State of Wisconsin

Department of Workforce Development

Equal Rights Division

Labor Standards Bureau

Special Minimum Wage License Application

A special minimum wage license may be issued to an employer to permit the employment of individual employees at a lesser hourly wage than prescribed by Section DWD 272.03. Such license will cover only those workers who are unable to earn the minimum wage, or who are student learners. The rate paid must be commensurate with the worker’s ability and productivity. The following definitions and policies shall be used when issuing such licenses

(1)“Worker with a disability” means an individual whose earnings or productive capacity is impaired by a physical or mental disability, including those relating to age or injury, for the work to be performed. Disabilities which may affect earning or productive capacity include blindness, mental illness, intellectual disability, cerebral palsy, alcoholism, and drug addiction. The following, taken by themselves, are not considered disabilities for the purposes of this section: vocational, social, cultural, or educational disabilities; chronic unemployment; receipt of welfare benefits; nonattendance at school; juvenile delinquency; and correctional parole or probation. Further, a disability which may affect earning or productive capacity for one type of work may not have this effect for another type of work.

(2)“Student Learner” means a student who is receiving instruction in an accredited school, college or university and who is employed on a part-time basis, pursuant to a bona fide vocational training program.

(3)“Sponsoring Agency” means a sheltered workshop, governmental agency or a nonprofit charitable organization or institution carrying out an occupational rehabilitating activity of an educational or therapeutic nature.

(4)Two types of “worker with a disability” licenses may be granted by the department.

(a)A type 1 license is issued to a specific employer to employ a worker with a disability in their establishment. This license may be issued for a period of time not to exceed one year.

(b)A type 2 license shall be requested by a sponsoring agency on behalf of a worker with a disability. A type 2 license may be issued by the department to a worker with a disability and will authorize any employer to pay the rate of pay stated on the license. An employer who hires a licensed worker with a disability shall retain a photocopy of the license for the employer’s records. This license may be issued for a period of time not to exceed one year.

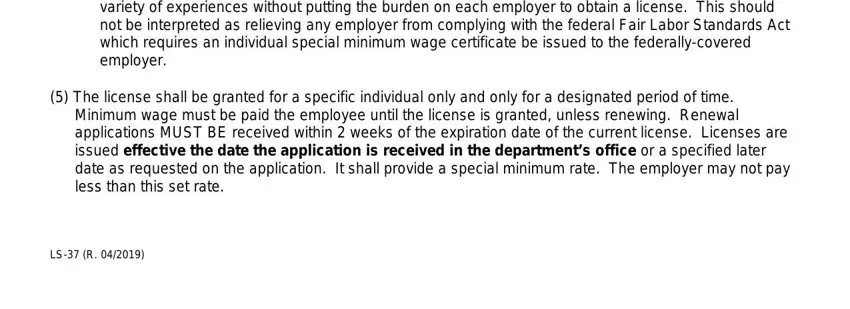

Note: The intent of issuing a type 2 license to the worker with a disability instead of to the employer is to permit the sponsoring agency to make short-term placements. This would enable the worker to gain a variety of experiences without putting the burden on each employer to obtain a license. This should not be interpreted as relieving any employer from complying with the federal Fair Labor Standards Act which requires an individual special minimum wage certificate be issued to the federally-covered employer.

(5)The license shall be granted for a specific individual only and only for a designated period of time. Minimum wage must be paid the employee until the license is granted, unless renewing. Renewal applications MUST BE received within 2 weeks of the expiration date of the current license. Licenses are issued effective the date the application is received in the department’s office or a specified later date as requested on the application. It shall provide a special minimum rate. The employer may not pay less than this set rate.

LS-37 (R. 04/2019)

(6)Records to Be Kept: In addition to the records required in DWD 272.11, the employer shall keep the following:

(A)For Student Learner:

(1)The student shall be identified on the payroll records, showing occupation and rate of pay.

(2)A copy of the license and training agreement must be available at all times for inspection for three years.

(B) Records To Be Kept By Employers:

(1)Every employer of workers under a special minimum wage license, or the referring agency or facility in the case of records verifying a worker’s disabilities, shall maintain and have available for inspection the records specified in this subsection.

