Should you would like to fill out apportionment, you don't have to download any kind of applications - simply use our online tool. Our professional team is ceaselessly endeavoring to expand the editor and insure that it is much faster for users with its extensive features. Unlock an endlessly progressive experience today - check out and discover new possibilities as you go! In case you are looking to start, this is what it's going to take:

Step 1: Access the PDF doc in our tool by clicking the "Get Form Button" above on this webpage.

Step 2: As you open the online editor, you'll notice the document made ready to be filled in. In addition to filling out various blank fields, you could also perform other sorts of things with the Document, specifically putting on any words, changing the original textual content, adding images, affixing your signature to the PDF, and much more.

This document will require specific details to be typed in, therefore ensure you take your time to type in exactly what is required:

1. Before anything else, once filling in the apportionment, beging with the form section that has the following fields:

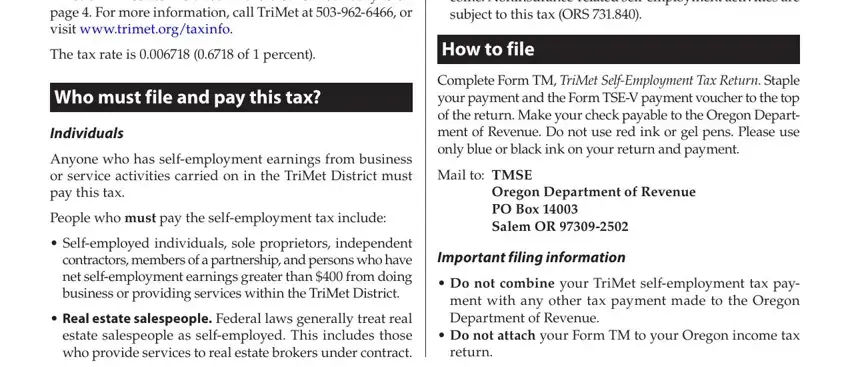

2. After filling in this section, head on to the subsequent part and fill in all required particulars in all these blanks - A list of ZIP codes included in, Insurance agentsapplies only to, The tax rate is of percent, How to file, Who must file and pay this tax, Individuals, Anyone who has selfemployment, People who must pay the, Real estate salespeople Federal, Complete Form TM TriMet, Mail to TMSE, Oregon Department of Revenue PO, Important filing information, Do not combine your TriMet, and Do not attach your Form TM to.

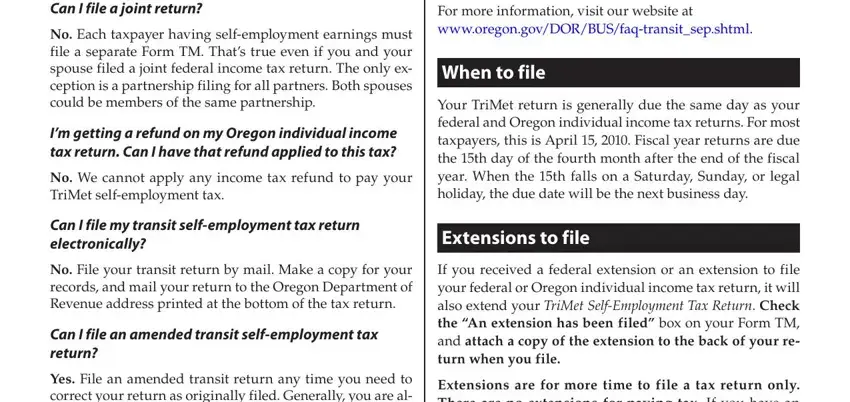

3. In this part, take a look at Can I file a joint return, No Each taxpayer having, Im getting a refund on my Oregon, No We cannot apply any income tax, For more information visit our, When to file, Your TriMet return is generally, Can I file my transit, Extensions to file, No File your transit return by, Can I file an amended transit, Yes File an amended transit return, If you received a federal, and Extensions are for more time to. Every one of these must be completed with greatest focus on detail.

You can certainly make an error when completing your Can I file my transit, for that reason be sure to take another look before you submit it.

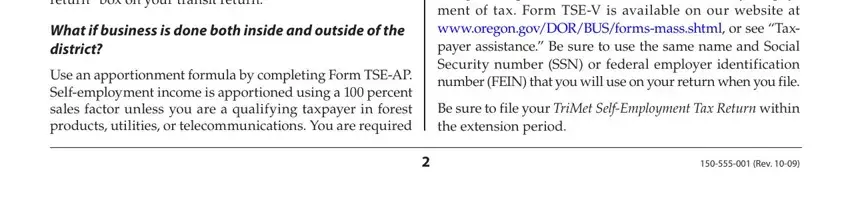

4. This next section requires some additional information. Ensure you complete all the necessary fields - Yes File an amended transit return, What if business is done both, Use an apportionment formula by, Extensions are for more time to, Be sure to file your TriMet, and Rev - to proceed further in your process!

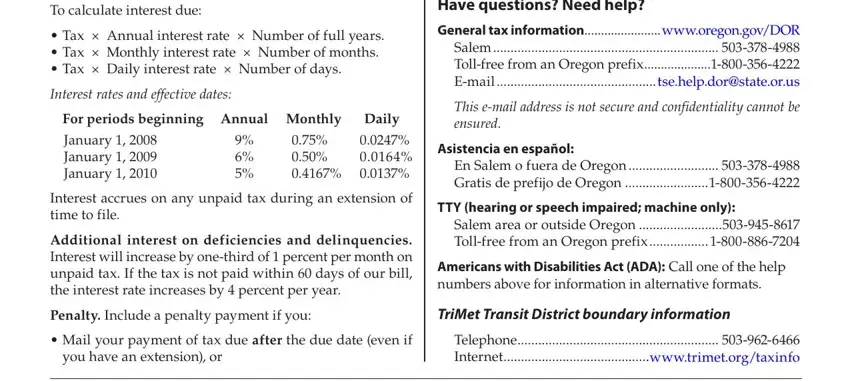

5. The pdf has to be concluded within this segment. Further there is a detailed listing of blank fields that need accurate details for your document submission to be accomplished: To calculate interest due, Tax Annual interest rate Number, Interest rates and effective dates, For periods beginning Annual, Interest accrues on any unpaid tax, Additional interest on, Penalty Include a penalty payment, you have an extension or, Have questions Need help, General tax, This email address is not secure, ensured, Asistencia en español En Salem o, TTY hearing or speech impaired, and Americans with Disabilities Act.

Step 3: Spell-check the information you've inserted in the blanks and click on the "Done" button. Join FormsPal now and easily get apportionment, available for downloading. All changes you make are kept , so that you can edit the form at a later point anytime. Here at FormsPal.com, we strive to guarantee that all of your information is maintained protected.