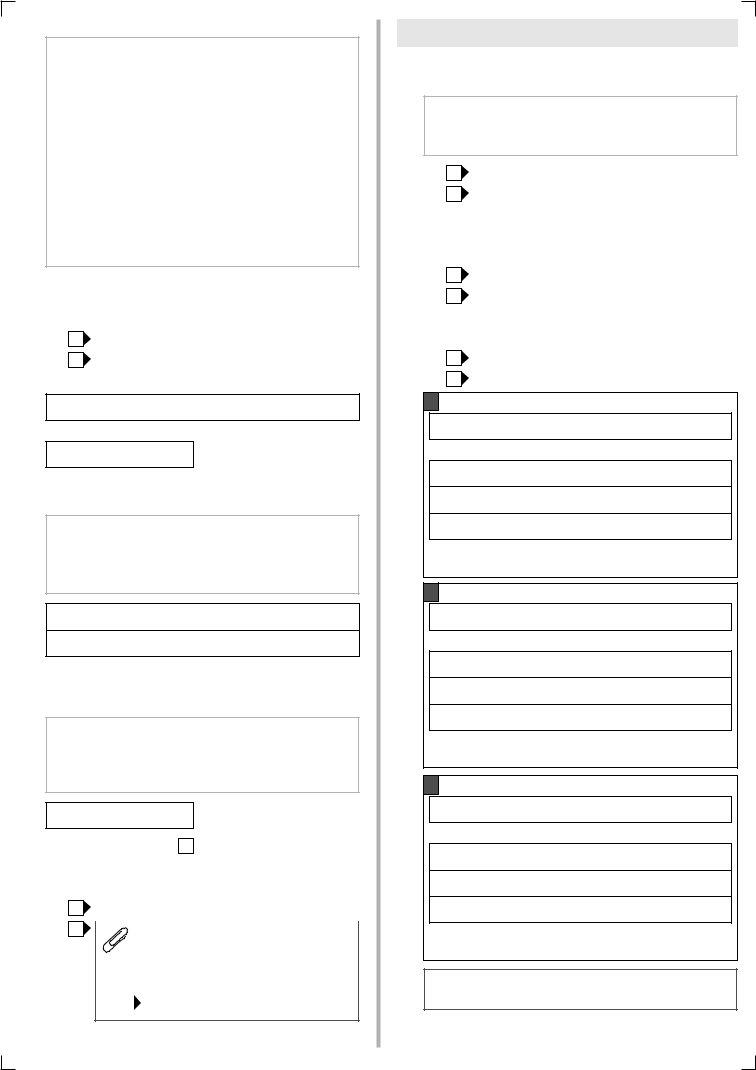

You'll be able to prepare mod pt private trust effortlessly using our PDFinity® PDF editor. FormsPal team is focused on providing you the absolute best experience with our editor by continuously presenting new capabilities and enhancements. Our tool has become much more useful with the newest updates! At this point, filling out documents is a lot easier and faster than before. Getting underway is easy! All that you should do is stick to the next basic steps below:

Step 1: Open the PDF inside our tool by pressing the "Get Form Button" at the top of this webpage.

Step 2: When you launch the PDF editor, you will find the document prepared to be filled out. Besides filling out various blanks, you may as well perform some other things with the Document, such as adding any words, changing the original textual content, inserting illustrations or photos, signing the PDF, and much more.