(a)Verification of the worker’s disability

(b)Evidence of the productivity of each worker with a disability which has been gathered on a continuing basis or at periodic intervals, which do not exceed six months in the case of employees, paid hourly wage rates

(c)The prevailing wage paid to a worker who is not disabled. This would be for the job performed and for a worker employed in industry in the vicinity for the same type of work using similar methods and equipment as that used by the worker with a disability employed under the special minimum wage license

(d)The production standards and supporting documentation for non-disabled workers for each job being performed by a worker with disabilities employed under the special license.

(e)In the case of workers with disabilities who are employed by a recognized non-profit rehabilitation facility and who are working in or about a home, apartment, or room in the residential establishment the records required under s. DWD 272.11.

(f)The employer shall maintain and preserve the records required by this section for 3 years.

(7)A license may be granted to employ the worker at a wage less than the minimum wage if the following conditions exist and application and documentation are received as per DWD 272.09:

(A)The worker is so disabled that he or she is unable to earn the minimum wage, or

(B)The employer is carrying out a recognized rehabilitation program - medical, therapeutic, or educational - and the person with a disability may learn and gain experience, or

(C)The student learner is in a bona fide school-training program.

(8)Refusal to Issue a License and Revocation of a License. The Department may refuse to issue a license or may revoke, amend or modify any license it has issued, if, in its opinion, conditions or extraordinary circumstances warrant such action.

Note: The issuance of this license will not relieve an employer from responsibility under the Federal Minimum Wage Law. Write to the Regional Office of the U.S. Department of Labor, Wage and Hour Division, 230 South Dearborn Street, Room 562A, Chicago, Illinois 60604.

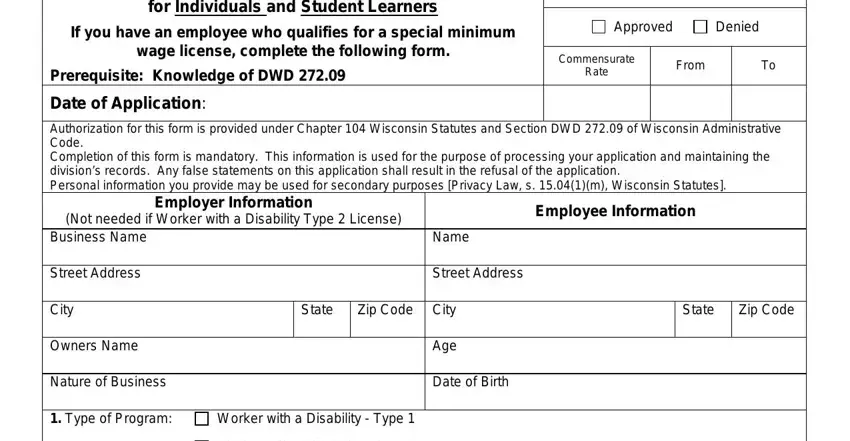

Application for a Special Minimum Wage License |

To be completed by the Department |

for Individuals and Student Learners |

|

|

|

|

|

Approved |

|

Denied |

If you have an employee who qualifies for a special minimum |

|

wage license, complete the following form. |

|

|

|

|

|

Commensurate |

|

From |

|

To |

Prerequisite: Knowledge of DWD 272.09 |

Rate |

|

|

|

|

|

|

Date of Application: |

|

|

|

|

|

|

|

|

|

Authorization for this form is provided under Chapter 104 Wisconsin Statutes and Section |

DWD 272.09 of |

Wisconsin Administrative |

Code.

Completion of this form is mandatory. This information is used for the purpose of processing your application and maintaining the division’s records. Any false statements on this application shall result in the refusal of the application.

