In the complex landscape of legal and financial obligations arising from judgments and debts, the MC 14 form emerges as a critical document within the Michigan judicial system. Officially designated for garnishee disclosure, this form is anchored in the legal framework provided by 15 USC 1672 and 15 USC 1673, alongside the Michigan Court Rules 3.101. It serves a multifaceted purpose, facilitating communication and compliance among the court, the garnishee, the judgment creditor (plaintiff), and the judgment debtor (defendant). The form meticulously outlines the process and requirements for garnishees, who are third parties in possession of, or owing money to, the debtor, to disclose assets subject to garnishment. This garnishment process can apply to both periodic payments, such as wages, and nonperiodic payments, like bank account funds, with specific instructions on how and when to withhold and remit these funds, prioritizing certain types of garnishments over others. Additionally, the form mandates garnishees to notify all parties involved, including the court, of any withheld or remitted funds, thus ensuring a transparent and orderly process of debt recovery, in adherence to statutory limits and protections. Important too, are the detailed instructions and legal references provided, guiding garnishees through the nuanced procedures required to fulfill their obligations under the writ of garnishment, highlighting this document's role in balancing the rights and responsibilities of all parties involved in garnishment proceedings.

| Question | Answer |

|---|---|

| Form Name | Form Mc 14 |

| Form Length | 3 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 45 sec |

| Other names | garnishees, USC, state of mi form mc14, GARNISHMENTS |

Original - Court |

2nd copy - Garnishee |

1st copy - Plaintiff |

3rd copy - Defendant |

Approved, SCAO

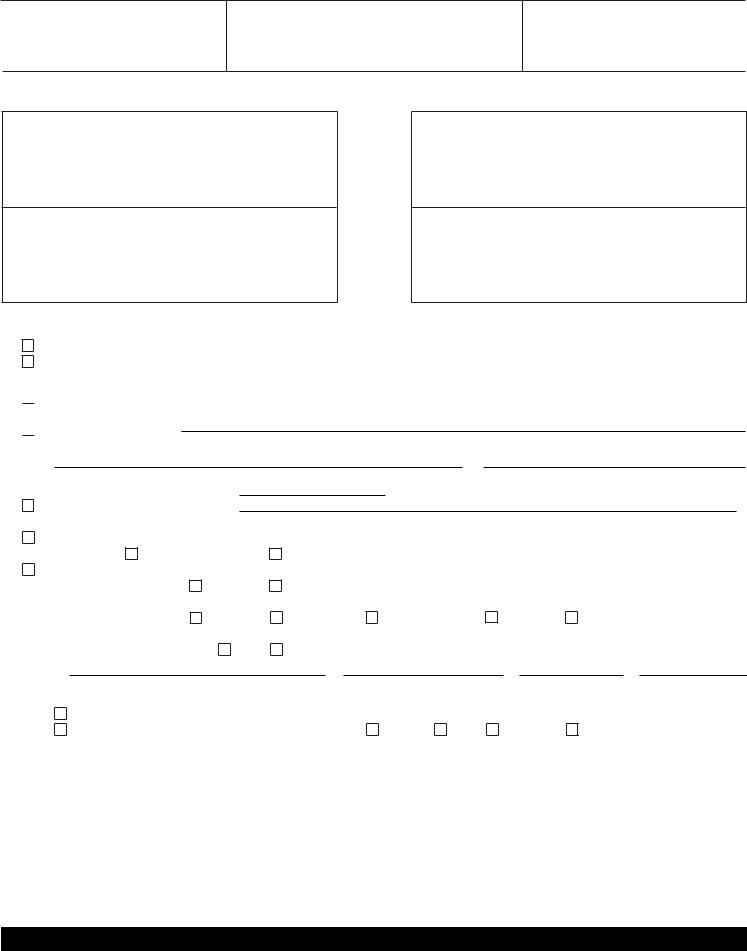

STATE OF MICHIGAN JUDICIAL DISTRICT JUDICIAL CIRCUIT

GARNISHEE DISCLOSURE

CASE NO.

Court address |

Court telephone no. |

Plaintiff name, address, and telephone no. (judgment creditor)

Defendant name, address, and telephone no. (judgment debtor)

v

Plaintiff's attorney, bar no., address, and telephone no.

Garnishee name and address

SEE INSTRUCTIONS ON OTHER SIDE |

|

|

|

|||

1. This disclosure is for a writ of garnishment issued on |

|

and received by garnishee on |

|

. |

||

a. The garnishee mailed or delivered a copy of the writ of garnishment to the defendant on |

|

|

. |

|

||

b. The garnishee was unable to mail or deliver a copy of the writ of garnishment to the defendant. |

|

|

|

|||

2.At the time of service of the writ:

Nonperiodic Garnishments

a. The garnishee is not indebted to the defendant for any amount and does not possess or control the defendant's property, money, etc. Reason:

b. The garnishee is indebted to the defendant for nonperiodic payments as follows:

Description of property, money, negotiable instruments, etc. under garnishee's control |

Type of account and account number, if applicable |

The amount to be withheld is $ c. Withholding is exempt because

and does not exceed the amount stated in item 2 of the writ.

