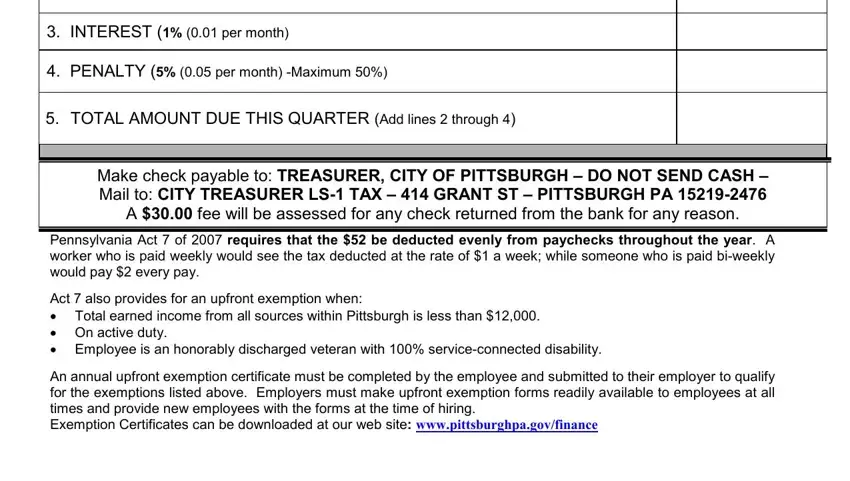

2. When the last section is completed, you should include the needed specifics in AMOUNT DUE, INTEREST per month, PENALTY per month Maximum, TOTAL AMOUNT DUE THIS QUARTER Add, Make check payable to TREASURER, A fee will be assessed for any, Pennsylvania Act of requires, Total earned income from all, Act also provides for an upfront, Employee is an honorably, and An annual upfront exemption allowing you to progress to the third part.

You can certainly make an error while filling in your An annual upfront exemption, thus make sure you go through it again prior to when you send it in.

Step 3: Immediately after double-checking the filled in blanks, hit "Done" and you are good to go! Right after registering afree trial account here, you will be able to download Form Ls 1 or email it without delay. The PDF document will also be at your disposal through your personal account page with your each edit. FormsPal guarantees your data privacy with a secure method that in no way saves or distributes any private information used in the file. Be assured knowing your documents are kept safe whenever you work with our tools!