Personal information you provide may be used for secondary purposes [Privacy Law, s. 15.04(1)(m), Wisconsin Statutes].

|

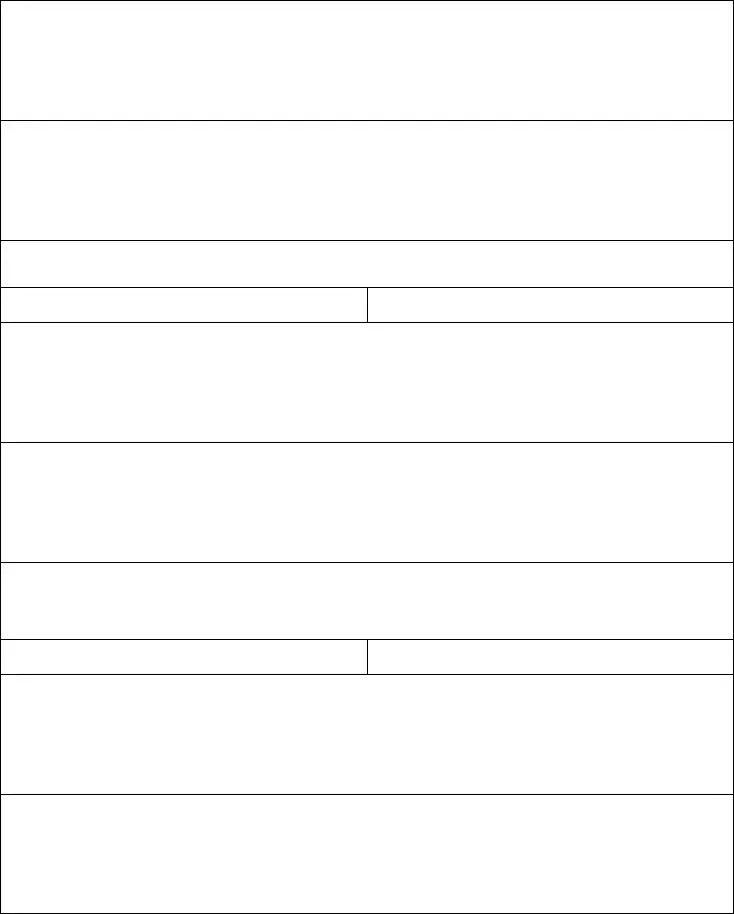

Employer Information |

|

|

Employee Information |

|

|

(Not needed if Worker with a Disability Type 2 License) |

|

|

|

|

|

|

|

Business Name |

|

|

|

Name |

|

|

|

|

|

|

|

|

|

|

|

Street Address |

|

|

|

Street Address |

|

|

|

|

|

|

|

|

|

|

|

City |

|

State |

Zip Code |

City |

|

State |

Zip Code |

|

|

|

|

|

|

|

|

Owners Name |

|

|

|

Age |

|

|

|

|

|

|

|

|

|

|

|

Nature of Business |

|

|

|

Date of Birth |

|

|

|

|

|

|

|

|

|

|

1. |

Type of Program: |

Worker with a Disability - Type 1 |

|

|

|

|

|

|

Worker with a Disability - Type 2 |

|

|

|

|

|

Student Learner |

|

|

|

|

|

|

|

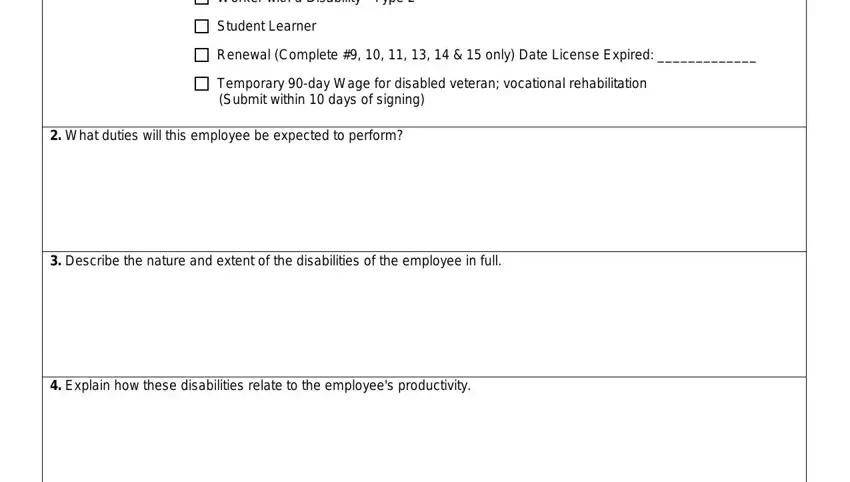

Renewal (Complete #9, 10, 11, 13, 14 & 15 only) Date License Expired: _____________ |