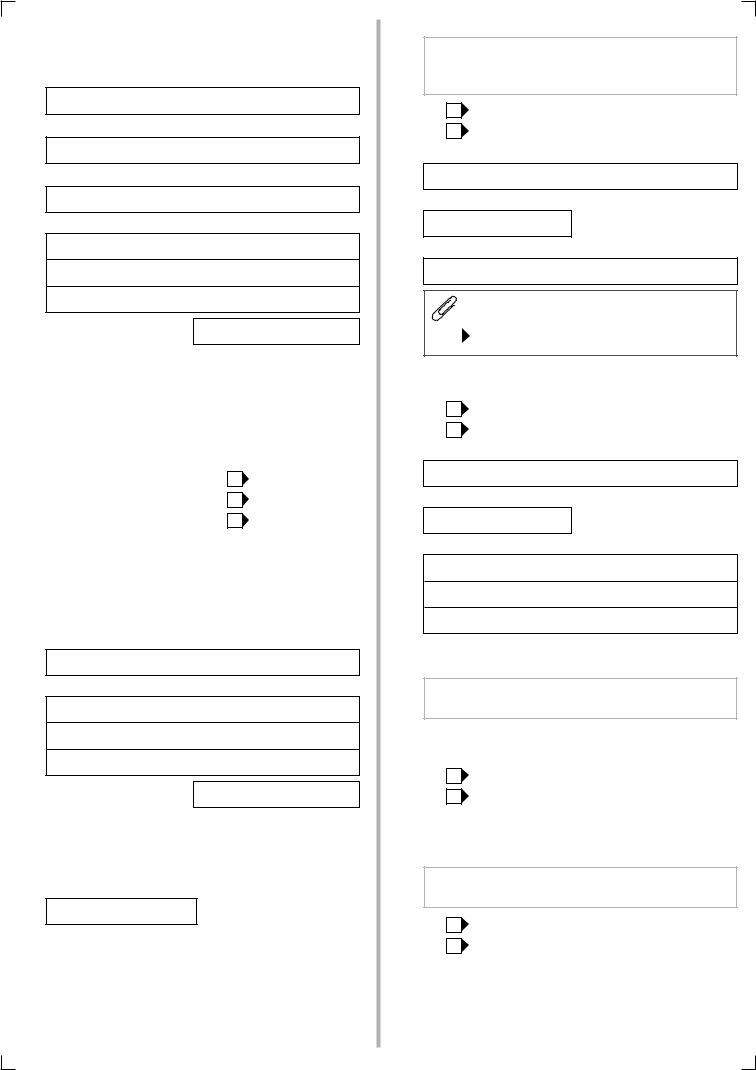

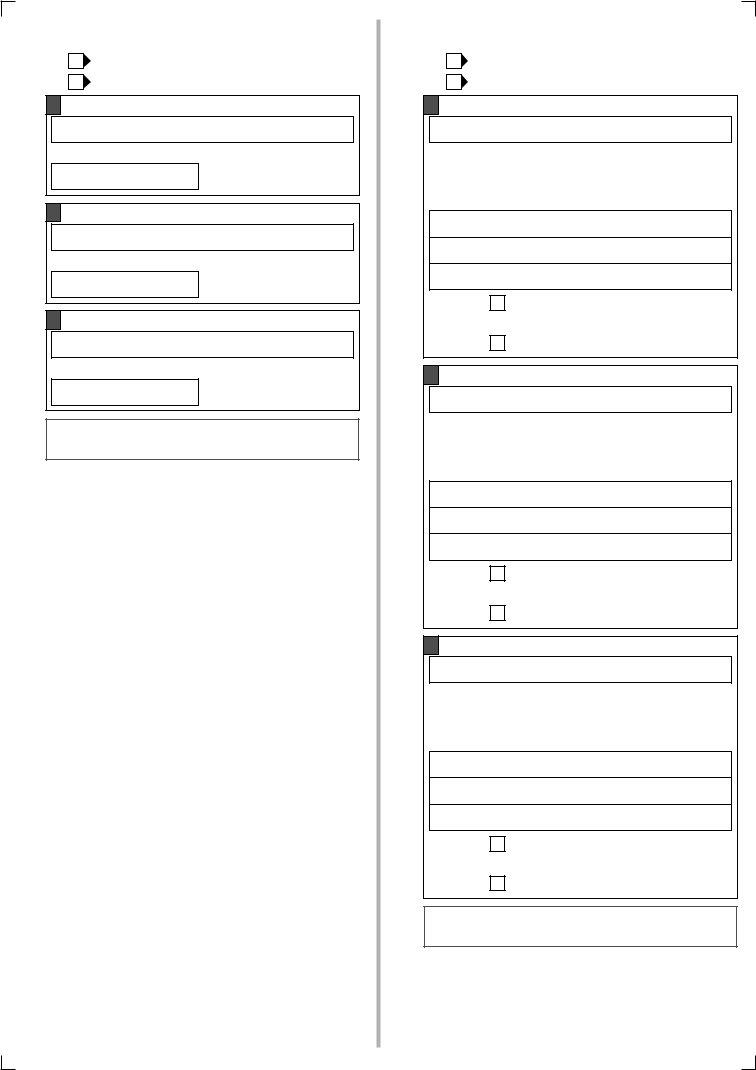

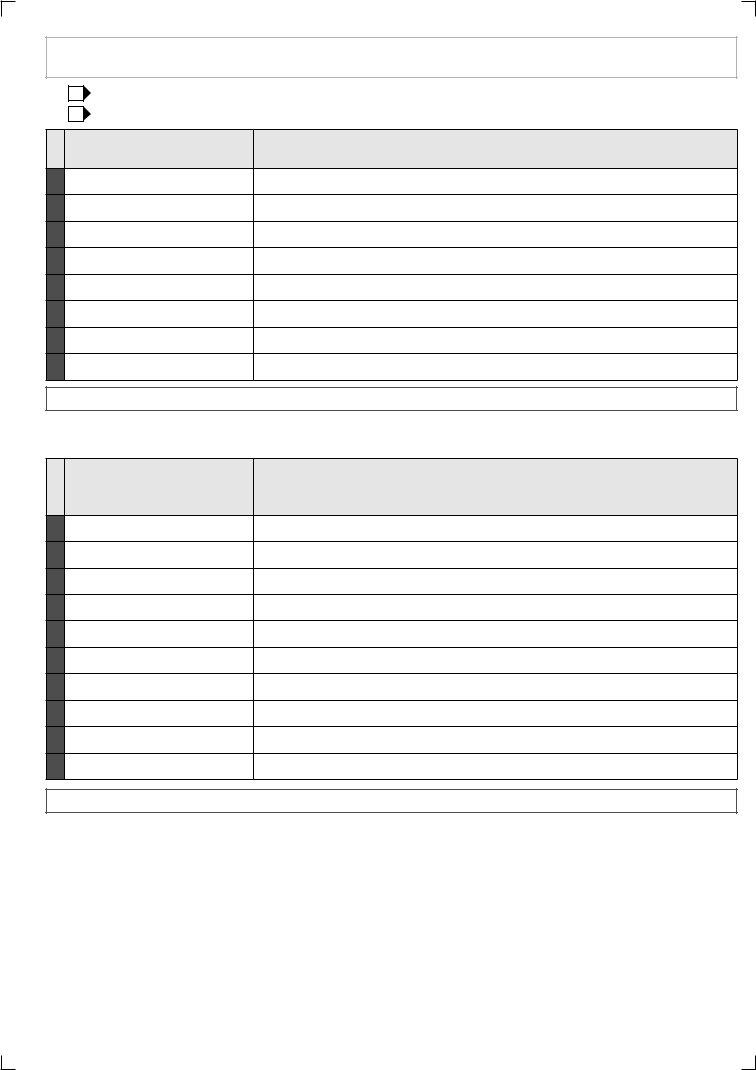

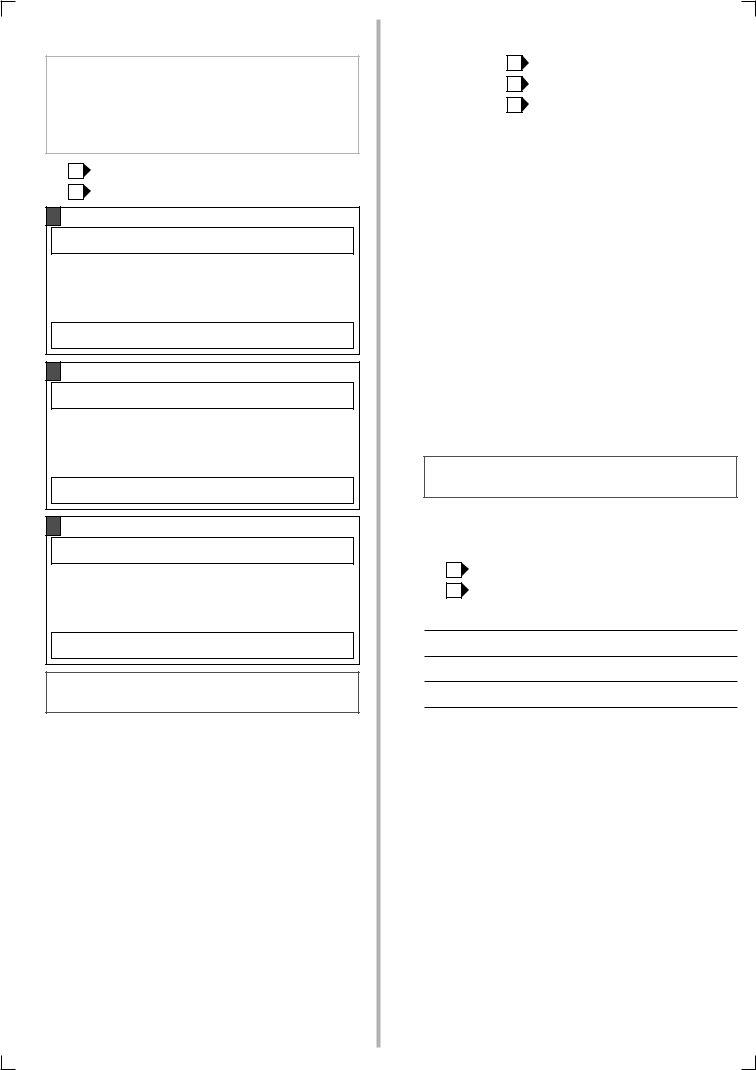

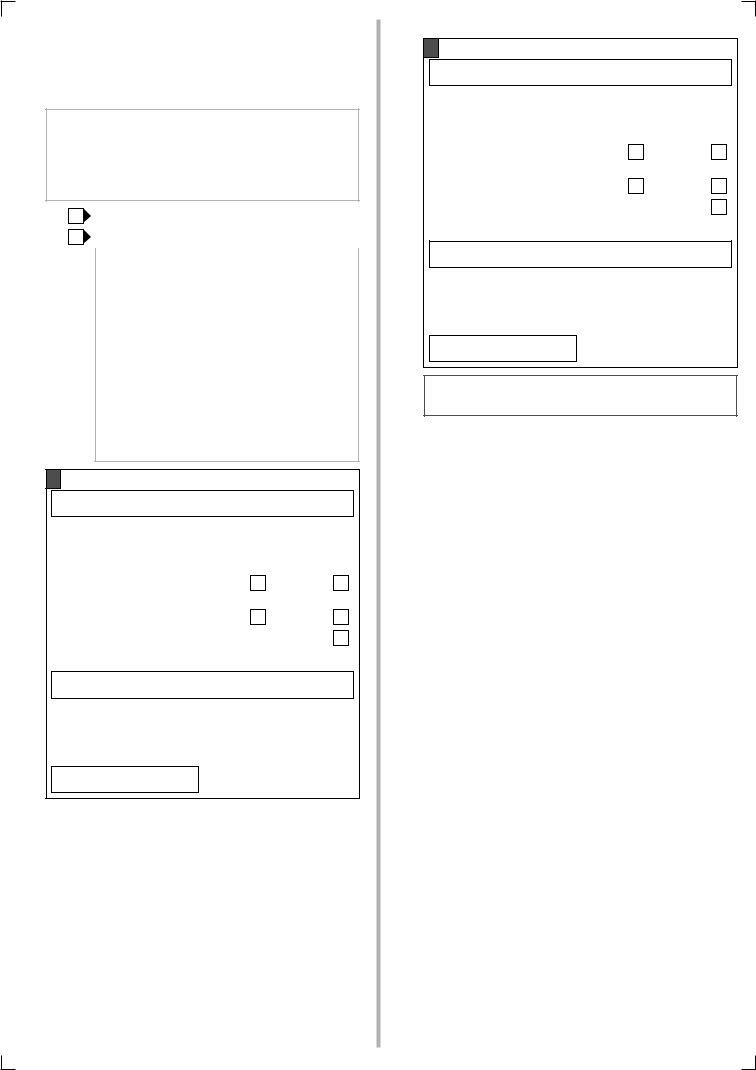

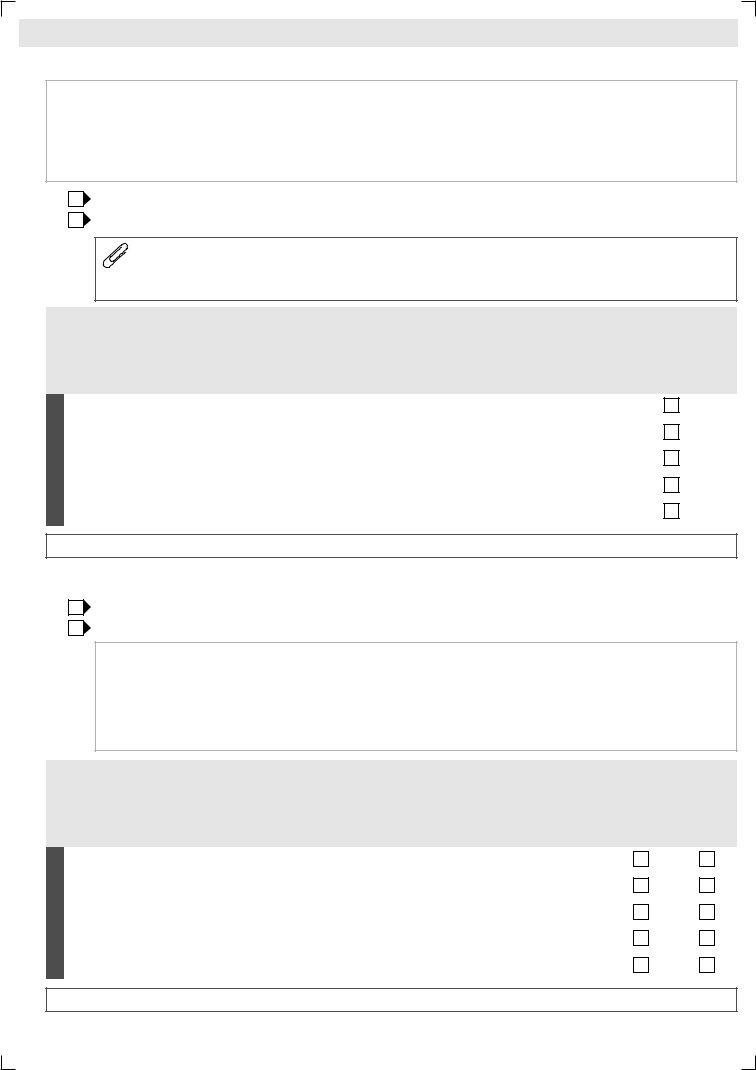

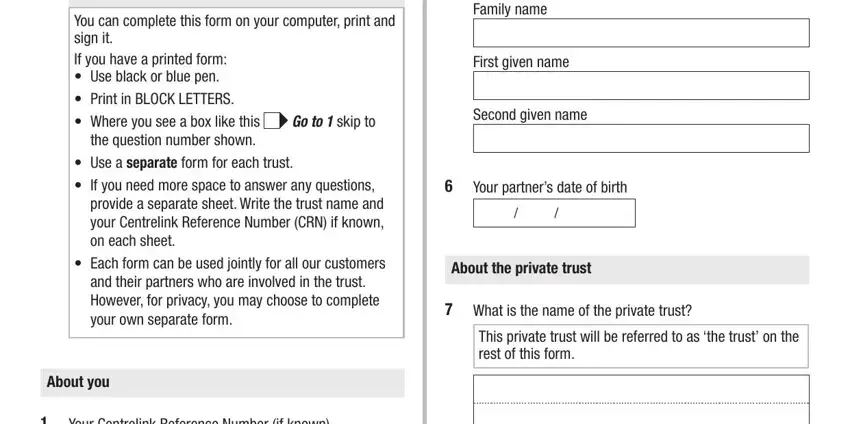

As a way to finalize this PDF form, ensure you type in the right details in each blank field:

1. While filling out the mod pt private trust, be sure to complete all needed blanks in its associated section. This will help to facilitate the work, which allows your information to be processed without delay and properly.

