Using the online editor for PDFs by FormsPal, it is easy to fill in or alter form mc 262 here and now. FormsPal professional team is relentlessly endeavoring to improve the editor and enable it to be even easier for people with its handy functions. Unlock an ceaselessly innovative experience now - take a look at and find new opportunities along the way! To start your journey, consider these basic steps:

Step 1: Simply click on the "Get Form Button" in the top section of this page to get into our form editing tool. This way, you will find everything that is necessary to fill out your document.

Step 2: This editor enables you to change your PDF form in a variety of ways. Improve it by writing your own text, correct existing content, and include a signature - all at your fingertips!

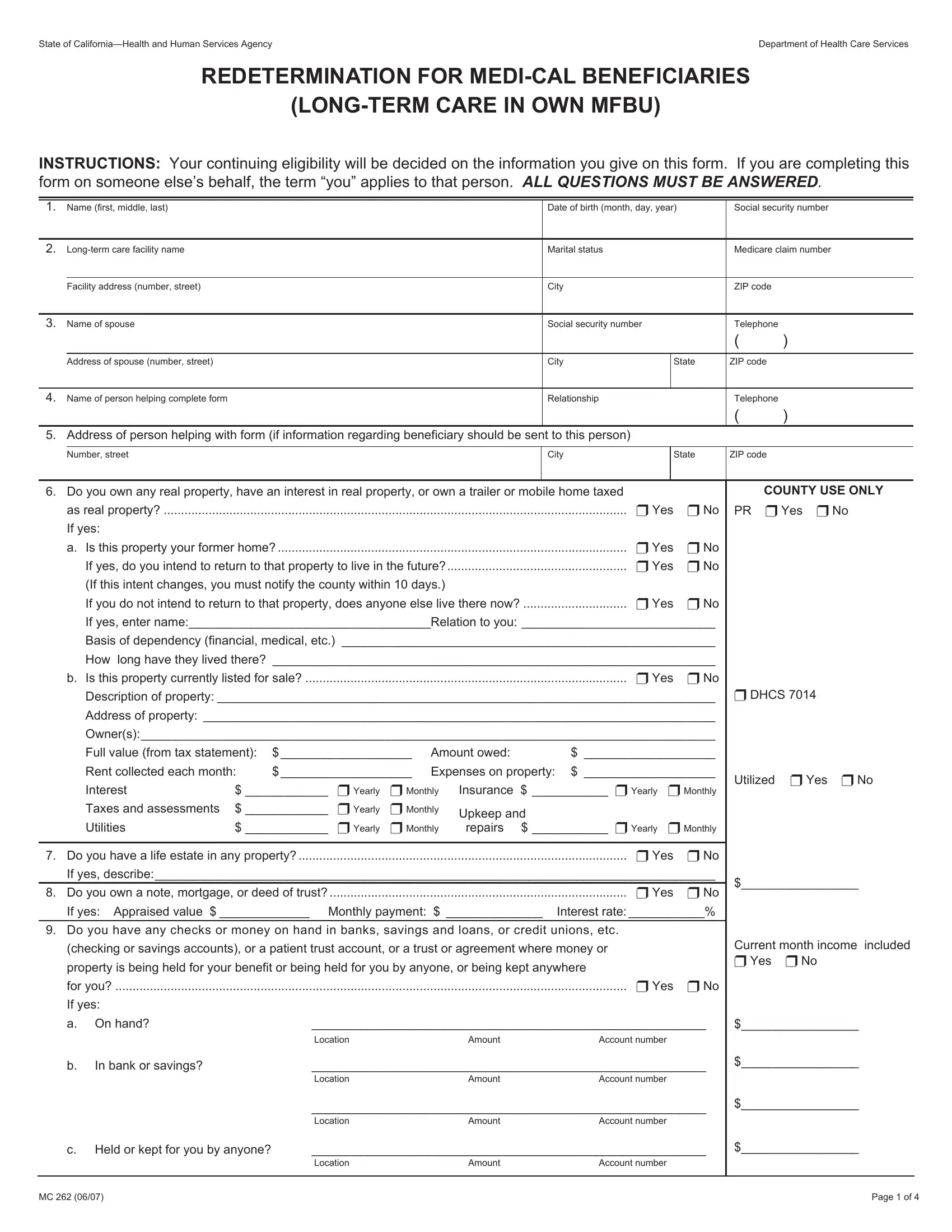

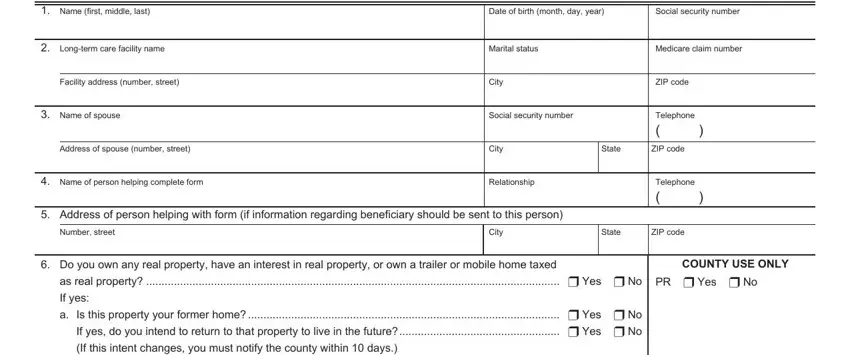

With regards to the blank fields of this precise form, here is what you should do:

1. For starters, while completing the form mc 262, begin with the section that features the following blank fields:

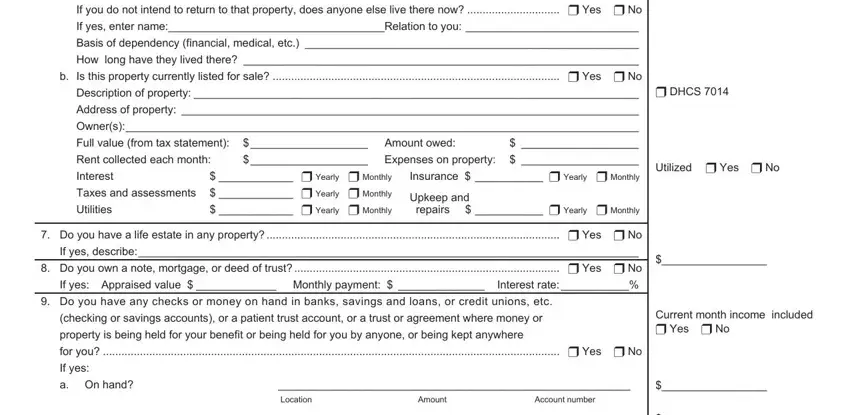

2. The subsequent part is to submit these particular blank fields: as real property u Yes u No If, Basis of dependency financial, How, long have they lived there, b Is this property currently, Address of property, Owners, Full value from tax statement, Rent collected each month, Expenses on property Insurance, u Yearly u Monthly, Interest Taxes and assessments u, u Yearly u Monthly, repairs, and u Yearly u Monthly.

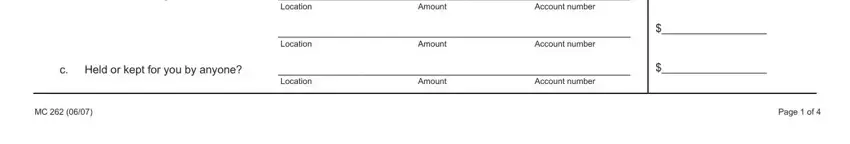

3. This next portion is mostly about In bank or savings, c Held or kept for you by anyone, Location, Account number, Amount, Location, Account number, Amount, Location, Account number, Amount, and MC Page of - type in each of these blank fields.

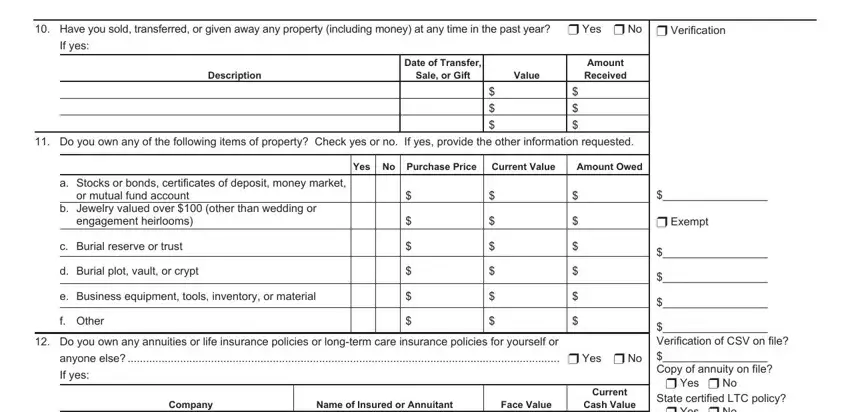

4. This next section requires some additional information. Ensure you complete all the necessary fields - Have you sold transferred or, u Verification, If yes, Description, Date of Transfer, Sale or Gift, Value, Amount Received, Do you own any of the following, Check yes or no, If yes provide the other, Yes No Purchase Price Current Value, Amount Owed, a Stocks or bonds certificates of, and or mutual fund account - to proceed further in your process!

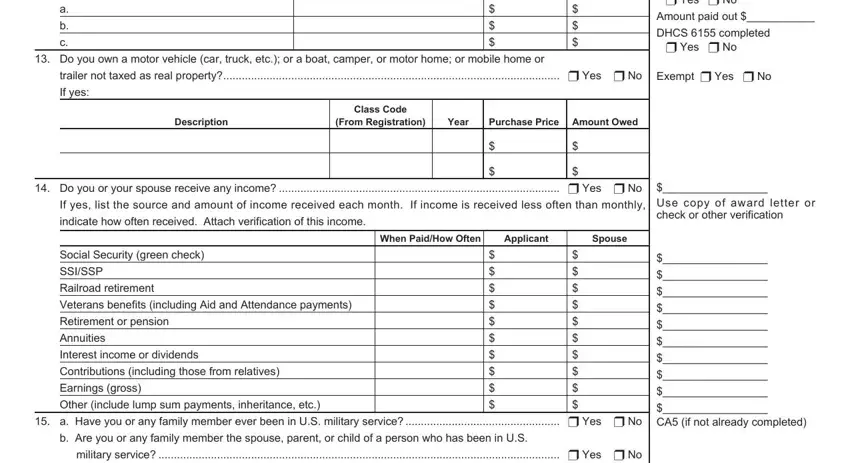

5. While you get close to the finalization of this form, you'll notice just a few more requirements that must be fulfilled. Particularly, Do you own a motor vehicle car, trailer not taxed as real property, Description, From Registration, Year, Purchase Price Amount Owed, Class Code, u Yes u No, Amount paid out, DHCS completed, u Yes u No, Exempt u Yes u No, Do you or your spouse receive any, If yes list the source and amount, and indicate how often received must all be filled out.

As to Do you own a motor vehicle car and DHCS completed, make certain you do everything right in this section. These two could be the key fields in the page.

Step 3: Check the information you have entered into the form fields and click the "Done" button. Right after starting afree trial account at FormsPal, it will be possible to download form mc 262 or email it directly. The PDF document will also be at your disposal via your personal cabinet with all your modifications. FormsPal offers secure document tools without personal data record-keeping or any kind of sharing. Feel comfortable knowing that your data is secure here!