|

|

Temporary 90-day Wage for disabled veteran; vocational rehabilitation |

|

|

|

(Submit within 10 days of signing) |

|

|

|

|

|

|

|

|

2. |

What duties will this employee be expected to perform? |

|

|

|

|

|

|

|

|

3. |

Describe the nature and extent of the disabilities of the employee in full. |

|

|

|

|

|

|

|

|

4. |

Explain how these disabilities relate to the employee's productivity. |

|

|

|

LS-37 (R. 04/2019)

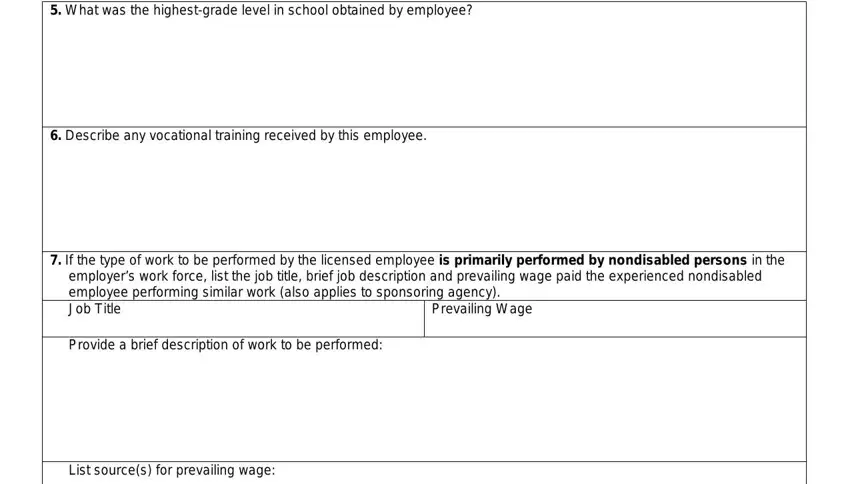

5.What was the highest-grade level in school obtained by employee?

6.Describe any vocational training received by this employee.

7.If the type of work to be performed by the licensed employee is primarily performed by nondisabled persons in the employer’s work force, list the job title, brief job description and prevailing wage paid the experienced nondisabled employee performing similar work (also applies to sponsoring agency).

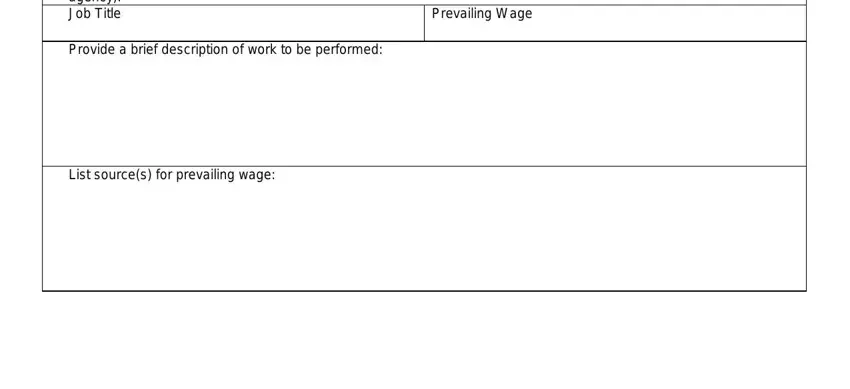

Job Title

Provide a brief description of work to be performed:

List source(s) for prevailing wage:

8.If the type of work to be performed by the licensed employee is primarily performed by disabled employees in the employer’s workforce, the employer may determine the prevailing wage rate by surveying 3 comparable businesses in the area for similar work and rates of pay for nondisabled workers. Or the employer can use federal bureau of statistics, job service, or an employment service which provides above entry-level wages (does not apply to sponsoring agency).