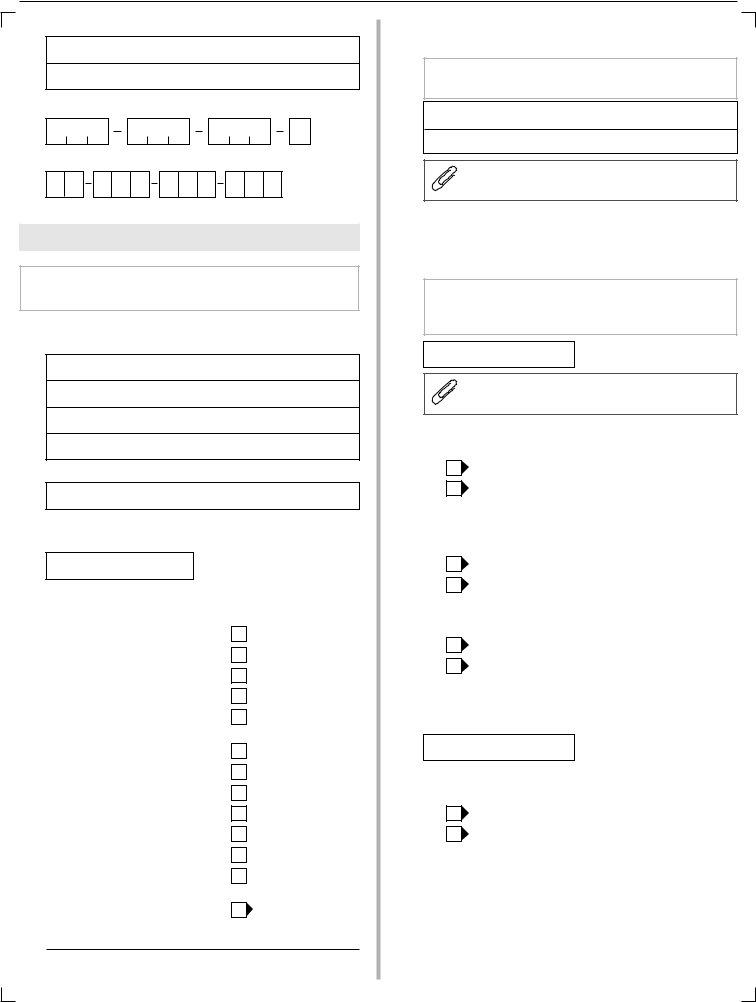

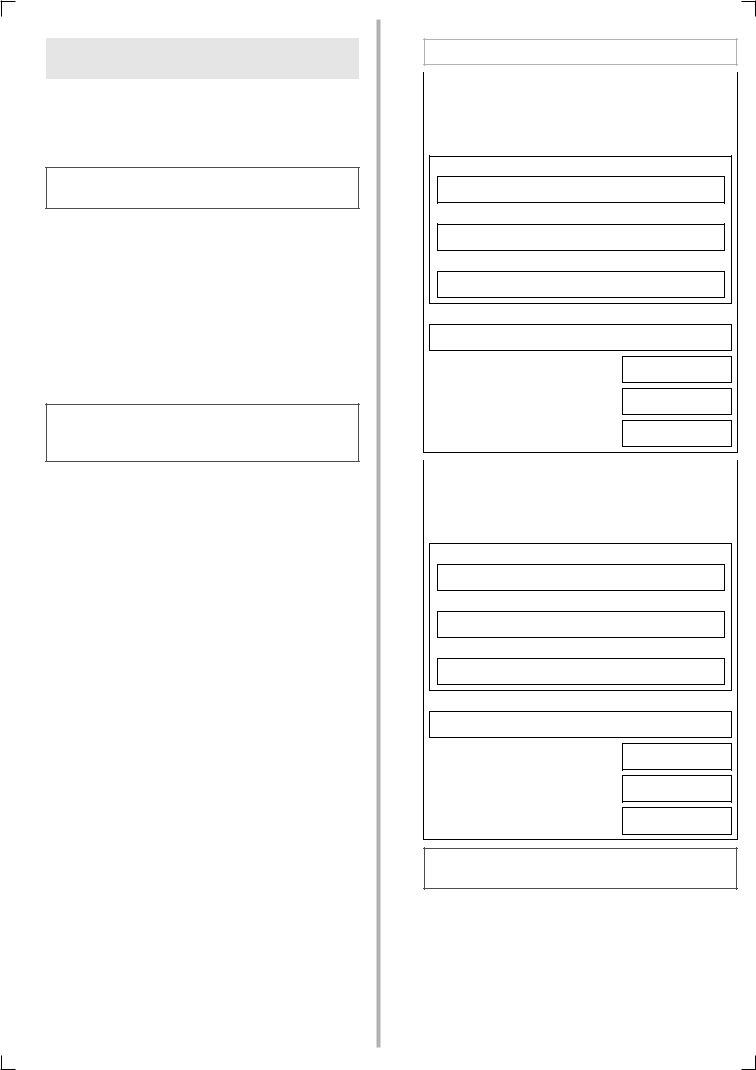

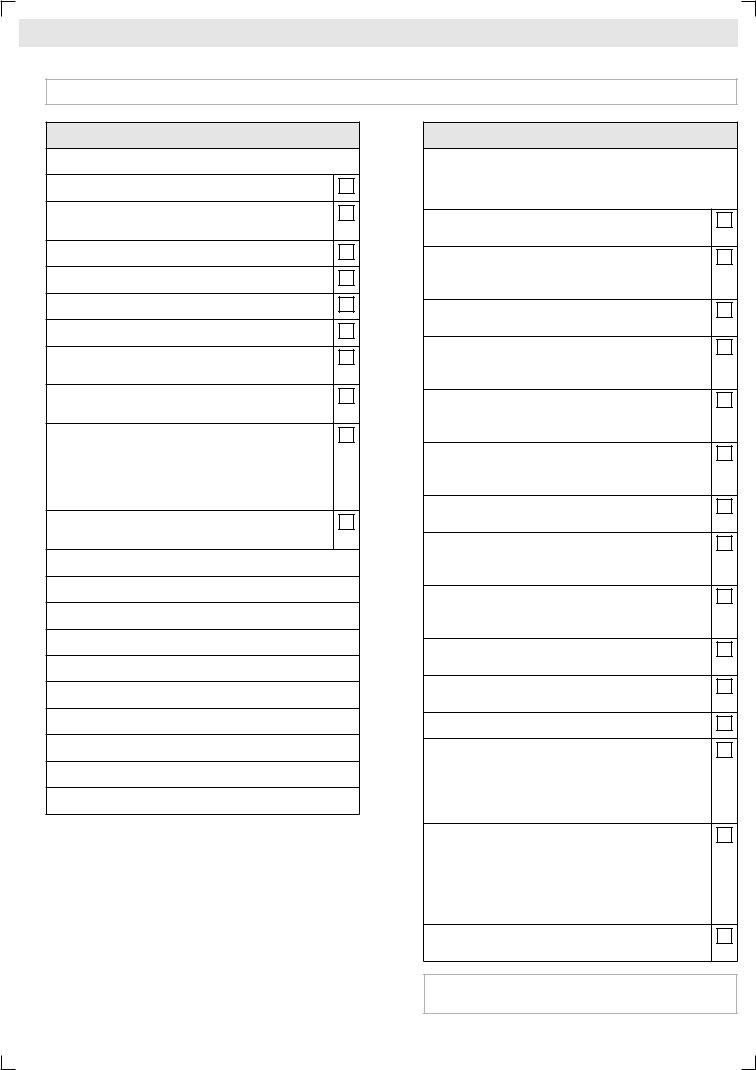

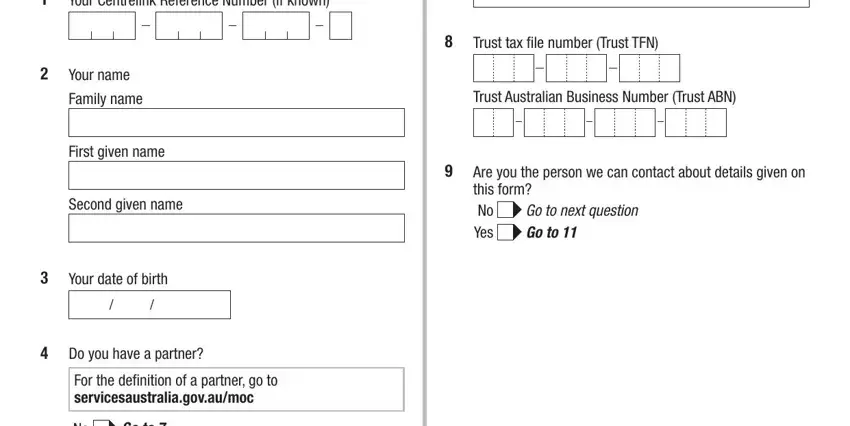

2. When this array of fields is finished, you're ready add the necessary particulars in Trust tax file number Trust TFN, Trust Australian Business Number, Are you the person we can contact, Go to next question, Go to, Your Centrelink Reference Number, Your name, Family name, First given name, Second given name, Your date of birth, Do you have a partner, For the definition of a partner go, No Yes, and Go to so you're able to proceed to the third stage.

