Our top level developers worked hard to build the PDF editor we're proud to present to you. This app makes it possible to simply fill out michigan 1040es and saves precious time. You just need to comply with this particular instruction.

Step 1: Hit the "Get Form Now" button to begin the process.

Step 2: At the moment, you can alter your michigan 1040es. The multifunctional toolbar makes it easy to insert, eliminate, change, highlight, and do other sorts of commands to the words and phrases and fields inside the document.

Prepare all of the following parts to create the form:

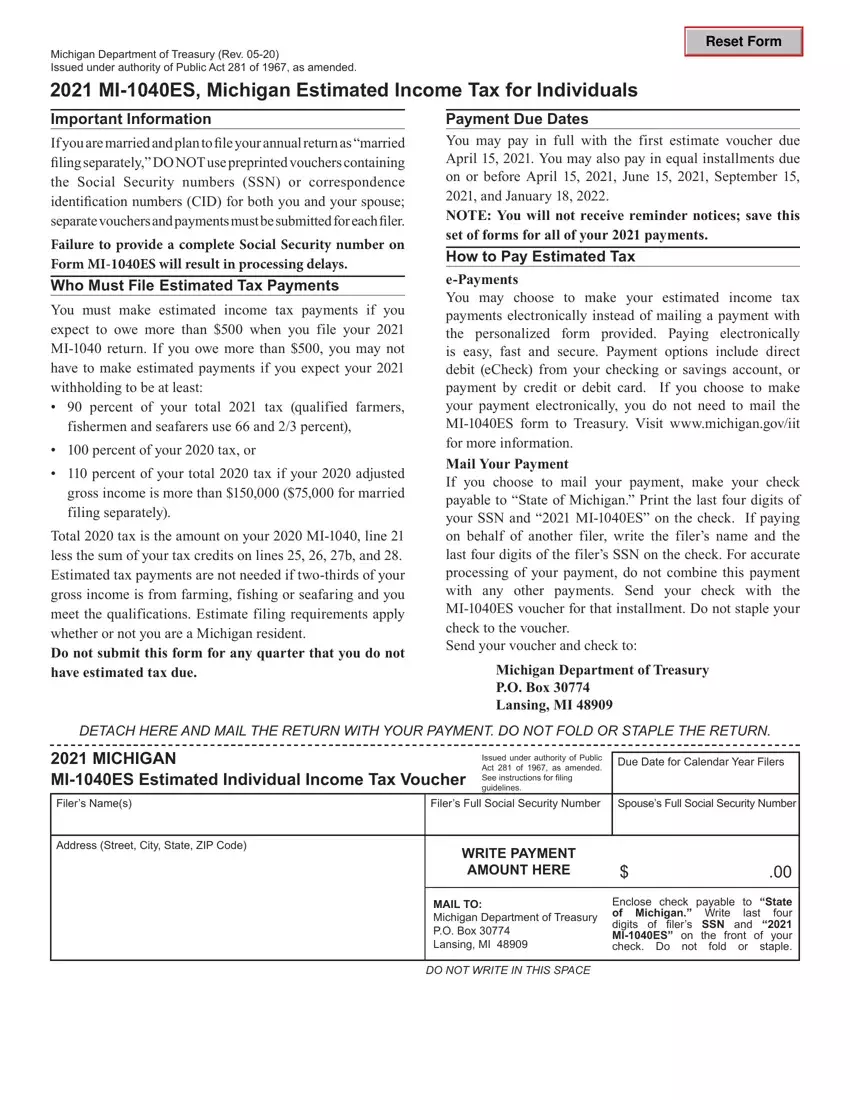

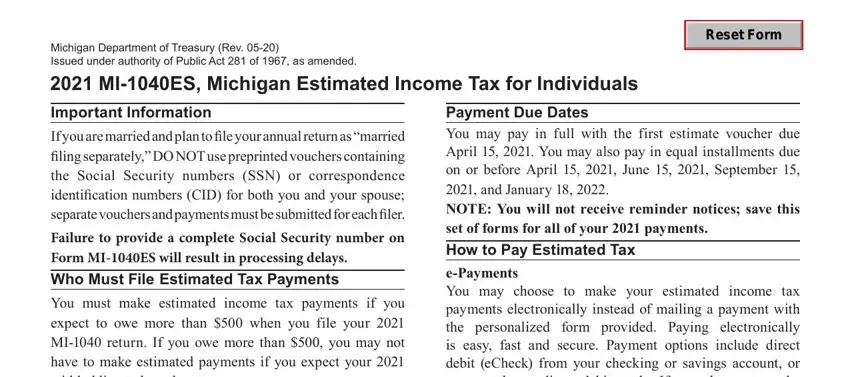

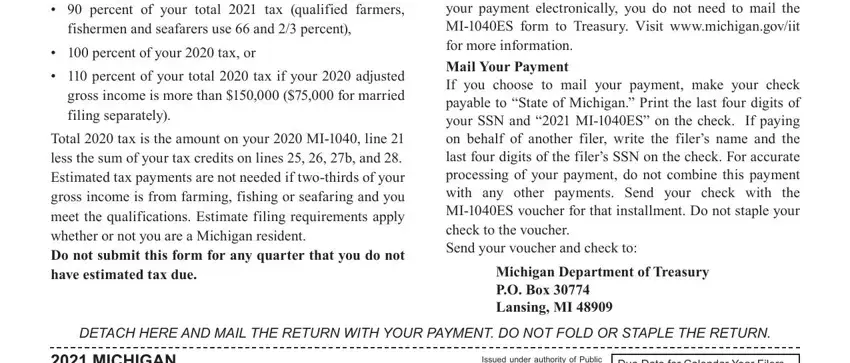

Please put down your data inside the area You must make estimated income tax, fishermen and seafarers use and, percent of your tax or, percent of your total tax if, Total tax is the amount on your, How to Pay Estimated Tax ePayments, Michigan Department of Treasury PO, DETACH HERE AND MAIL THE RETURN, MICHIGAN MIES Estimated, Issued under authority of Public, and Due Date for Calendar Year Filers.

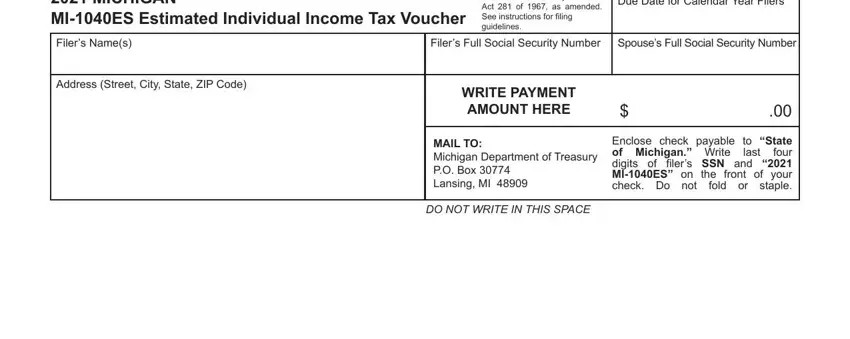

It's important to provide specific information within the segment MICHIGAN MIES Estimated, Issued under authority of Public, Due Date for Calendar Year Filers, Filers Names, Filers Full Social Security Number, Address Street City State ZIP Code, WRITE PAYMENT AMOUNT HERE, MAIL TO Michigan Department of, Enclose check payable to State of, last, and DO NOT WRITE IN THIS SPACE.

Step 3: Choose the Done button to save your file. So now it is readily available for transfer to your electronic device.

Step 4: To prevent all of the complications as time goes on, try to generate at the very least a couple of duplicates of your form.