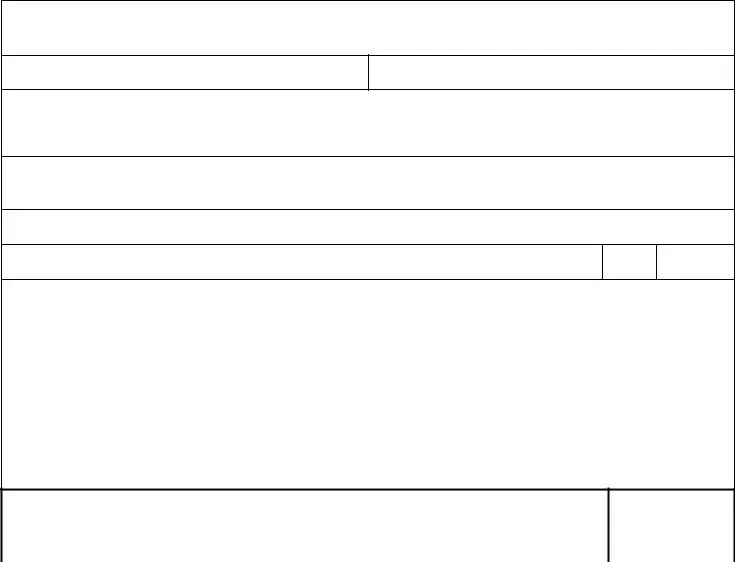

Job Title

Provide a brief description of work to be performed:

List source(s) for prevailing wage:

Scheduled hours of work per week

9.Commensurate Per Hour Wage employer will guarantee worker: $ ____________

Attach documentation of productivity tests, information, dates showing the rate arrived at for the worker with a disability.

10. Scheduled hours of work per day

11. List dates you wish this license to cover

From:To:

(Minimum wage must be paid until the effective date of the license. Licenses cannot be backdated. If you are renewing, prior license is in effect until this application Is granted or denied.)

12.Student Learner Information

(Review DWD 272.09(15))Attach a copy of program or signed training agreement.

Wage rate cannot be less than 75% of current minimum wage unless individual is a worker with a disability.

Name of School

State Zip Code

Employer’s Written Assurance:

(A)The wage rates of all hourly-rated employees paid in accordance with Chapter DWD 272.09 of the Wisconsin Administrative Code will be reviewed at least every six (6) months and

(B)Wages paid to all employees under DWD 272.09 will be adjusted at periodic intervals at least once a year to reflect changes in the prevailing wage paid experienced non-disabled workers employed in the vicinity for essentially the same type of work.

(C)Hours worked over 40 in a 7-consecutive day week must be paid at time and one-half the regular rate of pay.

(D)Time and payroll records shall be kept in accordance with DWD 272.11.

Employer’s Signature (Not needed if Worker with a Disability - Type 2 license. It is

assumed the sponsoring agency of this license will oversee this assurance.)

14. |

Sponsoring Agent or Agency Information |

|

|

|

|

|

|

|

|

|

|

|

|

|

Name |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Signature of Authorizing Official |

|

|

Title |

|

|

Date Signed |

|

|

|

|

|

|

|

|

Street Address |

|

City |

|

State |

Zip Code |

Telephone Number |

|

|

|

|

|

|

|

|

15. |

Required Signatures |

|

|

|

|

|

|

|

|

|

|

|

|

|

Employee Signature |

|

|

|

|

|

|

Date Signed |

|

|

|

|

|

Parent or Guardian Signature: (if Student Learner Program) |

|

|

|

Date Signed |

|

|

|

|

|

School Official Signature for Student Learner |

|

|

|

Date Signed |

|

|

Representative of State Agency or Department of Veterans Affairs for 90-day temporary authority |

Date Signed |

Signature |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Agency Name |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Send the Completed Application to

STATE OF WISCONSIN

DEPARTMENT OF WORKFORCE DEVELOPMENT

EQUAL RIGHTS DIVISION

P O BOX 8928

MADISON WI 53708

If you have any questions call (608) 266-0030

Website: http://dwd.wisconsin.gov/er