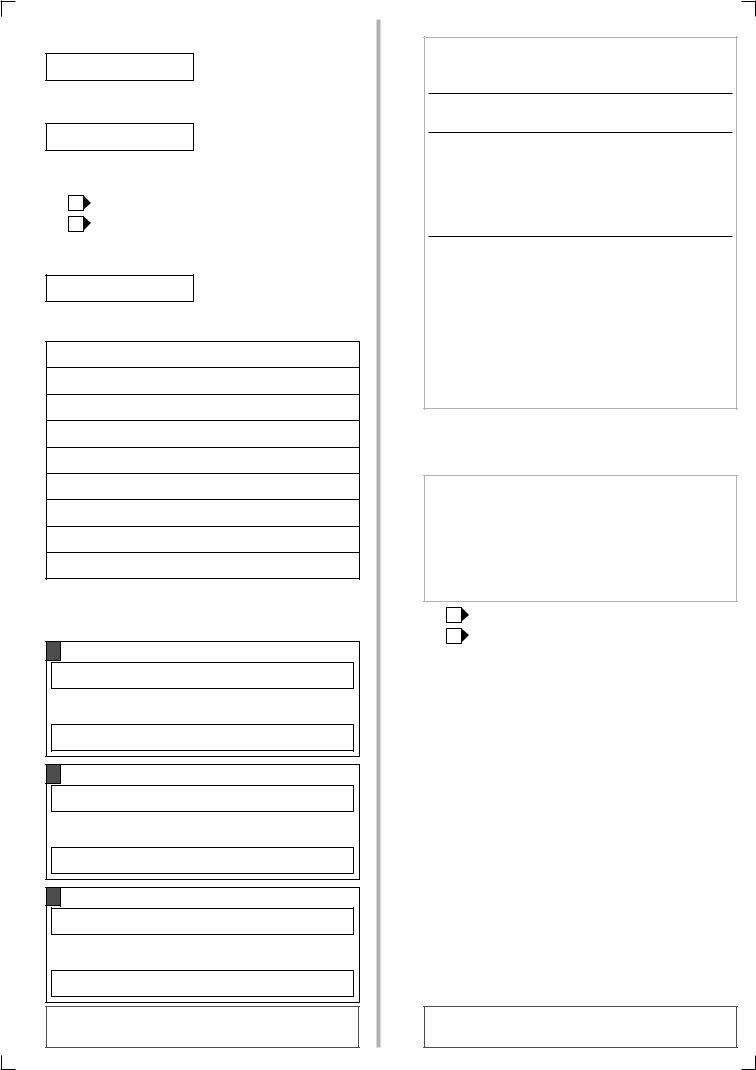

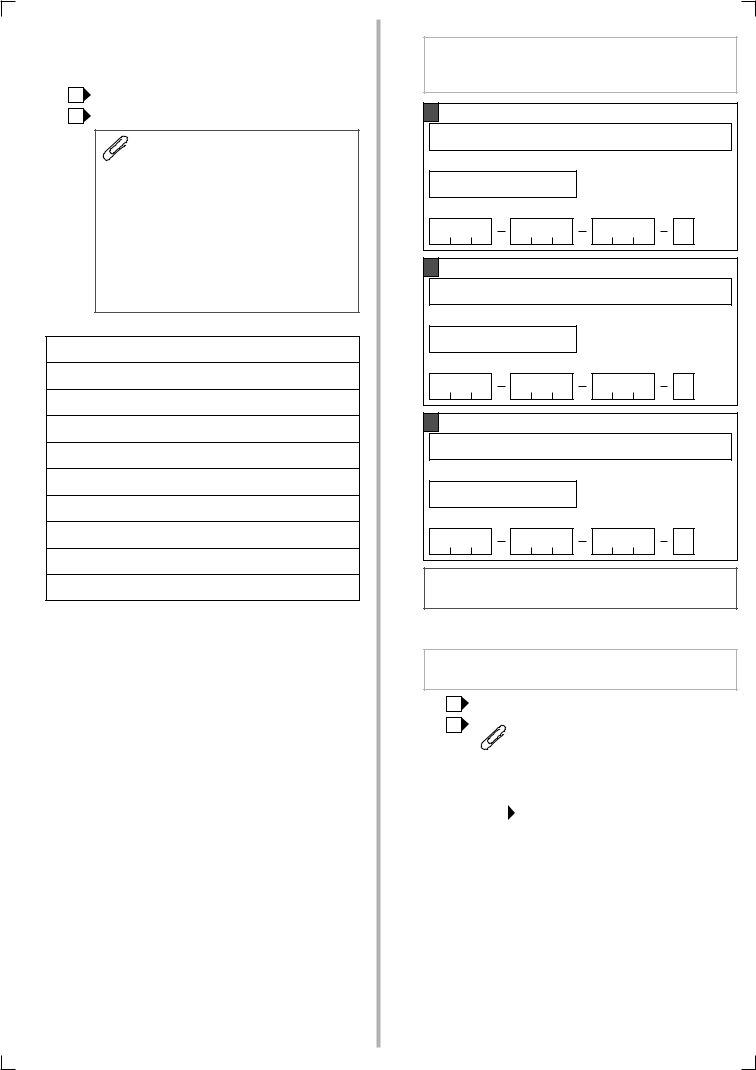

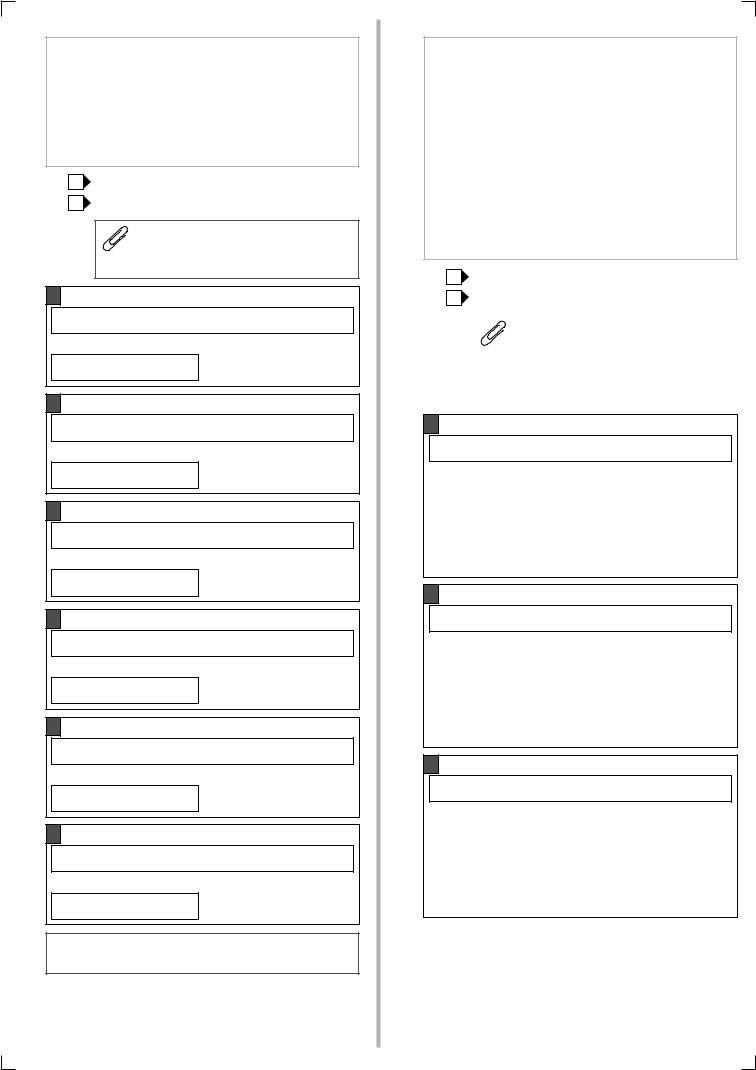

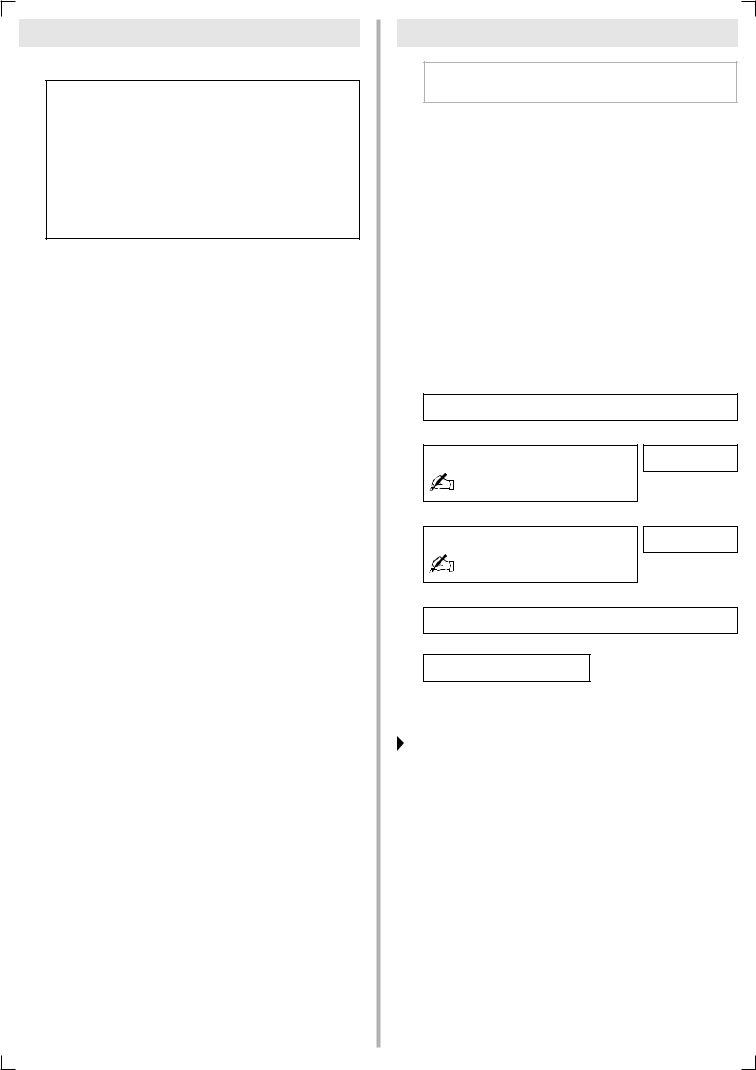

3. The next section should be relatively straightforward, No Yes, Go to, Go to next question, ModPT, and CLKModPT - every one of these blanks will need to be filled in here.

