The Form M-NRA plays a crucial role in managing the estate of a deceased person, especially in cases involving nonresidents. Crafted with meticulous attention to detail, this form encapsulates the essence of legal and administrative needs following a person's death. It requires comprehensive information about the decedent, including their name, date of death, social security number, and much more. Executors or personal representatives are tasked with providing detailed affidavits concerning the decedent’s domicile, ensuring the proper legal procedures are followed in nonresident cases. The form not only seeks information about the decedent's final resting place and the circumstances of their death but also delves into their living arrangements, voting behavior, tax payments, and other aspects of their life and residence in the years leading up to their death. Details such as possession of property, involvement in legal proceedings, social and religious affiliations, and even medical treatments within Massachusetts are scrutinized to establish domicile and accordingly manage estate affairs. This comprehensive approach ensures that estate administration is conducted with a full understanding of the decedent's life and affiliations, streamlining the process in adherence to legal standards.

| Question | Answer |

|---|---|

| Form Name | Form M Nra |

| Form Length | 4 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 1 min |

| Other names | m decedent, massachusetts decedent revenue online, how to massachusetts m nra, massachusetts preceding time |

DR

Form

NDA

Name of decedentDate of death (mm/dd/yyyy) Social Security number

3 |

3 |

3 |

|

|

|

Street address |

|

|

|

|

|

City/Town |

State |

Zip |

|

|

|

County of probate court |

Case/Docket number |

|

|

|

|

Name of executor/personal representative |

Designation |

|

|

|

|

Street address |

|

|

|

|

|

City/Town |

State |

Zip |

|

|

|

Name of attorney(s) representing the estate (if any) |

Phone |

|

|

|

|

Street address |

|

|

|

|

|

City/Town |

State |

Zip |

DOMICILE AFFIDAVIT

This affidavit must be submitted in nonresident cases. It must be completed and sworn to by the surviving spouse or member of the immediate family ofthe nonresident decedent having personal knowledge of the facts; or, if such spouse or member of the immediate family does not possess such

knowledge, then it must be submitted by some person having such personal knowledge. The affidavit must also be sworn to and signed by the execu- tor/personal representative or personDRAFThaving actual orascon tructiveofpossessionSeptemberof the property, if any8,. 2016

Every question must be answered. Write “Not applicable” or “None” if necessary. Use additional pages if necessary.

The signator of this document, under penalty of perjury, makes the following statements, based on personal knowledge of the facts set forth herein, for the purpose of establishing the place of decedent’s domicile at the date of death.

1A City/town and state or country where decedent was domiciled at date of death |

1B Year domicile established |

|

|

|

|

2A Place of decedent’s death (attach copy of death certificate): Home, hospital, etc. |

City/town and state or country |

|

|

|

|

2B Place of burial |

2C Date and place of birth |

|

3Your relationship to decedent

4List names and residence addresses of decedent’s surviving spouse and members of immediate family, including children and parents. If none, list brothers and sisters. Attach separate listing if needed.

DECLARATION

k,

Signature of surviving spouse, etc., having personal knowledge of the foregoing |

Date |

|

|

Signature of executor/personal representative or administrator (or person with actual or constructive possession of the property) |

Date |

Mail to: DR, Bx,B

Rev. 6/16

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

FORM |

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Name of decedent |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Date of death (mm/dd/yyyy) |

Social Security number |

||||||||||||||||

3 |

|

|

3 |

|

|

|

|

|

|

|

|

|

|

|

3 |

|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

DOMICILE AFFIDAVIT (cont’d.)

5 Fill in if decedent left a will. Name the court(s) which admitted the will to probate, the case/docket number, date admitted and also the court(s) which allowed ancillary administration. Attach an attested copy of the will and petition for probate of will listing the heirs at law unless filed previously.

6 Fill in if decedent did not leave a will and an executor/personal representative of the estate has been appointed. Name each court which appointed an executor/ personal representative or ancillary administrator and indicate the date of appointment for each. Attach an attested copy of the petition for administration listing the heirsat law unless filed previously.

7 Fill in if decedent ever lived in Massachusetts. If so, state period(s) of Massachusetts residence.

8Indicate the address, nature of decedent’s places of residence (e.g., house rented or owned, apartment, hotel or home of relatives or friends) and lengths of periods outside Massachusetts during the five years preceding death.

9Indicate the address, nature of decedent's places of residence and lengths of periods in Massachusetts during the five years preceding death.

10In which city or town and in what years did the decedent vote or register to vote during the five years preceding death?

11To what state, county or municipality, and in what years, did the decedent pay a tax on income, real estate or intangible property during the last five years?

DRAFT as of September 8, 2016

12For which taxable year did the decedent last file a Massachusetts income tax return?

