You'll be able to fill out mo easily using our PDFinity® editor. The editor is consistently updated by our staff, acquiring awesome features and becoming even more versatile. All it takes is several simple steps:

Step 1: Press the "Get Form" button at the top of this webpage to get into our tool.

Step 2: With our online PDF tool, you'll be able to do more than simply fill out blanks. Try all the features and make your forms seem professional with custom text put in, or tweak the file's original input to excellence - all that supported by the capability to insert any type of pictures and sign the PDF off.

It really is simple to complete the form using this detailed guide! Here is what you need to do:

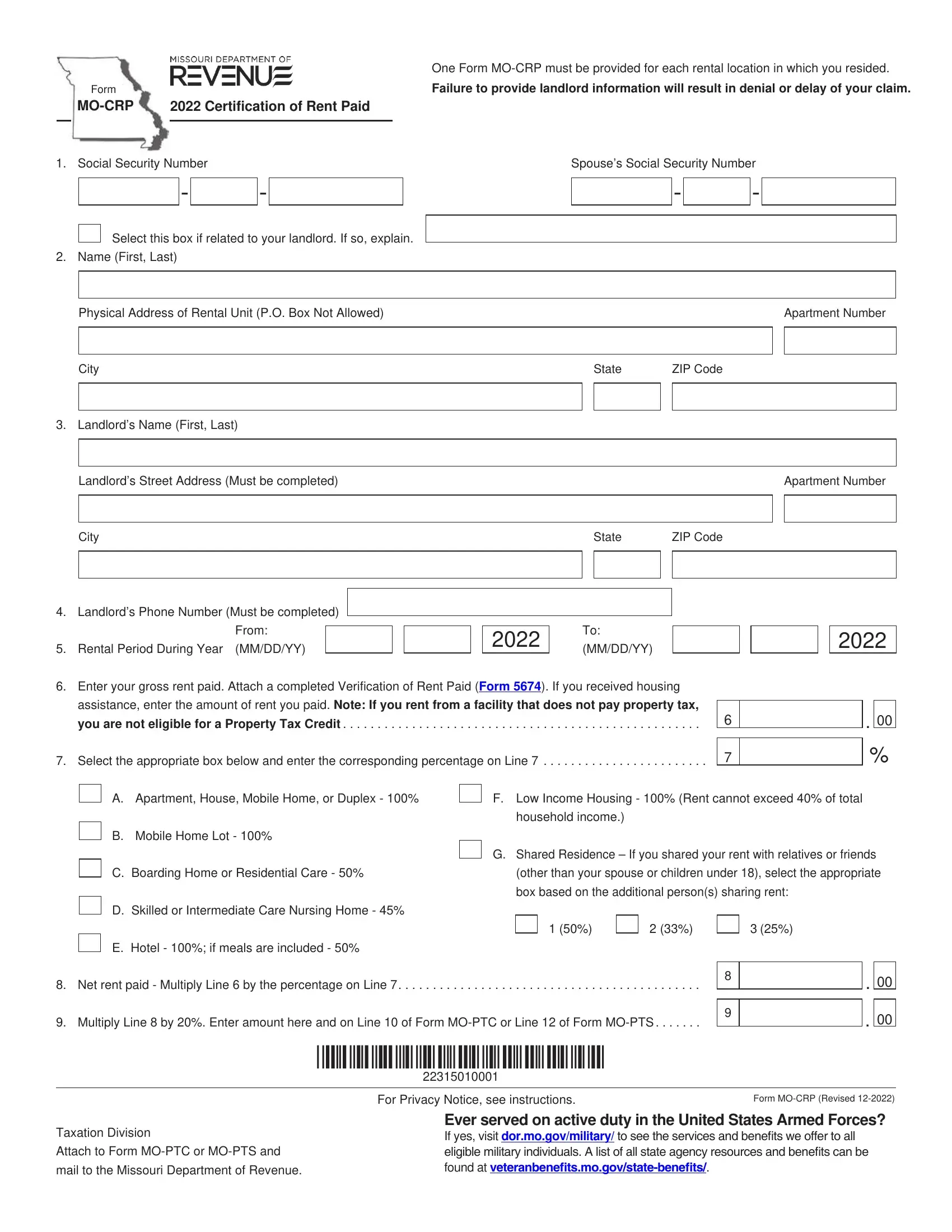

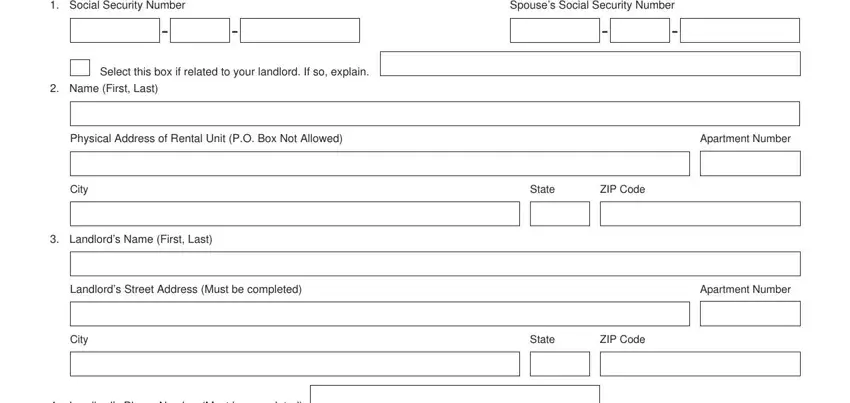

1. When filling in the mo, make certain to include all necessary blank fields in the relevant part. It will help to expedite the work, enabling your information to be processed efficiently and accurately.

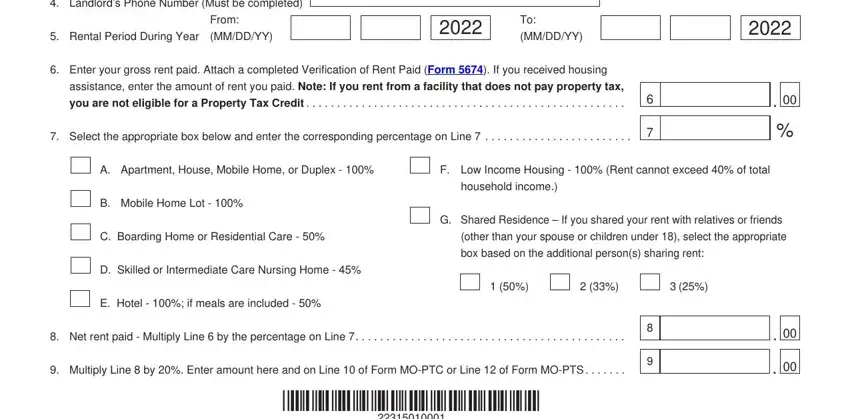

2. Given that the previous part is done, you should put in the necessary details in Landlords Phone Number Must be, Rental Period During Year, MMDDYY, From, MMDDYY, Enter your gross rent paid Attach, assistance enter the amount of, you are not eligible for a, Select the appropriate box below, A Apartment House Mobile Home or, F Low Income Housing Rent cannot, household income, B Mobile Home Lot, C Boarding Home or Residential, and D Skilled or Intermediate Care in order to progress to the 3rd step.

As for Select the appropriate box below and assistance enter the amount of, be certain you do everything properly here. The two of these are thought to be the key fields in the document.

Step 3: When you have glanced through the information in the fields, click "Done" to complete your document creation. Right after getting a7-day free trial account with us, it will be possible to download mo or send it via email promptly. The PDF will also be easily accessible from your personal account with your each and every modification. FormsPal is invested in the personal privacy of our users; we make sure that all personal information entered into our tool stays confidential.