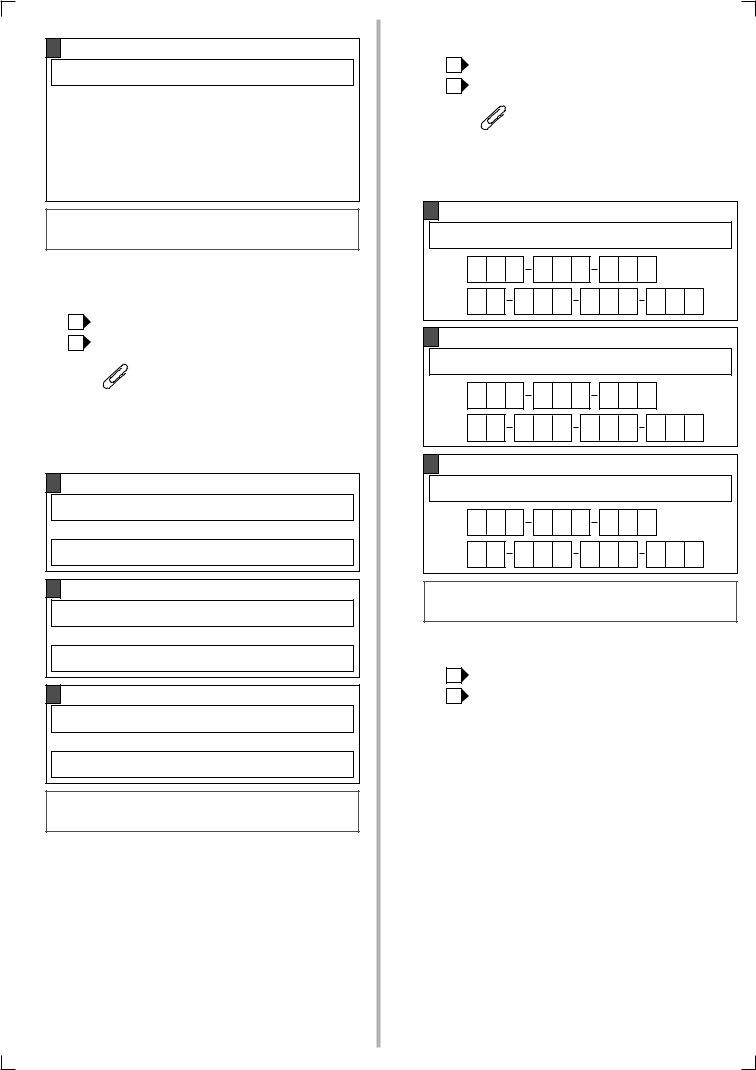

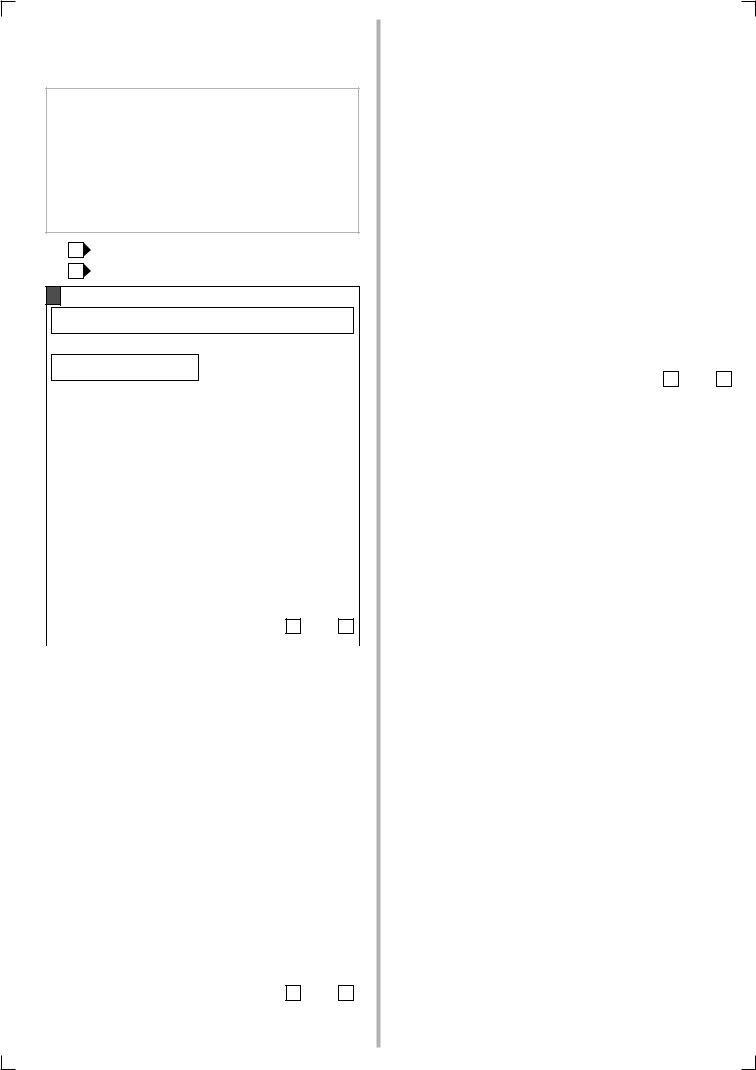

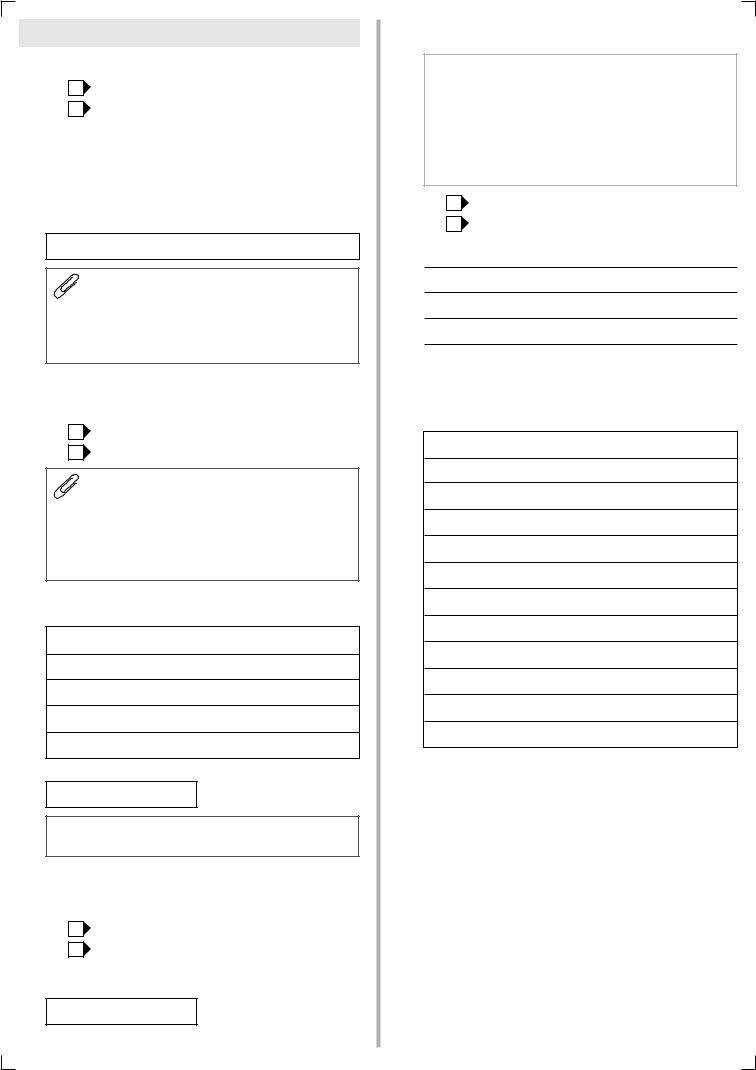

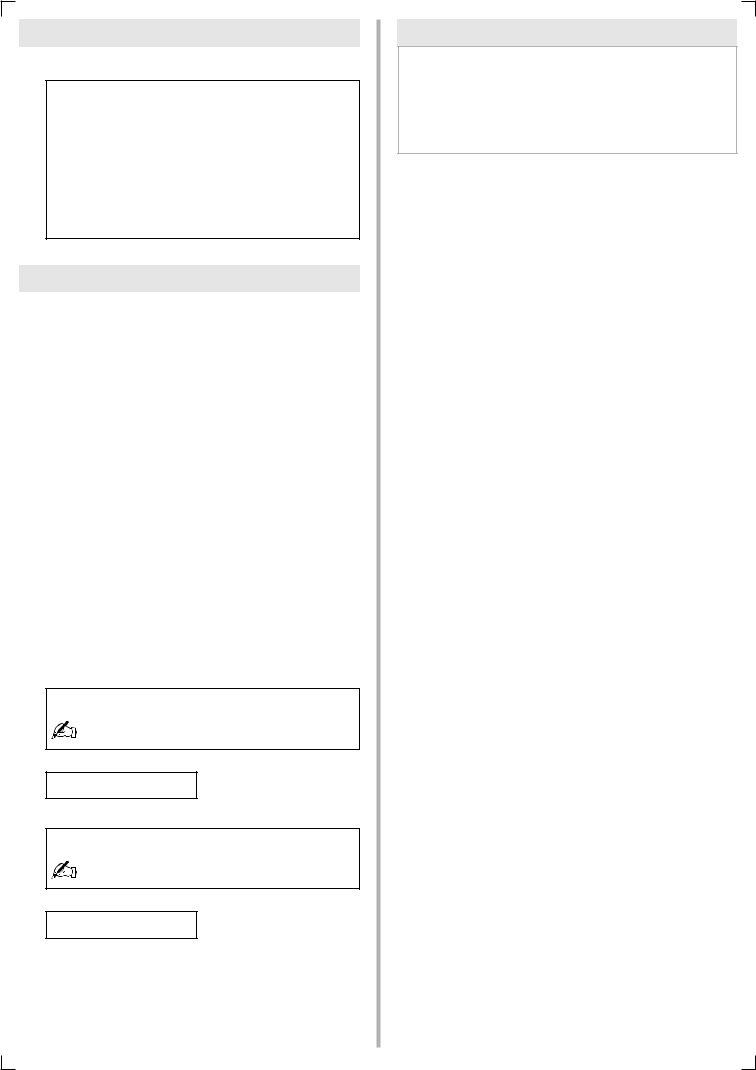

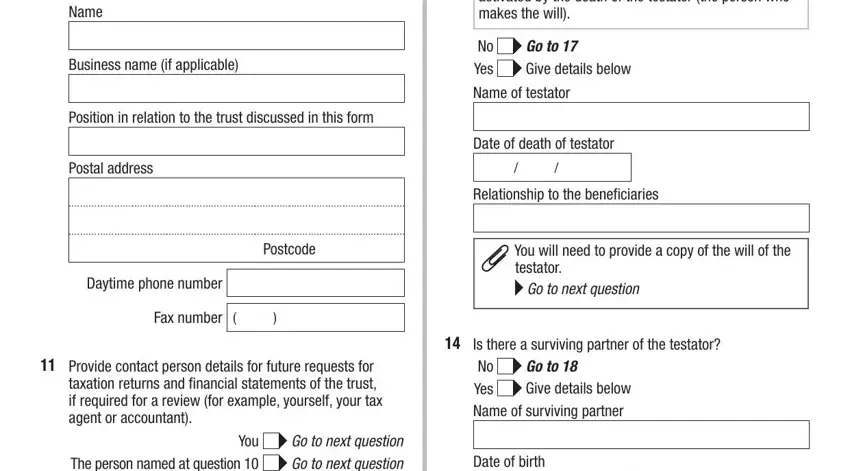

4. To go onward, the following part requires filling in a handful of form blanks. Examples of these are Name, A testamentary trust is one set up, Business name if applicable, Position in relation to the trust, Postal address, No Yes, Go to, Give details below, Name of testator, Date of death of testator, Relationship to the beneficiaries, Postcode, Daytime phone number, Fax number, and You will need to provide a copy of, which are fundamental to moving forward with this particular PDF.