13A Indicate in which office(s) of the Internal Revenue Service the decedent filed his/her federal income tax returns during the five years preceding death.

13B What was stated therein as the decedent’s residence?

14A Indicate the decedent’s occupation during the five years preceding death.

14B List name and address of employer. If

15 Fill in if decedent applied for a passport during the five years preceding death. List date(s) and place(s) and home address given on application.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

FORM |

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Name of decedent |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Date of death (mm/dd/yyyy) |

Social Security number |

||||||||||||||||

3 |

|

|

3 |

|

|

|

|

|

|

|

|

|

|

|

3 |

|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

DOMICILE AFFIDAVIT (cont’d.)

16 Fill in if decedent at any time during the five years preceding death executed a will, codicil, trust indenture, deed, mortgage, lease or any other document in which decedent was described as a a resident of Massachusetts. Describe such document and indicate what residence address(es) were given therein.

17 Fill in if decedent was party to any legal proceeding in Massachusetts during the five years preceding death. Indicate the tribunal, date and type of action.

18 Fill in if decedent belonged to any church, lodge, or other social, fraternal or religious club or organization in Massachusetts. Indicate name, address, position(s) held, membership status, etc.

19 Fill in if decedent maintained a

20 Fill in if decedent held a Massachusetts driver’s license at any time during the five years preceding death. Indicate dates.

21 Fill in if an automobile was registered in decedent’s name in Massachusetts at any time during the five years preceding death. Indicate dates.

22 Fill in if decedent underwent medical treatment or examinations or was hospitalized in Massachusetts at any time during the five years preceding death. Indicate name(s) and address(es) of attending physician(s) and date(s) admitted or examined.

DRAFT as of September 8, 2016

23 Fill in if decedent listed Massachusetts as home or residence on any government, employment or similar form during the five years preceding death. Provide explanation.

24 Fill in if the question of domicile has been raised in any jurisdiction(s) for any purpose (i.e., income tax) during the five years preceding death. Indicate where and what facts were disclosed and what decision was reached.

25Indicate any other information you wish to submit in support of contention that decedent was not domiciled in Massachusetts at the time of death.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

FORM |

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Name of decedent |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Date of death (mm/dd/yyyy) |

Social Security number |

||||||||||||||||

3 |

|

|

3 |

|

|

|

|

|

|

|

|

|

|

|

3 |

|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

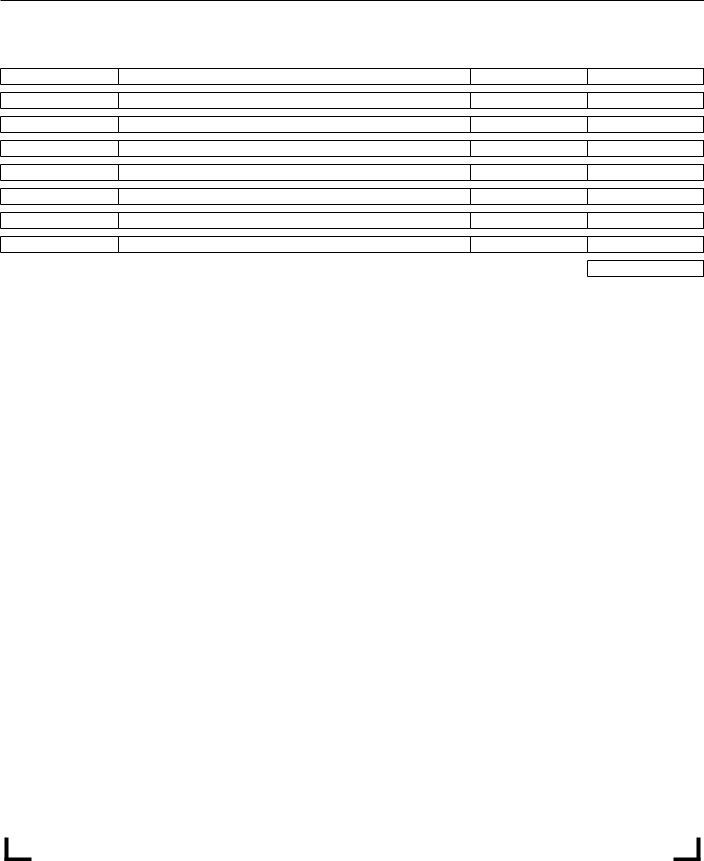

DOMICILE AFFIDAVIT (cont’d.)

26Complete the following schedule, listing gross values of all real and/or tangible personal property having an actual situs in Massachusetts includible in the gross estate. Indicate reference(s) to the July 1999 revision of U.S. Form 706. Do not deduct the value of any mortgage or lien. Attach separate listing if needed.

U

D

Enter the total gross value here and on Form

DRAFT as of September 8, 2016