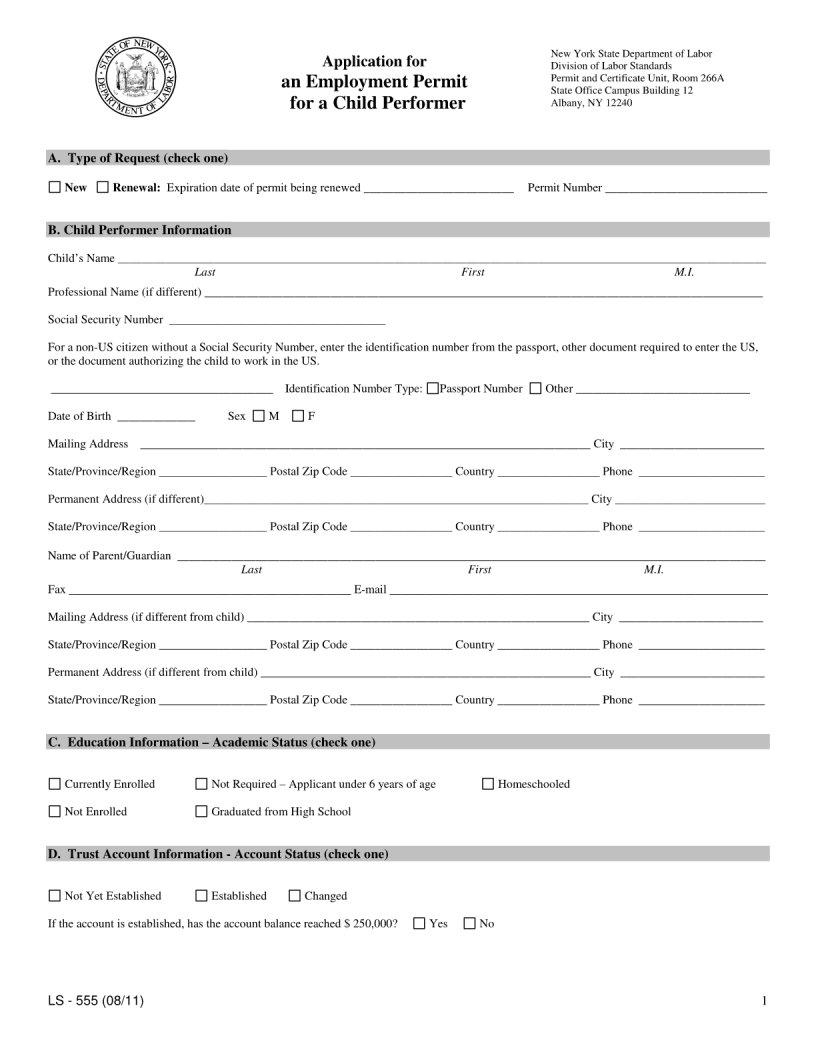

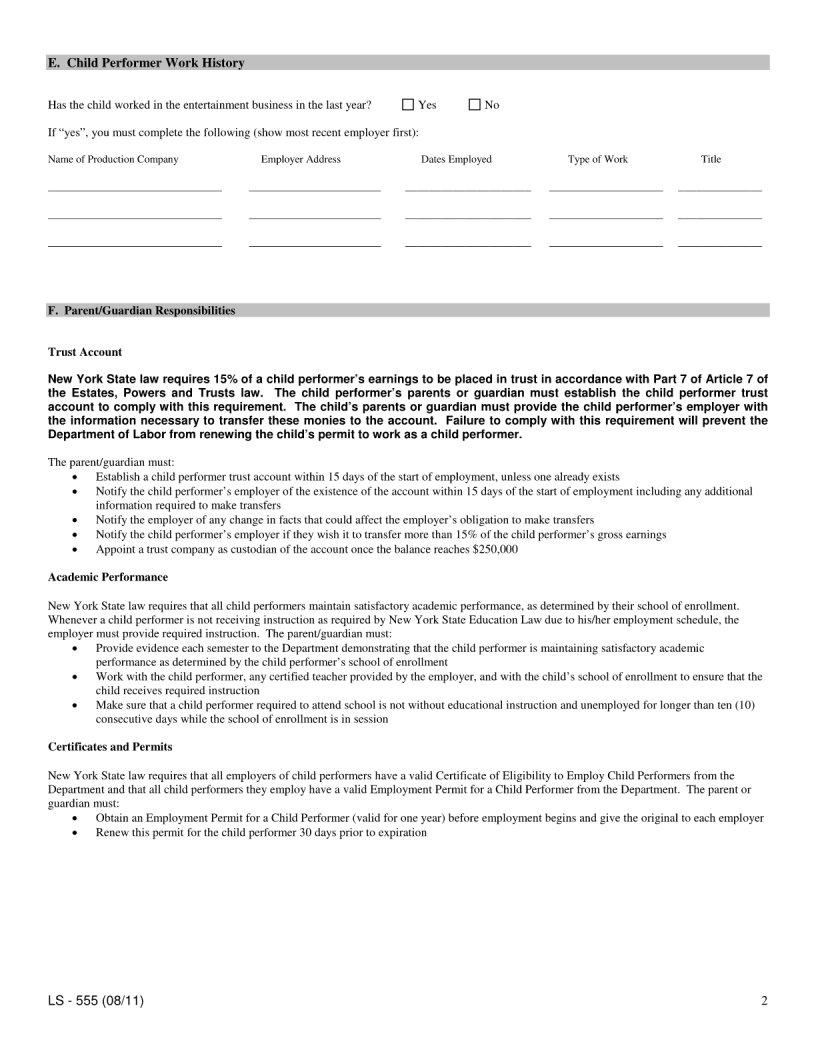

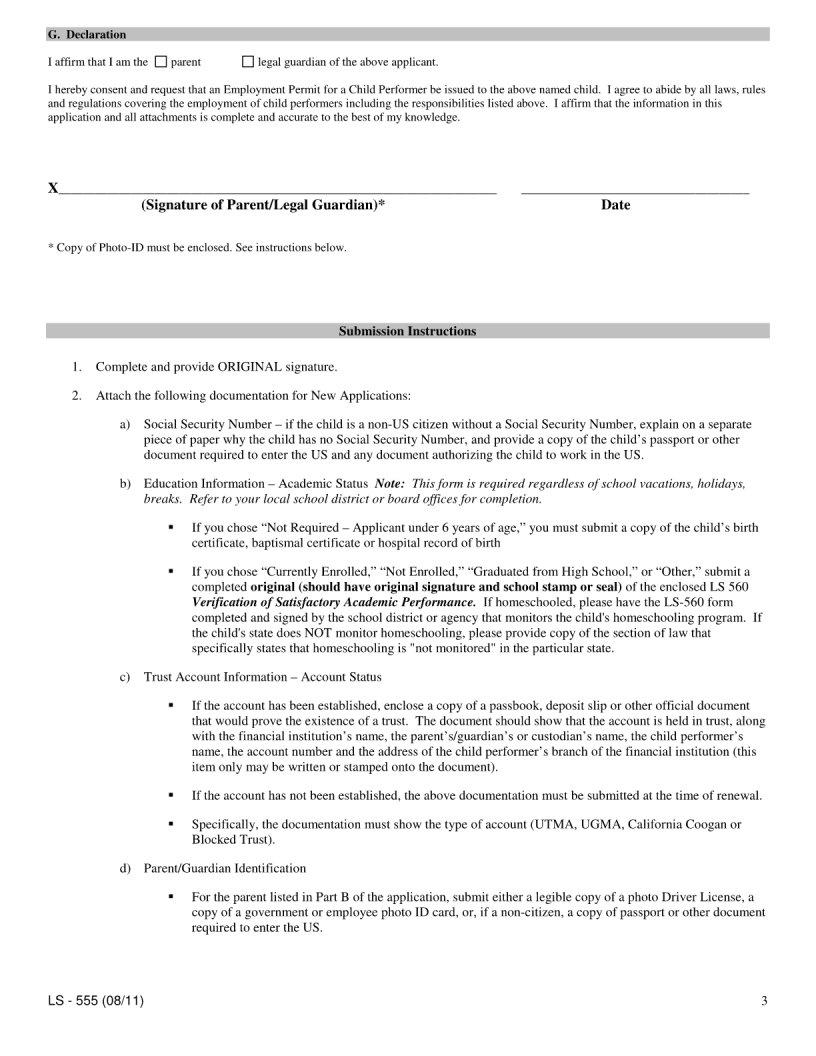

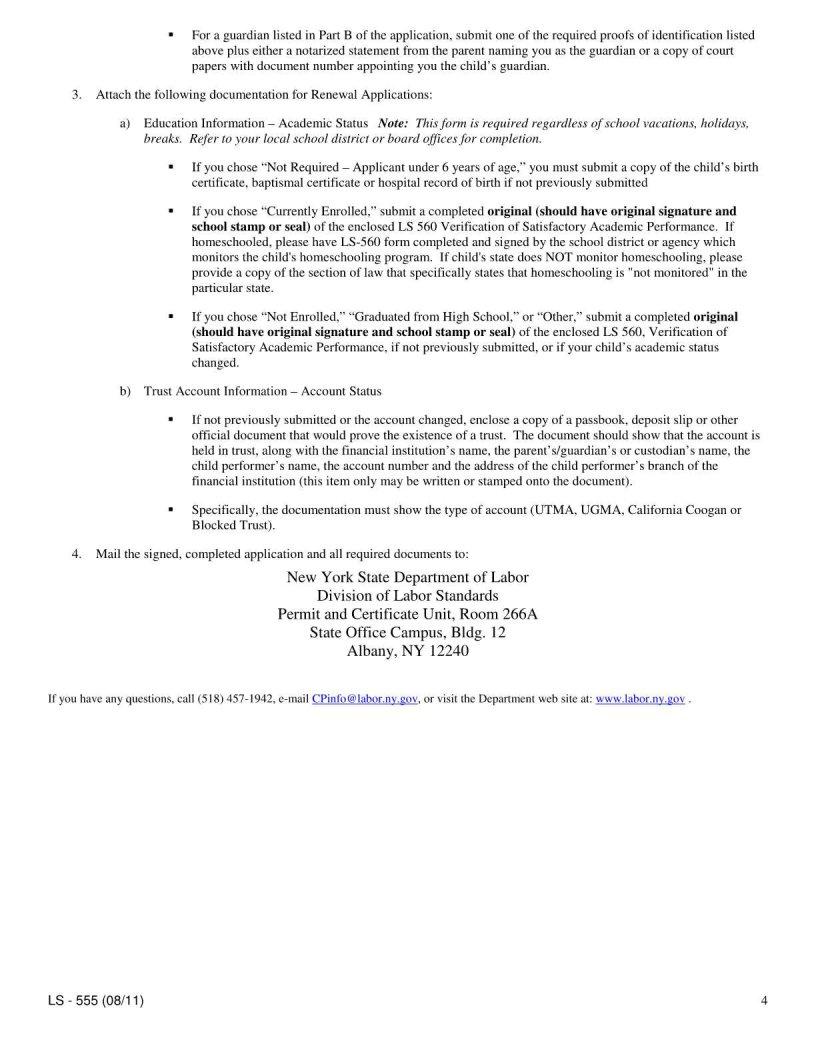

In the intricate landscape of maritime employment within the United States, the proper handling and reporting of workers' injuries represent a crucial aspect of maintaining not only the well-being of the workforce but also compliance with federal regulations. At the heart of this protocol is the Ls 555 form, a document that serves as a pivotal piece in the administrative puzzle, ensuring that maritime workers receive the compensation due to them in the event of an employment-related injury. This form, while seemingly straightforward, is imbued with significant implications for both employees and employers alike. It acts as a bridge between the initial injury report and the eventual resolution and compensation process, thus playing a fundamental role in the larger framework of the Longshore and Harbor Workers' Compensation Act. The intricacies of completing, submitting, and processing the form correctly cannot be understated, as they directly influence the efficiency and fairness of the compensation mechanism. Given its importance, a thorough understanding of the Ls 555 form, from its structure to its function within the maritime industry's regulatory environment, is essential for all stakeholders to ensure the rights and responsibilities of both workers and employers are adequately met.

| Question | Answer |

|---|---|

| Form Name | Form Ls 555 |

| Form Length | 4 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 1 min |

| Other names | California, ls560, UTMA, school form ls 560 |