You can work with mo mwp without difficulty with the help of our online PDF editor. The tool is consistently maintained by our team, acquiring useful features and growing to be even more convenient. Here's what you'll have to do to get started:

Step 1: Firstly, open the pdf tool by clicking the "Get Form Button" at the top of this site.

Step 2: Once you access the PDF editor, you will get the form all set to be filled out. Apart from filling out different blank fields, you may also do many other things with the PDF, particularly writing your own textual content, modifying the initial text, adding illustrations or photos, affixing your signature to the PDF, and much more.

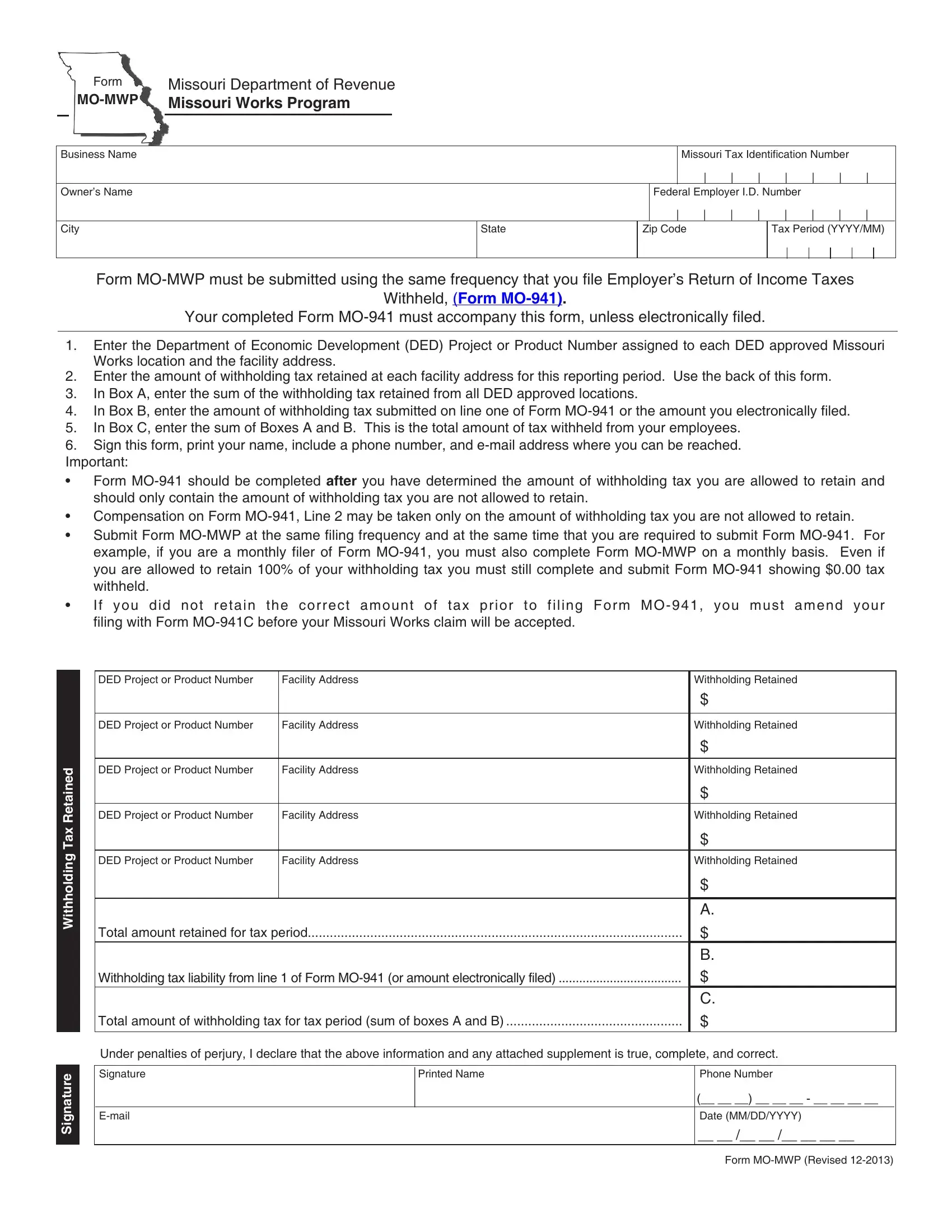

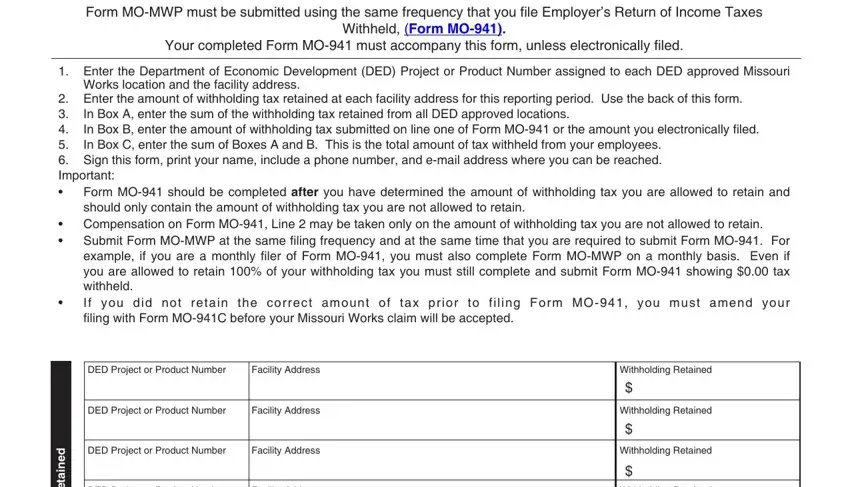

Filling out this form calls for attentiveness. Make sure that all necessary areas are filled out properly.

1. Whenever filling in the mo mwp, ensure to complete all necessary fields within the relevant section. This will help facilitate the process, making it possible for your details to be processed swiftly and properly.

Step 3: Always make sure that your information is correct and click on "Done" to complete the process. Get hold of your mo mwp the instant you register here for a free trial. Immediately use the form from your FormsPal account, with any modifications and changes automatically kept! At FormsPal, we strive to be sure that your information is maintained private.