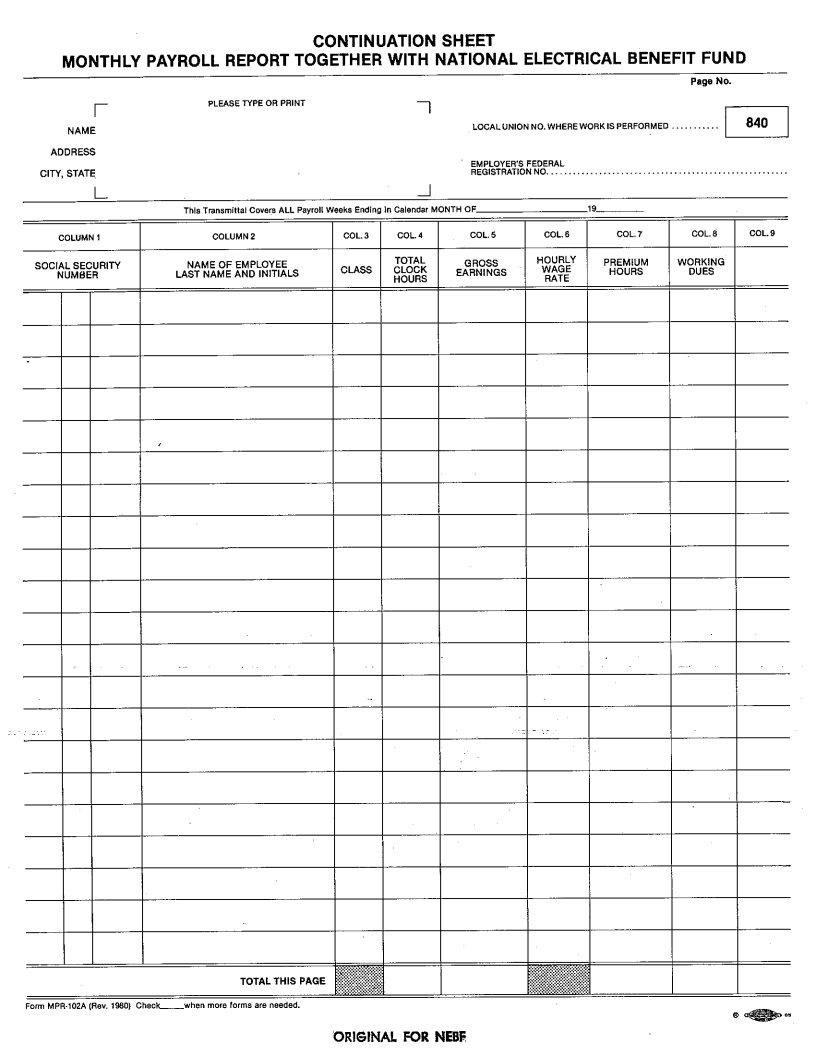

Mpr 102A is an annual tax form that must be filed by all Minnesota taxpayers who have income from property investments or rentals. The form is used to report the amount of income and expenses related to property investment or rental activity during the year. required for Mpr 102A are: total amount of rent received, any interest or dividend income earned on the rental property, advertising and management fees, repairs and maintenance costs, depreciation expenses, and any other income or losses related to the rental property. Note that you cannot use the standard deduction on this form - all expenses must be itemized. For more information about filing Mpr 102A, consult your tax preparer or visit the Minnesota Department of Revenue website.

| Question | Answer |

|---|---|

| Form Name | Form Mpr 102A |

| Form Length | 1 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 15 sec |

| Other names | schellongtest, schellong test vorlage, shellong test, schellong test formular |