.

Periodic Garnishments |

State the exemption and legal authority |

|

||||

|

|

|

|

|

||

d. The garnishee is not obligated to make periodic payments to the defendant during the effective period. |

|

|||||

Reason: |

not employed. |

other |

|

|

||

e. The garnishee is obligated to make periodic payments to the defendant during the effective period as follows. |

|

|||||

Payments are for |

earnings. |

nonearnings |

. |

|||

|

|

|

|

|

Specify nature of payment (see instructions on other side) |

|

Payments are made |

weekly. |

A higher priority writ/order |

is |

biweekly. |

semimonthly. |

monthly. |

other: |

|

|

|

|

|

frequency of payment |

is not |

currently in effect. If a higher priority writ/order is in effect, complete the following. |

|||

Name of court that issued higher priority writ/order |

Case number |

|

Date issued |

|

Date served |

||

Withholding under this writ |

|

|

|

|

|

|

|

will begin immediately if sufficient funds are available. |

|

|

|

|

|

||

will not begin immediately because defendant is |

laid off. |

sick. |

on leave. |

other: |

|

. |

|

|

|

|

|

|

|

specify |

|

I declare that the statements above are true to the best of my information, knowledge, and belief.

Date |

|

|

Garnishee/Agent/Attorney signature |

|

I certify that: |

|

|

|

|

on |

|

I mailed or personally delivered the original of this disclosure to the court. |

||

on |

|

|

I mailed or personally delivered a copy of this disclosure to the plaintiff/attorney. |

|

on |

|

|

I mailed or personally delivered a copy of this disclosure to the defendant. |

|

|

|

|

|

|

Date |

|

|

Garnishee/Agent/Attorney signature |

|

DO NOT Include Your Payment With This Disclosure. See item 3 of the instructions for details. MC 14 (9/12) GARNISHEE DISCLOSURE

GARNISHEE INSTRUCTIONS

Definitions:

•Periodic payments include wages, earnings, commissions, land contract payments, rent, and other periodic debt or contract payments that are paid to the principal defendant on a periodic basis.

•Nonperiodic payments include bank accounts, other property, money, goods, chattels, credits, negotiable instruments or effects, or earnings in the form of bonuses that are not paid to the principal defendant on a periodic basis. The rest of these intructions do not apply to garnishment of property, which needs to be sold before it can be applied to the judgment.

Responsibility to Disclose:

Within 14 days after being served with the writ of garnishment you must deliver or mail copies of this completed disclosure to the court, plaintiff's attorney (or plaintiff, if no attorney), and defendant. No further disclosures are required.

Withholding Instructions:

1.Determine when funds should be withheld.

a.If item 2b is checked, funds or other property available at the time of service of the writ must be withheld from the defendant from the time of this disclosure.

b.If item 2e is checked, funds must be withheld each time you are indebted to the defendant until the writ expires. Determine the date withholding will begin and end as follows.

1)For garnishees with weekly, biweekly, or semimonthly pay periods, withholding begins with the first full pay period after the writ was served and ends on the last day of the last full pay period before the writ expires.

2)For garnishees on a monthly pay period,

•if the writ is served on the garnishee within the first 14 days of the pay period, withholding begins on the date the writ was served and continues until the writ expires.

•if the writ is served on or after the 15th day of the pay period, withholding begins on the next full pay period after the writ was served and continues until the writ expires.

2.Priority Writs or Orders and Multiple Writs (for periodic garnishments only):

Garnishments with a higher priority than this garnishment of periodic payments are

• |

orders of bankruptcy court. |

• |

orders for past due federal or state taxes. |

• |

income withholding for support of any person. |

• |

other general garnishments served before this writ. |

a.If a higher priority writ/order is currently in effect and withholding is not applicable at this time, you must monitor the garnishment until (1) the higher priority writ expires, (2) the installment payment is set aside, (3) the defendant's wages are sufficient for both writs, or (4) other circumstances change, which make funds available. If this writ has not expired by then, withholding and payment should begin immediately. An amended disclosure is not necessary.

b.If a higher priority writ/order is served on you while this writ is in effect and there is not enough money available for both writs, you must suspend withholding under this writ and inform the plaintiff of that fact. Once the higher priority is paid off, the suspended writ becomes effective again if it has not already expired. No further payments can be withheld on this writ if it expires while a higher priority is in effect.

c.The plaintiff may not file another writ of garnishment of periodic payments for the same defendant, garnishee, and judgment while the existing writ is pending.

3.Determine the amount to be withheld. The amount withheld cannot exceed the amount of the balance of the judgment specified in item 2 of the request.

For periodic garnishment of earnings only, a calculation sheet (the last sheet of this multipart form) is provided to determine the amount to be withheld. You do not need to use this calculation sheet, but if you do, you are not required to file it with the court or provide it to the defendant and plaintiff. However, a record of payment calculations must be maintained and made available for review by the plaintiff, defendant, or court upon request.