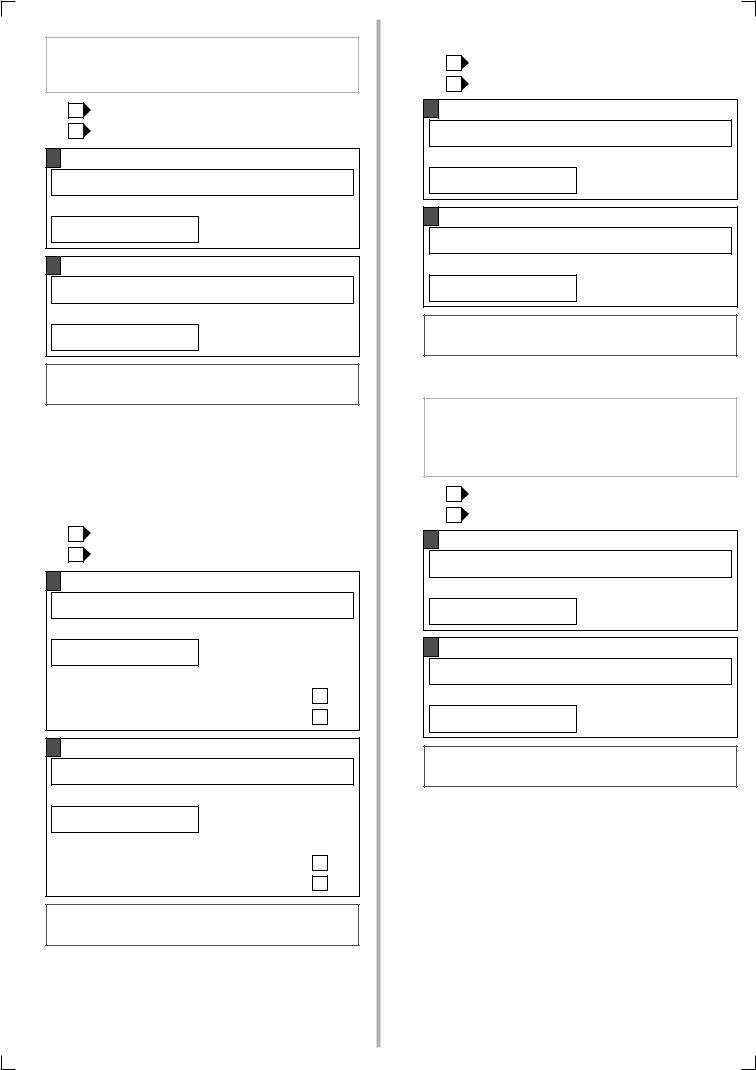

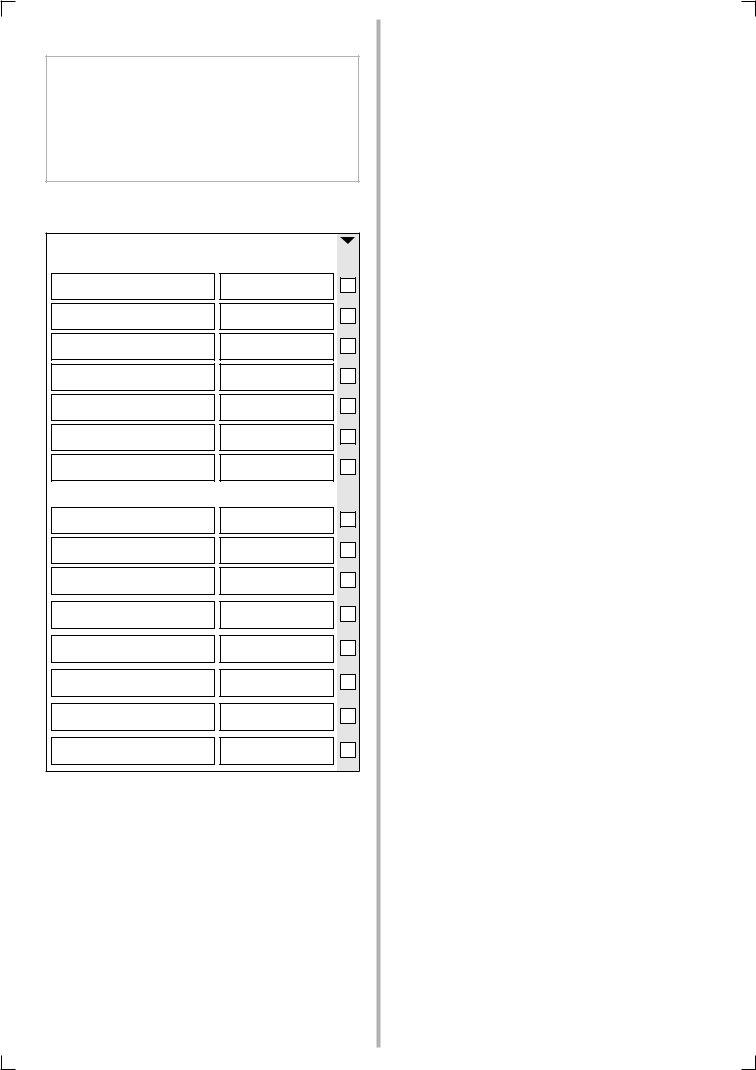

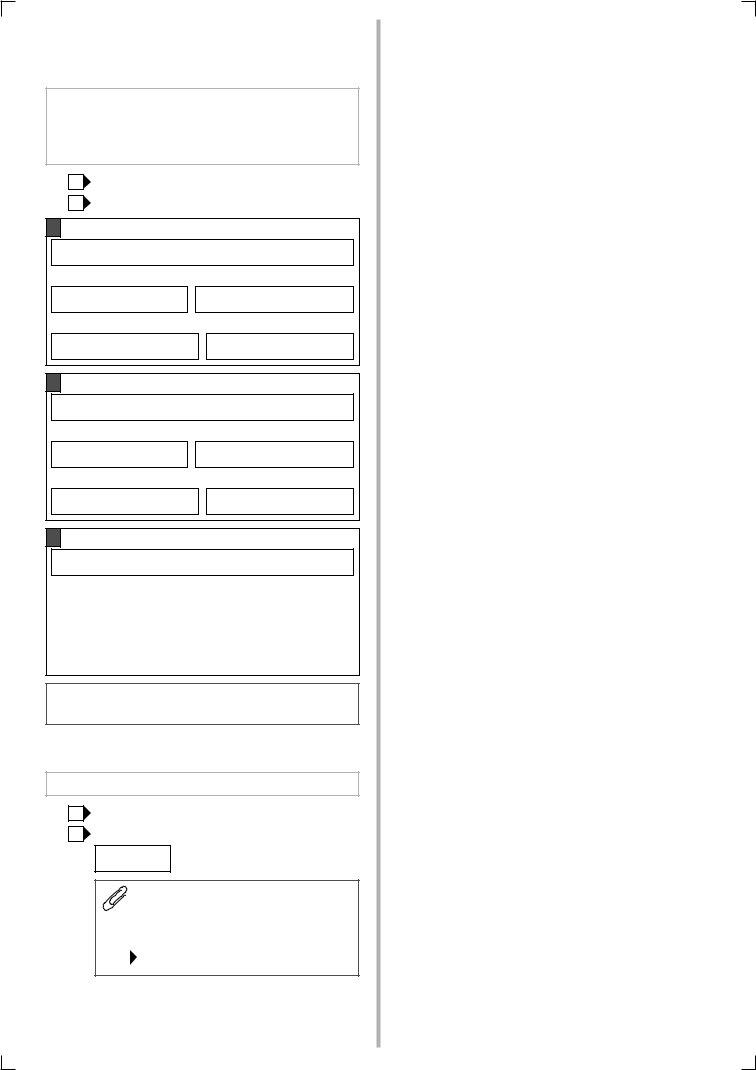

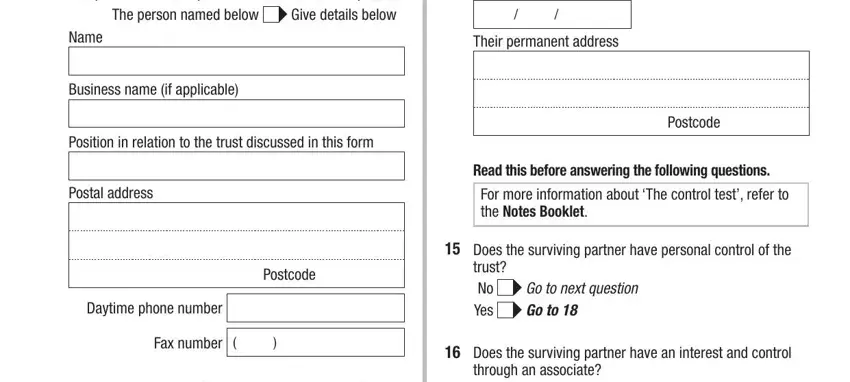

5. To wrap up your document, the last segment involves a couple of additional blank fields. Completing You The person named at question, Go to next question Give details, Name, Their permanent address, Business name if applicable, Position in relation to the trust, Postal address, Postcode, Read this before answering the, For more information about The, Postcode, Daytime phone number, Fax number, Does the surviving partner have, and Go to next question will certainly wrap up the process and you'll certainly be done in a flash!

Regarding Postal address and Does the surviving partner have, be certain that you double-check them here. Those two are definitely the most important ones in this PDF.

Step 3: Before submitting this form, check that all blank fields were filled in right. Once you confirm that it's correct, click “Done." Obtain the mod pt private trust as soon as you sign up for a free trial. Instantly use the pdf within your personal account page, with any edits and adjustments being conveniently saved! When using FormsPal, you can certainly complete documents without being concerned about database incidents or data entries getting distributed. Our protected software ensures that your private data is stored safe.