Payment Instructions:

Determine when disclosed amounts may be released. Funds available under this writ of garnishment may not be released to the plaintiff or court until 28 days after you were served with the writ. After 28 days, funds must be paid as ordered in this writ unless otherwise notified by the court. No further order to pay will be issued except for garnishments of property other

than money.

For periodic garnishments only. During the first 28 days, payments must be withheld but not paid. After the initial

Final Report Instructions:

A final report of withholding is required for periodic garnishments. Within 14 days after the writ expires or the garnishee is no longer obligated to make periodic payments, the garnishee must file with the court and mail to the plaintiff and defendant a final statement of the total amount paid on the writ. The statement must include the names of the parties, the case number, the total amount paid, and the balance on the writ. Form MC 48 can be used for this.

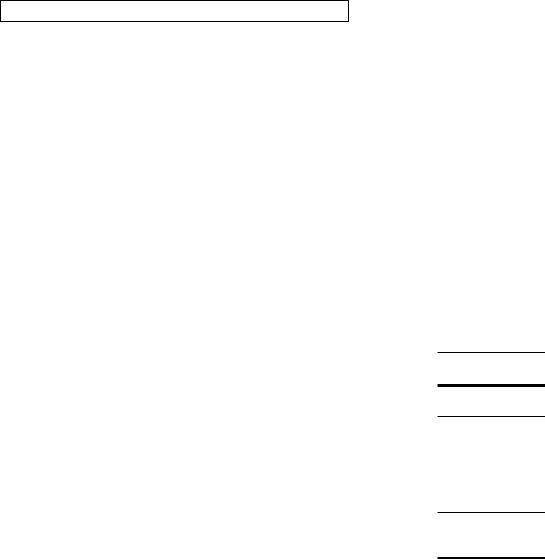

You do not need to use this calculation sheet. If you do, it does not need to be filed with the court or provided to the defendant and plaintiff. However, you must maintain some type of record of your payment calculations and make it available for review by the plaintiff, defendant, or court upon request.

GARNISHEE CALCULATION SHEET FOR EARNINGS

1. The employer's current payday is |

|

. The principal defendant's gross earnings |

|

from the employer that were earned for this pay period are: |

$ |

|

|

2. Deductions required by law to be withheld from gross earnings shown on line 1:

a. Federal withholding tax (for income tax) |

$ |

|

|

b. State withholding tax (for income tax) |

$ |

|

|

c. Employee portion of social security tax |

$ |

|

|

d. Employee portion of medicare tax |

$ |

|

|

e. City withholding tax (for income tax) |

$ |

|

|

f. Public employee retirement when required by law |

$ |

|

|

g. Total (add lines 2a through 2f) |

$ |

||

3. Disposable earnings (subtract line 2g from line 1) |

$ |

||

4. Test I for amount available for garnishment (25% of line 3): |

$ |

||

(this percentage does not apply to garnishments for support of a person) |

|

|

|

5.Test II for amount available for garnishment (disposable earnings minus federal minimum wage multiplied by appropriate multiple for normal pay period):

a. Locate the appropriate figure from the chart below and insert here |

$ |

|

|

b. Subtract amount on line 5a from amount on line 3. Insert amount here. |

$ |

||

If the amount is less than zero, enter |

|

|

|

6. Maximum amount subject to garnishment (line 4 or 5b, whichever is less) |

$ |

||

7.Amounts withheld from disposable earnings (see line 3) pursuant to orders with priority:

a. Orders of bankruptcy court |

$ |

|

|

|

|

|

|

b. Orders for past due federal or state taxes |

$ |

|

|

|

|

|

|

c. Income withholding for support of any person |

$ |

|

|

|

|

|

|

d. Other general garnishments served prior to this writ |

$ |

|

|

|

|

|

|

e. Total of all priority amounts withheld (add lines 7a through 7d) |

$ |

|

|

|

|

|

|

8. Amount subject to garnishment under this writ (subtract line 7e from line 6) |

$ |

|

|

||||

9. Amount to be withheld in response to this writ (line 8 above or line 2 |

|

|

$ |

|

|

||

|

|

|

|

||||

on the request and writ for garnishment, whichever is less) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Chart * |

|

|

|

|

|

|

|

Test II for Amount Available for Garnishment Beginning: |

July 24, 2008 |

July 24, 2009 |

|

|||

|

Weekly (or more frequently) pay period |

$196.50 |

|

$217.50 |

|

|

|

|

Biweekly pay period |

$393.00 |

|

$435.00 |

|

|

|

|

Semimonthly pay period |

$425.75 |

|

$471.25 |

|

|

|

|

Monthly pay period |

$851.50 |

|

$942.50 |

|

|

|

REV. (9/12) |

*Training wage: for person aged 16 to 19 on their first job, use 85% of the above figures. |

|

|||||

|

|

|

|

|

|

|

|